Goldman Now Expects Zero Earnings Growth In 2020

2019 was a remarkable year: the S&P’s total return was over 30% even as S&P earnings for the year actually fell. Well, according to Goldman, 2020 is set to be similarly as remarkable, because in a note released overnight, Goldman’s David Kostin writes that as of today, the bank expects US companies will generate no earnings growth in 2020, the second straight year without EPS growth despite record buybacks. This is what Kostin wrote:

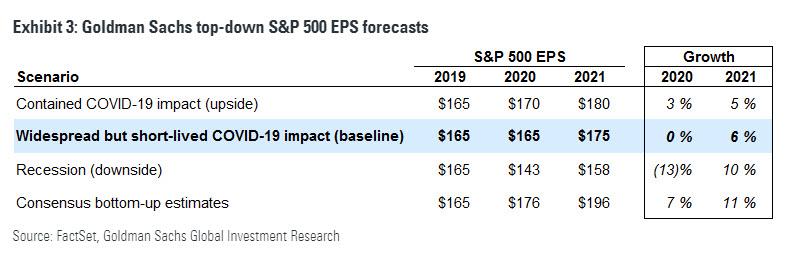

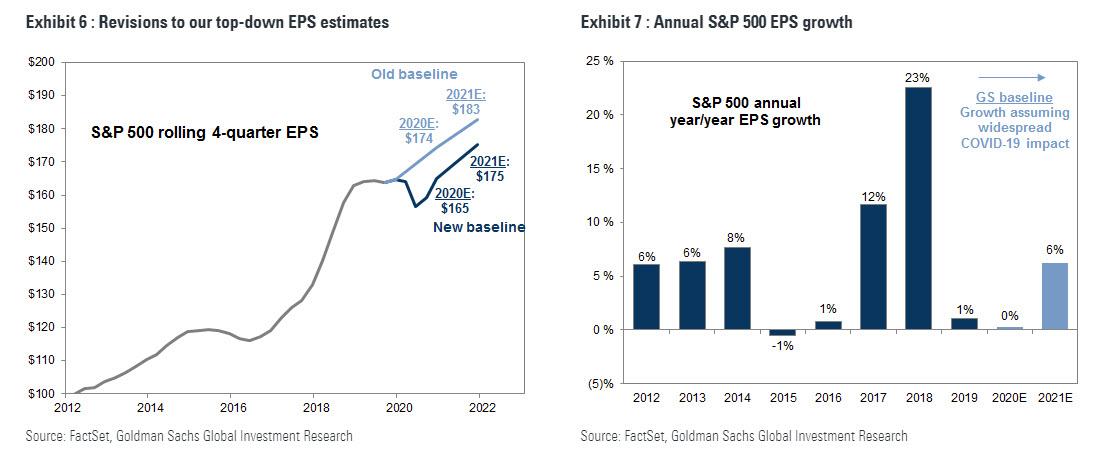

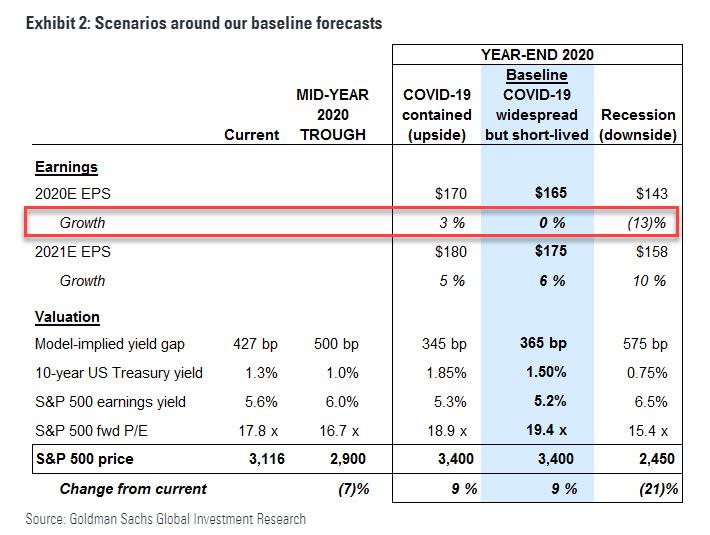

We have updated our earnings model to incorporate the likelihood that the virus becomes widespread. Our revised baseline EPS estimates are $165 in 2020 (previously $174) and $175 in 2021 (previously $183), representing 0% and 6% growth. Our reduced forecasts reflect the severe decline in Chinese economic activity in 1Q, lower end-demand for US exporters, supply chain disruption, a slowdown in US economic activity, and elevated uncertainty. Consensus forecasts imply EPS will climb 7% in 2020 and 11% in 2021.

