Our Triple-C Rated Economy: Complacency, Contradictions, And Corona

Authored by Michael Lebowitz and Jack Scott via RealInvestmentAdvice.com,

“I got my toes in the water, ass in the sand

Not a worry in the world, a cold beer in my hand

Life is good today, life is good today”

– Toes, Zac Brown Band

The economic and social instabilities in the U.S. are numerous and growing despite the fact that many of these factors have been in place and observable for years.

-

Overvaluation of equity markets

-

Weak GDP Growth

-

High Debt to GDP levels

-

BBB Corporate Debt at Record Levels

-

High Leverage and Margin Debt

-

Weak Productivity

-

Growing Fiscal Deficits

-

Geopolitical uncertainty

-

Acute Domestic Political Divisiveness

-

Rising Populism

-

Trade Wars

-

Coronavirus

As we know, this list could be extended for pages, however, the one thing that will never show up on this list is…?

Inflation.

Inflation

As reported by the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA), inflation has been running above 2% for the better part of the last few years. Despite CPI being greater than their 2% target, the Federal Reserve (Fed) has been wringing their hands about the lack of inflation. They insist that inflation, as currently measured, is too low. We must disclaim, this all assumes we should have confidence in these measurements.

At his January 29, 2020 press conference, Chairman Powell stated:

“…inflation that runs persistently below our objective can lead longer-term inflation expectations to drift down, pulling actual inflation even lower. In turn, interest rates would be lower, as well, closer to their effective lower bound.

As a result, we would have less room to reduce interest rates to support the economy in a future downturn to the detriment of American families and businesses. We have seen this dynamic play out in other economies around the world and we’re determined to avoid it here in the United States.”

Contradictions

There are a couple of inconsistencies in Powell’s comments from the most recent January 2020 post-FOMC press conference. These are issues we have become increasingly interested in exploring because of the seeming incoherence of Fed policy. Further, as investors, high valuations and PE multiple expansion appear predicated upon “favorable” monetary policy. If investors are to rely on the Fed, they would be well-advised to understand them and properly judge their coherence.

As discussed in Jerome Powell & the Fed’s Great Betrayal, Powell states that the supply of money that the Fed provides to the system is to be based on the demand for money – not the economic growth rate. That is a major departure from orthodox monetary policy. If investors had been paying attention, the bond market should have melted down on that one sentence. It did not because the market pays attention to the current implications for the Fed’s actions, not the future shock of such a policy. It is a myopic curse that someday could prove costly to investors.

As for Powell’s quote above, the first inconsistency is that the circumstances they have seen “play out in other countries” have not shown itself in the U.S. To front-run something that has not occurred assumes you are correct to anticipate it occurring in the future. It is pure speculation and quite a leap even for those smart PhDs at the Fed.

“Overall, the U.S. economy appears likely to expand at a moderate pace over the second half of 2007, with growth then strengthening a bit in 2008 to a rate close to the economy’s underlying trend.”

– Ben Bernanke, Testimony to Senate Banking Committee, July 2007

Although we have not actually seen this “dynamic” play out in the U.S. since the great depression, Fed officials are so concerned about deflation that they have begun telegraphing their intent to allow inflation to overshoot their 2% target. Based on current Fed guidance, periods of lesser inflation would be offset by periods of higher inflation.

Our question is, how do they come to that conclusion and based on what analytical rigor and evidence? There is, by the way, evidence from other countries throughout the history of humanity, that when money is printed to accommodate the spending incontinence of politicians, people lose confidence in the domestic currency. That would be devastatingly inflationary, and it is, without question of measurements, where we are headed.

The next inconsistency is that the Fed’s protracted engagement in quantitative easing (QE) over the past ten years has created precisely the circumstances about which Powell warns here – “less room to reduce interest rates… to the detriment of American families and businesses.”

The Chairman of the U.S. Fed, Jerome Powell, should understand how supply and demand works, but as a reminder, the less available something is, everything else constant, the more it is worth. Mr. Chairman, your predecessors removed $3.5 trillion of bonds from the market, what did you think would happen to bond prices and therefore yields?

Powell stumbled head-first into that self-contradiction, especially after watching the fantastic failure to normalize rates through rate hikes and quantitative tightening (QT) earlier in 2019, which caused him to perform a hasty 180-degree policy reversal in the fall of 2019.

We think this is a workable plan, and it will, as one of my colleagues, President Harker, described it, it will be like watching paint dry, that this will just be something that runs quietly in the background.

– Janet Yellen, Federal Reserve Chairman, June 14, 2017, FOMC Press Conference

Contrary to the reassurances of Janet Yellen and many other Fed members, it (QT) was a lot more exciting than watching paint dry. That too is troubling.

Wise Owl

In a recent interview on RealVision TV, James Grant, publisher of Grants Interest Rate Observer said:

“Is inflation a thing of the past?… are forces in place today that could reproduce [the great inflation of the 1970s? Inflation by definition, represents a loss of confidence in money. How do you lose confidence in money? Well, you create too much of it to subsidize the spending habits of the politicians. That’s one possible cause and are we on the way to something like that? Well, possibly. In this splendid economy, we’re generating a trillion-dollar budget deficit.”

Grant continues:

“Then two, there is the physical structure of the economy. We live in a world of expedited delivery of just in time rather than just in case. We live in a world of ubiquitous information about supply chains, but maybe if push comes to shove in the world of geopolitics, the supply chains might break. Lo and behold, we might be on our own in America for things we now import, and if we are, those prices would not be so low, they would be much higher.”

