Core Producer Price Growth Slows In October But Food Prices Surge

Tyler Durden

Fri, 11/13/2020 – 08:39

After yesterday’s disappointing (for some) cooler-than-expected CPI, analysts also expect producer price growth to decelerate in October but it modestly beat expectations, rising 0.3% MoM (vs +0.2% MoM exp).

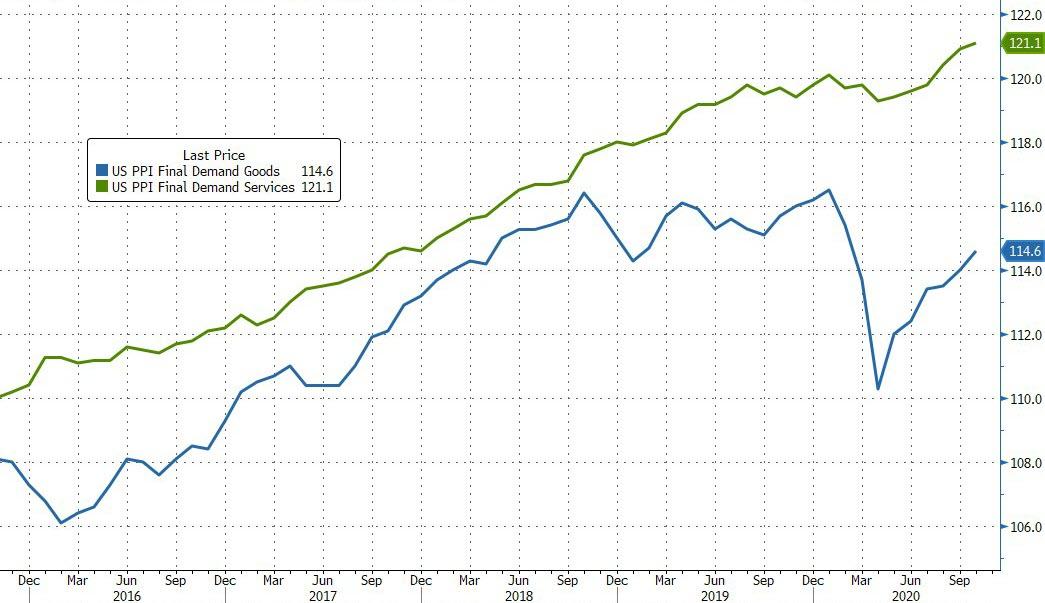

On a YoY basis, producer prices rise 0.5%, well below that of consumer prices…

Source: Bloomberg

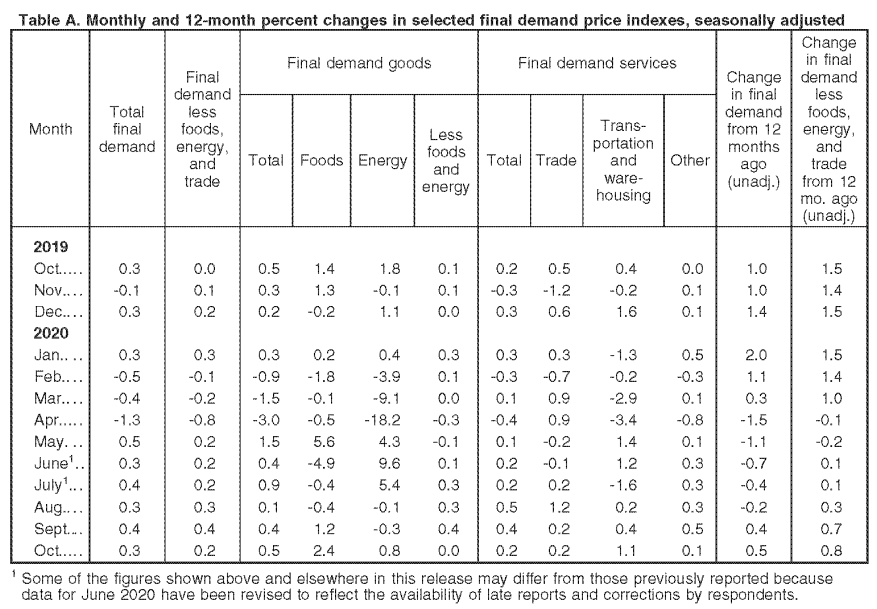

In October, nearly 60 percent of the rise in the final demand index can be traced to a 0.5-percent increase in prices for final demand goods. The index for final demand services moved up 0.2 percent.

Source: Bloomberg

Core PPI disappointed expectations, rising just 0.1% MoM vs +0.2% exp.

In October, a major factor in the increase in prices for final demand goods was the index for fresh and dry vegetables, which rose 26.8 percent. Prices for gasoline, meats, chicken eggs, and thermoplastic resins and materials also moved higher.

In contrast, the residential electric power index fell 1.0 percent. Prices for light motor trucks, packaged fluid milk and related products, and passenger cars also decreased.

The index for final demand services rose 0.2 percent in October after advancing 0.4 percent in September.

Nearly 40 percent of the broad-based October increase can be traced to prices for final demand transportation and warehousing services, which moved up 1.1 percent. Over a quarter of the advance in the index for final demand services can be traced to prices for long-distance motor carrying, which rose 1.9 percent. The indexes for hardware, building materials, and supplies retailing; securities brokerage, dealing, and investment advice; automotive fuels and lubricants retailing; hospital inpatient care; and automobile retailing (partial) also moved higher. Conversely, margins for chemicals and allied products wholesaling fell 2.6 percent. The indexes for gaming receipts (partial) and physician care also decreased.

This is certainly not what an unhinged Fed wanted to see.