How Much Fiscal Stimulus Will Be Needed To Turn Markets?

Well before the Global Covid Crisis (or GCC) hit, investors always assumed that the next recession would require material fiscal easing to exit, especially since year after year Davos told us that central banks were out of ammo (the Fed’s actions in the past few days have seriously questions that assumption, as the real question is not whether central banks have ammo – they can always print more money – but credibility). And now that the Fed has joined the rest of the world’s central banks in the zero-rate club, announcement of significant fiscal easing seems the most likely catalyst – alongside a peak in the US/European COVID-19 infection rate – for driving a market reversal.

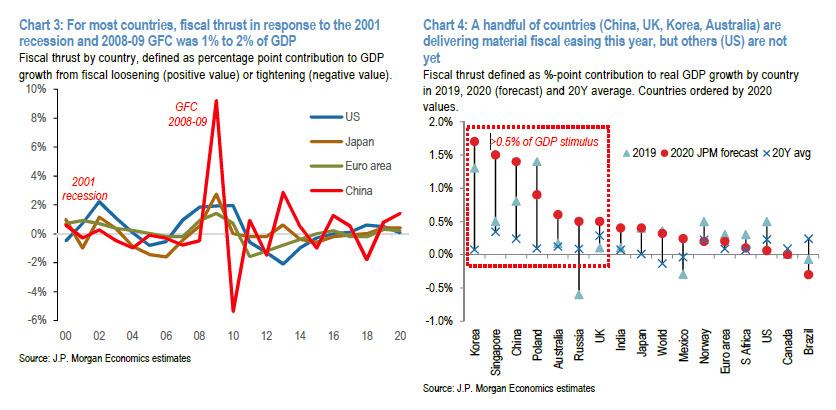

But how to define material? Many countries have delivered fiscal thrust of 1% to 2% of GDP during recessions, so this figure could serve as a benchmark.

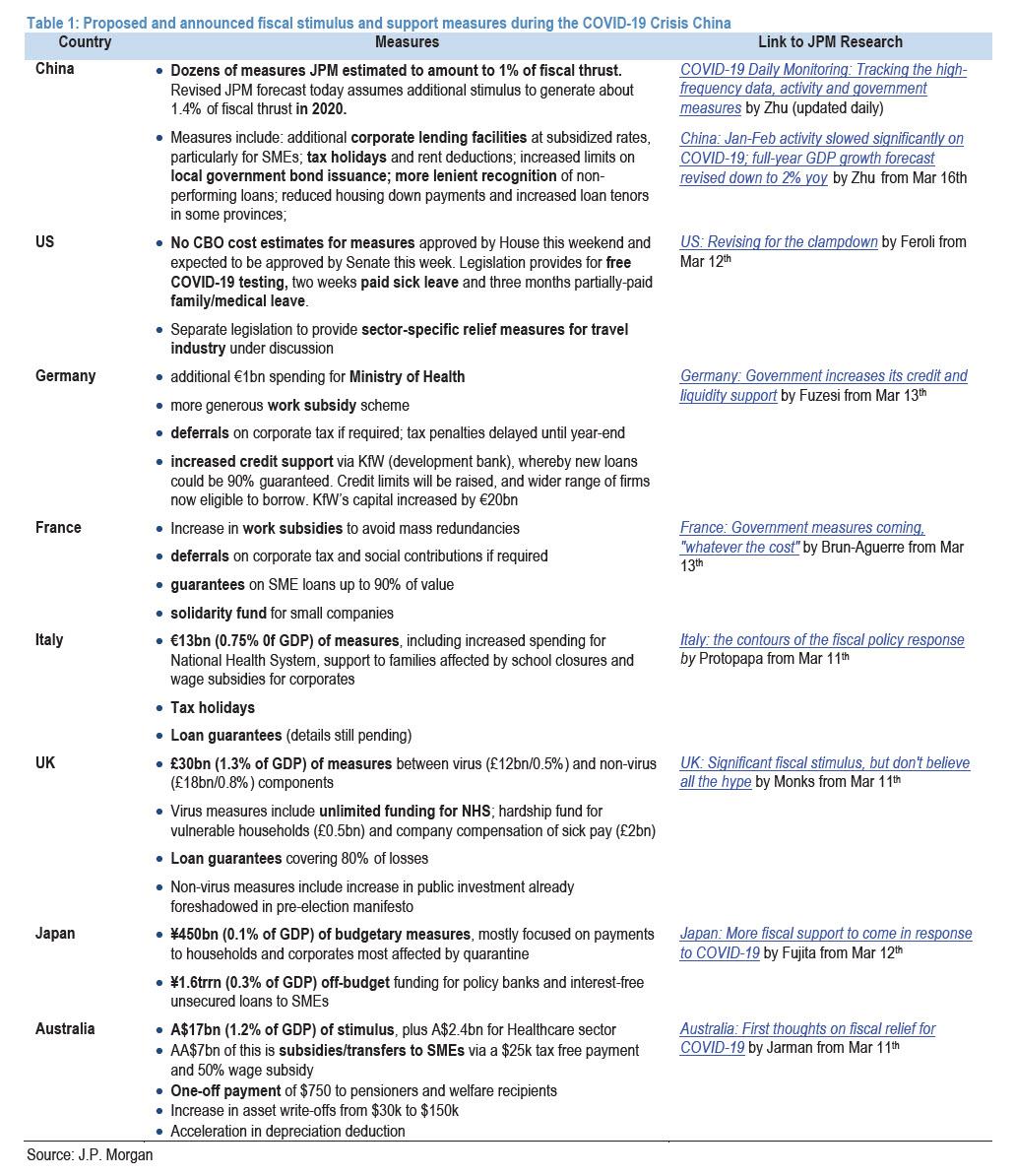

Unfortunately, according to JPMorgan’s John Normand, no large country but China come close to this zone. Curiously, the notoriously stingy Europe has also been outpacing the US in terms of its suite of targeted measures such as credit guarantees, wage subsidies and tax holidays, but many of these indispensable measures are tough to quantify, so lack an announcement effect on financial markets.