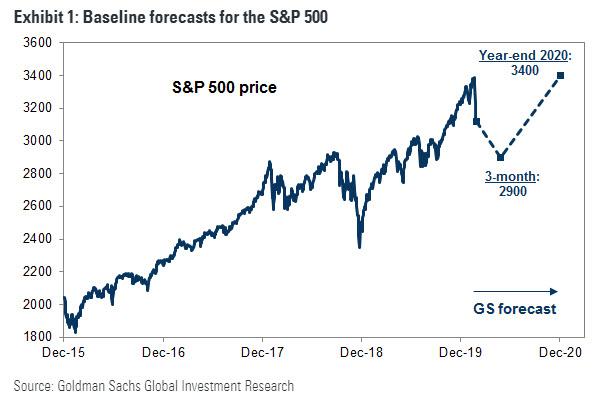

As Kostin elaborates, under his baseline forecast, COVID-19 disrupts supply chains for a prolonged period of time and weighs on US consumption (“widespread”). In sticking with Goldman’s chronic optimism, the bank then assumes that the economic weakness will be short-lived, with most of the lost activity recouped in late 2020. Our estimates are well below consensus bottom-up forecasts for 7% and 11% growth in 2020 and 2021, respectively.

Just to cover its bases, Goldman also considers alternate scenarios where the impacts from the virus are contained or more severe. In these scenarios, it assumes growth recovers more rapidly (+3% EPS growth to $170 in 2020, “contained”) or deteriorates more sharply (-13% EPS growth to $143 in 2020, “recession”).

And visually:

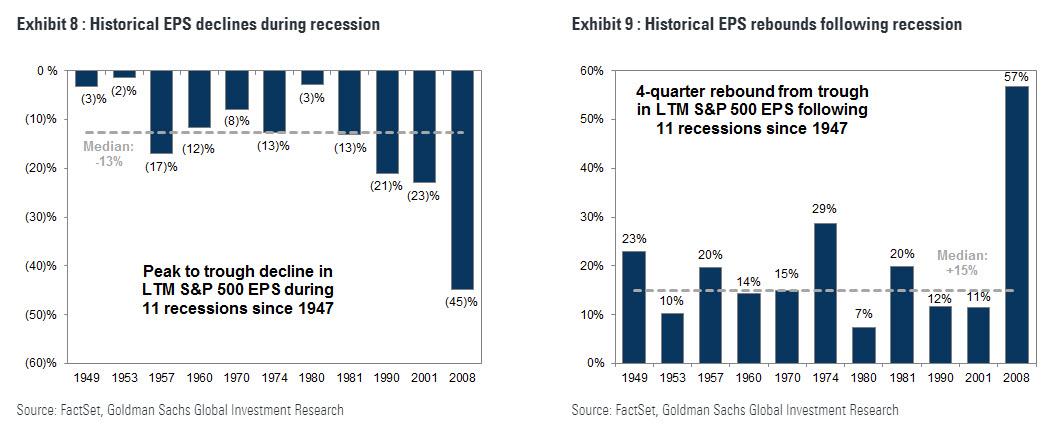

On other hand, if Goldman is once again overly optimistic – which it always is, recall the bank was predicting 4 rate hikes in 2019 and instead we got 3 rate cuts – Kostin gives an alternative scenario if the US enters a recession, “history suggests S&P 500 EPS would fall by 13% in 2020. If COVID-19 spreads rapidly, supply chain delays could persist, US consumer demand could plummet, and firms could lay off workers in an effort to maintain margins. Using 11 previous recessions since 1947, S&P 500 EPS typically fell by 13% from peak to trough (typically ~4 quarters). Although earnings recessions have been more severe during the past 30 years, consumer balance sheets are healthy and banks carry much stronger capital ratios relative to history. Under our recession scenario, we assume S&P 500 earnings fall by 13% from peak to trough and rebound by 10% during the subsequent four quarters.

