Market Crash. Is It Over, Or Is It The “Revenant”

Authored by Lance Roberts via RealInvestmentAdvice.com,

If you haven’t seen the movie “The Revenant” with Leonardo DiCaprio, it is a 2015 American survival drama describing frontiersman Hugh Glass’s experiences in 1823. Early in the movie, Hugh, an expert hunter, and tracker, is mauled by a grizzly bear. (Warning: the scene is very graphic)

In the scene, the attack comes in three distinct waves.

-

The bear attacks, and brutally mauls Hugh, who plays dead to survive. The attack subsides.

-

The bear comes back, and Huge shoots it, provoking the bear to maul him some more.

-

Finally, Huge pulls out his knife as the bear attacks for a final fight to the death. (Hugh wins if you don’t want to watch the video.)

Interestingly, this is also how a “bear market” works.

Bob Farrell, a legendary investor, is famous for his 10-Investment Rules to follow.

Rule #8 states:

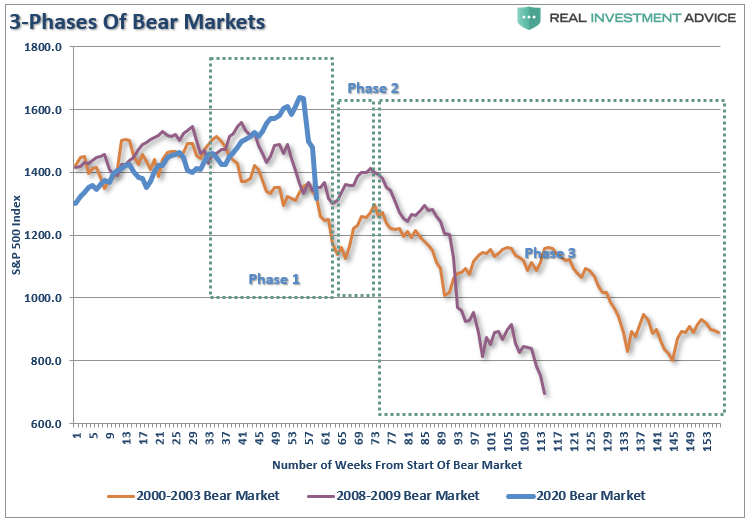

Bear markets have three stages – sharp down, reflexive rebound and a drawn-out fundamental downtrend

- Bear markets often START with a sharp and swift decline.

- After this decline, there is an oversold bounce that retraces a portion of that decline.

- The longer-term decline then continues, at a slower and more grinding pace, as the fundamentals deteriorate.

Dow Theory also suggests that bear markets consist of three down legs with reflexive rebounds in between.

The chart above shows the stages of the last two primary cyclical bear markets versus today (the 2020 scale has been adjusted to match.)

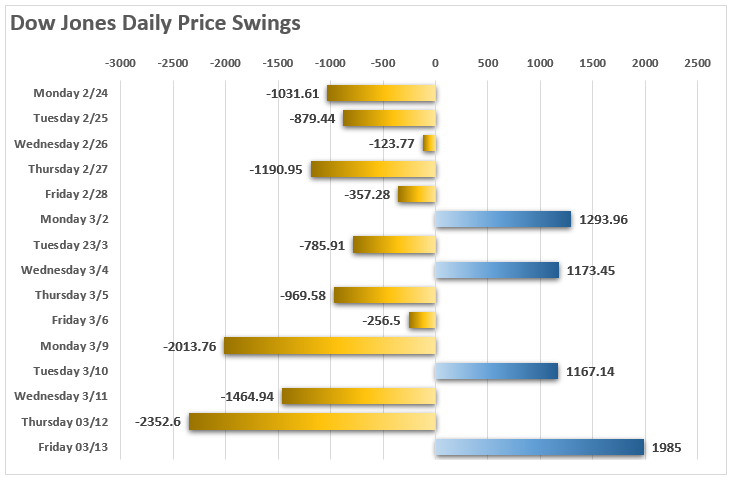

As would be expected, the “Phase 1” selloff has been brutal.

