How Did We Get Here?

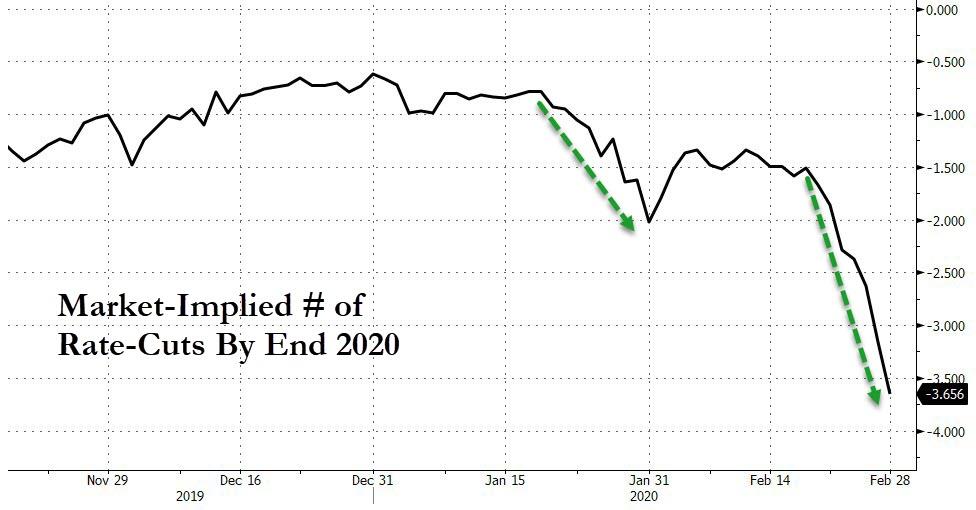

In the breathless words of Ron Burgundy, “well, that escalated quickly!” Amid all the calls for The Fed to rescue investors with 1, 2, 3, or even 4 rate-cuts…

The question many prefer to not ask – for fear of the answer – is: How did we get here!?

Nomura’s Charlie McElligott provides the details of what sparked the greatest drop from a peak into correction in the history of the stock market…

-

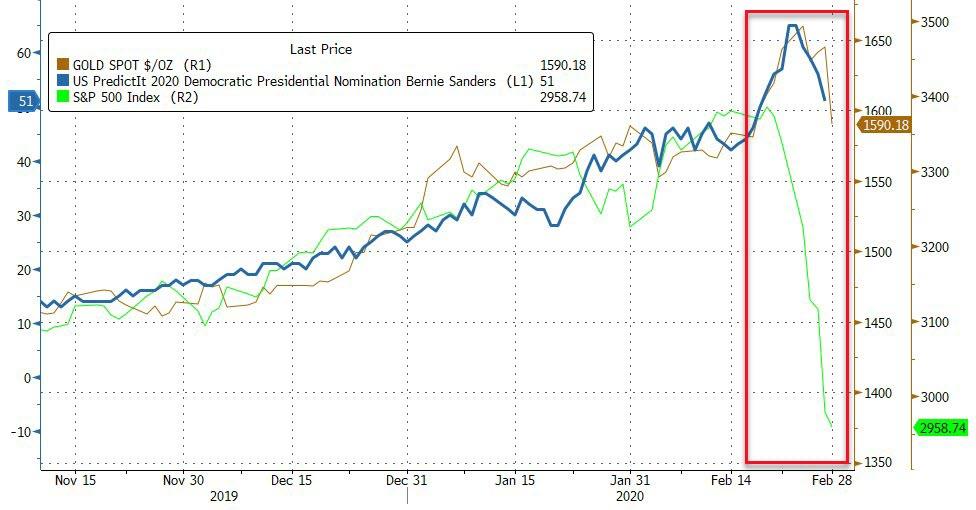

Two “left tail” macro-catalysts surged into last week (Coronavirus “black swan” and the stunning ascent of Bernie Sanders as “candidate #1” acting as a clustered “negative growth shock” impulse) hit at the perfectly wrong time into US Equities – and US Rates – markets

-

Into options expiries for both US Equities and USTs / Rates late last week, we had seen Dealers extraordinarily “Long Gamma” in each of these “ultimate” asset-classes thanks to recently placid “financial conditions” thanks to Fed “policy asymmetry” and a relatively “Goldilocks” US Economy which incentivized “vol selling” behavior from investors looking for “yield enhancement” / “income generation”—helping in-turn drive S&P and Nasdaq to hit their all-time highs just last Wednesday