Meanwhile, until Tuesday, US fiscal easing had been trivial so far, though the legislative process will likely run a few rounds. Furthermore, on Tuesday the Trump administration finally announced a $1.2 trillion stimulus plan – which seemingly was growing by $100 trillion by the hour – and which anticipates sending $1,000 checks to all Americans.

Is that enough? Judging by today’s market’s reaction which send the Dow higher by 1,000 point and bond yields surging the most in decades, traders certainly had a more favorable take on the stimulus plan, and its inflationary impact, announced today compared to the fiasco following the Fed’s Sunday emergency “bazooka” intervention, which led to a record 3,000 point drop in the Dow Jones.

As Bloomberg’s Cameron Crise put it, a putative $1.2 trillion stimulus package represents 5.5% of the U.S. economy. “To put it in context, that’s almost identical to the American Recovery and Reinvestment Act of 2009 (at least the original cost), though it’s less than the combined impact of the ARRA and a prior stimulus bill from autumn of 2008. These are big numbers, and they’re what markets want to see.”

But are they big enough? In a separate article, Bloomberg urges readers to “think of a number, then double it. That’s more or less what Wall Street is telling governments racing to draw up emergency spending plans as the coronavirus brings their economies to a sudden stop.”

Of course, the fiscal response is a process, and the final number will end up being the one that finally stabilizes the market, but the same process does bring up a question: why has policy easing – even globally-coordinated measures – in the first couple of months of a recession or financial crisis usually failed to trigger a sustained market reversal?

The answer, according to JPMorgan, is that there is always a core issue that must be resolved – usually around excess leverage, but this time around an infection’s spread. Until resolution is more advanced, markets tend to price and then maintain a risk premium for several quarters of contracting growth, falling profits, ratings downgrades and rising defaults. Monetary and fiscal easing can limit the extent to which that risk premium tightens financial conditions, aggravates the core vulnerability and turns a manageable shock into a completely unwieldly one, but easier policy rarely obviates adjustment.

Which brings up question #2: given how much pessimism is already discounted in valuations and positioning and how much rightful skepticism surrounds monetary policy, could material fiscal stimulus catalyze a turn even absent a peak in infection rates? It’s possible, especially if Wall Street is accurate in modelling what is coming as the shortest-ever recession of two quarters rather than an average one lasting at least four quarters.

But, here too, we go back to the key question: how much is enough, or said otherwise, “what number is material?”

This is where things get murky as the definition of material fiscal stimulus does not exist, per se.

As JPMorgan notes, most investors have a sense of how much monetary easing is usually required to end a US recession, since the Fed has always had to cut at least 200bp and has cut an average of about 400bp during such episodes since the 1970s. On the other hand, the appropriate amount of fiscal easing is fuzzier, because budget policy isn’t always relaxed deliberately during a recession, beyond the activation of automatic stabilizers like unemployment insurance. When fiscal policy is loosened, it usually comes sufficiently late in the recession (due to the legislative process), that it isn’t obvious how much tax cuts and/or higher spending contributed to the initial bottoming-out process in asset prices.

The following two charts, plus table provide a best-guess on what might register with markets as significant fiscal stimulus, and judge how close current efforts are to that threshold. The charts show JPMorgan economists’ estimate of fiscal thrust, which is the percentage point contribution to real GDP growth from fiscal loosening or tightening, over the past 20 years. That sample only covers the 2001 recession and the GFC, but highlights the following principle: Fiscal thrust in the DM economies has tended to aim for 1% to 2% of GDP during recessions, but so far, no DM government has committed to such an expansion. The closest are the UK and Australia, where our economists expected about 0.5% of thrust this year. The US has eased only trivially. The Congressional Budget Office hasn’t scored the COVID-19 relief bill that passed the House this weekend and should pass the Senate this week, but the value of free COVID-19 tests and sick leave will

European measures have been much more comprehensive than US ones, but as noted above, are tougher to translate into a notional amount of fiscal easing. As detailed in Table 1, Europe’s measures are much like China’s in terms of providing a range of targeted credit guarantees, tax holidays, wage subsides and direct payments to households. Some of these programs – like credit guarantees – are backstops rather than stimulus, and their value will only be one when they are tapped rather than ex ante on announcement. Also, funding schemes that apply to new loans would not ease investors’ concerns about the default risk around existing debt when revenue has collapsed.

There is of course the sense that this time government will do something entirely new, i.e., the much-discussed “helicopter money drop”, also known as putting MMT in practice, which would lead to a wholesale change in how government is funded as central banks become de facto branches of the government, meant to monetize debt until hyperinflation is rampant.

“Governments may need to step in to directly guarantee liquidity provision to thousands of corporates and even individuals,” said George Saravelos, Deutsche Bank’s global head of currency research, “This may literally require helicopter drops of money.”

Today’s promise by Trump to send $1,000 to all Americans is just the first step.

Tyler Durden

Tue, 03/17/2020 – 18:50