Naturally, this scenario would be catastrophic to Goldman’s clients who were never warned about this – Goldman itself 3 weeks ago was idiotically claiming that the US is virtually recession proof – and so Kostin had to hedge that as well, predicting a just as idiotic V-shaped recovery in case the pandemic remains confined to China.

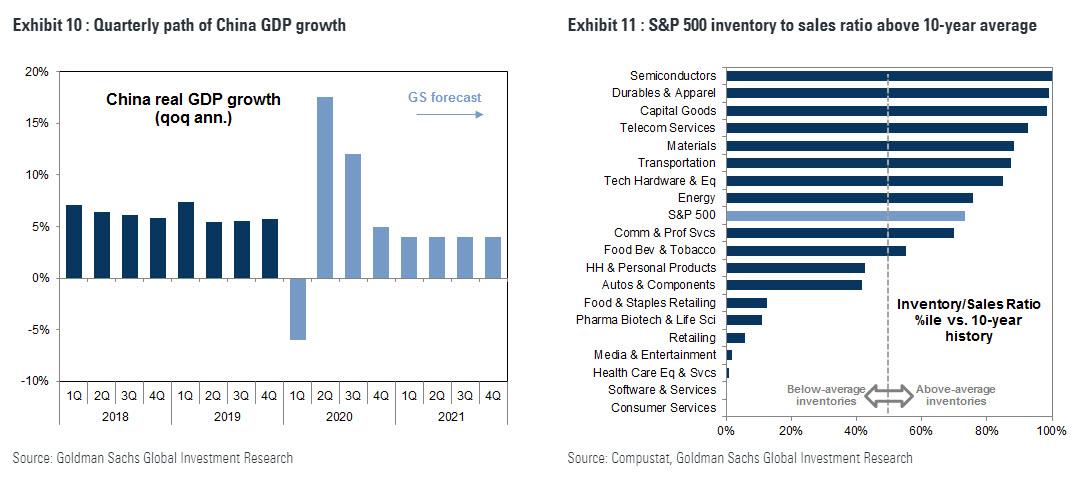

However, if the outbreak remains largely confined to China, economic activity could rebound to normal levels in 2Q and companies could rely on existing inventories. Our China economics team expects that real GDP growth in China (qoq annualized) will recover sharply following the 1Q contraction. High frequency indicators suggest that production is gradually resuming across the country. In addition, many S&P 500 companies have built inventories that can be drawn upon in the interim to compensate for disrupted supply chains. The S&P 500 inventory to sales ratio ranks in the 73rd percentile relative to the past 10 years and is even further above-average for some of the industries most clearly at risk (e.g., Semiconductors). If lost activity from 1Q is recouped quickly and average annual US and world GDP growth is largely unchanged, our top-down model suggests S&P 500 EPS growth of 3% in 2020 and 5% in 2021.

