Deutsche Bank: Helicopter Money Will Be “Disastrous” And Will Lead To Hyperinflation, “Buy Gold”

“Consensus reality is like paper money. It has no value except everyone believes in it. It has no real value, only pretend value, which is fine as long as everyone keeps pretending.”

“As helicopter money becomes increasingly inevitable, the big news is that we are calling for the thawing of the Ice Age after the next recession – whenever that arrives.”

Now that helicopter money has finally arrived, and bizarrely has brought with it that blast-from-the-past idiocy that is the trillion-dollar coin – which does nothing more than remind the population that money, like any other consensus construct, is just an illusion and depends on “faith and credit” and an increasinlgy grotesque one at that reliant on such “in your face” gimmicks as minting platinum coins to bailout the world – the discussions of what the monetary endgame (with even deflation god Albert Edwards admitting that his iconic “Ice Age” is about to melt under the red-hot heat of paradropped cash) will look like have begun in earnest.

Doing it part to kindle this debate, no pun intended, are Deutsche Bank strateigst Oliver Harvey and Robin Winkler who have published a report covering the two aspects of the helicopter money debate. And since we are confident that readers can find the happy ending version on countless other pro-paradrop forums, typically those run by socialist “island-dwelling traders” who have never actually traded (and their drug-delivery skills it turns out were also dismal) and who have no concept of how money or credit actually works, we will focus on the one that captures accurately what will happen on short notice: hyperinflation.

So for everyone curious what the hyperinflationary endgame looks like, here it is, courtesy of DB’s Oliver Harvey.

Helicopter money would make the coronavirus a lot worse

The economic policy response to the coronavirus looks very similar to the last financial crisis. Central banks have responded with liquidity for the private sector through swap lines with banks and purchases of commercial paper from corporates and have lowered the cost of money through interest rate cuts and quantitative easing. Governments are announcing sizeable fiscal packages which will provide businesses and households with direct cash injections. Today, for example, the German government pledged EUR 100bn, or 3% GDP. The US has announced a similar sized fiscal stimulus. Some have called for the government to go further, and act as a buyer of last resort for businesses, for example.

The problem is that this crisis is very different from 2008, or for that matter 1929, where much of today’s macro playbook was written. 2008 was a classic demand shock caused by a loss of confidence in the banking sector. In a demand shock, fiscal and monetary tools should be used aggressively to bring confidence back. In Paul Krugman’s classic formulation of the Washington Baby Sitters Co-operative, for example, prospective babysitters were worried about using up their supply of baby-sitting tokens to go out because babysitting opportunities were becoming scarcer. This led to further scarcity in babysitting opportunities. The cycle was only broken by the Co-Operative issuing more baby-sitting tokens, which led to babysitters feeling confident about spending them again. This is a neat analogy for how monetary stimulus helps during a credit crunch.

Coronavirus is not a demand shock, however. It is first and foremost a supply shock which is now spilling over to demand. Consumers did not initially stay away from shops and restaurants because they were worried about their future economic prospects, but because governments told them to stay at home. Holidays are not being canceled to shore up household finances but because countries have closed their borders. Workers have not been furloughed from factories because of insufficient orders but because employers are worried about the risk of spreading disease. It is of course true that the mass unemployment caused by these measures will result in a dramatic drop in aggregate demand. It is also true that the confidence effects caused by such measures is likely to result in cash hoarding by households and businesses – indeed such behaviour is in evidence in markets at the moment. But this is the second order response to a first order shock to aggregate supply.

Understanding this has very important implications for the policy response to the coronavirus. It should worry us that policymakers and academics think providing massive stimulus is the solution. This is because policymakers appear to be attempting to shift demand back to where it was a couple of months ago, at the same time as holding supply fixed. To put it another way, if the government tries to keep spending at levels before lockdowns began, while at the same time keeping lockdowns in place, there will be simply more money chasing after significantly fewer goods and services. The result of this will be inflation, and a lot of it.

This might seem like an absurd argument given that market inflation expectations – the price of inflation linked bonds – have fallen since the crisis began. But, it is perfectly consistent to say that even though this crisis ultimately originated with a supply shock, the market has up until now expected demand to fall somewhat more in response. What matters is that at present supply is inelastic – unlike in traditional Keynesian formulations – because while the government might be handing out $100 dollar bills it won’t be allowing workers to work regular days, restarting flights or reopening factories until the virus subsides.

