Twitter’s board decided this week to ready a “poison pill” strategy in an effort to fend off Elon Musk’s $43 billion bid to buy the company. Despite owning less than one percent of Twitter, the board has rejected Musk’s offer to buy the company at a premium.

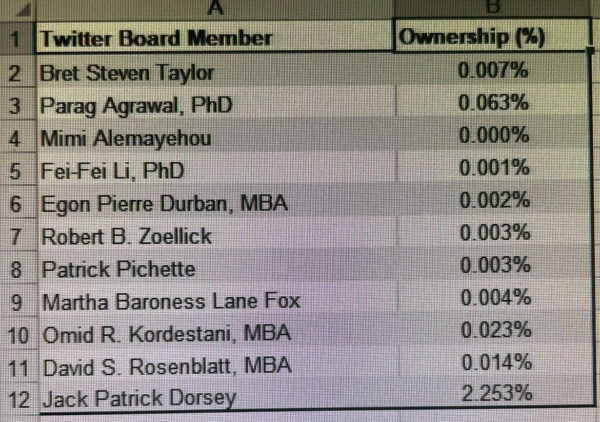

Businessman Chris Bakke shared a spreadsheet that showed the percentage of Twitter stock owned by individual board members.

Former Twitter CEO Jack Dorsey owns 2.25%, though he will be exiting the board when his term expires later this year. Beyond Dorsey, current CEO Parag Agrawal holds the next highest ownership stake with 0.063%. After Agrawal, not one member of Twitter’s board holds more than a quarter of one percent of the company’s shares.

Current members of Twitter’s 12-person board include ex-Google CFO Patrick Pichette, Mastercard executive Mimi Alemayehou and Stanford Professor Dr. Fei-Fei Li.

Despite this low ownership stake, Twitter’s board announced Friday that they would be employing a “poison pill” strategy if any one shareholder gains more than 15% ownership. Musk’s current holding is said to be a little north of 9% while the index fund Vanguard holds slightly more.

“Wow, with Jack departing, the Twitter board collectively owns almost no shares!” Musk wrote in reply to Bakke’s tweet. “Objectively, their economic interests are simply not aligned with shareholders.”

Wow, with Jack departing, the Twitter board collectively owns almost no shares! Objectively, their economic interests are simply not aligned with shareholders.

— Elon Musk (@elonmusk) April 16, 2022

On Thursday, Musk offered to buy the remaining shares of Twitter that he doesn’t already own at $54.20 per share, an offer worth more than $43 billion. Musk’s offer would buy Twitter at a premium, which is currently trading at $45.08 per share.

Many analysts, including Goldman Sachs, view the company as a $30 stock while more optimistic analysts point to its 52-week-high of $77.06, which was reached during a bull market. Twitter has traded in the 30–50-dollar range almost exclusively over the last five years.

Despite this, Twitter’s poison pill strategy would flood the market with newly issued stock. While this would devalue its individual shares, and possibly trigger a Musk sell-off which could crater the stock, it could also help resist Musk’s takeover. Poison pills almost always make a hostile takeover financially unfeasible, according to several Wall Street analysts.

Musk has long stated that he has a “Plan B” if Twitter’s board goes through with this strategy. The Tesla CEO has floated the idea of starting his own social media platform in the past, making this a possible route.

He could also invite shareholders to bypass the board and sell their shares directly to him at a premium. On Saturday, musk tweeted the Elvis lyrics “love me tender”, seemingly putting this option on the table.

Elon Musk tweeted “Love Me Tender” today. What does this mean? Sounds like Mr. Musk will bypass the board and invite the shareholders directly to sell (tender) their stock to him at a premium so they’ll make a shitload of money. Sounds like Plan B.

— First Words (@unscriptedmike) April 17, 2022