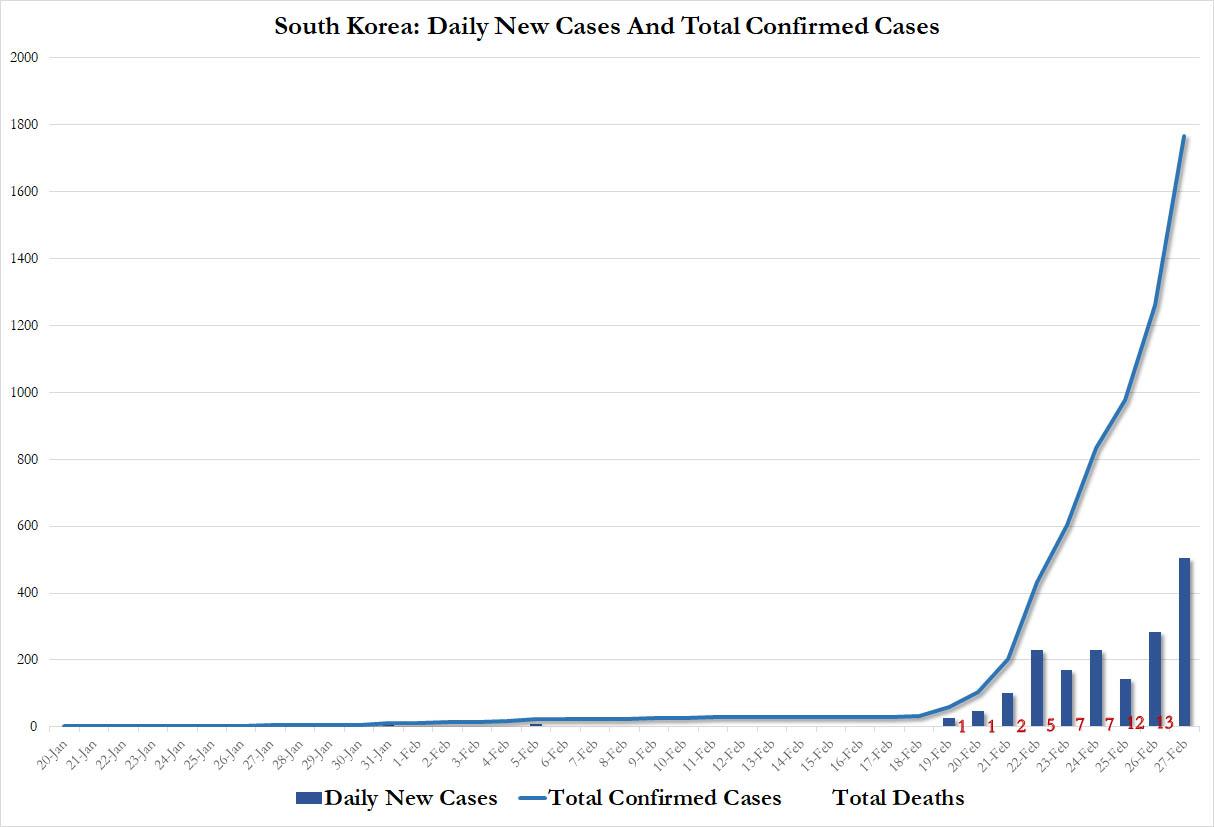

That said, best of luck with this rebound…

… considering that South Korea has now surpassed China in daily new cases.

For those who care, here is the full summary of the Goldman note:

1. Investors fear the coronavirus (COVID-19) will expand from an epidemic to a pandemic. The rapid expansion of coronavirus human-to-human infections across multiple continents has sparked a five-day 8% sell-off in the S&P 500 index. At 3116, the stock market now stands at the same level as last December but is 8% below the all-time high of 3386 on February 19th.

2. Epidemic vs. Pandemic: The World Health Organization (WHO) defines an epidemic as a sudden increase in the number of cases of a disease. “Pandemic” is defined as an epidemic that has spread over several countries or continents, affecting a large number of people. As of February 26th, WHO and CDC data indicate that there have been 82,164 confirmed COVID-19 cases across 39 countries resulting in 2,801 deaths (fatality rate of 3.4%). For context, the seasonal flu in the US infects 24-45 million people and results in 23,000-61,000 deaths representing a fatality rate of roughly 0.1%. On February 25, federal health officials at the US Center for Disease Control (CDC) stated that they expect to see community spread in the US and “now is the time for US businesses, hospitals, and communities to begin preparing for the possible spread of COVID-19.” We believe portfolio managers should also prepare for this possibility.

3. Trading the market in 2020: Consensus currently expects 2020 EPS will equal $176. With bond yields at 1.3%, the yield gap between the forward earnings yield (5.6%) and the 10-year US Treasury yield equals 427 bp. For context, the long-term average yield gap equals 230 bp. If investors adopt the view in coming months that COVID-19 will become widespread, the yield gap could widen to 500 bp. If bond yields drop to 1%, the resulting 16.7x forward P/E means the S&P 500 would trade at 2900, representing a 7% decline from the current level and a 14% drop from the all-time high.

4. US companies will generate no earnings growth in 2020. We have updated our earnings model to incorporate the likelihood that the impact of the virus becomes widespread. Our revised baseline EPS estimates for 2020 and 2021 are $165 (previously $174) and $175 (previously $183), respectively, representing 0% and 6% growth. Our reduced profit forecasts reflect the severe decline in Chinese economic activity in 1Q, lower end-demand for US exporters, disruption to the supply chain for many US firms, a slowdown in US economic activity, and elevated business uncertainty. Consensus bottom-up forecasts imply full-year EPS will climb by 7% in 2020 and by 11% in 2021.