That selloff sets up a “reflexive bounce.” For many individuals, they will “feel like” they are “safe.” This is how “bear market rallies” lure investors back in just before they are mauled again in “Phase 3.”

Just like in 2000, and 2008, the media/Wall Street will be telling you to just “hold on.” Unfortunately, by the time “Phase 3” was finished, there was no one wanting to “buy” anything.

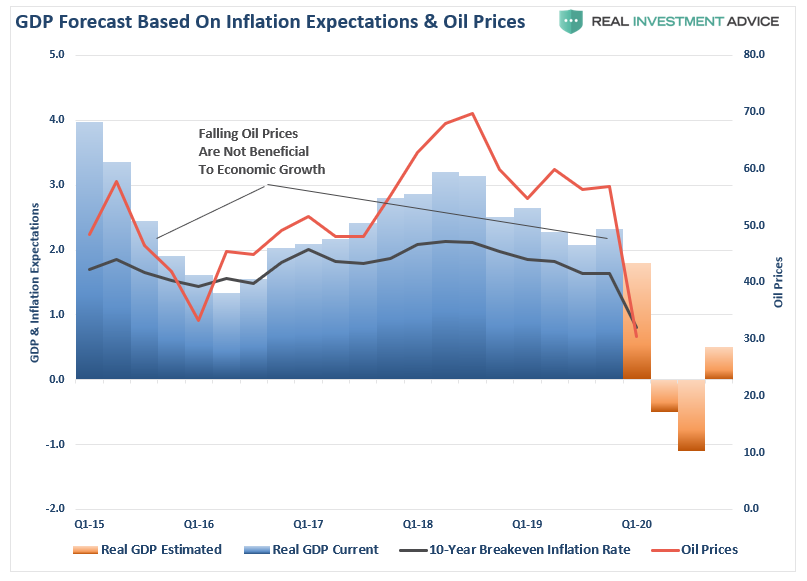

One of the reasons we are fairly certain of a further decline is due to the dual impacts of the “COVID-19” virus, and oil price shock. As noted in our MacroView:

“With the U.S. now shutting down and entrenching itself in response to the virus, the economic impact will be worsened. However, given that economic data is lagging, and we only have numbers that were mostly pre-virus, the reports over the next couple of months will ultimately reveal the extent of the damage.

With oil prices now at $30/bbl and 10-year breakeven rates to 0.9%, the math is significantly worse, and that is what the severity of the recent selloff is telling us. Over the next two quarters, we could see as much as a 3% clip off of current GDP.”

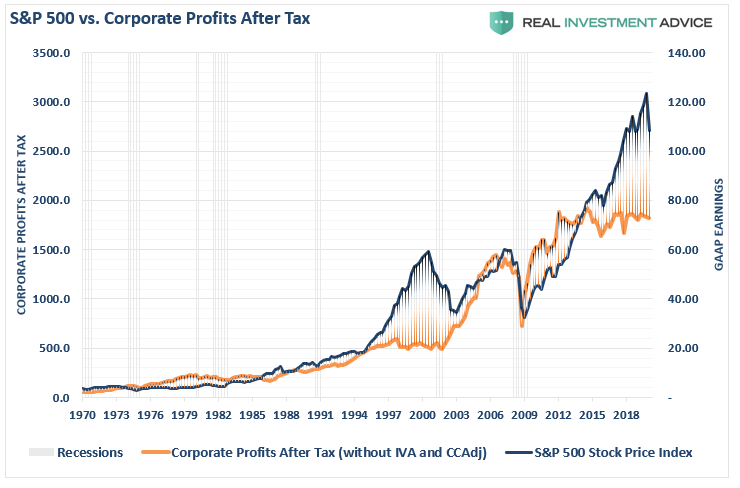

Unfortunately, while asset prices have declined, they have likely not fully accounted for the impact to earnings, permanently lost revenues, and the recessionary impact from falling consumer confidence. Historically, the gap between asset prices and corporate profits gets filled.

