Futures Plunge, Gold Soars As Covid-19 Contagion Craters Complacency

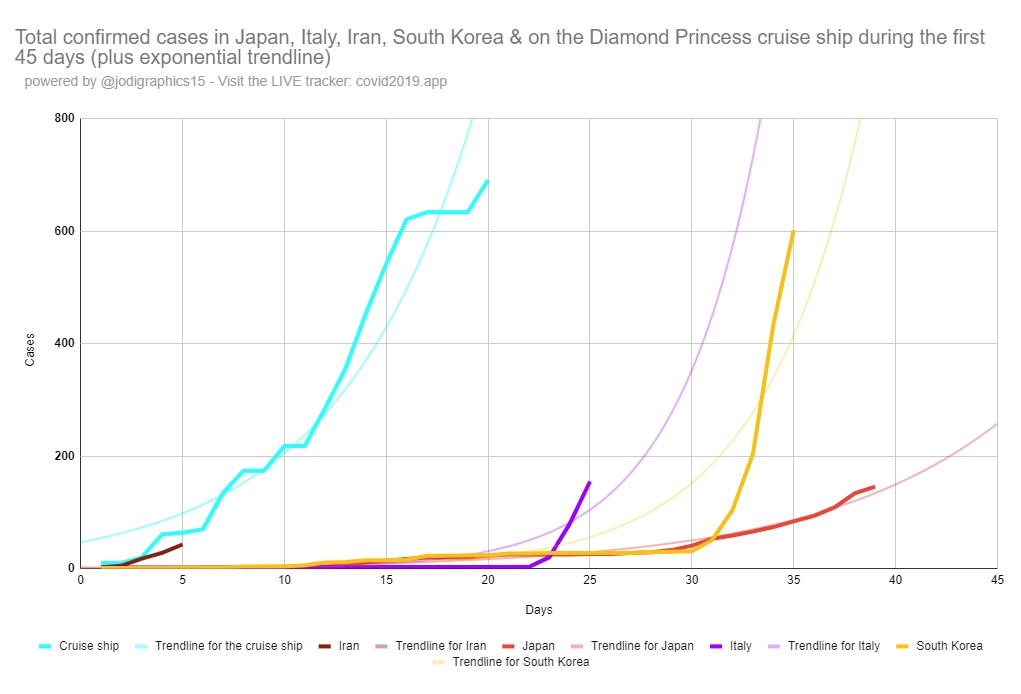

After a weekend in which attention is now firmly focused on the accelerating spread of the coronavirus outside of China (whose epidemic numbers have become a bigger joke than the country’s GDP), with Italy now a supercluster of new cases that has sealed off Northern Italy and threatens to shut down Schengen…

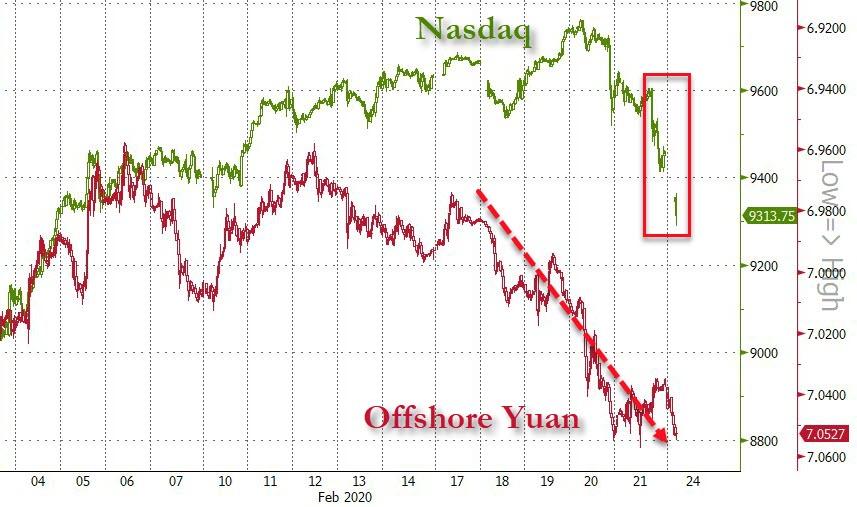

…traders are back to their desks and for once, it appears they are realizing that central bankers can’t print their way out of this particular pandemic mess.

US equity futures are accelerating their catch down to reality…

Dow Futures are down 400 points…

Spot gold is up over 2%, breaking $1680…

WTI Crude is also plunging, back to a $51 handle…

And after JPY’s recent collapse, Nikkei futures are down 500 points in early trading…

And therefore, as always, The BoJ is out with its standard boiler-plate – we’ll puke more money and buy more of everything – plan…

The Bank of Japan will be fully prepared to take necessary action to mitigate the impact of the coronavirus on the world’s third-largest economy, its Governor Haruhiko Kuroda said. Kuroda said there was no major change to the BOJ’s projection that Japan’s economy would keep recovering moderately thanks to an expected rebound in global growth around mid-year.

He also repeated the view that, while the central bank stands ready to ease monetary policy further “without hesitation”, it saw no immediate need to act.

But Kuroda said the BOJ would scrutinize developments on the virus outbreak carefully, since the damage to Japan’s economy could be profound if the epidemic is prolonged and disrupts supply chains.

First of all, just how is printing money going to fix the virus; and second, what is this “moderate recovery” he is talking about after the -1.6% GDP print?!

Finally, we do note that Japan is closed for the Emperor’s Birthday celebration so markets are especially illiquid… and cash bond trading remains closed. However, 10Y bond futures are surging, implying a 1.41% yield…

Nevertheless, it appears, as we noted above, investors are starting to wake up to the fact that central bankers can’t print vaccines… and you can only swallow so many blue pills before the red one becomes too tempting.

Time for a phone call…

Tfw futures are down over 1% pic.twitter.com/ZERqmvPAVi

— TheCreditBubble (@TheCreditBubble) February 23, 2020

Tyler Durden

Sun, 02/23/2020 – 18:28