Dow Dumps 2,000 Points From Highs & ‘Jawboning’ Is Failing To Halt The Panic

Update (1350ET): Like a champion boxer who is just past his prime, Trump economic advisor Larry Kudlow took to CNBC early Tuesday afternoon to try and jawbone the markets higher as US stocks headed for their fourth day in a row.

Kudlow stressed that the US has been “ahead of the curve” when it comes to “protecting citizens” (by canceling flights, barring foreigners etc.) – even as the CDC warns that the US is dangerously unprepared for “community outbreaks” that it believes will inevitably arrive. People need to stay “calm”, Kudlow said, adding that we won’t really know how bad this will be for the US until a few weeks have passed.

Kudlow stressed the human toll of the outbreak, calling it “an incredible human tragedy.” But as far as the economy is concerned, “I don’t think we’re looking at an economic disaster at all,” he added.

To support his claim, Kudlow cited the recent spate of Fed data, claiming there has been “no evidence” of supply disruptions.

Granted, there have been bright spots, but we can’t help but wonder: Is Kudlow looking at the same data we are?

And how does one explain gold and the 30-year?

As far as rate cuts are concerned, Kudlow says “I’m not hearing that.”

“I’m not hearing the Fed is going to make any panic moves.”

We can almost hear the bulls shouting ‘Aw, C’mon Larry!’ at their TV screens.

Before launching into a tangent about the “human toll”, the G-7 and the US’s growth playbook, Kudlow left us with a solid departing thought: whatever happens next with the virus, “it’s not gonna last forever,” Kudlow said.

And if you’re investing for the long term, it simply doesn’t make sense to lose your nerve in a selloff, right?

Right?

* * *

As we detailed earlier, US equity markets are extending their losses and strategists are starting to wake up to the ugly reality that The Fed can’t print vaccines… no matter how much they promise easing, it won’t fix the consumption slump or supply chain collapse.

As CNBC reports, the influx of foreign nationals to the United States from areas impacted by the coronavirus means a large American outbreak is “increasingly likely,” a scenario that could “rattle” markets in tandem, according to investment bank Jefferies.

Equity strategist Simon Powell wrote in a note to clients that although the incidence of new coronavirus cases in China appears to be slowing, recent breakouts in Italy, Iran and South Korea hint that the disease is capable of spreading to and within many locations.

“We increasingly find it hard to believe that USA cases are as low as reported, and believe that given the flow of Chinese, Korean and Iranian nationals into North America, a large USA community-based outbreak is increasingly likely,” Powell wrote on Tuesday.

“Imagine trying to quarantine a large city in the USA for a month, similar to how the Chinese have shut down Wuhan, or the way the Italians are trying to ring-fence 10 towns near Milan,” he added.

“Our working hypothesis is that it wouldn’t work, and could cause panic on a scale that would spook markets.”

The Dow is down over 2000 points from its highs late last week…

How much pain are they willing or can they afford to take?

NorthmanTrader.com’s Sven Henrich explains, the answer is ‘Virtually none’.

The economy is not the stock market, but the stock market is the economy. Or rather the stock market is the biggest threat to the economy and must be protected at all costs.

To me it was never a question that the Fed was going to cut rates again in 2020 despite claims of the 3 rates cuts in 2019 cuts just having been a “mid-cycle adjustment”, or despite claims of a coming reflation trade or despite new market highs exceeding all expectations thanks to the Fed liquidity.

No, I said it right at the beginning of January:

The Fed will cut rates again in 2020.

— Sven Henrich (@NorthmanTrader) January 6, 2020

And the question to me, despite all the brave Fed claims, was simply how much market pain they’d be willing to endure before shifting the brave stance again. Just last week I posed:

Ah who am I kidding… they’ll freak at 5% down 😂

In 2019 Powell stepped in with jawboning at every 5%-7% down.

— Sven Henrich (@NorthmanTrader) February 20, 2020

And 3 days later and 5% down here comes the jawboning. RATE CUTS NOW!!!

No, I’m not kidding, here’s the jawbone via former president of the Minneapolis Fed:

The Fed Needs to Cut Rates Now:

“The Fed’s rate-setting Federal Open Market Committee holds its next meeting on March 17-18. I don’t think that the FOMC should wait that long to deal with this clear and pressing danger. I would urge an immediate cut of at least 25 basis points and arguably 50 basis points.”

