“It’s Not Different This Time…”

Authored by Sven Henrich via NorthmanTrader.com,

It’s not different this time. It’s worse.

For weeks the bull machine was relentless, ignoring everything on the heels of massive central bank intervention. The warning signs kept mounting in charts getting extended, a narrowing of the rally, volatility building bullish patterns, divergences galore and investors recklessly going full retard as I called it.

Nothing matters until it does. Suddenly it does and all the building technical structures suddenly mattered and we see large reversals and technical reversals across the board.

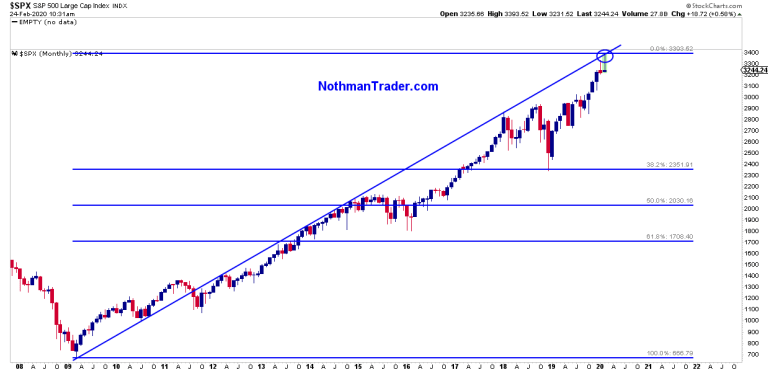

One can certainly make the case that this here is just a long overdue correction in an extended market. And this may well be the case, but as I outlined this weekend it may not be as markets hit a key technical zone:

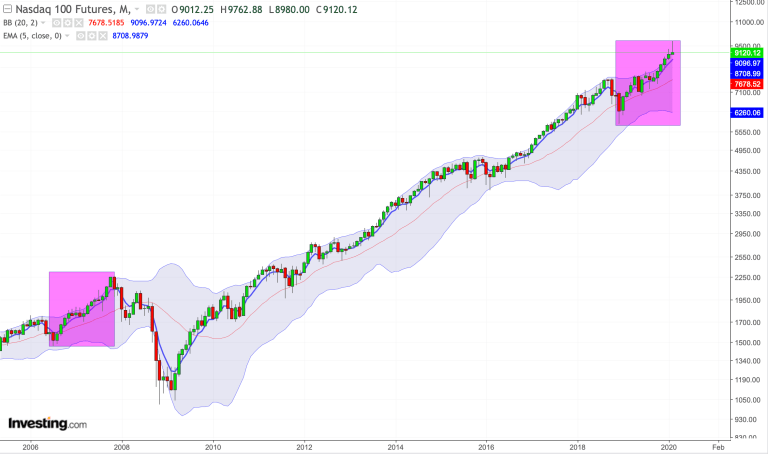

And tech looks auspiciously close to repeating the sins of the past:

Ironically all of this coming on the heels of flashy magazine covers eerily similar to the ones of 20 years ago:

Business week Feb 14, 2000: “Time to celebrate. This month, the current economic expansion became the longest in U.S. history. The boom has done more than create millions of new jobholders and stock owners. It has also restored the public’s confidence” pic.twitter.com/89RMUl1fUR

— Sven Henrich (@NorthmanTrader) February 20, 2020

And retail, thanks to now free commissions and a Fed giving people the illusion that risk assets are risk free, jumping on the chasing vertical charts game:

This is not a headline from the year 2000.

This is a headline from 2020:

Mom and Pop are on epic stock buying spree with free trades

“Retail traders have become manic.”https://t.co/Yt9FwzjBCC— Sven Henrich (@NorthmanTrader) February 23, 2020

And now gains are disappearing faster then they came on the coronavirus everybody again dismissed as temporary. After over 10 years of non stop central bank intervention investors have become trained to ignore all bad news as central bankers always managed to distort the price discovery equation and made ‘by the dip’ the new age religion. This is the legacy central banks have created and now retail has finally jumped in hook, line and sinker into the largest economic market disconnect in history:

158.9% last week. Well done.

Who knows, maybe central banks succeed again and that is certainly part of the binary outcome equation to consider here in 2020. More rate cuts, more QE, more stimulus, it’s all coming.

But know this: If they lose control and this virus is not contained we’re staring at a rapidly deteriorating global economy which could easily trigger a global recession. No QE can fix this if the global supply chain shuts down. The real tragedy:

Imagine central bank reckless pedal to the metal interventions trapped everyone long into historic valuations and now an unforeseen trigger pushes the global economy into a recession with central banks already all in.

— Sven Henrich (@NorthmanTrader) February 24, 2020

And that’s why it’s worse. They’ve already stimulated for over 10 years. Due to their failure to normalize they’ve left themselves weak with little incremental stimulus to offer. Sure they can cut a few more times, but it took over 500 basis points in cuts to stop the bleeding in 2000 and 2007.

Well, here we are:

More debt ever, with precious little ammunition to deal with a real downturn. Well done.

So yes, let’s all hope this virus that has now migrated globally gets contained quickly. So far that does not appear to be the case and the message from WHO is concerning:

What’s so scary to everyone is the fact that we don’t know anything about the virus. We don’t know exactly how it transmits. We don’t know if we’ll have a vaccine within 12-18 months.

– #WHO spokesman on #COVID19 on @SquawkBoxEurope

— Julianna Tatelbaum (@CNBCJulianna) February 24, 2020

They don’t know and they don’t know how to deal with it.

Which is what I said 2 weeks ago:

Nobody has a clue how bad this coronavirus situation really is.

— Sven Henrich (@NorthmanTrader) February 13, 2020

Nobody knows and with over 7.5 billion people on the planet there’s really no script for this. And yet investors ignored it all hoping the Fed’s liquidity will trump it all. It hasn’t, if anything it looks like a massive potential trap now.

I do hope they figure it out soon, nobody wants to deal with a pandemic. So far stocks are down only about 4%-5% from last week’s all time highs and are short term oversold, but valuations have not anywhere near priced in a global recession.

So 2020 then becomes a binary proposition: Either this virus gets contained in short order and its impact will be indeed temporary or it won’t. That’s not in any of our control. If it gets controlled then yes central banks can kick the can again and be left with even less ammunition for when the next crisis hits which is not exactly an encouraging message in the longer term.

But if this is not controlled then we’re staring at a global recession in which case the yield curve that everybody ignored has a stern message: It’s not different this time, it never was. And given the global structural backdrop in debt, valuations, demographics and tired central bank policies: It’s worse, much worse.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Mon, 02/24/2020 – 14:16