For S&P Bulls, All That Matters Is 3,139

Yesterday, we asked “are men or machines behind the selling panic?”

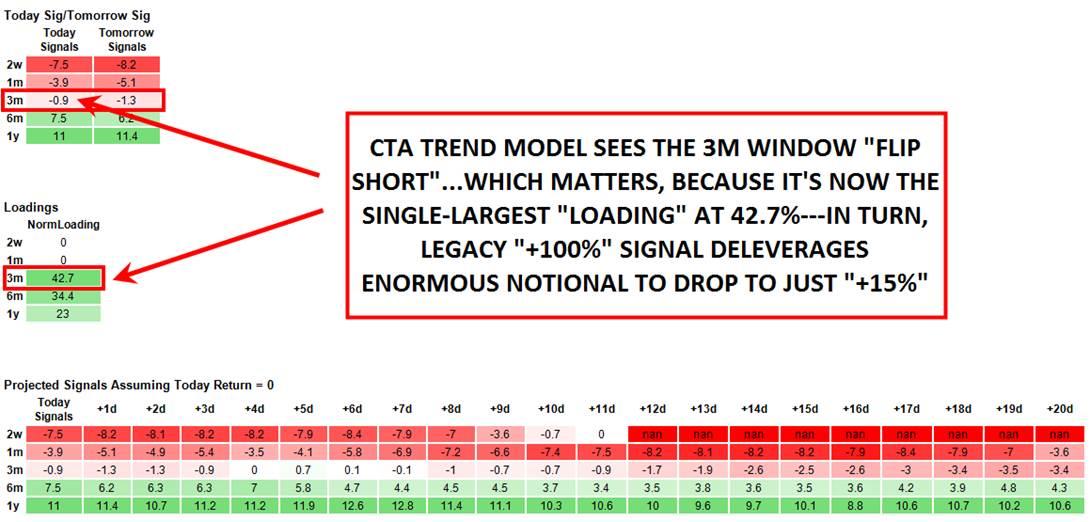

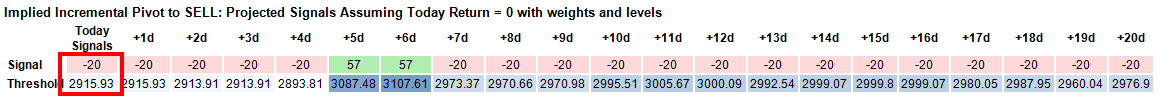

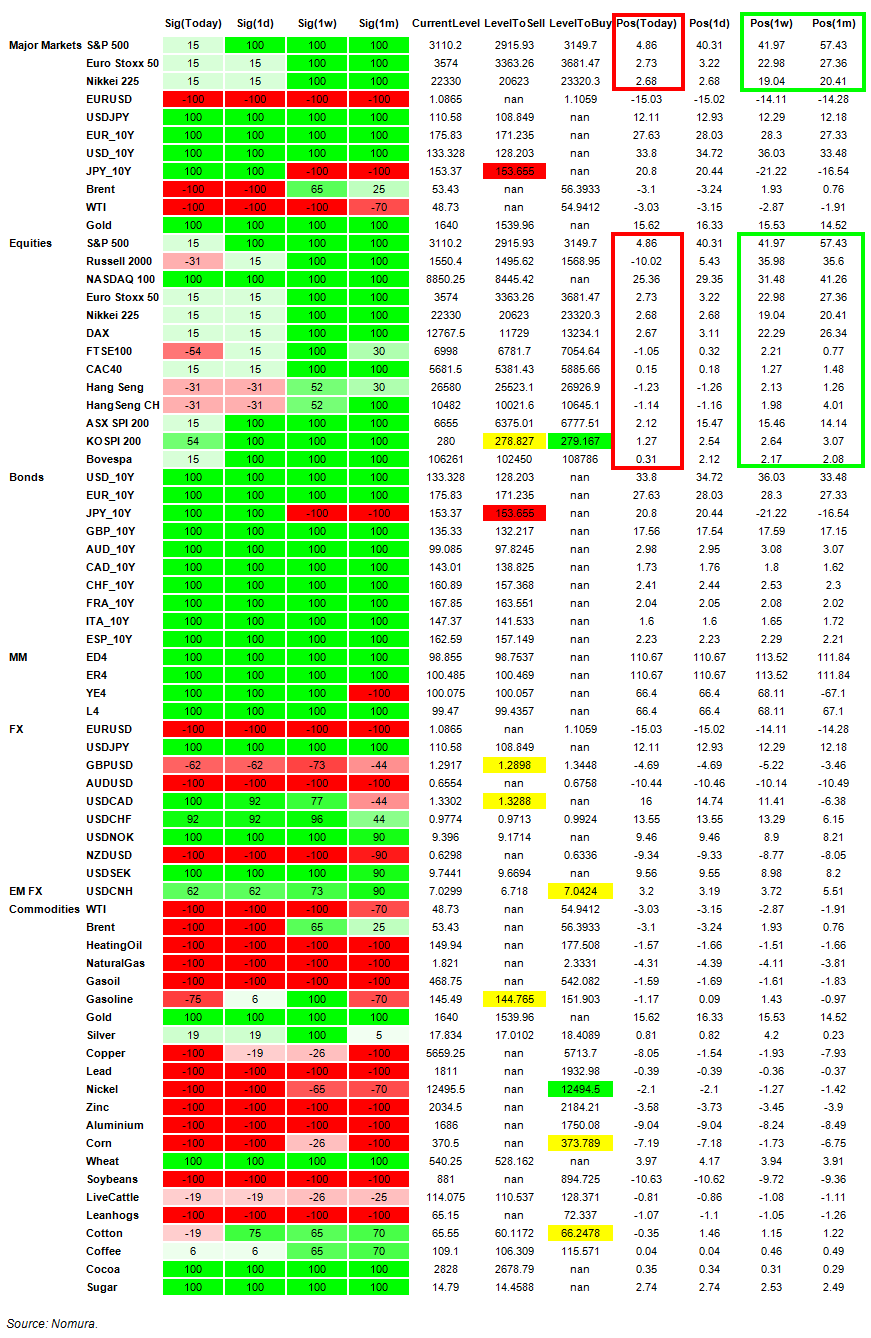

This morning we are starting to get a clearer picture as men AND machines are ‘flipping’. As Nomura’s Charlie McElligott points out in a note this morning, the CTA trend model for S&P futures “triggers” on the break below 3,139…

“Flipping Short” and creating mechanical selling thereafter as the overall S&P position across all time-signals deleverages from +100% to just +15%…