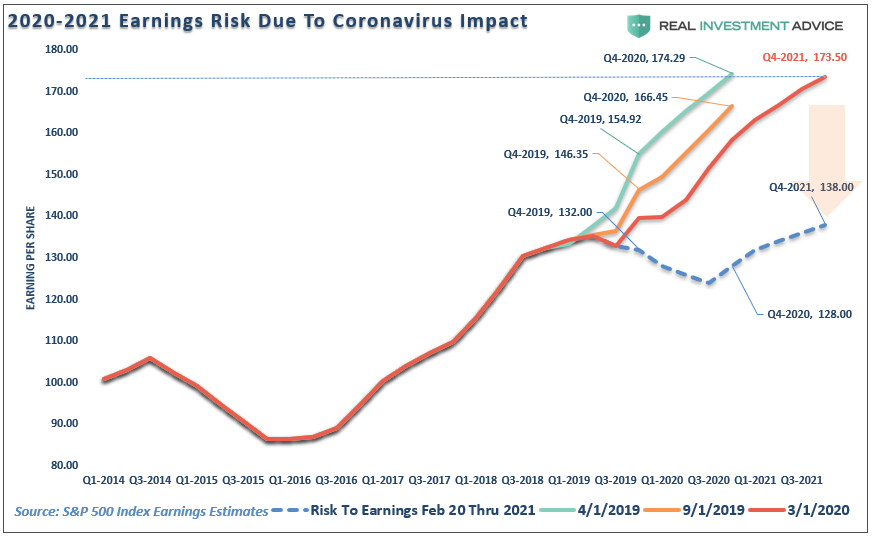

In “Playing Defense: We Don’t Know What Happens Next,” I estimated the impact on earnings that is still coming.

“What we know, with almost absolute certainty, is that we will be in an economic recession within the next couple of quarters. We also know that earnings estimates are still way too elevated to account for the disruption coming from the COVID-19.”

“What we DON’T KNOW is where the ultimate bottom for the market is. All we can do is navigate the volatility to the best of our ability and recalibrate portfolios to adjust for downside risk without sacrificing the portfolio’s ability to adjust for a massive ” bazooka-style ” monetary intervention from global Central Banks if needed quickly.

This is why, over the last 6-weeks, we have been getting more “defensive” by increasing our CASH holdings to 15% of the portfolio, with our 40% in bonds doing the majority of the heavy lifting in mitigating the risk in our remaining equity holdings.

Interestingly, the Federal Reserve DID show up on Thursday as expected. In a statement from the New York Fed:

The Federal Reserve said it would inject more than $1.5 trillion of temporary liquidity into Wall Street on Thursday and Friday to prevent ominous trading conditions from creating a sharper economic contraction.

If the transactions are fully subscribed, they would swell the central bank’s $4.2 trillion asset portfolio by more than 35%.” – WSJ

