Six Weeks After Dalio’s “Cash Is Trash”, Cash Sees Biggest Inflow In History

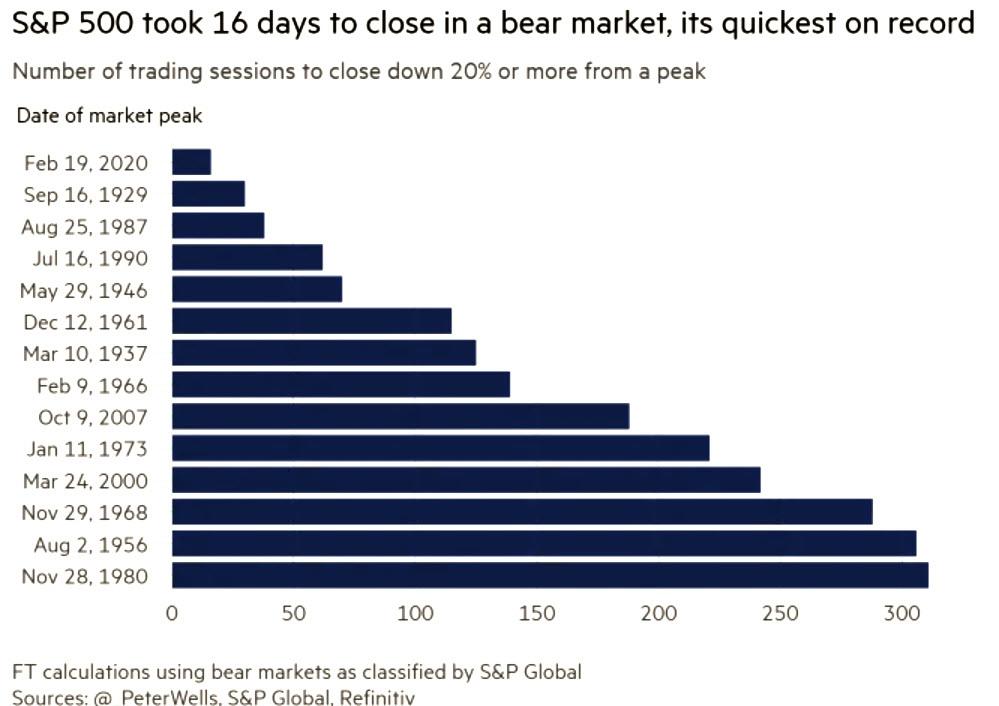

The past week has been one of market superlatives: the biggest Dow point crash ever, the biggest Stoxx 600 drop on record, the longest lock “limit down” in the Emini future ever observed, the biggest rebound in the Dow since the financial crisis, the biggest VaR shock in history, the fastest drawdown to a bear market from a market peak…

… and so on.

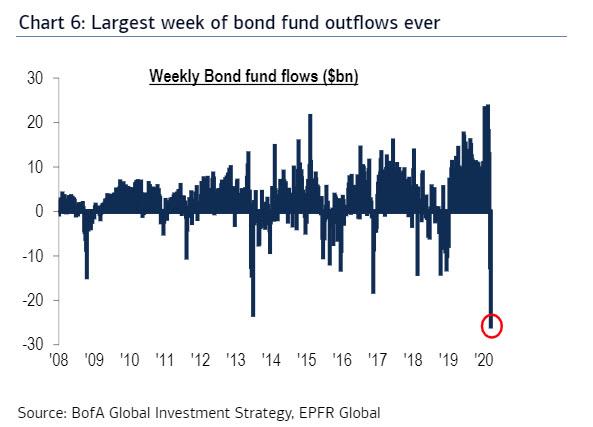

Here are a few more: last week’s unprecedented market moves caused real panic among investors, both institutional and retail, and according to the latest weekly Lipper fund fund flows data compiled by Bank of America, we saw a whopping $4.7 billion pulled out of equities, $25.9 Billion pulled out of bonds, the largest outflow ever…

… as well as:

- The biggest IG + HY + EM debt outflow ever ($34.1bn).

- The biggest financial sector outflow ever ($3.3bn).

- The biggest government bond ever ($13.9bn).

- Second biggest inflow to gold ever ($3.1bn).

And the punchline: at $136.9 billion, last week saw the biggest cash inflow ever.

Why is this notable? Because less than 2 months ago, well… see for yourselves:

Ray Dalio: “You can’t jump into cash. Cash is trash.” pic.twitter.com/4noJ7CFHha

— Gualestrit (@gualestrit) January 30, 2020

And visually:

It is hot takes like these that make us wonder if all those apocryphal rumors about how Bridgewater became the world’s biggest hedge fund are actually true.

Tyler Durden

Fri, 03/13/2020 – 14:44