Goldman Head Of Commodities: “Gold Has Immunity To The Virus”

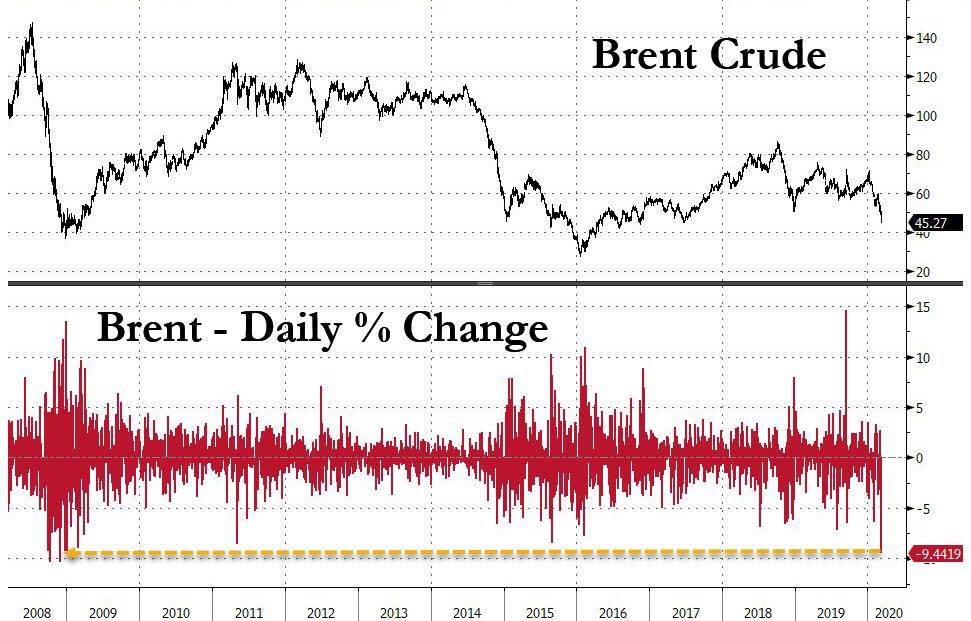

In the following essay by Goldman’s Jeff Currie, published in the bank’s latest Top of Mind report, the bank’s head of global commodity research argues that we’re facing “the largest commodity demand shock since the Global Financial Crisis and sees more volatility ahead.” In retrospect, his forecast was spot on when it comes to the price of Brent, which on Friday suffered its biggest one-day drop since the global financial crisis as OPEC+ disintegrated when Russia and Saudi Arabia failed to reach a production cut agreement.

But it’s not all doom and gloom: while Currie is confident there will be even more blood across most commodities, there is one metal which he believes will be safe: gold “which—unlike people and our economies—is immune to the virus.”

Gold, which a WSJ “expert” idiotically called a “pet rock” back in 2015…

… is according to Goldman the last thing that might store value, namely “the currency of last resort and avoids the concern that paper currencies could be a medium of transfer for the virus. As a result, gold has outperformed other safe haven assets like the Japanese Yen or Swiss Franc” a trend Goldman sees continuing as long as uncertainty around the full impact of COVID-19 remains, which will be the case for a long time, and is also why gold is currently the best performing asset class YTD, a “once in a decade event” as the last time this happened was back in 2010.

Currie’s full essay is below.

The physical realities of disruption

The global economy is a complex physical system with real physical frictions—a reality that financial markets often seem to forget, but have been painfully reminded of with the outbreak of COVID-19. If a ship is in the wrong place, it can take weeks to get it in the right one. That said, the extent of the physical disruption owing to the current outbreak was both minimized and masked by the timing of the Chinese travel disruption.

Occurring during the Lunar New Year holiday, which sees 2.1 billion people—representing nearly 30% of global output— celebrate for one to two weeks, the entire global economy was already prepared for reduced activity in a large part of Asia during this period, with order times and inventories adjusted accordingly. Ships leave Asia before the Lunar New Year laden with goods destined for the West, a 30-40-day trip, and return with scrap and raw materials in late February. This buffer in supply chains bought China nearly a month to contain the spread of the virus, and their strategy is increasingly looking successful, with early indicators suggesting viral containment and economic restarts.

