Bank Of Japan Buys Record 101 Billion Yen In ETFs To Stabilize Markets

While over the past 24 hours, the US Federal Reserve appears to have gotten cold feet about intervening in the market and/or cutting rates, its Japanese peer had no such misgivings.

AS a reminder, Friday saw Fed Chairman Powell step in with a rare public statement, in which he stated that “the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.” And yet despite this Greenspan-playbook preview which helped send US stocks soaring in the last minutes of Friday trading, Powell didn’t actually do anything over the weekend, as the whispers had had it.

His BOJ colleague, Haruhiko Kuroda, however, was far more aggressive, and on Monday morning, the BOJ also csme out and made clear that it too has noticed that things are not going well (and recall Japan was already in recession, which today’s Q4 capex data at -5.0% only underlines), and said that the BoJ would “closely monitor future developments.”

More importantly, however, besides mere jawboning, the BOJ did in fact step in to stabilize markets, and with the Nikkei openly sharply lower, the BOJ unleashed a record stock market intervention and bought a record amount of Japanese stock ETFs on Monday, central bank data showed. Indeed, according to Reuters, on top of its small daily purchase of ETFs targeted to “encourage companies’ capital spendings”, the BOJ bought 100.2 billion yen ($926 million) of ETFs, much larger than the 70-74 billion yen it habitually buys.

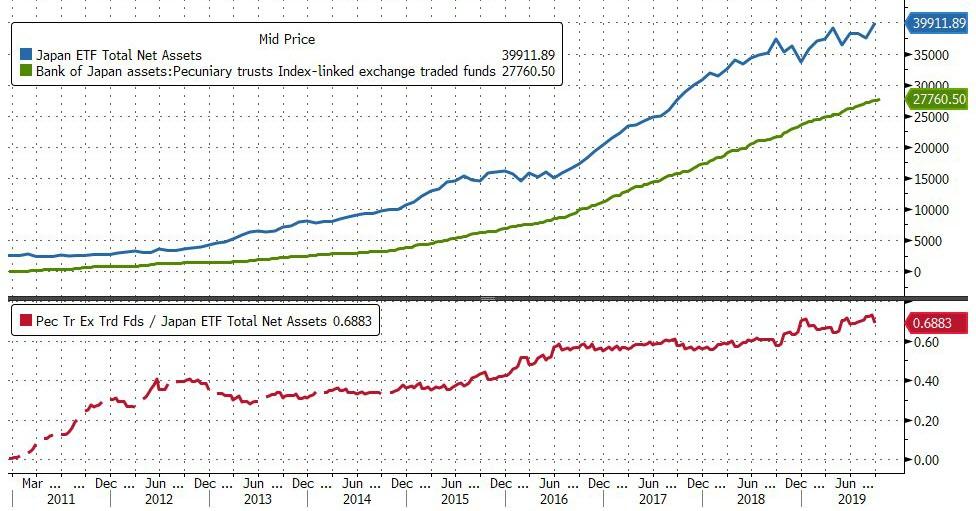

The BOJ’s panicked attempt to stabilize the market takes place three monts after we reported that the Japanese central bank would start lending out ETFs to prevent a market freeze as a result of its relentless purchases, and as the market literally runs out of ETFs to purchase and keep systemic liquidity ample. The problem: the BOJ already owns nearly 80% of the country’s stock of ETFs, the result of a program begun in 2010 and ramped up in 2013.

And with every incremental purchase, not only does the stock of existing ETFs shrink, but incremental BOJ intervention threatens to tip over the market into an illiquid crunch. Of course, the BOJ can “fix” this issue by simply expanding its universe of eligible securities to also include single stocks, which is inevitable now that the coronavirus pandemic threatens to transform Japan’s garden-variety recession into a depression. Until then, however, for all those asking why futures aren’t far lower, thank Kuroda, whose central bank once again demonstrate that the only thing that matters is stocks.

Tyler Durden

Mon, 03/02/2020 – 09:06