Traders React To The Death Of The Longest Bull Market In History

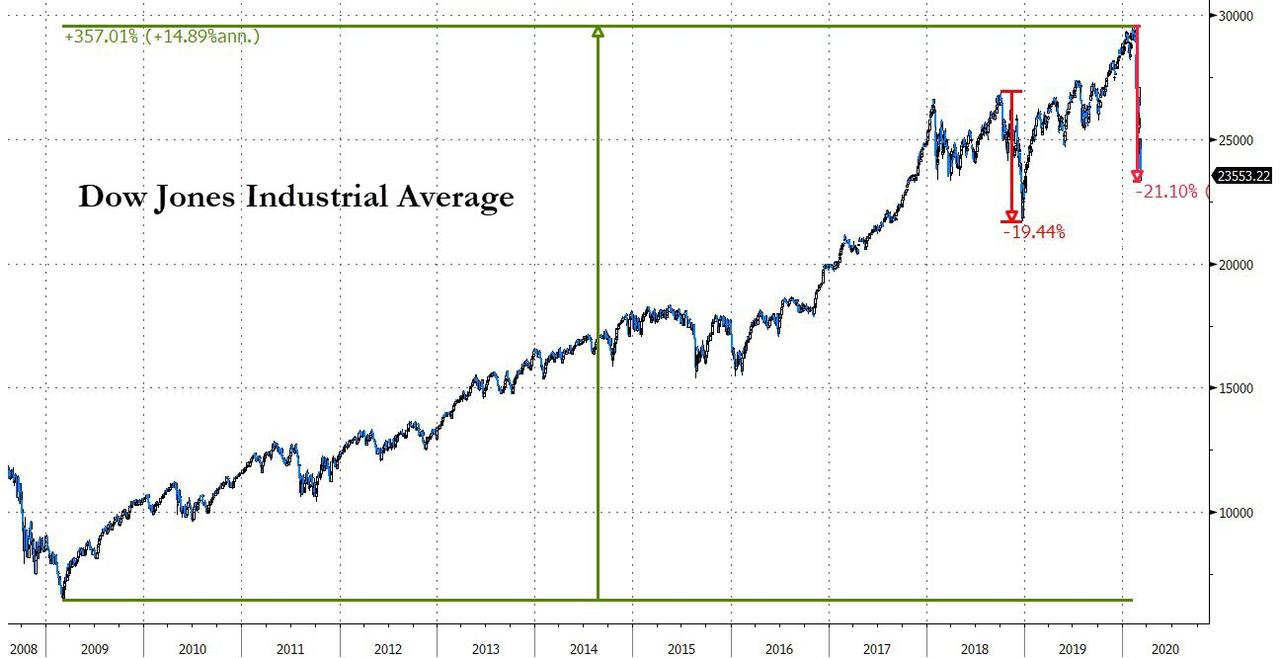

After a record 11-year, 357% surge off the March 6th, 2009 lows, The Dow Jones Industrial Average’s longest bull-run in history came to an end today (two days after its 11th birthday) with its first 20% – bear market – drop.

In fact, the 19-day collapse is the fastest peak-to-bear-market crash in the history of the stock market.

Asset-gatherers, commission-rakers, strategists, analysts, talking heads, and freshly minted gurus (well it always goes up right?) are out en masse to lament the death of the bull (and of course to look for the next dip-buying opportunity): (via Bloomberg)

Quincy Krosby, chief market strategist at Prudential Financial Inc., where she started working in 2009. Prior to that, she was with Hartford Financial Services Group Inc.:

“Did I see it coming this far? No. Throughout the past 11 years, the market has had a lot of dips, and always the Federal Reserve came to the rescue. There were 5% dips, there were 10% drops, and then there were periods where the dips were bigger. Right now, the Fed is not enough, central bank action is not enough. There is a pyramid of uncertainty right now. It’s a man-versus-virus story, but that’s not the only concern.”

Ian Winer is currently an advisory board member at Bellator Asset Management. He ran a long/short portfolio at Galleon Group when the financial crisis hit. In the meantime, he’s worked at Nomura and Wedbush.:

“When Lehman Brothers came under, the next day we came in, we didn’t have any portfolio, it has just vanished. I didn’t believe we’d bounce back the way we did, at all. I completely under-appreciated the liquidity that the central bank has been pouring into the market and how powerful of a force that would be. I was still scarred — and even to these days, there’s an element of me that still has a hard time believing in this bull market, having seen the devastation the financial crisis has caused. It’s still hard not to have it at the back of people’s minds, even after all this time in the rally. There’s a level of skepticism that entered into people’s minds — people of my age, Gen X, who never quite recovered. A rally since 2009 speaks volumes about what the Central bank’s liquidity injection was able to accomplish. The actual prices in the stock market, the real estate market and other speculative markets have been propped up, which has created an asset bubble that will eventually burst.”