5. Path to unprofitability. Our top-down base case assumes S&P 500 firms will report a decline in EPS during 1H 2020. Consensus bottom-up estimates imply 1Q EPS growth of +1% followed by 2Q EPS growth of +5%. The trajectory of the US and global economy is highly uncertain at this time. For modeling purposes, we assume economic growth slows sharply during 1H 2020, but rebounds in 2H 2020 and 2021. A more severe pandemic could lead to a more prolonged disruption and a US recession. Under a recessionary scenario, S&P 500 EPS would fall by 13% to $143 in 2020 before rebounding by 10% to $158 in 2021. In an upside scenario where COVID-19 spread is more contained, EPS would equal $170 (+3%) in 2020 and $180 (+5%) in 2021.

6. Lower profits, but also much lower interest rates. The ten-year US Treasury yield has sunk to the lowest level in more than 50 years. At the start of the year, the 10-year note yield equaled 1.9% but has since plunged to 1.3%. The fed funds rate currently equals 1.5-1.75%. Futures assign a 32% probability the FOMC will cut the policy rate at the March 18 meeting and an 86% probability of at least two 25 bp cuts by year-end.

7. Baseline valuation forecast: By year-end, we expect the yield gap will narrow to 365 bp and the S&P 500 will trade at 3400 (+9% above the current level). Our valuation forecast incorporates our macro model, including interest rates, the output gap, inflation, consumer confidence, and policy uncertainty. We assume breakeven inflation and consumer confidence will return to current levels by year-end and policy uncertainty will decline post-Election. Assuming bond yields climb modestly to 1.5%, consistent with futures market pricing, we forecast S&P 500 forward P/E will rise to 19.4x. We maintain our year-end price target of 3400 as lower bond yields offset lower earnings.

8. Alternative valuation scenarios: If the COVID-19 outbreak is contained and bond yields rise to 1.85%, slightly lower valuation multiples would offset the continued growth in S&P 500 EPS. In this scenario, the S&P 500 would still trade at 3400, representing a 19x forward P/E multiple. In a downside scenario, we assume bond yields fall to 0.75% and the yield gap widens to 575 bp. As a result, the forward P/E multiple would decline to 15x and S&P 500 would end the year at 2450 (-21% from the current level).

9. Sectors: Shift more defensive given slowing growth. We raise Real Estate to Overweight from Neutral, and Utilities to Neutral from Underweight. In contrast, we lower our Industrials weighting to Neutral from Overweight, and lower Financials to Underweight from Neutral. Real Estate companies generate 81% of their revenue domestically and have significant recurring revenue. Utilities have similar revenue characteristics but the historical relative valuation is comparatively more attractive for Real Estate. Industrials and Financials are both pro-cyclical so a slowing economy represents a challenge to companies in both sectors. However, Financials has the added headwind of falling interest rates, which will squeeze net interest margins for banks.

10. Themes: America First. Global economic growth is slowing but the US is comparatively better positioned than most other regions. The consumer accounts for 70% of the US economy, the unemployment rate stands at 3.6% (the lowest rate in 50 years), wages are rising, households have been deleveraging for a decade, and consumer confidence remains strong. Pandemic risk is real and our basket of firms that are domestically-oriented (GSTHAINT, median stock has 100% US sales) will likely outperform companies with a high share of foreign sales (GSTHINTL, 30% US sales).

11. Election implications. Prediction markets continue to suggest the most probable election outcome is a divided federal government. Our earnings scenarios presented above assume the current statutory corporate tax rate remains unchanged at 26% with the effective rate at 19%. However, if corporate tax reform is reversed, the 2021 effective tax rate would climb by 800 bp and the impact on S&P 500 profits would be significant. A rise in uncertainty would also result in lower equity valuations. History shows that US presidential re-election probabilities are highly dependent on 2Q US GDP growth. If COVID-19 becomes widespread and leads to a slowdown in US growth or a recession, it could alter current expected election outcomes.

Tyler Durden

Thu, 02/27/2020 – 09:01