Here’s Why Both Bonds & Stocks Are Bid

Tyler Durden

Wed, 11/04/2020 – 14:10

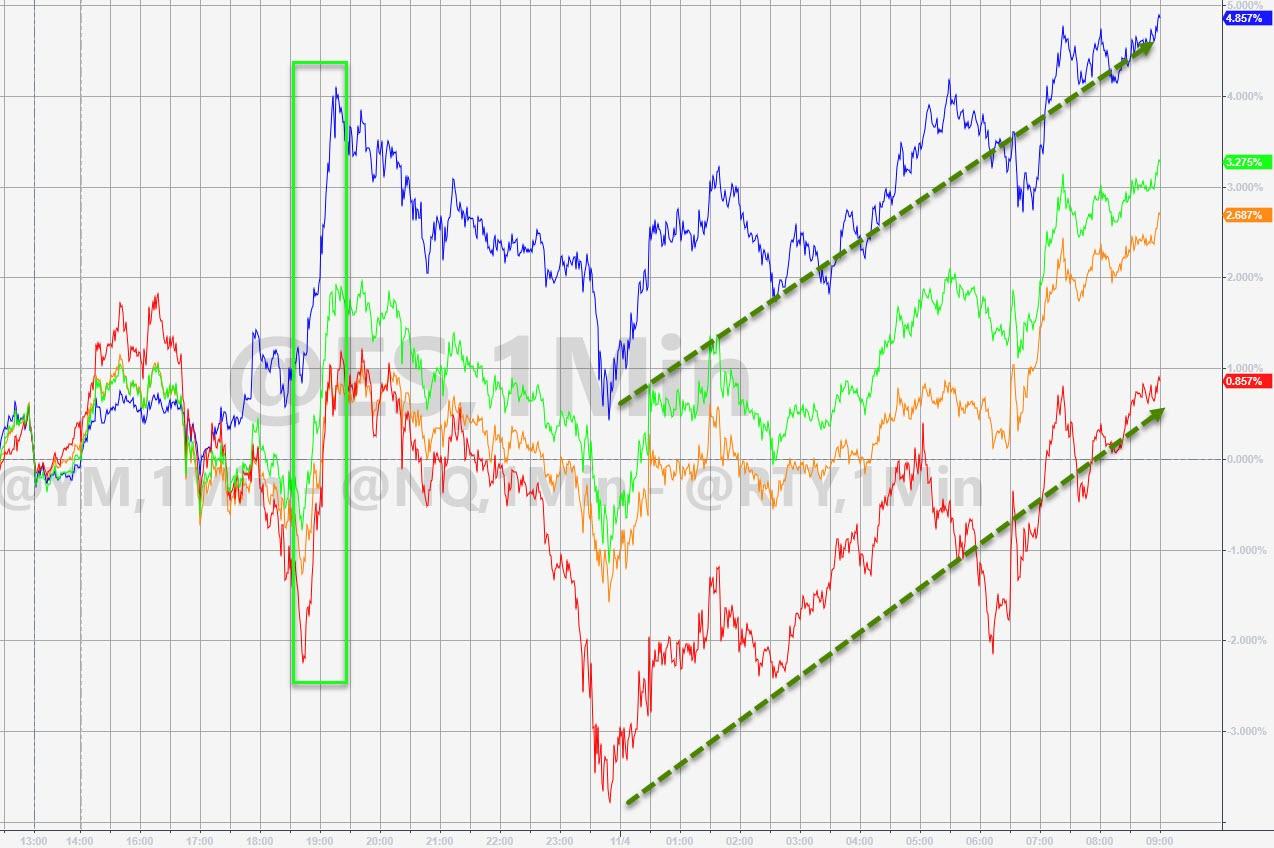

US equity and bond markets are at face-value in disagreement over how ‘great’ whatever headline you choose to consider descriptive of the current state of play with the election.

