EU Leaders Slam Trump’s “Unliteral” Travel Ban, Global Outbreak Death Toll Passes 4,500: Live Updates

Following last night’s Oval Office unveiling of a 30-day travel ban affecting roughly two dozen European countries, though not the UK, which confirmed its 7th death from the outbreak. Notably, the ban will only affect the movement of people (and American citizens are of course exempt) but not trade in goods, as the White House hastily clarified when they saw the market’s initial reaction, and will exempt the UK.

London was notably silent after the surprise announcement, but in Brussels, the bureaucrats running the EU were somewhat less than pleased. EU leaders slammed President Trump’s “unilateral” travel ban and warned the coronavirus pandemic is an international problem that demands coordinated action (like what Christine Lagarde demanded yesterday?). European Commission President Ursula von der Leyen European Council Leader Charles Michel issued a joint statement on Thursday that highlighted European alarm at the US move. “The coronavirus is a global crisis, not limited to any continent and it requires cooperation rather than unilateral action,” they said, per the FT.

Von der Leyen and Michel

Meeanwhile, Spain’s entire cabinet is being tested for coronavirus, with the results due to be announced on Thursday afternoon, and countries in Scandinavia have begun shutting down schools less than a day after Sweden reported its first virus-related death.

Notably, the ban leaves out all of Asia, stymieing liberals who were ready to pounce on another “racist” Trump travel ban. Though many are still bellyaching about Trump’s decision to leave out the UK, which is run by Trump’s ‘good friend’ Boris Johnson. But as Rencap’s Charlie Robertson pointed out, Trump’s decision to exempt the UK was based on epidemiological evidence.

Trump is right that the EU has a much worse #coronavirus problem than the UK. For every American confirmed case, there are 46 Italians, 23 Danes, 12 Spanish, 9 French, 6 Germans and just 2 Irish or British. But the travel ban has minimal effect. US cases doubling every 2-3 days pic.twitter.com/UijASCp2BW

— Charlie Robertson (@RencapMan) March 12, 2020

Across the US, private schools appear to be closing under pressure from parents.

#Covid19 #Utah my wife and I decide to pull all of our kids out of our private school. I spoke with the principal and two hours later the decision was made to close school until at least end of March. https://t.co/bTSngf2XFr

— Branden Rosenhan MD (@DocBranden) March 12, 2020

This comes after Seattle became the largest city in the US to close its schools over the virus. We’ve heard rumors that Utah is planning to close its public-college campuses.

But the biggest blow to market confidence last night arrived courtesy of the NBA, which cancelled Wednesday’s matchup between the Utah Jazz and Oklahoma City Thunder, then announced that it would suspend the season for the time being after Rudy Gobert, Utah’s star center, tested positive for the virus, becoming the first American professional athlete to test positive for the virus.

A few days ago, Gobert infamously made light of the hysteria by ‘touching’ all the microphones in the press room.

In hindsight, it looks like this might have been a mistake.

Around the same time, actors and husband-wife duo Tom Hanks and Rita Wilson revealed in an Instagram post that they had also tested positive. The response was pandemonium on social media.

Moving on to Thursday morning, futures have been limit-down all night once again, just like we saw Sunday into Monday,

The CDC recommended last night that companies in Silicon Valley and Seattle start implementing mandatory temperature checks for all employees, according to the LA Times.

Bloomberg reported last night that Blackstone had recommended that its portfolio companies had drawn down on their revolving credit facilities, something that the FT’s Robert Smith pointed out would be an “instant capital hit” to banks.

Instant capital hit to banks 👇 https://t.co/WzkUkUfgtA

— Robert Smith (@BondHack) March 11, 2020

Yesterday, Boeing shocked the market by announcing that it would immediately draw down on its $13.825 billion revolving credit facility to ward off any “liquidity issues,” something that we warned soon after would could represent the beginning of a liquidity crisis for banks, whose shares have already been badly beaten thanks to the Fed’s “emergency” 50bp rate cut and record-low Treasury yields. Now, with their clients in full-on panic mode, it’s hardly surprising that companies want to bulk up their balance sheets for the coming economic storm.

The only problem, is that this is essentially the equivalent of a corporate bank run…

…as companies aren’t so much worried about their own future, but the banks’ future, because why else would anyone want to hold cash in their wallet when they can keep it safe and sound in a bank…unless they were worried that it was no longer ‘safe’ to do so.

Moving from one liquidity risk to another, during the opening of CNBC’s “Squawk Box” Thursday morning, Andrew Ross Sorkin declared that some of his hedge fund sources had been trading notes and hopping on conference calls to discuss strange trading patterns in the 10-Year Treasury. We highlighted some suspicious activity in a post from yesterday.

Sorkin’s sources are worried about shortages of liquidity that could once again create potentially destabilizing rictions in credit markets.

For more on this, we’d like to remind readers of a post from a few years back that offers a straightforward explanation of this phenomenon).

It seems sell-side analysts have already seized on the issue: Bank of America also warned in a research note about deteriorating Treasury market liquidity.