And futures are below that now…

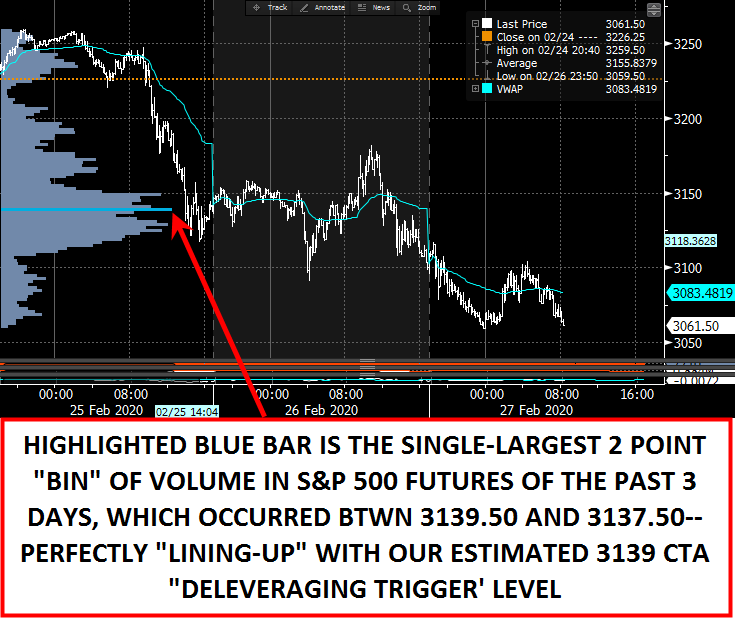

The flush was clear…

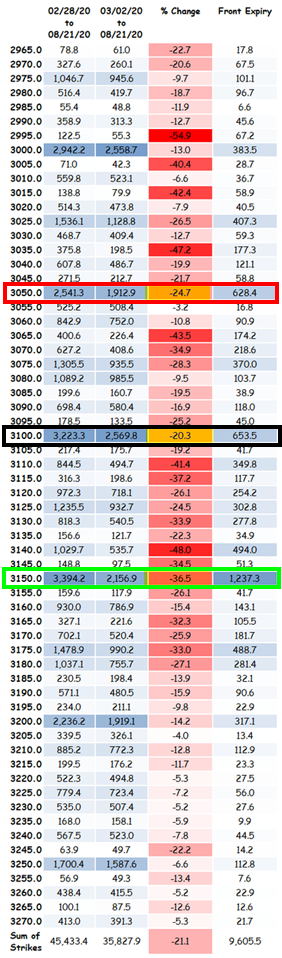

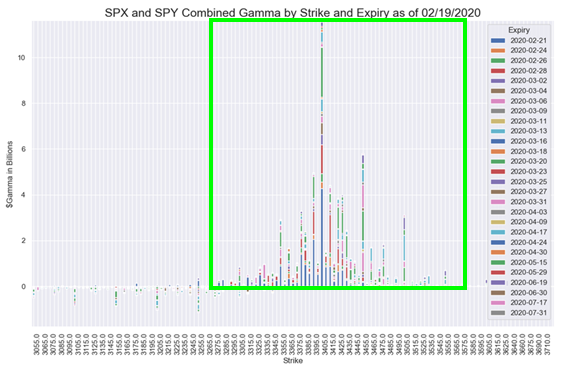

Additionally, if the S&P breaks 3,040 or so, it could rapidly extend its losses (on a Gamma flush) to 2,970…

And then look out below…

…to 2,915…

As CTAs have slashed their VaR exposure to equities…

And Risk Parity Funds are adding to the panic with their forced deleveraging…

The question is – can an emergency rate-cut do anything to stop this?

Tyler Durden

Thu, 02/27/2020 – 09:18