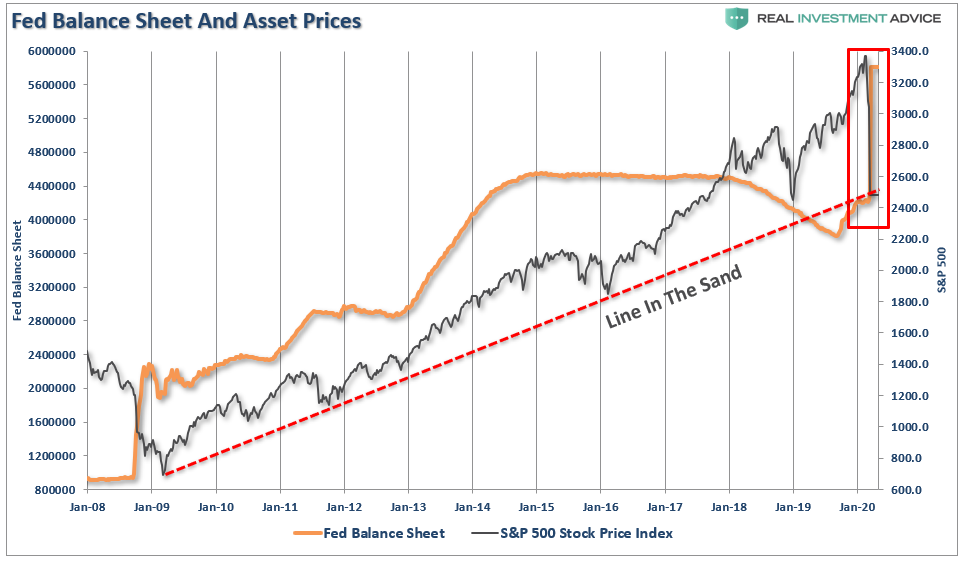

As you can see in the chart below, this is a massive surge of liquidity hitting the market at a time the market is sitting on critical long-term trend support.

Of course, this is what the market has been hoping for.

- Rate cuts? Check

- Liquidity? Check

On Friday, the market surged, and ALMOST recouped the previous day’s losses. (Sorry, it wasn’t President Trump’s speech that boosted the market.)

However, this rally, and liquidity flush, most likely does not negate the continuation of the bear market. The amount of technical damage combined with a recession, and a potential surge in credit defaults almost ensures another leg of the beg market is yet to come.

A look at the charts can also help us better understand where we currently reside.

Trading The Bounce

In January, when we discussed taking profits out of our portfolios, we noted the markets were trading at 3-standard deviations above their 200-dma, which suggested a pullback, or correction, was likely.

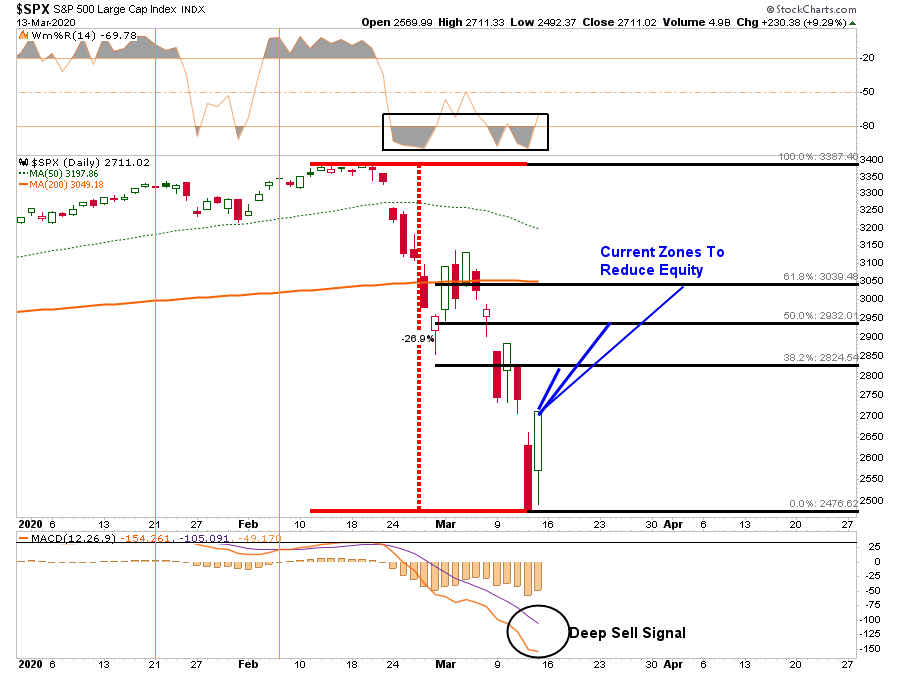

Now, it is the same comment in reverse. The correction over the last couple of weeks has completely reversed the previous bullish exuberance into extreme pessimism. On a daily basis, the market is back to oversold. Historically, this condition has been sufficient for a bounce. Given the oversold condition (top panel) is combined with a very deep “sell signal” in the bottom panel, it suggests a fairly vicious reflexive rally is likely as we saw on Friday.

The question, of course, is where do you sell?

Looking at the chart above, it is possible for a rally to the 38.2%, or 50% retracement levels. However, with the severity of the break below the 200-dma, the 61.8% retracement level, where the 200-dma now resides, will be very formidable resistance. With the Fed’s liquidity push, it is possible for a strong “Phase 2” rally. Our plan will be to reduce equity exposure at each level of resistance and increase our equity hedges before the “Phase 3” mauling ensues.