Panic, pre-emptive cutting.

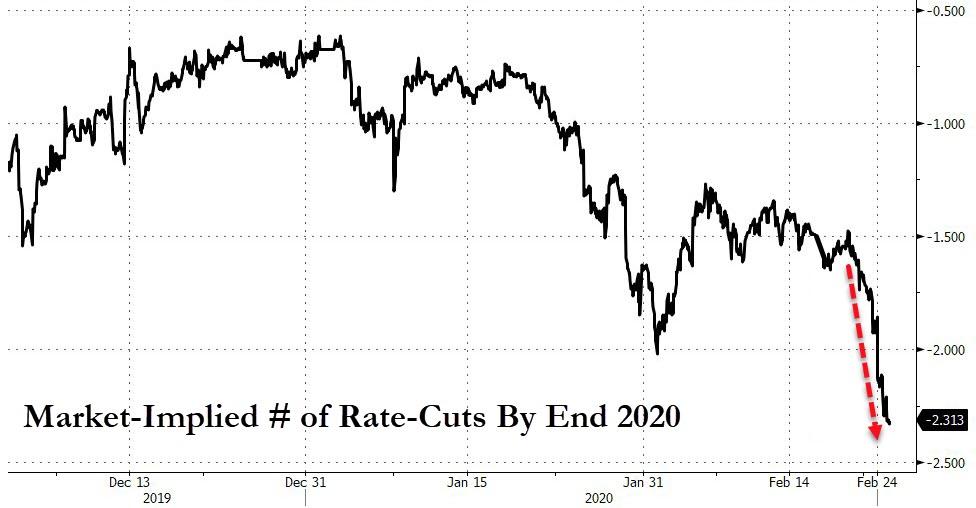

And of course a Fed, that simply can’t afford to disappoint markets for fear of any sell-off is now faced with a market that is now pricing in 2 rate cuts in 2020.

But it’s not just the Fed that is now again under pressure to deliver.

3 down days and 5% down and the political jawboning is already in full swing:

The Coronavirus is very much under control in the USA. We are in contact with everyone and all relevant countries. CDC & World Health have been working hard and very smart. Stock Market starting to look very good to me!

— Donald J. Trump (@realDonaldTrump) February 24, 2020

News: Kudlow spoke w/ Post after markets closed. Encouraged people to buy.

“The coronavirus will not last forever. The US looks well-contained and the economy is fundamentally sound,” he told me. “If you’re a long term investor, you should seriously consider buying these dips.”

— Robert Costa (@costareports) February 24, 2020

How much value to put in these efforts? The political calculus is clear: Keep markets elevated for the election:

WaPo last week: Trump has told advisers that he does not want the administration to do or say anything regarding the Coronavirus outbreak that would further spook the markets. He remains worried that any large-scale outbreak could hurt his reelection bid. https://t.co/0QeqNu0C0X

— Kyle Griffin (@kylegriffin1) February 24, 2020

Whatever it takes. Does it have economic predictive meaning? Not necessarily:

Kudlow 101: There Ain’t No Recession

“Yesterday’s tremendous ADP jobs report puts the dagger into the very heart of the recession case.” – Larry Kudlow December 6, 2007*Recession started December 2007https://t.co/1TlL9RRWPY

— Sven Henrich (@NorthmanTrader) February 25, 2020

They will jawbone until the bulls come home. Fact is the virus is still not contained and if a global recession unfolds they can cut rates and jawbone until they’re blue in the face.

It remains all about control.

But the very effort itself reveals something: They are worried about losing control of markets for a sizable downturn in markets may trigger what they are trying to avoid for obvious reasons: A recession. And the threshold of accepting any sort of pain in markets is thin: 5% and you see them react.

The question remains about efficacy. We’ve just seen an attempt to put a floor under the market. Let’s see if it lasts. Calls for rate cuts now after 5% down, that’s now the benchmark. Comes to show how fragile this market construct really is. It can’t hold its own without Momma Fed.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Tue, 02/25/2020 – 13:50