Shale Drillers Need A Miracle To Keep Production From Falling

Authored by Irina Slav via OilPrice.com,

With West Texas Intermediate falling below $45 a barrel after the latest burst in coronavirus panic, U.S. shale oil and gas producers are feeling growing heat. Except for the Permian, where production of both oil and gas is still growing, the U.S. shale patch is retrenching. And the Permian may soon follow suit.

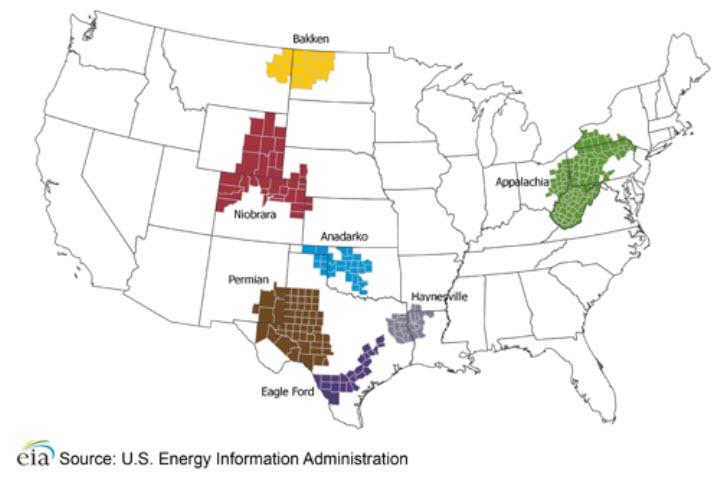

In its latest Drilling Productivity Report, released earlier this month, the Energy Information Administration said oil production had declined across six of the seven major shale plays in the country, by some 21,000 bpd. In the Permian, however, production rose by 39,000 bpd, tipping the total into a net increase of 18,000 bpd. Now, while this confirms the star status of the Permian, it also suggests that oil production growth is becoming uneconomical in other shale plays.

A recent report on oil and gas production trends in 2019 showed the slowdown is not a sudden one. Titled “Rockies and Bakken in Focus”, the report, by Enverus, says growth in production in these regions had slowed to a crawl amid the low oil prices. Pipeline constraints, the oil and gas info provider noted, were also stifling production growth.

While relief for the pipeline constraints in the Bakken and the Denver-Julesburg area is coming, prices don’t look like they are going anywhere except maybe further down if OPEC+ fails to agree to deeper cuts. This means the financial pressure many oil and gas drillers in the shale patch are already feeling will only deepen and production growth will slow further.

Earlier this week the chief executive of Schlumberger said as much. Speaking to Reuters on the sidelines of an industry event in Saudi Arabia, Olivier Le Peuch said he expected growth in U.S. shale oil production to slow down to 600,000 to 700,000 bpd this year and further to just 200,000 bpd next year as low prices continue to take their toll.

This wasn’t all, either. According to Le Peuch, unless the oilfield service sector comes up with new extraction technology that works at lower than current costs, U.S. shale oil production will not return to growth at all, but plateau.

“Shale production growth will go to a new normal … unless technology helps us crack the code,” Le Peuch said.

This is the latest reminder yet that there is only so far that you can cut costs by choosing the sweetest spots in a shale play and using the most efficient technology. Add to this the fact that the sweet spots are already depleted and producers have moved to not so low-cost locations, and the outlook for U.S. shale oil darkens.

The situation in gas is even worse. As the Enverus report notes, the breakeven cost for gas production in the Denver-Julesburg Basin and the Bakken are now higher than the Henry Hub benchmark and quite a bit higher, at that. Henry Hub futures prices are currently below $2 per million British thermal units until July, when the futures price tops $2 per mmBtu. The breakeven for producers in the Rockies and the Bakken, on the other hand, is more than $3 per mmBtu.

While for oil the biggest problem is the slump in demand in China and the fear of slumping demand elsewhere as the coronavirus conquers new territory, for gas the problem is a persistent overhang in inventories. To make matters worse, the coronavirus fallout is also affecting demand for gas.

Earlier this month a buyer cancelled two cargos of liquefied natural gas from Cheniere Energy, Bloomberg reported last week. The cargoes were to be delivered to Spain’s Repsol and Endesa, in yet another confirmation that the European market is oversaturated with gas for the time being.

Shell—the world’s biggest LNG trader—and Qatar are rerouting deliveries and rescheduling them in response to the escalation in the demand situation, Bloomberg also reported, adding that more buyers of U.S. LNG were considering delivery cancellations. The solution? Build more power plants.

“Prices globally are converging and until there is a boatload of new generation built domestically and abroad, there is just simply not much room in the market,” Campbell Faulkner, OTC Global Holdings chief data analyst, told Bloomberg.

This will be quite an undertaking and it would take quite a while to complete provided there is enough investor interest and government support for so much new generation capacity. Essentially, the solution is hypothetical and as such useless for the immediate term. What is left is shrinking production further, which gas producers are already doing. The ironic twist: it is still growing because of associated gas.

The Permian, where companies have gone to produce oil, not gas, booked the biggest increase in gas production last month, at 198 million cu ft daily. This compares with a combined decline of 360 million cu ft daily combined for Appalachia and the Anadarko basin, according to the EIA’s drilling productivity report for January. In other words, drillers in the Permian are producing more gas whether they want it or not, because they are producing more oil.

To cut the gas inventory overhang, shale drillers, and not just those in the Permian but everywhere in the shale patch, would need to cut oil production and that would put them at greater financial risk because of their reliance on borrowed capital. Once again, U.S. shale drillers need a price miracle to keep going without too much pain.

Tyler Durden

Mon, 03/02/2020 – 15:00