“Worst Thing In My Career” – US Stocks Suffer Fastest Collapse From Record Highs Since Great Depression

This didn’t age well…

Highest Stock Market In History, By Far!

— Donald J. Trump (@realDonaldTrump) February 19, 2020

A sea of red…

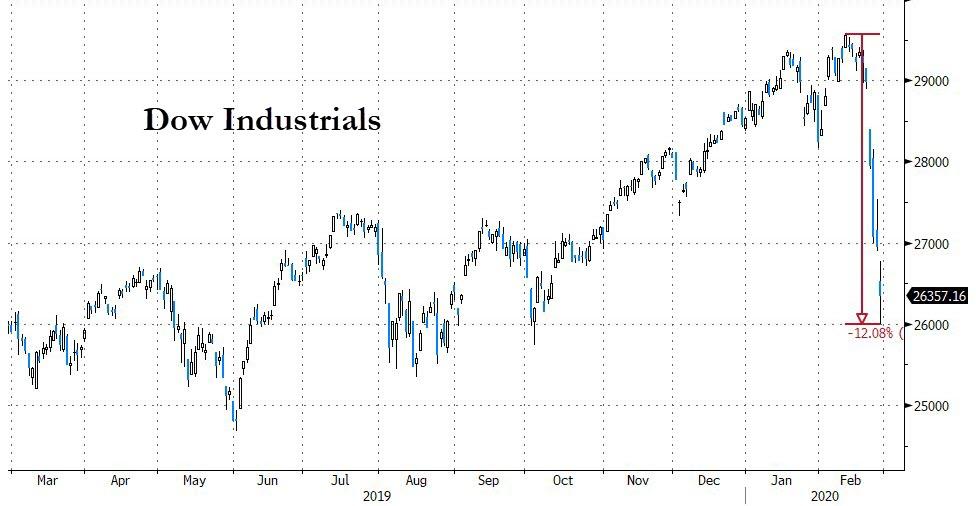

The Dow has collapsed from a record high into ‘correction’ in the space of just six days. As we detailed earlier, this is the fastest collapse from an all-time peak since 1928, just ahead of The Great Depression:

Source: Bloomberg

As Guggenheim’s Scott Minerd declared on Bloomberg TV:

“…this is possibly the worst thing I have seen in my career… it’s hard to imagine a scenario in which you can contain the virus threat,” adding that “Europe and China are probably already in recession and US GDP will take a 1.5-2.0% hit.”

“The stock market could be down 15-20%… and would likely force The Fed’s hand.”

Guggenheim’s Scott Minerd says the coronavirus crisis is possibly the worst thing he’s ever seen in his career: “This has the potential to reel into something extremely serious” pic.twitter.com/xLhhNm3u7t

