Covid-19 Outbreak Meets Another Catastrophe Bond Trigger Condition

The outbreak of Covid-19 in China, South Korea, Japan, Iran, Italy, and other parts of Europe and the Americas has likely “met another of the conditions within the trigger mechanism of the World Bank’s pandemic catastrophe bond transaction, raising the chance that noteholders face losses in the coming weeks,” reported Artemis, a market intelligence firm with the focus on catastrophe bonds.

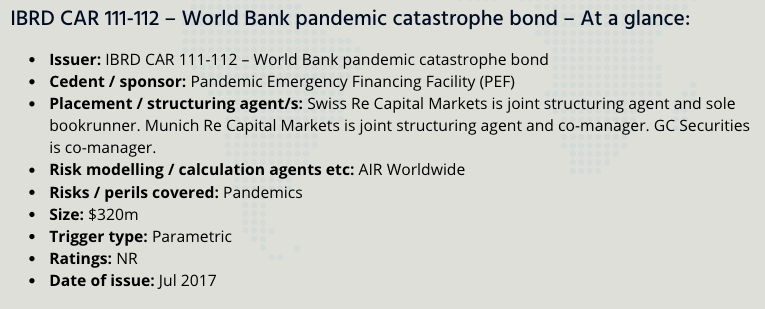

The World Bank’s $320 million IBRD CAR 111-112 pandemic catastrophe bond issue supports its Pandemic Emergency Financing Facility (PEF), is now at risk of default as the virus rapidly spreads across the world.

Artemis said pandemic cat bonds “can be triggered if the outbreak reaches pandemic levels and meets certain pre-defined trigger criteria, in terms of officially confirmed cases, growth rate, fatalities, and international spread.”

Artemis notes that several conditions have already been met, which means the cat bonds could be triggered in the next couple of weeks:

The first condition that was met was for the number of confirmed deaths occurring in China, the source country of the outbreak.

As deaths in China have continued to escalate, reaching some 2,744 as of today (Feb 27th), this trigger condition had already been met.

Now, Iran has reported deaths in the country from the coronavirus have reached 26, which is higher than the trigger condition concerning international spread of any outbreak, further heightening the risk of default to the pandemic catastrophe bond notes.

Artemis notes Iran’s confirmed cases and deaths must be reported through the WHO to become official:

We have to stress here that this is the Iranian government’s figure, not the official WHO reported number that would be used to determine whether any default or payout was due. So while the number has surpassed the point required by the trigger, it would still need to be reported as such by the WHO and also be subject to a calculation agent review as well, before it would be determined whether a payout came due.

But at 26 already it seems like we can consider that this second important trigger condition for the pandemic catastrophe bond will now be breached.

As a reminder, the World Bank facilitated pandemic cat bonds in two separate issues:

The World Bank facilitated pandemic catastrophe bond is structured into two tranches, issued to investors as $225 million of Class A notes and $95 million of Class B notes, with both exposed to a coronavirus outbreak, but under different terms and reflecting different levels of risk.

The Class A notes require a coronavirus outbreak to result in over 2,500 deaths (already met in China alone), with at least 250 cases being confirmed on a rolling basis, as well as more than 20 deaths being seen in at least one country overseas (now met in Iran), for an initial 16.67% loss of principal to this tranche to occur.

Higher losses require higher numbers in all cases and there is a stepped payout mechanism for both tranche of notes.

The Class B notes are the more likely to face triggering under a qualifying outbreak event, as only more than 250 confirmed deaths are required, alongside the other factors, for a payout to be due.

The trigger criteria for the Class B notes is more complicated though, as different payout rates are applicable depending on how many countries outside of the originating country see more than 20 confirmed deaths each. Right now it looks like this is just one country so far, in Iran, although Italy has now seen 14 deaths and South Korea 13.

Alone this isn’t going to trigger the pandemic cat bonds, as other conditions also need to be met, as defined in the underlying insurance contract terms.

Artemis said, “there is no need for a pandemic to be declared by the WHO, or any other body, for the cat bond to trigger.”

And here it’s is: “the earliest we could see any triggering of the pandemic catastrophe bond, at any percentage level of payout, will be after March 23rd and only if the growth rate is positive and meets the necessary terms of the trigger contract language as well.”

As “two conditions of the trigger met” – Artemis warns: “The market will consider the risk heightened further for the pandemic catastrophe bond notes.”

The World Health Organization’s (WHO) Dr. Michael Ryan was quoted on Friday as saying, “declaring a pandemic would be unhelpful.” As to why WHO officials continue to downplay the virus outbreak remains a mystery, or maybe not – perhaps declaring a pandemic is terrible for the cat bondholders and financial elites who run global financial markets.

Tyler Durden

Fri, 02/28/2020 – 13:55