Stocks are soaring, led by growthy mega-tech names…

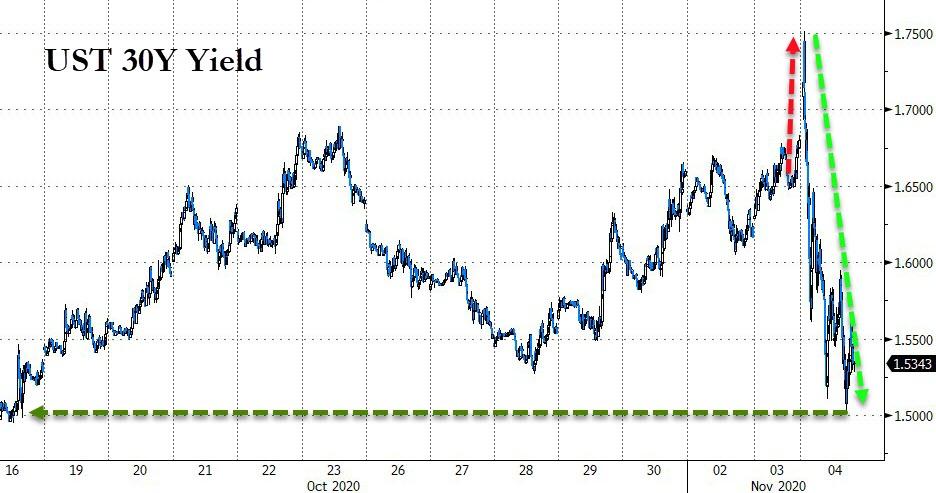

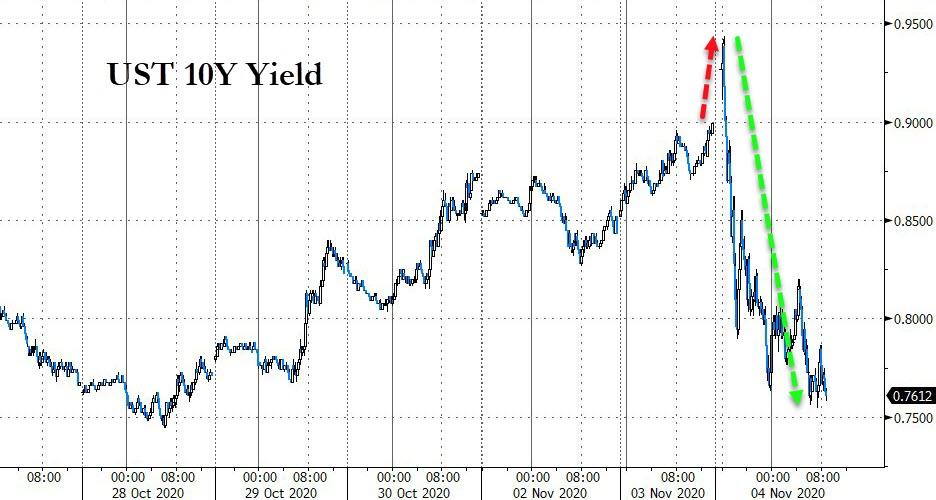

And bonds are aggressively bid with long-end yields down dramatically overnight…

So WTF is going on?

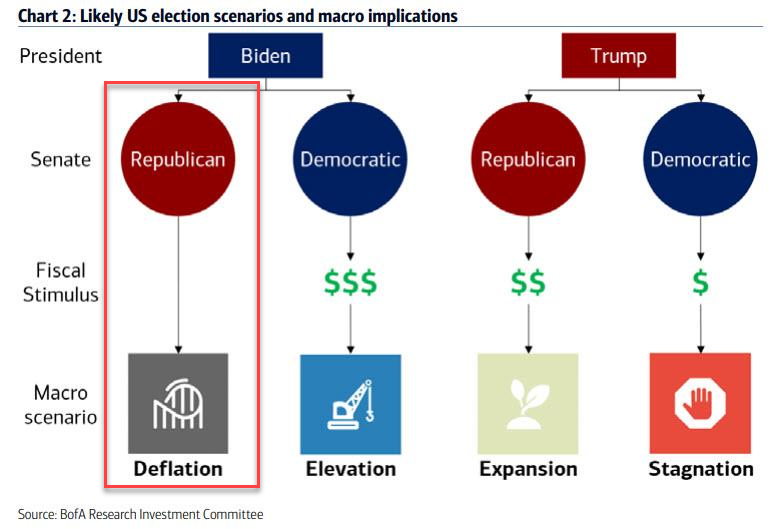

Well, first things first, what happened overnight was the end of the ‘blue-wave’ massive-stimulus spend narrative, which has a definite ‘deflationary’ impact on the economy…

And that has forced and unwind of the reflation trade and a reversion into growth stocks…

Furthermore, as Charlie McElligott had warned, the massive ‘crash risk’ positioning into the election was always going to act as a catalyst for volatility collapse if the worst case scenario did not occur.

“I too have pounded the table on the idea that a lot of this sticky vol from over-hedging “crash” event risk could then mechanically “slingshot” Equities higher into the year end, particularly as tail-risk passes and hedges are then unwound back into the market bc those options will be decaying hard into imminent expirations.”

And that’s what we’re seeing in VIX…

“So in the sense that last night saw us clear said “left-tail” crash-risk of a shock “Blue Wave” and the negative long-term implications of “magnitude” higher taxes and re-regulation, we are then rationally beginning to see implied vols and “Vol of Vol” get hammered and helping my thesis realize today (UX1 -2.9 vols, VVIX -16.7), which to me confirms that Vanna flows alone are going to be very supportive of higher Equities prices from here, especially as divided government will keep the pressure on the Fed to maintain max “easy” financial conditions going-forward in the background”

On the bond side, clearly a deflationary impulse is ‘bullish’ but there is a massive, record, overhang of short positioning that is about to (or is already) feeling serious squeeze pain…

“The bond market was efficiently priced for a blue sweep and potential for higher deficit spending,” said Subadra Rajappa, head of U.S. rates strategy at Societe Generale SA. Now, “it is looking less likely that we will have the final results soon. So you are seeing a flight to safety as bond investors brace for uncertainty.”

A record short by a long way…

The US election was supposed to pave the way for a sell-off in Treasuries as a blue-wave spending spree sparked inflationary excess, but the opposite has happened in a race that remains too close to call (stripping us of concerns surrounding the long-term negative implications of higher taxes and wholesale re-regulation of US industry) and has killed the blue wave narrative.

“The close fight has raised the specter of contested elections and thrown doubts over fiscal stimulus,” said Eugene Leow, a fixed-income strategist in Singapore at DBS Group Holdings Ltd. “Depending on how messy things get, 10-year yields can drop to the 0.7%-0.75% area in the short-term.”

Yields on the 10-year Treasury bond fell nearly 14 basis points, the largest daily drop in seven months

“The short Treasuries trade is really coming back to bite,” said George Boubouras, head of research at hedge fund K2 Asset Management in Melbourne.

“Investors are clearly pricing in a ‘no blue wave’ scenario,” a higher possibility of a Trump victory and a more fiscally conservative stance, he said.

And so that’s why both bonds (deflationary regime and short-squeeze) and stocks (growth rotation and crash-risk unwind) are both soaring this morning…

For now, it’s “buy all the things”, but as Simon Harvey, a foreign-exchange analyst at Monex Europe, warned, “a partisan deadlock can be as bad, if not worse, for markets than this prolonged period of uncertainty.”

It “will only lead to markets downgrading their global growth outlook further.”