— Bloomberg TV (@BloombergTV) February 27, 2020

Investors are piling into safe-havens (bonds and bullion) as they dump stocks…

Source: Bloomberg

Still, could be worse…

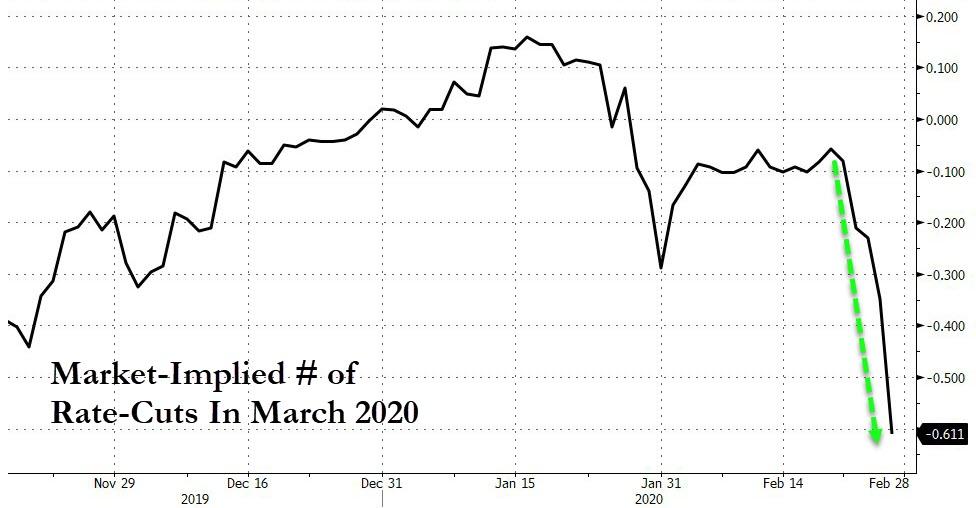

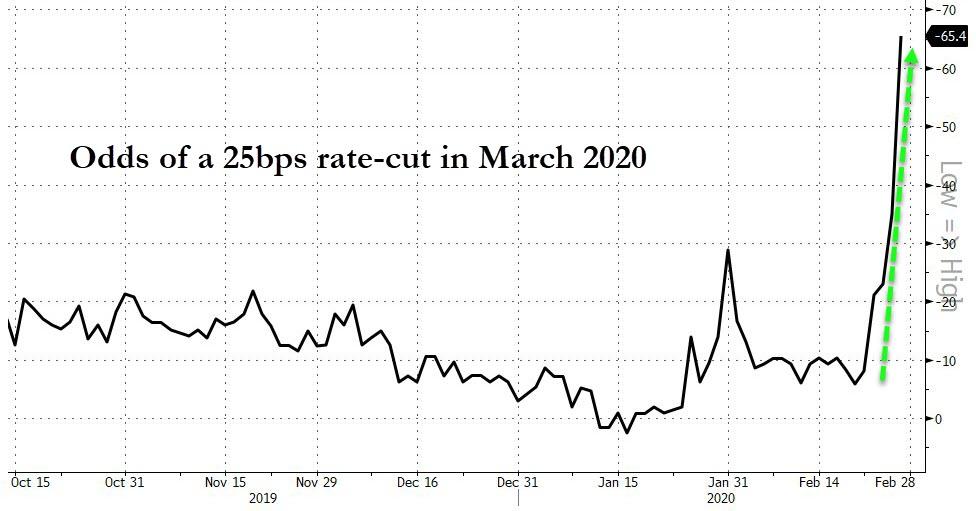

The market is already demanding 3 rate-cuts this year…

Source: Bloomberg

With the odds of an emergency cut in March soaring…

Source: Bloomberg

And, stocks have erased most of the ‘NotQE’/Repo liquidty bailout gains…

Source: Bloomberg

From the turn down last Wednesday, all the major stock indices are in correction territory, down over 10%…

The Dow was down over 12% from its highs at the lows of the day today…

Source: Bloomberg

Today was the biggest single-day point drop in Dow history…

Source: Bloomberg

Today’s price action was stunning. Weakness overnight extended lower after the open, then a massive ramp higher (pushing Trannies and Small Caps briefly green), before it all fell apart again…

Dow futures show the action best – Futures were down almost 1000 points, extending the overnight losses through the open, that was followed by a quick 800 point ramp – which failed to take out overnight highs – and then faded back towards the lows into the close…Dow 26k seemed the Maginot Line…

S&P closed below 3,000…

Source: Bloomberg

…and broke below its 200DMA (as did the Dow and Russell 2000), Nasdaq closed below its 100DMA…

FANG Stocks have lost $350 billion in market cap in the last 6 days…

Source: Bloomberg

Bank stocks continue to bloodbath…

Source: Bloomberg

Airlines staged an epic comeback today after crashing at the open, but faded lower into the close to end red…

Source: Bloomberg

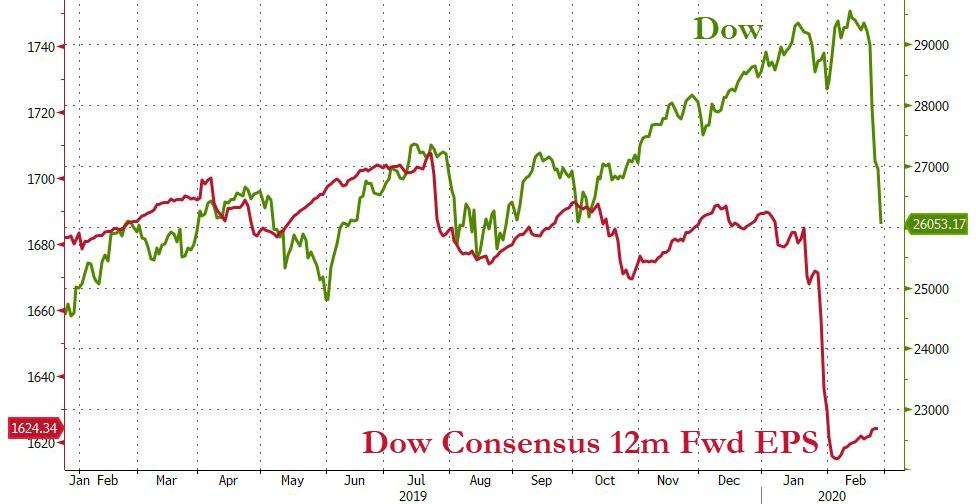

Why is everyone so surprised at the drop in the Dow, when earnings expectations have already plummeted…