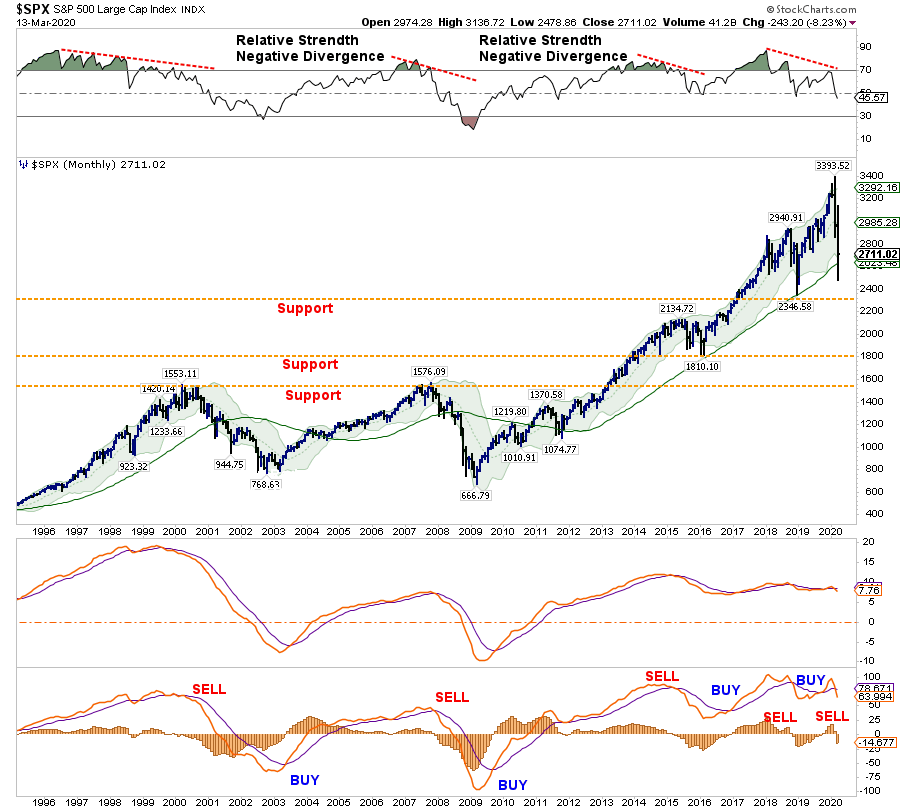

The following chart is a longer-term analysis of the market and is the format we use for “onboarding” our clients into allocation models. (Vertical black lines are buy periods)

“But Lance, how do you know that Friday wasn’t THE bottom?”

A look at longer-term time-frames gives us some clues.