Again, pointing back to our recent article referenced above, Jerome Powell & the Fed’s Great Betrayal, there are other indicators of inflation that contradict what the Fed believes. In that article, we discussed real-world examples such as M2 growth, and auto and housing prices, to contrast with the BLS and Fed engineered metrics. Despite a plethora of readily available data to the contrary, we are continually reminded by the Fed of the absence of inflation.

As we know, the Fed just began another round of radical policy accommodation to incite higher inflation. If you pre-suppose a confluence of circumstances that begins to constrict global supply chains, then the inflation Grant theorizes might not be so far-fetched. The Fed, as has historically been the case, would be caught looking the wrong way, and given their proclivity toward wanting more inflation, it would almost certainly be too late to respond.

“Moreover, the agencies have made clear that no bank is too-big-too-fail, so that bank management, shareholders, and un-insured debt holders understand that they will not escape the consequences of excessive risk-taking. In short, although vigilance is necessary, I believe the systemic risk inherent in the banking system is well-managed and well-controlled.”

– Benjamin S. Bernanke Fed Chairman confirmation hearing November 15, 2005

“Rather than making management, shareholders, and debt holders feel the consequences of their risk-taking, you bailed them out. In short, you are the definition of moral hazard.”

– Senator Jim Bunning at Bernanke second confirmation hearing December 3, 2009

In the same way, there were recorded levels of laughter in FOMC meetings at the absurd incentives homebuilders were offering to sell houses in 2004, 2005, and 2006. The Fed is now equally blind, neglect, and arrogant concerning the perceived absence of inflation. The laughter in the Eccles Building boardroom stopped abruptly in mid-2007 as the housing market stalled. The Coronavirus may be a similar wake-up call with serious economic consequences.

Here and Now

The situation that is developing illustrates the one-dimensional nature of Fed thinking. Despite having the latest news on the spread of the Corona Virus at the January 29, 2020 Federal Open Market Committee (FOMC) meeting, the Fed’s concern was for a slowdown in global growth and failed attempts to prime inflation. There was no consideration for possible second and third-order effects of the virus.

What are the possible second and third-order effects? They are the things that follow after the obvious occurs. In this case, there is no question that China’s growth is going to be hurt by the virus and quarantines, the restrictions on flight and travel, and factory shutdowns. That is obvious.

Consider the virus is now spreading rapidly to other suppliers of U.S. goods and services such as Korea, Japan, and Italy. What might not be obvious is that the growing problem will impede global commerce and cause fractures in the extensive and complex network of global supply chains. Goods and services we are accustomed to finding on the shelves of the local Wal-Mart or via the internet may not be available to us, or if they are, they may come at a cost well above the price we paid before the pandemic. If that occurs, those changes in prices will eventually find their way to the BLS inflation data collectors, and then, as the old saying goes, all bets are off.

Summary

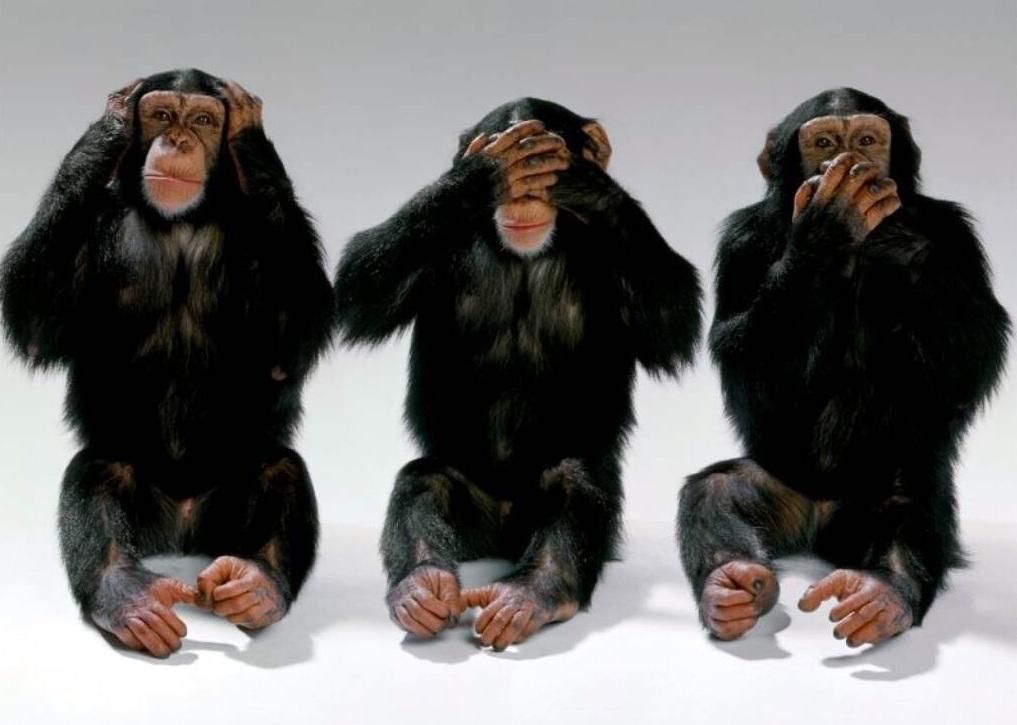

There are plenty of uncertainties in the world. Individuals have the decision-making ability to evaluate those uncertainties and the risks they pose. That said, it is difficult to remember a time when the potential turbulence we face has been so broadly ignored by the “market” and so overlooked by the Fed and politicians. It is as though we have been tranquilized by the ever-rising stock market and net worth as an artifact of that fallacious indicator of security.

By all appearances, stock index levels convey not a worry in the world. Indeed, life is good today. We are just not so sure about tomorrow.

Tyler Durden

Wed, 02/26/2020 – 14:15