Jeff Mills is chief investment officer of Bryn Mawr Trust. Over the past decade, he spent time at PNC Financial Services and joined Bryn Mawr in 2019:

“In terms of mood and sentiment, it’s textbook. In markets, stability breeds instability. As we got a Phase 1 trade deal, as Brexit was resolved, as the Fed promised to keep rates low, all risks seemed to melt away. Stability in markets causes the perfectly rational behavior of investors taking more risk. That additional risk taking sows the seeds of instability. Just as people are most optimistic, just as the market seems least likely to fall, it does. So the swing from very optimistic to fear, in my opinion, is not unusual. What is a bit unusual is the catalyst and the speed of the move lower. I think that has exacerbated the mood swing.”

Marvin Loh is a senior global macro strategist for State Street. In 2008, he was at Oppenheimer covering finance companies:

“If you were in growth, in the Faang names, it has been tremendous. The amount of wealth that was created just by being in the market was tremendous. If you were lucky enough to have been in the growth sectors or, even better, in the tech names that drove it, it’s just been unprecedented. One thing I found interesting is just how much more — the fact that growth out-performed value by so much for such a long period of time and it wasn’t shared to the same degree globally. U.S. markets outperformed the rest of the world. That shows how unique it was from that perspective and why it was able to power on for so long.”

Doug Ramsey is chief investment officer at Leuthold Group. He’s lived through the 1987 crash and the tech bust. He joined Leuthold in 2005:

“It was the most hated bull market — people said that early on. I think in the middle of the decade people go on board. Certainly in the last year they became believers,” he said. “I’d also call the whole decade the steroids era because of all the help out of the Federal Reserve. I think it certainly did get a lot of help from the Federal Reserve. This was the steroids era of the stock market — the Fed propped it up.”

Linda Zhang is the chief executive officer at Purview Investments. When the bull market started in March 2009, Zhang worked as a portfolio manager for global multi-asset mutual funds at MFS Investment Management. Zhang worked at BlackRock when the financial crisis hit:

“This bull market will go down in history as the one that nobody believed would last this long. A lot of people have been hurt because their retirement money disappeared. Most of us had no idea in 2005 and 2006 what type of pain the financial markets are about to go through. What destroyed us in 2008 was over-leverage. What brought to where we are in 2020 is too much hope, sky-high valuations.”

Rich Weiss, chief investment officer of multi-asset strategies at American Century Investments in Mountain View, California:

“This bull market is very atypical in terms of duration. If you look at the last couple of years, growth hasn’t been stellar: anywhere around the world. Real economic growth is hovering around 2%, which is respectable, but certainly not bull market growth. This particularly bull market, low interest rates are arguably the primary driver.”

Peter Tchir, head of macro strategy at Academy Securities LLC:

“So many of the rules that were put in place were supposed to help small companies, and yet it’s the big ones that have benefited, on the banking side in particular. That’s made it more certain that policy makers need to make sure banks do well, and central banks will react more aggressively because of it.”

Dean Curnutt, chief executive officer of Macro Risk Advisors:

“We got here because of unusual, potentially unprecedented circumstances and because a strongly held consensus baked into market prices has been shattered,” he said. “Volatility that has remained so low for so long undeniably dictated positioning and forced investors to contemplate whether markets had experienced permanent, structural change. The sharpness of this adjustment, then, is the result of the collision of crowded trades implemented during exceptionally quiet times with a bona-fide turning point in the business cycle.”

However, we give the last word to former Dallas Fed President Richard Fisher who prophetically mused last week:

“Does The Fed really want to have a put every time the market gets nervous? …Coming off all-time highs, does it make sense for The Fed to bail the markets out every single time… creating a trap?”

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, and even 2007-2009.. and have only seen a one-way street… of course they’re nervous.“

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?“

the market is dependent on Fed largesse… and we made it that way…

…but we have to consider, through a statement rather than an action, that we must wean the market off its dependency on a Fed put.”

Perhaps, just perhaps, the market carnage is all happening for ‘your’ own good.

Tyler Durden

Wed, 03/11/2020 – 20:25