JPM Cuts Q2 GDP To -14%: “The Lamps Are Going Out All Across The Economy”

At the start of the 20th century, JP Morgan (the person) was instrumental in letting electric lamps shine on America thanks to his collaboration with Thomas Edison which unleashed electricity, and culminated in the formation of General Electric. So it is rather poetic that JP Morgan the bank is there to watch as they are shut down.

In a note published late on Wednesday by JPM’s chief economist Michael Feroli, he writes that in Chair Powell’s Sunday evening conference call he said there will be no Summary of Economic Projections because the forecast is “unknowable” and as Feroli notes, “we sympathize with this sentiment” because “In economic parlance, the current environment is one of pervasive “Knightian uncertainty”—that is, an unknown for which we cannot even quantify the odds of various outcomes.”

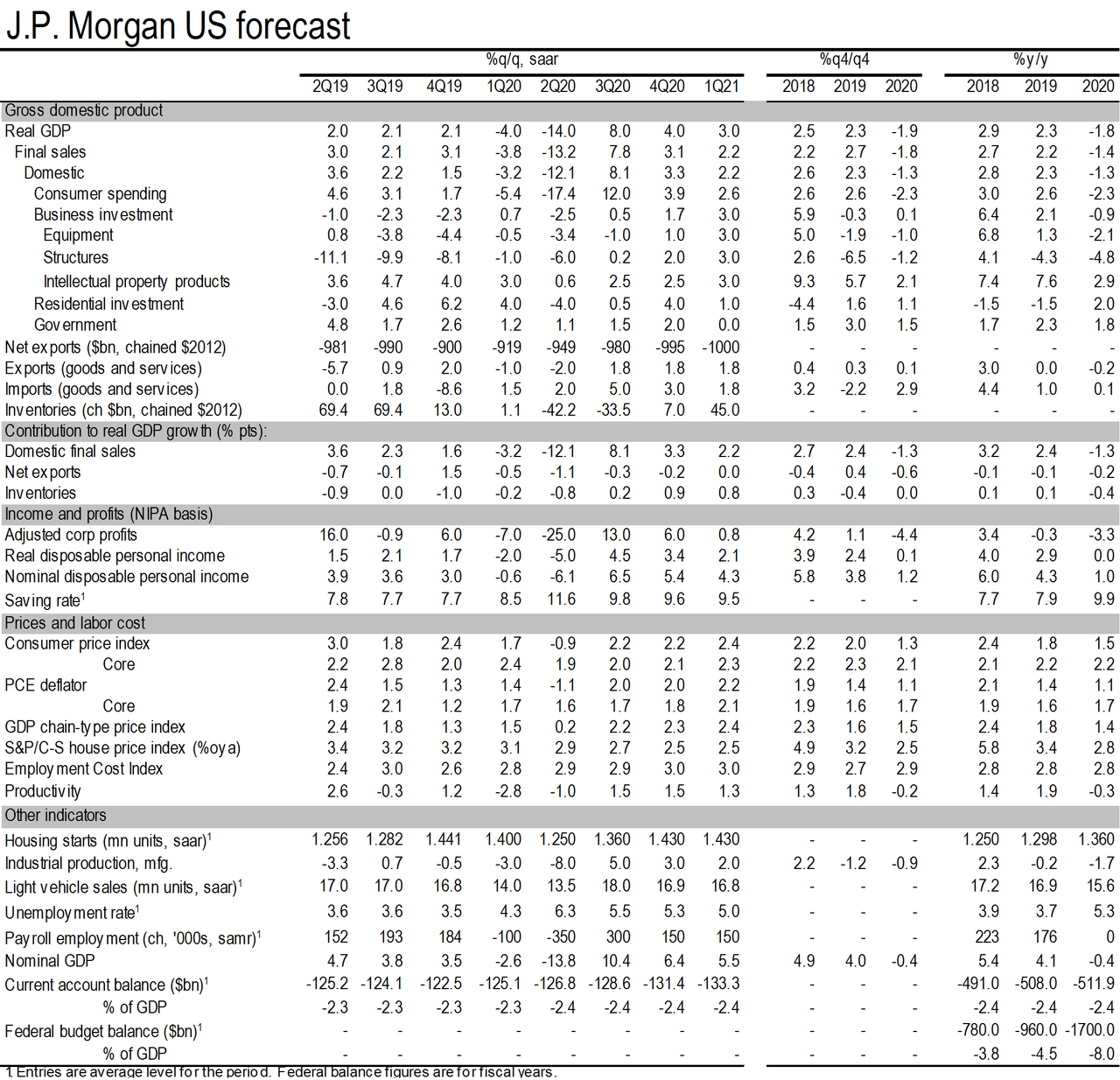

While that description clearly applies to the present situation, the very process of producing a forecast still possesses some value, as it can highlight the key assumptions needed to break past this uncertainty according to Feroli. With this in mind, JPMorgan has slashed its forecast for real annualized GDP growth in Q1 to -4.0%, followed by an even weaker -14.0% in Q2, far, far worse than Goldman’s -5%. However, just like Goldman, JPM too sees a V-shaped recovery in Q3, when it expects the economy to recover to 8.0% in Q3 followed by 4.0% growth in Q4. For the full year (Q4/Q4) JPM now look for growth of -1.5%, a number which will be more of a Great Depression-like -10% if the second half rebound does not materialize.

This growth profile causes the unemployment rate to rise from the current 3.5% to 6.25% by middle of the year before easing back down to 5.25% by year-end. Amusingly, despite predicting a V-shaped recovery, JPM says that “the fact that the unemployment rate ends the year substantially higher than the current level should make clear why it would not be accurate to describe this as a V-shaped recovery, even with a strong Q3: that strength is not nearly enough to undo the expected damage to the labor market.”

Hey Mike, wait a few months to see what “not a V-shaped recovery” really looks like.

Below is JPM’s chart of “Knightian uncertainty”, i.e., one in which every single number is nothing but total guesswork. Timestamp it because its next iteration will show a 20% GDP drop in one, or likely more, quarters.

Some more details from the note:

As before, we continue to assume that ground zero of the economic weakness is those consumer services with inadequate social distancing: air travel, movies, sporting events, etc. In our reckoning of where to draw the lines, this group represents around 7% of GDP. We assume activity in this group falls to 63% of normal activity in March, followed by 25% in April, 63% in May, and fully recovers to 100% of normal activity in June. We do not assume a reoccurrence of the virus in the fall. With these assumptions alone, this group would subtract 4%-points from Q1 growth and almost 11%-points from Q2 growth before adding 7%-points to Q3 growth. On top of this we assume spillover to other categories of spending, particularly in Q2 as the weakening environment depresses sentiment, destroys jobs and weakens business and household balance sheets. We expect these spillover effects to last in Q3, counteracting the support to growth from activity coming back on line. Crucially, we expect a vigorous policy response to partially offset these negative feedback loops. The Fed has already done a lot, and will remain creative in trying to do more. Additionally we are now expecting $1 trillion in federal fiscal support to the economy. We expect this to come through (i) direct cash payments to households, (ii) support for state and local government finances, and (iii) liquidity support to struggling businesses. While we expect rapid passage of this support, the deployment of funds in the economy should take a few months and is expected to peak in Q3. As before, we continue to see the inflation outlook driven more by demand weakness than supply weakness.

But it is the conclusion is where JPM’s wit truly shines, please pardon the pun:

Prices of toilet paper and hand sanitizer will not rise enough to get inflation back to the Fed’s 2 percent objective any time in our forecast. Consequently, we have the Fed on hold this year and next.

Tyler Durden

Wed, 03/18/2020 – 15:35