By Tyler Durden

By Tyler Durden

The impact of Covid-19 on supply chains has been tremendous. Uncertainty across the global economy is building as China remains in economic paralysis. The luxury fashion industry is suffering its most significant “shock” since the 2008 financial crisis, reported the Financial Times.

Our angle in this piece is to assess which luxury brand companies are most exposed/dependent on China. Many of these firms have complex operations in the country, from manufacturing facilities to brick and mortar stores to e-commerce platforms. Chinese consumers accounted for 40% of $303 billion spent on luxury goods globally last year.

The virus outbreak has also disrupted complex supply chains for mid-market apparel brands, like Under Armour, Adidas, and Puma, warning about collapsing demand and factory shutdown woes.

LVMH, Kering, and Richemont are luxury brands that are some of the least exposed to China because their manufacturing facilities are outside the country.

However, Luca Solca, a luxury goods analyst at Bernstein, said it doesn’t matter where luxury brands are making their products, the whole demand story in China has collapsed.

Kering, the owner of Gucci, warned earlier this month that the virus outbreak in China could damage sales in the first quarter.

A Moody’s report this week showed US-listed luxury brands, Coach and Kate Spade owner Tapestry, have increased their market exposure to China in recent years to gain access to a robust market, allowing their revenues to increase far faster than industry norms. That strategy today is likely to have backfired.

See: 177 Different Ways to Generate Extra Income

Fashion brands from Hennes & Mauritz, Next of the UK, and Tory Burch, have built factories in China to take advantage of inexpensive silk, fabrics, and cotton, along with lower labor costs, are now experiencing supply chain disruptions that could lead to product shortages in the months ahead.

The National Chamber for Italian Fashion warned earlier this week that the virus impact in China would lead to a $108 million drop in Italian exports in the first quarter because Chinese demand has fallen. If consumption remains depressed, then luxury exports to China could drop by a whopping $250 million in 1H20.

A top executive at Shanghai’s luxury shopping mall Plaza 66 said the mall had been deserted this month. Stores such as Cartier and Tiffany’s have been shuttered.

“We are now, brand by brand, reallocating that inventory to other regions in the world so that we are not too heavy in stock in China,” Kering chief executive François-Henri Pinault said last week. The move suggests the environment in China remains dire and to persist well into March.

Jefferies Group noted this week that Burberry Group is the most exposed luxury brand to China.

The crisis developing in the global luxury retail market is the first demand shock since that last financial crisis more than a decade ago. Brands that have manufacturing and retail exposure to China will be damaged the most.

UBS analyst Olivia Townsend said luxury brands she spoke with said factories are to remain shut for all of February may lead to product shortages.

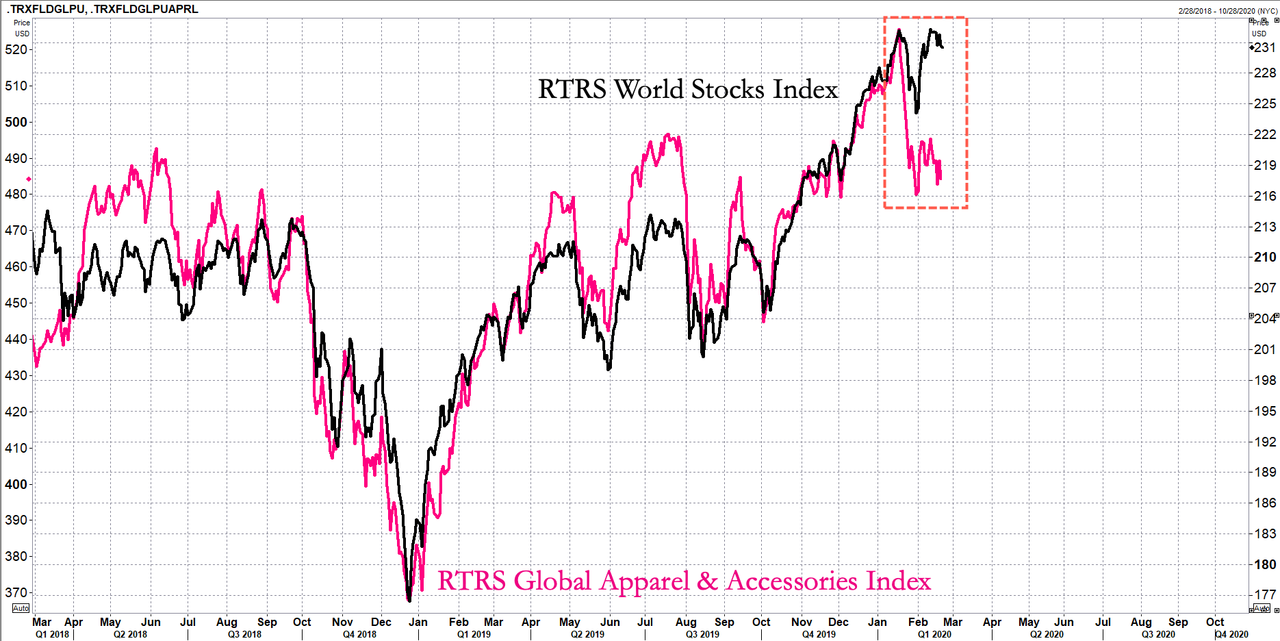

The demand crisis comes as the global apparel industry rolls over suggests that world stocks could be headed for a correction.

Article source: Zerohedge

Top image: Jing Daily

Subscribe to Activist Post for truth, peace, and freedom news. Become an Activist Post Patron for as little as $1 per month at Patreon. Follow us on SoMee, Flote, Minds, Twitter, and Steemit.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.