‘Drug-Addicted’ Market “Is Salivating For Rate-Cuts”

Authored by Richard Breslow via Bloomberg,

Equity prices have continued to make their way lower. Analysts warn that they could have further to go. Yet, listening to traders talk, the preponderance of them are looking for places to buy.

It’s been a hard sell-off with a bid tone. It’s the perfect environment for continuous bursts of activity as short-term positioning imbalances get unwound because conviction within the speculative community is so very low. As it should be. But that’s not a recipe for achieving successful results.

The reality is that the current issue besetting the market is going to take longer to be resolved than the level of patience too many investors are any longer capable of exercising. We live in a world where there are long-term investors, short-term participants and seemingly no one in-between.

Markets used to derive a great deal of stability from traders with a medium-term perspective. They cared about the news. They respected price action. But, they attempted to understand the context of events and market inclinations that would get them from now until the next known known. And then they would deal with surprises by being disciplined with their trading levels and stops. They traded expectations and then attempted to avoid the event.

Did the Chinese handle the initial outbreak of the virus as well as they might have? Probably not. I dare say, not many countries would have. But they were first and scrambling. And, while the sight of the quarantined cities was frightening, it may have been unavoidable and the right thing to do. By many accounts, they are indeed having some success in bringing their productive capacity back on line. But it, unavoidably, takes time. You can’t just flick a magical switch that traders would like.

It appears that a growing number of other countries will have to deal with this problem as well. And we need to accept that it will be a slower process of recovery than anyone would like. Other than, perhaps, fiscal measures to help maintain consumer demand, there is little that will ultimately be helpful except dealing with the health issue. And time.

Everyone seems to be breathlessly waiting for the economic numbers that will start to be released in March to tell traders how these economies have been faring as they navigate the situation. As a guess, they will be disappointing. As they should be. Those numbers border on irrelevant. The only way to deal with this problem will inevitably have had adverse consequences for both supply and demand.

The economic facts that should be monitored in the short-run are whether things are starting to loosen up. We know businesses in China were shuttered. We know companies that rely on their products had supply disruptions. Some total. That doesn’t need to be proved, or be taken as permanent. The most relevant question is whether things are starting to flow again. Even if it will take time to get fully up to speed. Direction, not absolute amount matters at the moment. To get some sense of how China is doing, relying on traditional economic numbers won’t be as helpful as we would like. Asking the companies which use their products if they are getting, or even starting to get, them will be a much more informative data point. Motion is progress.

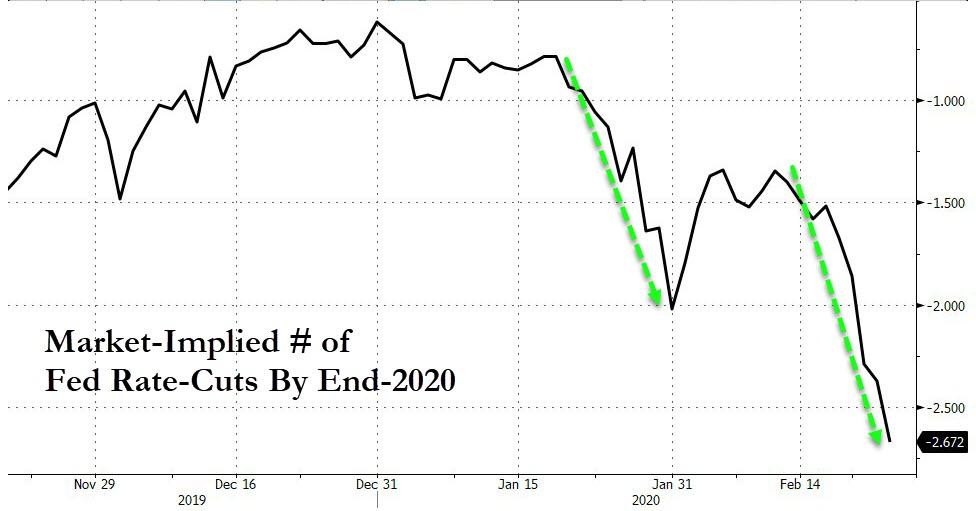

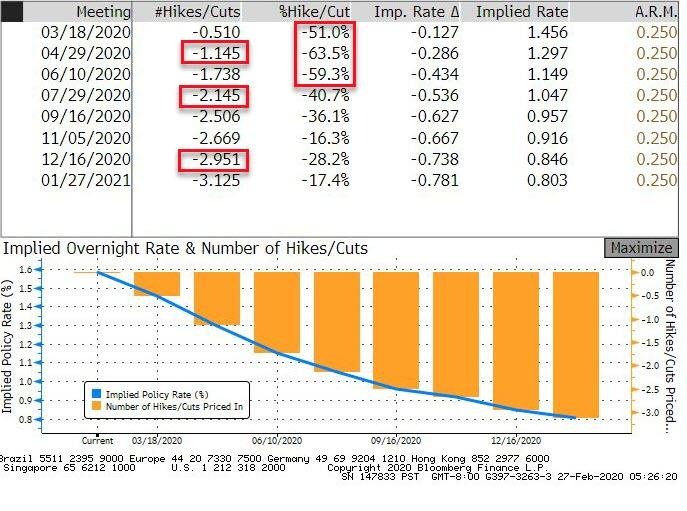

The market is salivating for rate cuts. In the U.S., futures pricing keeps bringing the expected date that the Fed acts closer.

We can debate the should they, will they question. Interestingly, a lot of advocates for a cut prefer to skip the former in favor of the latter as an easier issue to resolve. I’m not convinced that’s correct. The only thing it would accomplish is to stoke demand for even more.

A medium-term trader might accept that price action implies that the prudent thing is to position as if they will. And be out before the actual FOMC meeting. Trading on market expectations and momentum. Then skipping the coin toss. And the aftermath mayhem we’ve too often become accustomed to. The market doesn’t need to be right for them to have made money.

Tyler Durden

Thu, 02/27/2020 – 09:30