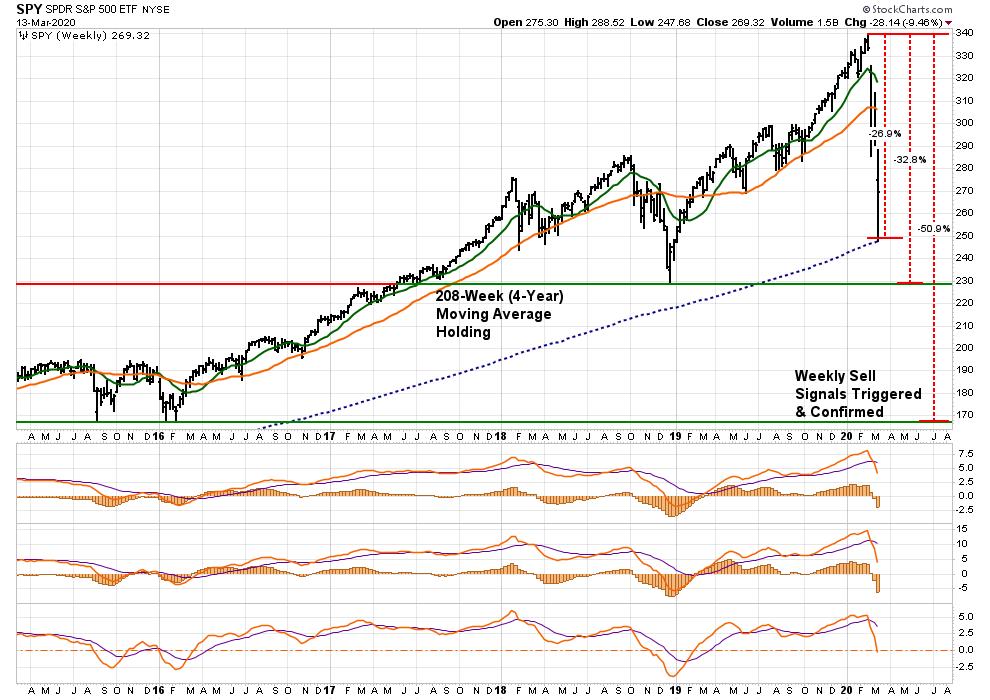

With all of our longer-term weekly “sell signals” now triggered from fairly high levels, it suggests the current selloff is not over as of yet. In other words, we will see a rally, followed by a secondary failure to lower lows, before the ultimate bottom is put in.

I have mapped out the three most logical secondary bottoms for the market, so you can assess your portfolio risk accordingly.

-

A retest of current lows that holds is a 27% decline.

-

A retest of the 2018 lows, most likely, is an average recessionary decline of 32.8%

-

A retest of the 2016 lows, coincident with a “credit event,” would entail a 50.9% decline.

Given the weekly signals have only recently triggered, we can look at monthly data to confirm we still remain confined to a “bearish market” currently.

On a monthly basis, sell signals have been triggered. However, these signals are NOT VALID until the end of the month. However, given the depth of the decline, it would likely require a rally back to all-time highs to reverse those signals. This is a very high improbability.

Assuming the signals remain, there is an important message being sent, as noted in the top panel. The “negative divergence” of relative strength has only been seen prior to the start of the previous two bear markets, and the 2015-2016 slog. While the current selloff resembles what we saw in late 2015, there is a risk of this developing into a recessionary bear market later this summer. The market is holding the 4-year moving average, which is “make or break” for the bull market trend from the 2009 lows.

However, we suspect those levels will eventually be taken out. Caution is advised.

What We Are Thinking

Since January, we have been regularly discussing taking profits in positions, rebalancing portfolio risks, and, most recently, moving out of areas subject to slower economic growth, supply-chain shutdowns, and the collapse in energy prices. This led us to eliminate all holdings in international, emerging markets, small-cap, mid-cap, financials, transportation, industrials, materials, and energy markets. (RIAPRO Subscribers were notified real-time of changes to our portfolios.)

There is “some truth” to the statement “that no one” could have seen the fallout of the “coronavirus” being escalated by an “oil price” war. However, there have been mounting risks for quite some time from valuations, to price deviations, and a complete disregard of risk by investors. While we have been discussing these issues with you, and making you aware of the risks, it was often deemed as “just being bearish” in the midst of a “bullish rally.” However, it is managing these types of risks, which is ultimately what clients pay advisors for.

It isn’t a perfect science. In times like these, it gets downright messy. But this is where working to preserve capital and limit drawdowns becomes most important. Not just from reducing the recovery time back to breakeven, but in also reducing the “psychological stress,” which leads individuals to make poor investment decisions over time.

As noted last week:

“Given the extreme oversold and deviated measures of current market prices, we are looking for a reflexive rally that we can further reduce risk into, add hedges, and stabilize portfolios for the duration of the correction. When it is clear, the correction, or worse a bear market, is complete, we will reallocate capital back to equities at better risk/reward measures.”

We highly suspect that we have seen the highs for the year. Most likely, we are moving into an environment where portfolio management will be more tactical in nature, versus buying and holding.

Take some action on this rally.

If this is a “Phase 2” relief rally of a bear market, you really don’t want to be around for the “final mauling.”

Tyler Durden

Sat, 03/14/2020 – 12:40