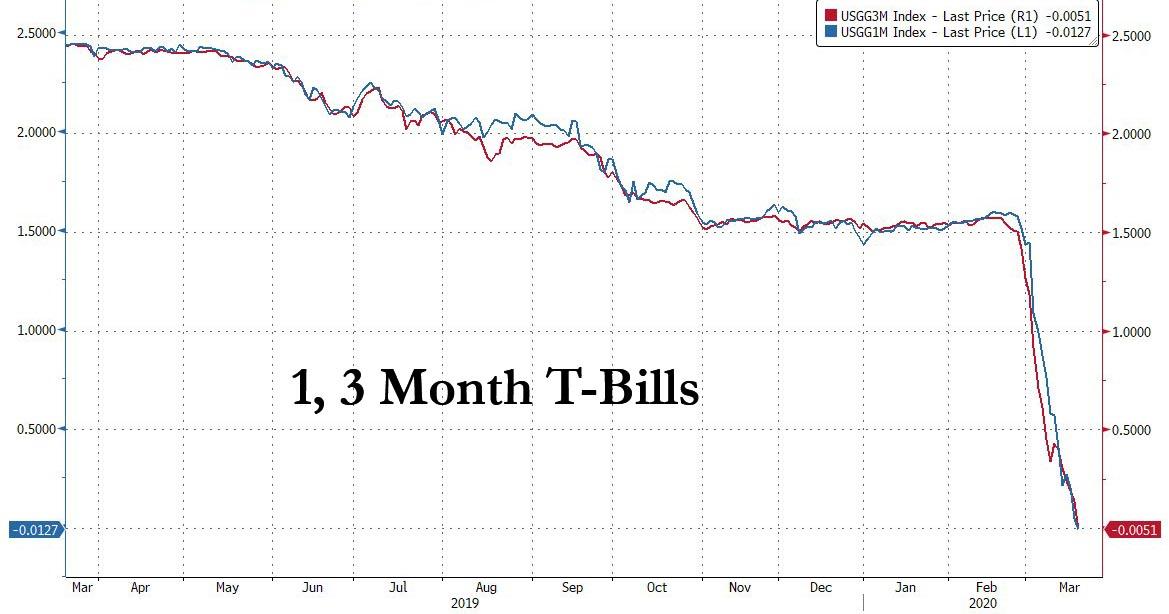

All Bills Up To Three Months Now Have Negative Yields

With the Fed Funds rate now at the lowest possible positive level (0-25bps) and supported by the zero lower bound at least until the Fed cuts rates to negative as most other central banks, today’s historic scramble to obtain dollars which send the Bloomberg Dollar Index to an all time high manifested itself in the furious buying of one particular instrument: no not coupon Treasuries, which tumbled again amid widespread liquidations that sent the 10Y and 30Y yields to 1.192% and 1.787% respectively despite breakevens plunging to all time lows…

… we are talking about T-Bills to the 3 month mark,whose yields slumped below zero today, where they have remained all day in a harbinger of what is coming to the rest of the curve.

Should this unprecedented dollar squeeze become even more exacerbated overnight, look at first 6, then 12M bills, eventually 2Y coupons (and so on), also have a negative yield in the coming weeks as the US slowly but surely becomes Japan.

Tyler Durden

Wed, 03/18/2020 – 17:26