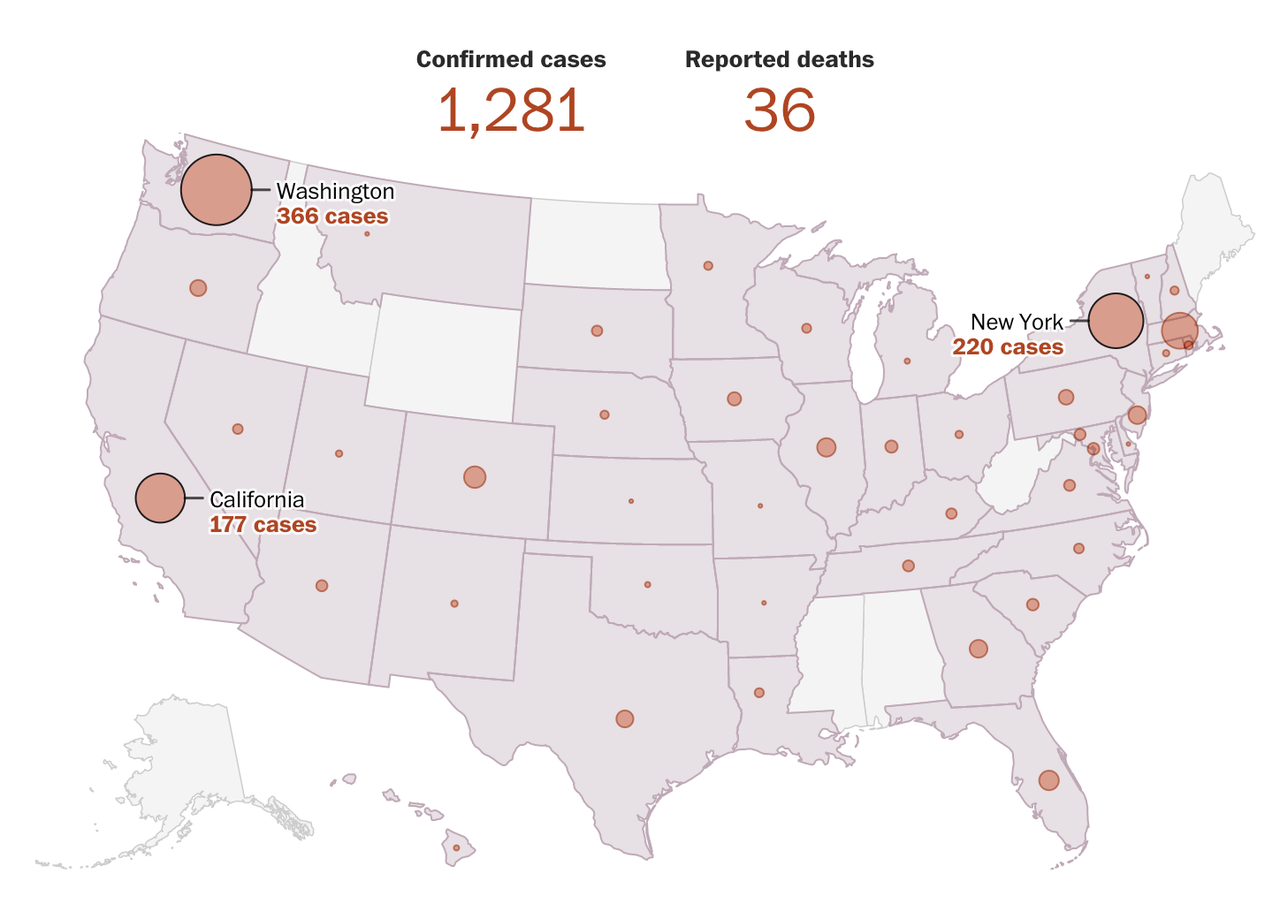

Looking ahead, will America follow Italy’s lead in the direction of – if not outright national domestic travel bans – but the ‘social distancing’ concept that has been bandied about in recent days. Notably, CNBC was practicing its own ‘social distancing’ with Becky Quick reporting in from New Jersey while Sork and Joe Kernen reported from different locations in NY. Heading into the US trading day, the WHO said 124,519 cases as of Thursday morning. Globally, we’ve seen at least 4,607, with Italy reporting 827 deaths. In the US, the Washington Post counted 1,281 cases, a count that includes as-yet-unconfirmed by the CDC but “presumptively” confirmed in state labs.

In Italy, the country woke up to a national travel ban and mass closures of schools and businesses for the first time. In South Africa, officials reported the first case of local transmission of the coronavirus on Thursday, There are concerns that African health systems could be overwhelmed if local transmission accelerates, which is why reports that surfaced a few minutes ago about a man who just traveled back to the country – after recently visiting New York – apparently tested positive, though it’s not clear if these cases are the same.

#CoronavirusInSA A 43-year old Joburg man who had traveled to New York via Dubai returned to South Africa with the virus on Sunday.

— EWN Reporter (@ewnreporter) March 12, 2020

South Africa’s Health Ministry said a 32-year-old man contracted the virus after contact with a Chinese businessman at a time when China is claiming that its economy is nearly 100% back online after the crisis, CNBC reported. It also reported that the death toll from the collapse of a makeshift quarantine in China has climbed to 29.

Iran’s health minister said Thursday that a national plan to root out all those who are infected contacted 3.5 million people out of the country’s population of 80 million. Dr Saeed Namaki said 270 patients had been hospitalized after being contacted in accordance with the effort, which began last week.

Meanwhile, on CNBC, Mohamad El-Erian, who has correctly warned investors to stay away from the market since the most recent selloff began, said there’s nothing the world can do now to prevent a recession as more surprises like the NBA suspending its season are inevitably in store.

“We are going into a global recession We are going to see a string of sudden economic stops,” said Mohammad El-Erian, an economist at Allianz and formerly Bill Gross’s No. 2 at PIMCO.

So, instead of the “v”-shaped recovery we were promised, it looks like we’ll be getting the “u” shaped rebound, or possibly even the dreaded “l-shaped” recovery, especially if Trump’s battle over the payroll tax holiday eats up more time before the fiscal stimulus package hits. Others will focus on how long until the NBA restarts the season.

Tyler Durden

Thu, 03/12/2020 – 07:12