WTI Back Above $50 After Smaller Than Expected Crude Build

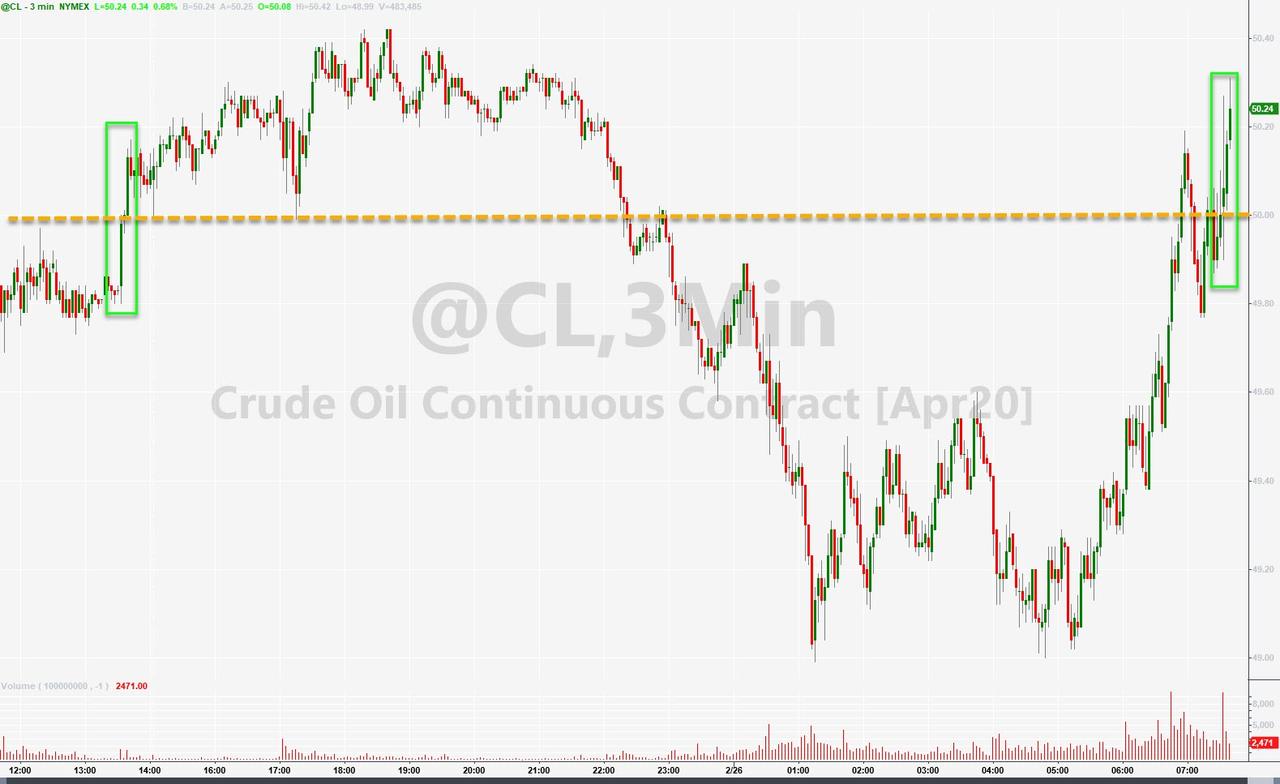

Oil prices roundtripped overnight after running back above $50 following the smaller-than-expected API-reported crude build, sliding back lower overnight, and ramping back to $50.00 ahead of the official government data thanks to promises from OPEC+ that they will meet, despite the virus concerns:

“The OPEC secretariat is in contact with the authorities in the city of Vienna on the recent reported cases of infections in Austria,” Secretary-General Mohammad Barkindo says while returning from meeting in Riyadh.

“While we continue in earnest with the preparations for the meetings of the extraordinary conference next week, we are continuing to monitor developments closely”

‘There will be blood’ comes to mind.

Additionally, Bloomberg Intelligence Senior Energy Analyst Vince Piazza says E&Ps have professed heightened capital discipline in 2020, which should slow oil-production growth in the U.S and help tighten balances. But global demand remains a broader concern, with the fears of the coronavirus spreading even as oil exports from the U.S recovered recently.

API

-

Crude +1.3mm (+2.8mm exp)

-

Cushing +411k

-

Gasoline +74k (-1.9mm exp)

-

Distillates -706k (-900k exp)

DOE

-

Crude +452k (+2.8mm exp)

-

Cushing +906k

-

Gasoline -2.691mm (-1.9mm exp)

-

Distillates -2.115mm (-900k exp)

The official crude inventory data showed an even smaller build than API (and notably less than expected)

Source: Bloomberg

The gasoline draw is far greater than that predicted by API on Tuesday. National stocks are down 2.69 million barrels to 256.39 million barrels – but even with the draw they are still near a seasonal five-year high.

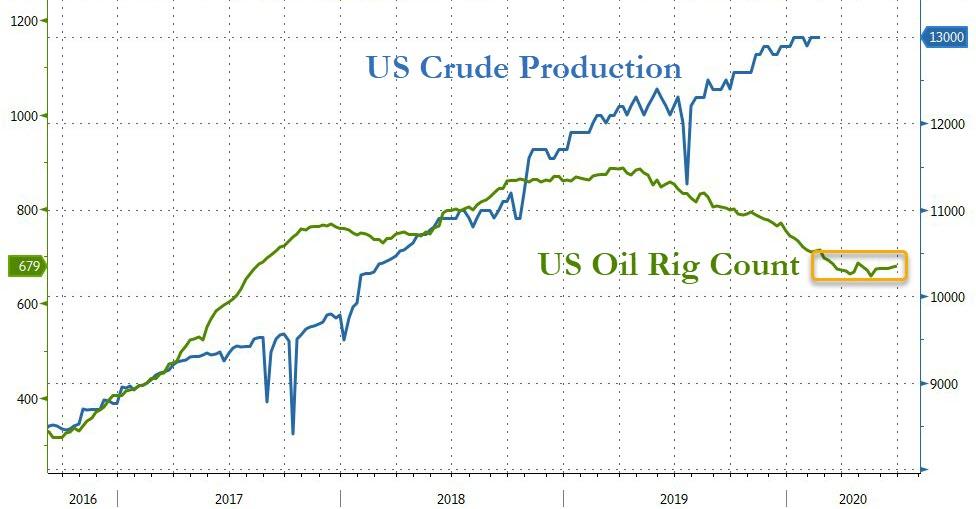

US Crude production remained at record highs as the rig count has stabilized…

Source: Bloomberg

WTI has surged back above $50, back towards overnight highs on the smaller than expected crude build…

Tyler Durden

Wed, 02/26/2020 – 10:38