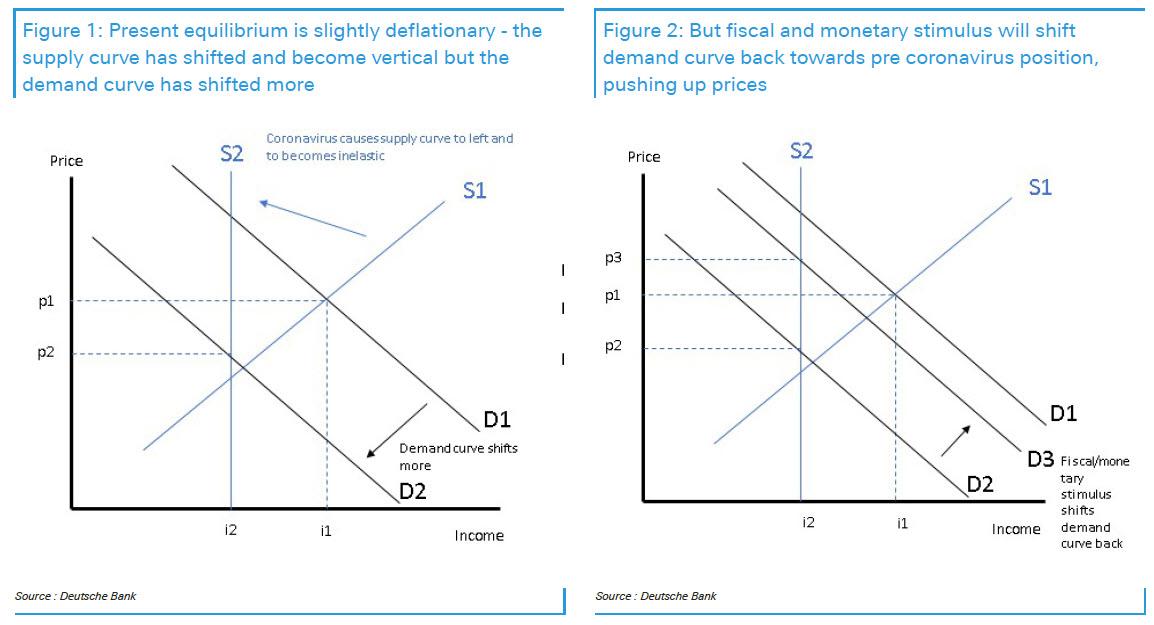

In figures one and two we present a graphical representation of this argument. Figure one shows a stylized version of the present equilibrium. The demand curve has shifted left and become vertical (inelastic). The demand curve has shifted left to a greater extent, meaning that the present equilibrium is likely to be slightly deflationary (p2 and i2). In figure two, the effect of fiscal and monetary stimulus shifts the demand curve back towards its position before coronavirus but the supply curve remains fixed (p3 and i2). The result is a higher price level.

Those worried about deflation might argue that given bleak economic prospects, cash handouts will just end up being saved by workers and businesses. But saving is all about expectations. The moment people believe prices will begin to rise in the shops for essential goods, workers will start spending those handouts. Unless the volume of goods and services available to buy increases again, this will in turn translate directly into higher prices.

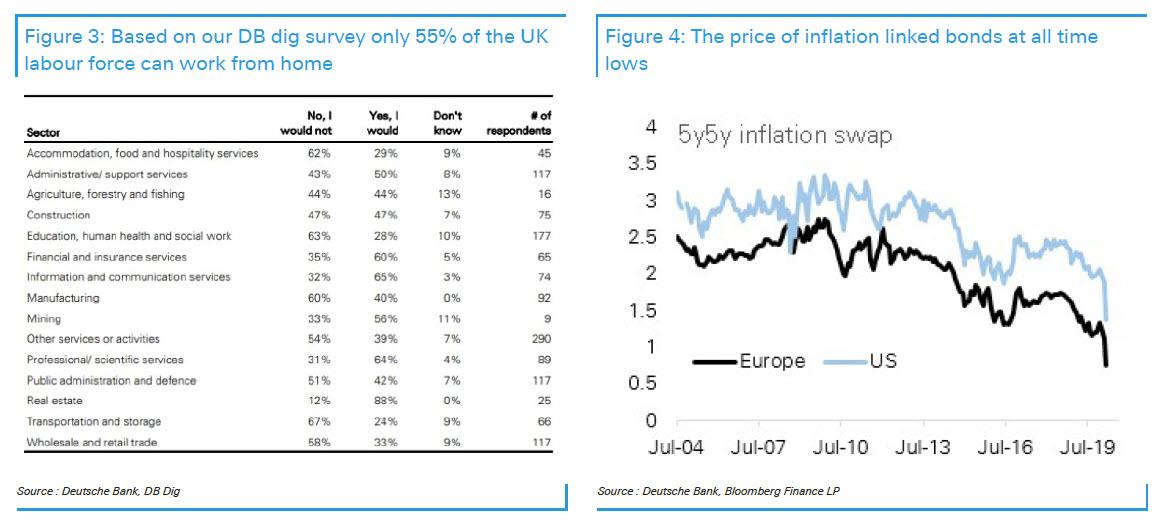

A similar point can be made about the labour market. There are a limited amount of jobs that can be done from home. According to our DB dig suvey, for example, suggests that only 55% workers will be able to work from home (figure 3). This means the supply of labour has been restricted by the coronavirus. Keeping employees in their jobs, and paying them the same wages, for doing nothing – as the Governor of the Bank of England has suggested – will result in a massive rise in unit labour costs. Presumably the government will compensate employers for doing so. But again, this money has to go somewhere – namely higher prices. In effect, there has been a huge upward shift in the Phillips curve.

Two caveats are important. As the coronavirus has created a massive credit crunch due to the sudden evaporation of corporate revenue, it is appropriate for the government to provide enough liquidity for businesses to keep them afloat for the duration of the crisis. These businesses were profitable before restrictions were imposed and can be again when they are eventually lifted. Similarly, it is justified for the government to mitigate the impact on living standards for the recently unemployed through benefit payments. As we acknowledged, the shock to demand is likely to have been greater than the shock to supply at this stage.

What would be disastrous is if governments embarked on New Deal style spending program via monetary financing at a time when it is imposing stringent supply constraints on the economy. The result may be hyperinflation, and end up doing more harm to people’s living standards than nothing at all.

In the wake of the 2008 financial crisis, those that warned about the inflationary risks of QE and fiscal expansion were given a tough time by most professional economists – and rightly so. They predicted that inflation would result out of an expansion of the monetary base when the economy was suffering from a deficit in aggregate demand. Perhaps scarred by their experience, or perhaps due to the distressing human tragedy that is currently unfolding, they have been notably quiet this time around. That is unfortunate because, as the saying goes, policymakers always solve for the last crisis.

We are worried that the real pain trade for markets – and the economy – is the long awaited return of inflation.

A good hedge would be to buy gold, as well as inflation linked bonds in the US and Euro Area, which are currently trading at all time lows

Tyler Durden

Sun, 03/22/2020 – 22:41