Source: Bloomberg

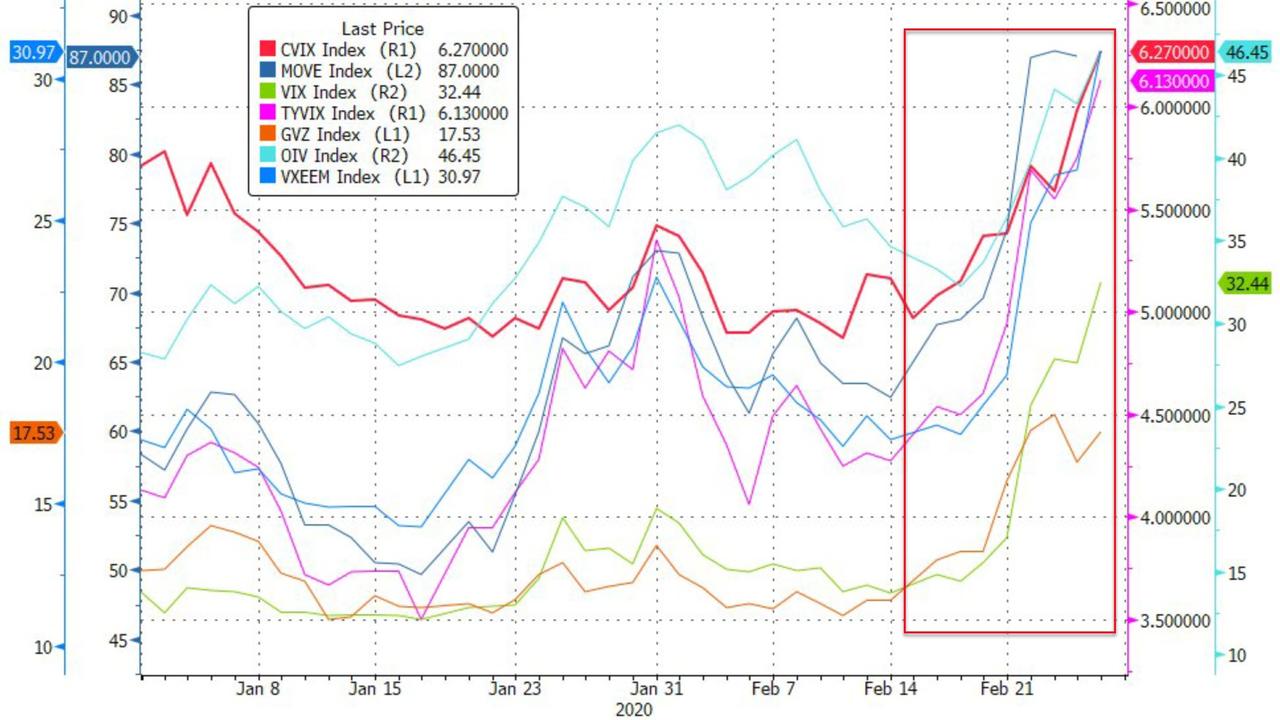

VIX topped 36 intraday, dipped a little, then ramped back to 34 in the last hour…

VIX is also catching up to the outlook suggested by the collapsing yield curve…

Source: Bloomberg

Credit markets are crashing wider in cash and derivatives…

Source: Bloomberg

And rather stunningly, XOM’s dividend yield has exploded to its highest since Feb 1986 (as the stock price crashes)…

Source: Bloomberg

Before we move on to bonds, this is utterly insane!!! China is now dramatically outperforming US and EU stocks since the start of the virus headlines…