Economic and viral contagion into the Atlantic basin However, economic contagion from China is now likely to spread into the Atlantic over the next month, on top of the viral contagion that has already begun to occur. We estimate that c.45% of scheduled Asia-Europe containership sailings were cancelled in the four weeks following the onset of the Lunar New Year holiday, and as much as 60% of the weekly containership sailings from Asia-Europe/US have been cancelled during the first three weeks of February. This means the March ramp-up in Chinese activity could be slow given the physical realities of re-starting global supply chains. Goods need to be produced, trucked to the ports, documented and then loaded.

This large and unexpected cancellation of sailings to China will likely create shortages in backhaul capacity from the Atlantic that will cause freight rates to spike in coming weeks. Transportation bottlenecks in the Atlantic basin should peak in the next 30-40 days, assuming the recent restarts in China continue. At the same time, supply chain disruptions in the Atlantic basin face further downside risks from internal European travel restrictions, with, for example, 58% of German goods exports in 2018 going to other EU countries, and only 7% going to China. And unlike in China, there is no holiday period that companies have planned for to buffer these disruptions. Indeed, auto-parts maker MTA, whose factory sits inside the Italian quarantine zone, has warned German car producers would shut in a week without their components.

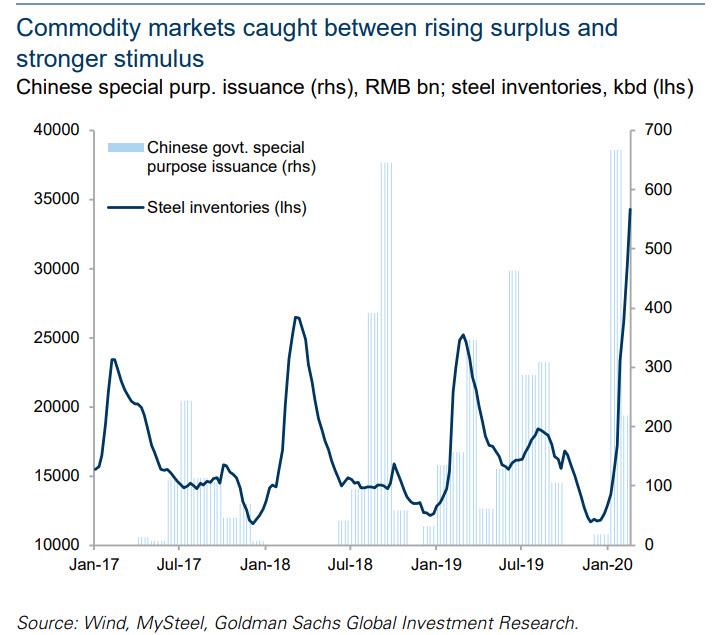

Largest commodity demand shock since 2008 The unprecedented disruption to economic activity in China has resulted in an estimated 4 million b/d of lost oil demand compared to 5 million b/d during the Great Recession in 2008/09. While we see severe travel disruption contained to East Asia for now, further disruption across the West is a real risk with both Italy and Iran now under travel restrictions. And finite storage capacity in China—though large—is filling up quickly, presenting further downside risk if storage is ultimately breached. Solid goods like metals do not face that risk. Although steel demand in China is down nearly 50% yoy, the unprecedented inventory increases have been accommodated. Tension between surplus and stimulus drives volatility The disruption to commodity demand falls broadly into two categories. Either the commodity is consumed as a stock— steel in infrastructure or aluminium in durable goods—or it is consumed as a flow—crude in transport or coal in energy production. Demand for the stock is deferred, as projects resume after the shutdown ends, while demand for the flow is lost, with energy use and transport returning to previous levels.

As Chinese policymakers become increasingly vocal about their intention to use monetary, fiscal and macro-prudential policies to minimize the economic impact of the coronavirus shock, markets have focused on the potential for this stimulus to save deferred demand. Case in point: onshore steel rebar prices are now above pre-outbreak levels despite a massive build in inventory, while Brent crude is down 23% since the onset of coronavirus fears. This continued tension between economic stimulus and surplus inventory will likely create commodity price volatility.

Gold has immunity to the virus

While so much about the current environment remains unclear, there’s one thing that isn’t: gold, which—unlike people and our economies—is immune to the virus. It is the currency of last resort and avoids the concern that paper currencies could be a medium of transfer for the virus. As a result, gold has outperformed other safe haven assets like the Japanese Yen or Swiss Franc, a trend we see continuing as long as uncertainty around the full impact of COVID-19 remains.

Tyler Durden

Sat, 03/07/2020 – 15:17