What’s Behind Today’s Market Plunge? A Stunned Wall Street Responds

When Apple unexpectedly announced last week that it wouldn’t be able to meet its quarterly guidance issued less than three weeks earlier, stocks dipped… and then almost instantly roared higher, with AAPL itself filling the gap from the guidance cut in just days (a far cry from the devastation and FX flash crash when AAPL did the same in January 2019).

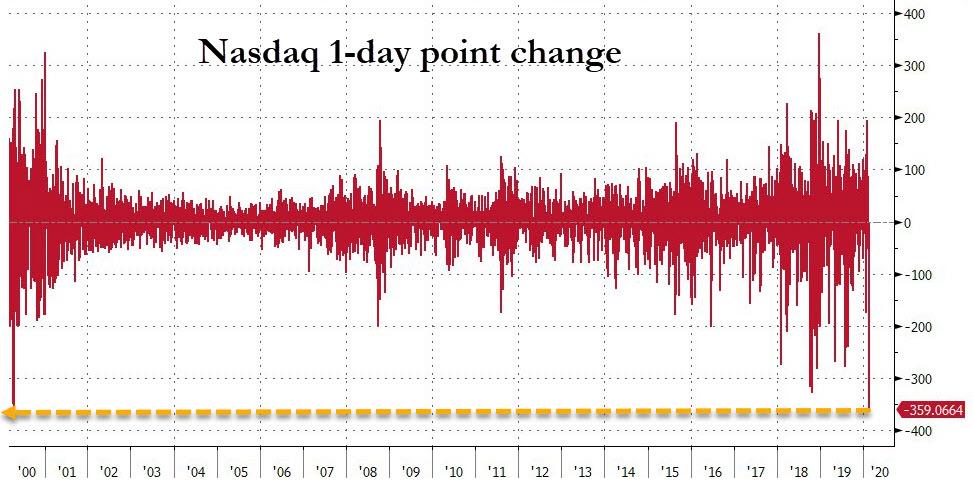

Yet while there was nothing materially new announced over the weekend, if only for those who have been closely following the news of China’s encroaching economic paralysis, the collapse of global supply chains and the accelerating spread of the coronavirus offshore, markets finally puked today, with the Nasdaq briefly suffering its biggest intraday point loss in history.

At the same time, as tech stocks finally got hammered, the 10Y yield finally dipped below the 1.40% “tipping point” which according to BofA is a harbinger of both a recession and zero interest rates in the next 12-18 months. But mostly a recession, and unless the Fed cuts rates immediately – as Kocherlakota demanded – stocks may not be able to recover ther mojo any time soon.

Finally, there was the technical consideration of Friday’s op-ex expiration which as we noted earlier released tens of billions in dealer gamma, and wiped out most of the downside market buffer, potentially triggering billions more in systematic selling if today’s liquidation isn’t stopped on time.

So which of these catalysts was the primary reason behind today’s selling avalanche which has hammered the S&P the most since December 2018, or as Bloomberg puts it, “What in this weekend’s news explains the shattering of calm that had enveloped U.S. equities all year?” While we doubt there is one correct answer, here is what several prominent traders told Bloomberg when asked to list their reason(s):

Alec Young, managing director of global markets research at FTSE Russell:

“We knew for a while that it would slow Chinese growth and that it would have a negative impact on the global supply chain for any company that sources a lot of their input products from China. What’s new is that we’re getting significant outbreaks in Italy, for example. It happens to be close to Milan, which obviously is the financial center of Italy and it’s also close to southern Germany and Switzerland, which together that region is really the manufacturing hub of Europe. That’s new,” he said.

“The spread of the virus to Europe, the worsening situation in China but also now South Korea — which is also a major global export hub — it’s ratcheting up the uncertainty. Unfortunately, this issue is very unusual in markets where information normally comes pretty quickly, it can be discounted. This issue by definition comes in dribs and drabs over a period of many weeks and months. It’s very dangerous. A lot of people were too dismissive of this too early.”

Michael Antonelli, managing director and market strategist at Baird:

“The economic data was overwhelming the virus fears. There was a subtle shift last week in how the market viewed the virus. It was right to ignore the virus in the sense that the human death toll doesn’t seem to be on pace to be one of the worst in history. The subtle shift was the market concern about supply chains. The concern now is about how do businesses continue to function in a world where borders start to get shut. That’s the concern they started to worry about. Then you saw the outbreak in Italy and Japan and Korea. If all of a sudden Korea and Japan had to shut down borders and now Italy, now it looks like the global economy screeches to a halt.”

Quincy Krosby, chief market strategist at Prudential Financial Inc.:

“What we saw over the weekend was the path of the virus — you have the duration, how long this is going to last and you have the direction — and the direction is moving away from China and moving onto areas that we haven’t seen before,” she said. “If this were to hit the U.S. in ways — and remember the U.S. is large — in ways where in New York City, and LA and Chicago started to see the number of cases starting to build and folks actually in hospitals and dying, you’re going to see people much more nervous.”

Jim Paulsen, chief investment strategist at Leuthold Group:

“The 30-year yield last week broke to new lows and the 10-year yield is on the cusp of that. I think that is a bigger culprit behind the sell-off than most appreciate. All the headlines are about the coronavirus, but I think the bigger thing in the room is the bond market. It’s been a chronic fear for some time — actually, it has been a fear throughout this recovery — but it certainly has been since last year when the stock market took off and bond yields went down. There’s been this idea: what does the bond market know that the stock market doesn’t? And the bond market seems to be suggesting some near-term calamity while stocks seem to be ignoring it and it’s creating a lot of fear.”

Delores Rubin, a senior equity trader at Deutsche Bank Wealth Management:

“Last week the news was China was sending people back to work so containment of the virus seemed to be in place. But the news out of South Korea and Italy, especially hearing Milan events canceled outright, has created real concerns about a prolonged effect. If these waves of outbreaks persist, we could see the economic effect of the precautions put in place by governments and companies.”

Source: Bloomberg

Tyler Durden

Mon, 02/24/2020 – 15:49