Source: Bloomberg

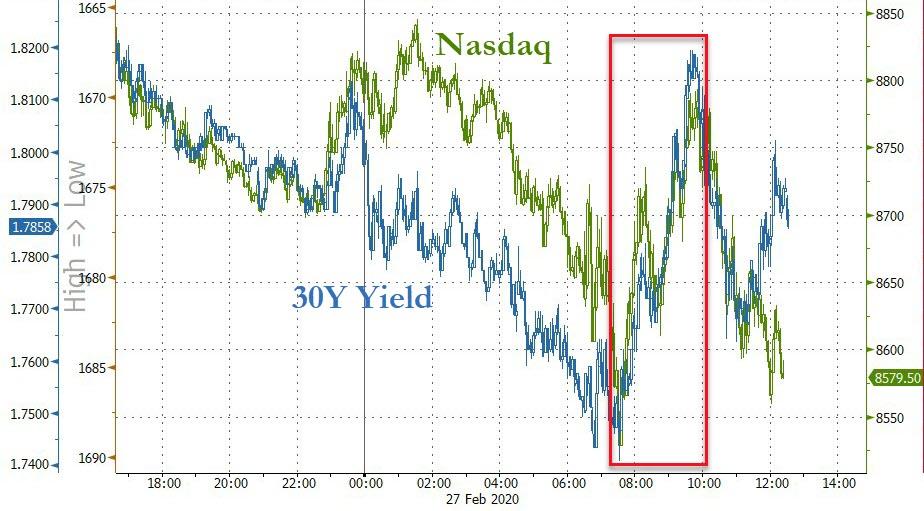

Today’s two hour panic-buying stocks, panic-selling bonds effort looked a lot like pension-rebalancing…

Source: Bloomberg

Lots of volatility in bond land today with yields crashing overnight to fresh lows, ramping back to unch after the US cash equity open, then falling back towards the record lows (down 4-5bps across the curve on the day)…

Source: Bloomberg

30Y Yields fell to a 1.74% handle!

Source: Bloomberg

The dollar tumbled today to one-week lows…

Source: Bloomberg

Cryptos bounced back today after an ugly week…

Source: Bloomberg

Gold and copper were flat today as silver and crude tumbled…

Source: Bloomberg

WTI collapsed today to a $45 handle, down a stunning 30% from the early January spike highs on Iran missile strikes…

Source: Bloomberg

And as oil prices crash, Energy credit markets are collapsing – HY Energy OAS at widest since April 2016…

Source: Bloomberg

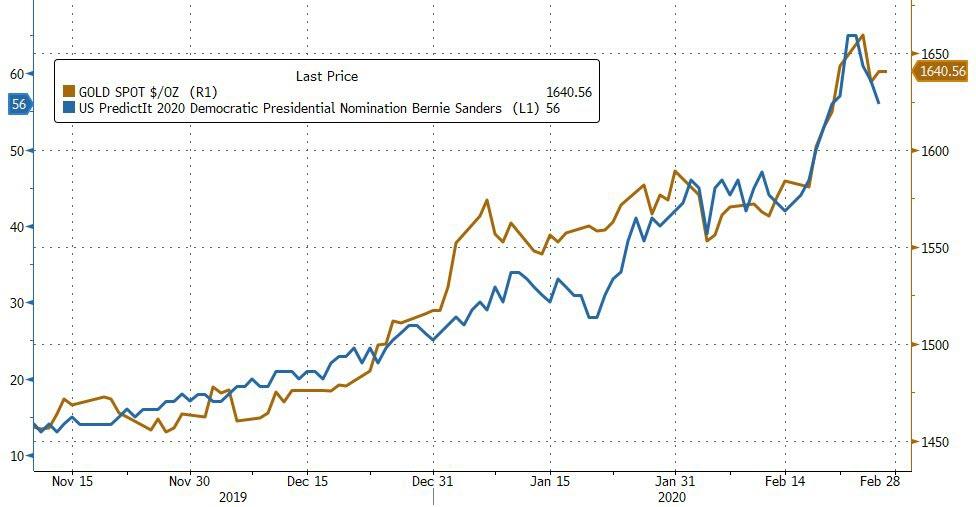

Finally, gold was flat today as the odds of a Bernie nomination slipped modestly… but that correlation is quite stunning…

Source: Bloomberg

Partying like its the end of 1999…

Source: Bloomberg

We’re gonna need more liquidity…

Source: Bloomberg

Somebody’s got to get their boot back on the throat of global financial market volatility…

Source: Bloomberg

Seemed like the right time to bring out the deer!!

Tyler Durden

Thu, 02/27/2020 – 16:01