-

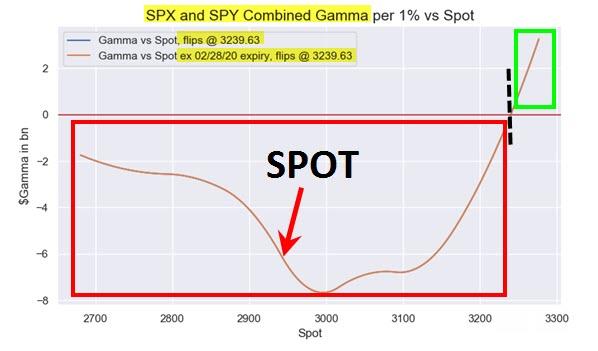

This (now ancient) Dealer “Long Gamma” choke-hold over prior months had acted as an insulating / vol suppressing flow that buffered against shock-moves and, generally speaking, had kept us in relatively tight directional “bands” (as Dealers short options need to “buy dips or “sell weakness,” especially as we neared expiry)

-

However and following the large expiries late last wk (VIX last Weds, everything-else last Fri), these two “macro shock catalysts” created a profoundly negative price impulse which sent “spot” levels in Equities Index, Equities Vol and Rates deeply through prior ranges, which drove Dealers into “Short Gamma” territory – meaning that instead of insulating market moves as they had been previously, that now Dealer hedging flows would see them pressing into the directional moves (in this case, shorting into the new lows in Equities index, or buying VIX- and USTs- / STIRS- the more they “rallied”)

-

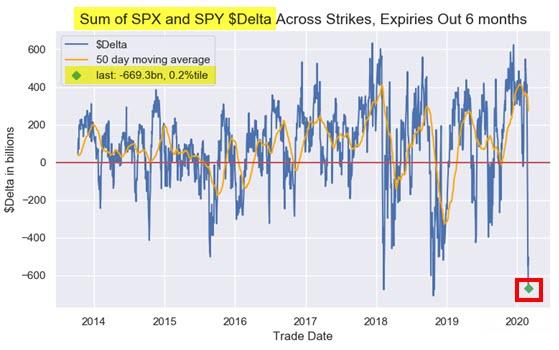

And as we’ve stated in this note now for nearly a decade – in a market structure which is now built on “negative convexity” / “short vol” / “short gamma” strategies in order to generate “yield,” as you’ve been incentivized by the global central bank “put,” financial repression” and their complete submission to “financial conditions” (the politically correct form of saying that Central Banks are beholden to markets and the “wealth affect”), any spikes in volatility are to be “sold” and dips in equities are to be “bot,” while said vol / term premia suppression policies (rate cuts, large scale asset purchases, liquidity injections) too “green light” carry- and momentum- trades, especially with the cheap cost of leverage

-

The problem is, the more something “trends” the more leverage you need to apply to maintain target exposures – which is the working definition of “stability breeding instability”

-

So on that macro catalyst “shock down” which forced Dealers into “Short Gamma” territory then exacerbating the moves further at the “extremes” (selling lows in Equities to remain hedged, or buying Vol / USTs / ED$ at highs), we then exposed the MECHANICAL DELEVERAGING FLOWS of systematic “vol control” / “target volatility” universe which now need to gross-down—because VOLATILITY IS THE EXPOSURE “TOGGLE”

-

And this isn’t just for “quants,” because anybody operating under a VaR risk management framework is also a de facto “vol control” fund, where these rolling “macro catalyst crises” blow-up accumulated leverage in previously “easy money” carry- and momentum- trades in turn driving shock “de-grossing” events that we come to expect now every few months

-

And in peak perversity and after their forced “VaR-downs,” it’s the same “backtests” (which are a function of the “known phenomenon” of Central Bank interventions to yet-again “save the day”) which tell the models and condition the human behavior to again thereafter “short rich vol / premium” when it hits these high %iles

-

Soon, S&P Puts are “bombed” and VIX Calls / futures sold, while systematic roll-down in VIX steps-in after inversions then normalize—and this normalization of vol then means that the “vol control” / “target vol” stuff then begins their mechanical “RE-leveraging,” forcing the “chase” too from fundamental investors back into the market who too have been conditioned to “buy the stock dip, sell the vol rip”

-

“Crash-down, crash-up” – RINSE, REPEAT

Spot On! But if you really want to know how we got here, it’s a longer tale that for former Dallas Fed’s Fisher noted yesterday:

“Does The Fed really want to have a put every time the market gets nervous? …Coming off all-time highs, does it make sense for The Fed to bail the markets out every single time… creating a trap?”

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, anbd even 2007-2009.. and have only seen a one-way street… of course they’re nervous.“

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?“

“the market is getting ahead of itself, because the market is dependent on Fed largesse… and we made it that way…

…but we have to consider, through a statement rather than an action, that we must wean the market off its dependency on a Fed put.”

It’s not the virus, it’s The Fed stupid!

Tyler Durden

Fri, 02/28/2020 – 15:01