Behold The “Green” Scam: Here Are The Most Popular ESG Fund Holdings

Every several years it’s same old: not long after the start of the post-crisis era, the investing craze du jour was 3D printers; when that fizzled it was replaced with craft burgers/sandwiches which then morphed into the biotech bubble; when that burst blockchain companies were the bubble darlings of the day, which in turn were replaced by cannabis stocks. Not longer after, the pot bubble burst, leaving a void to be filled.

That’s when the virtue-signaling tour de force that is ESG, or Environmental, Social, and Governance, made its first appearance, which just happened to coincide with the oh so obviously staged anti-global warming crusade spearheaded by a 16-year-old child (whose words are ghost-written by its publicity-starved parents) as well as central banks, politicians, the UN, the IMF, the World Bank, countless “green” corporations and NGOs, and pretty much everyone in the crumbling establishment.

After all, who can possibly be against fixing the climate, even if it costs quadrillions… or rather especially if it costs quadrillions – because in one fell swoop, central banks assured themselves a carte blanche to print as much money as they would ever need, because who evil egotistical bastard would refuse the monetization of, well, everything if it was to make sure future generations – the same generations these same central banks have doomed to a life of record wealth and income inequality – had a better life (compared to some imaginary baseline that doesn’t really exist).

And since the green movement was here to stay, so was the wave of pro-ESG investing which every single bank has been pitching to its clients because, well you know, it’s the socially, environmentally and financially responsible thing.

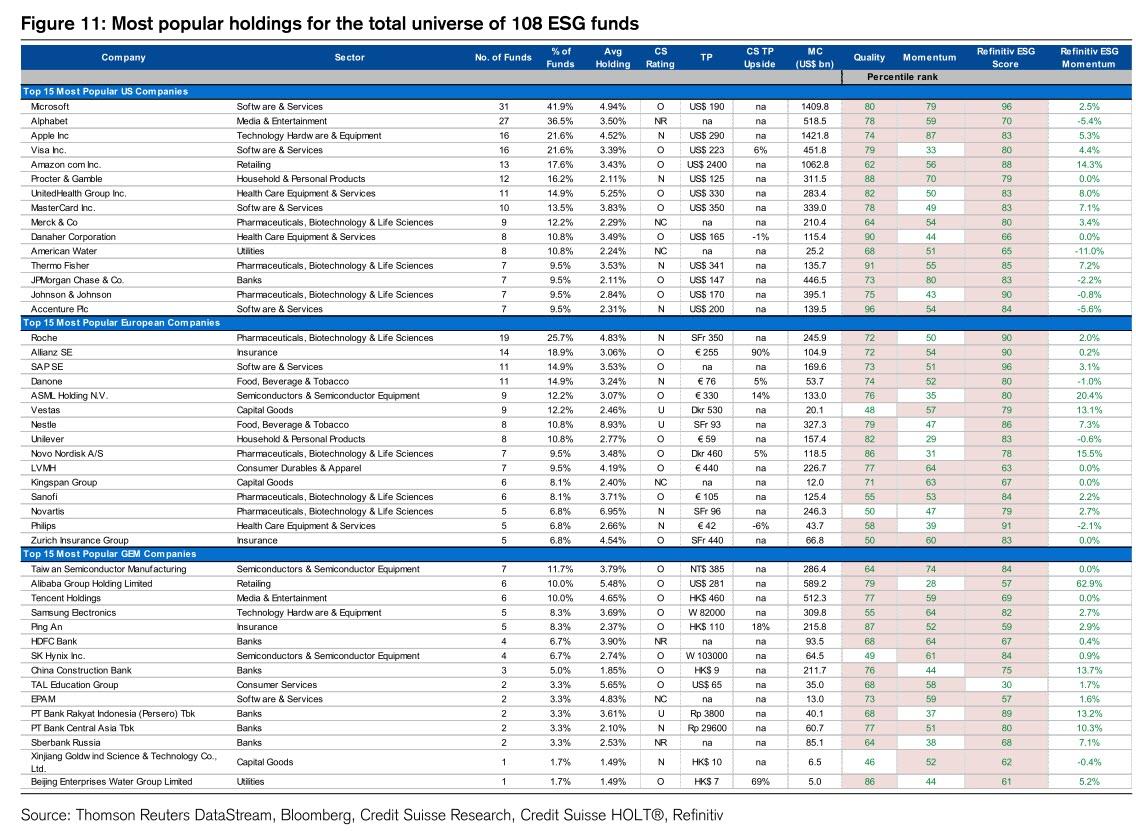

There is just one problem. Instead of finding companies that, well, care for the environment, for society or are for a progressive governance movement, it turns out that the most popular holdings of all those virtue signaling ESG funds are companies such as…. Microsoft, Alphabet, Apple and Amazon, which one would be hard pressed to explain how their actions do anything that is of benefit for the environment, or whatever the S and G stand for. It gets better: among the other most popular ESG companies are consulting company Accenture (?), Procter & Gamble (??), and… drumroll, JPMorgan (!!?!!!?!).

Yes, for all those who are speechless by the fact that the latest virtue-signaling investing farce is nothing more than the pure cristalized hypocrisy of Wall Street and America’s most valuable corporations, who have all risen above the $1 trillion market cap bogey because they found a brilliant hook with which to attract the world’s most gullible, bleeding-heart liberals and frankly everybody else into believing they are fixing the world by investing in “ESG” when instead they are just making Jeff Bezos and Jamie Dimon richer beyond their wildest dreams, here is Credit Suisse’s summary of the 108 most popular ESG funds. Please try hard not to laugh when reading what “socially responsible, environmentally safe, aggressively progressive” companies that one buys when one investing into the “Green”, aka ESG scam.

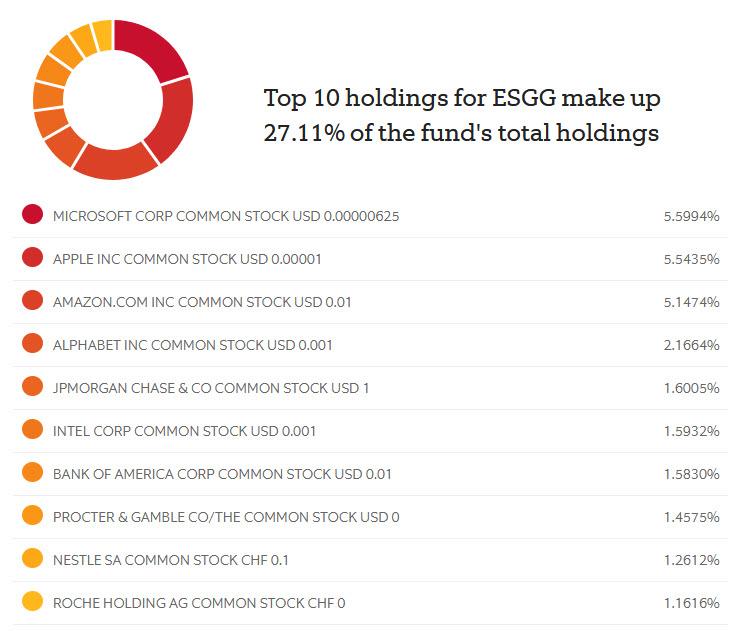

Impossible, you say. Nobody can be that hypocritical… surely Credit Suisse has made an error? Well, no. As confirmation here are the Top 10 Holdings of the purest ESG ETF available: the FlexShares ESGG fund. Below we present, without further commentary, its Top 10 holdings.

Tyler Durden

Sat, 02/22/2020 – 21:52