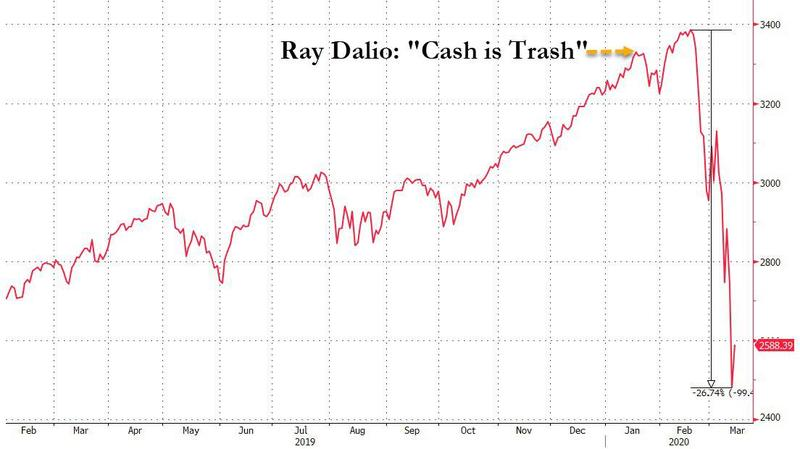

Ray “Cash Is Trash” Dalio Says Global Economy Could Suffer $12 Trillion In Losses

Two months after his disastrous “cash is trash” CNBC appearance from Davos, Ray Dalio again appeared on CNBC this morning to pontificate about the coronavirus, estimating that the virus will cost the economy and US corporations up to $4 trillion, or roughly 5% of the US $21 trillion GDP.

Worldwide, Dalio estimates $12 trillion in corporate losses due to the pandemic. The hardest hit industries are taking catastrophic losses, with the business travel sector expected to lose an astonishing $820 billion and the restaurant industry slated to lose $225 billion.

The outbreak and the ensuing lockdowns across the country have ravaged corporations, with Treasury Secretary Steven Mnuchin even candidly asserting that the U.S. could see a Great Depression-like 20% unemployment in a worst case scenario.

Additionally, Moody’s has estimated that 80 million jobs were already at “high or moderate” risk as a result of the outbreak. Names like MGM, Oyo Hotels, Scandinavian Airlines and General Motors have already started making layoffs. Other companies, like Delta Airlines and American Airlines, have instituted hiring freezes.

Weekly jobless claims showed their first pop to 281,000 (from last week’s 211,000) and are bound to get significantly worse.

Dalio commented:

“What’s happening has not happened in our lifetime before. What we have is a crisis. There will also be individuals who have very big losses. There’s a need for the government to spend more money, a lot more money. A lot of people are going to be broke.”

He also said that he thinks fiscal stimulus should be $1.5 trillion to $2 trillion at a minimum. The market, meanwhile, has dropped more than 25% in a matter of weeks since Dalio came out publicly and said “cash is trash”.

To Dalio’s credit, he has pointed out that action taken by Central Banks has been anything but normal: “[There’s an] inability of central banks to stimulate in a way that’s normal. They have less capacity to ease monetary policies when interest rates have already hit the floor.”

#PrincipleOfTheDay pic.twitter.com/8616aTjf7F

— Rudy Havenstein – Stay home. It’s a bad virus. (@RudyHavenstein) March 18, 2020

He continued: “We are now at a point where there will have to be a debt restructuring and a monetization of that. We’re living in a different world, like the 1930s in which 1930s, 1932, you have a devaluation of the dollar. You have the printing of money.”

Meanwhile, along with the market, Dalio’s funds have plunged. Bridgewater is down “somewhere in the vicinity of 10% to 20%,” Dalio said. We’ll take the “over”.

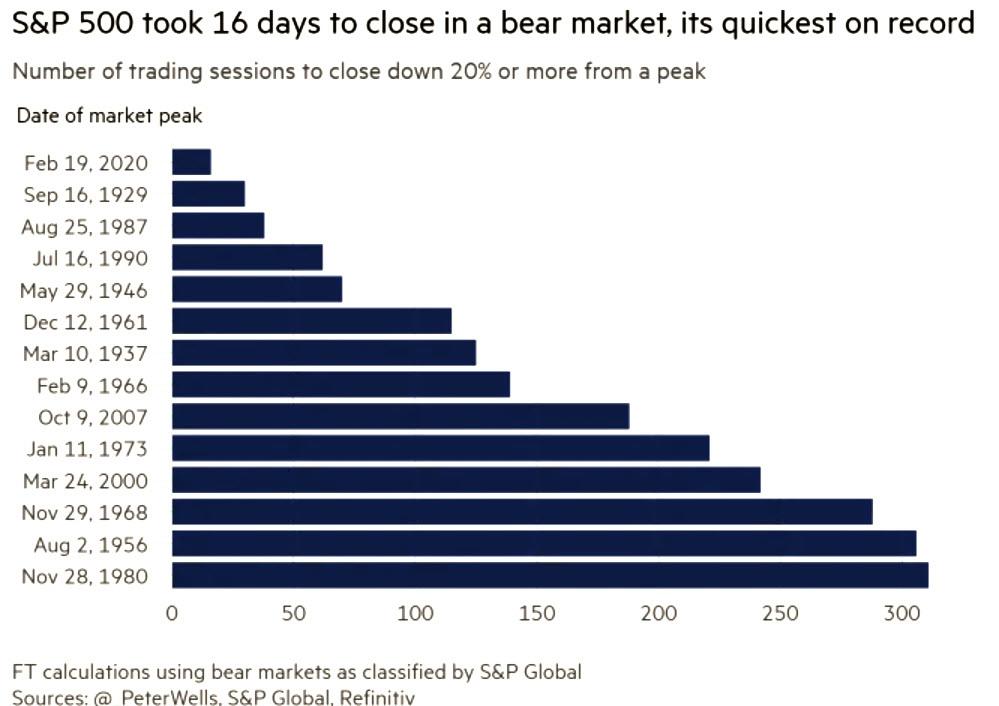

As we noted just days ago, the past month has been one of market superlatives: the biggest Dow point crash ever, the biggest Stoxx 600 drop on record, the longest lock “limit down” in the Emini futures ever observed, the biggest rebound in the Dow since the financial crisis, the biggest VaR shock in history, the fastest drawdown to a bear market from a market peak…

… and so on.

And the punchline: at $136.9 billion, two weeks ago saw the biggest cash inflow ever.

You can watch Dalio’s interview here:

Tyler Durden

Thu, 03/19/2020 – 18:55