Stockman: The Crony Capitalist Thieves Are Back

Authored by David Stockman via Contra Corner blog,

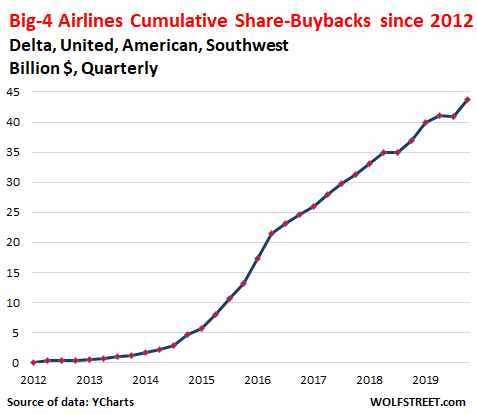

The nerve of it is a wonder to behold. The US airline industry has spent a decade shoving itself into harm’s way by strip-mining their balance sheets to fund share buybacks and goose top executive stock options.

For crying out loud – the reckless irresponsibility of it is mind-boggling. That’s because for decades upon decades this has been a highly cyclical industry – vulnerable to global dislocations caused by recessions, storms, wars, terror and more. Accordingly, airline companies absolutely need deep equity balance sheets and ample standby liquidity, even at the expense of short-term earnings.

Needless to say, the Big Four US airlines – Delta, United, American, and Southwest – were having none of financial rationality, prudence and common sense. As Wolf Richter properly pointed out:

“These stocks are now getting crushed because they may run out of cash in a few months, yet they would be the primary recipients of that $50 billion bailout, well, after they wasted, blew, and incinerated willfully and recklessly together $43.7 billion in cash on share buybacks since 2012 for the sole purpose of enriching the very shareholders that will now be bailed out by the taxpayer.”

We say nothing doing!

If the Big Four Airlines can’t raise enough cash in the high cost long term debt markets or by issuing highly dilutive preferred stock or equity, there is only one solution – and that is chapter 11. Holy moly, that’s why we have this legal protection procedure.

The airlines will have precious little business for the duration of the great COVID spring break anyway. So let the court-appointed trustees operate with the same skeleton crews that the airlines will be running even if they get the bailout. The level of customer service and employment will be essentially the same in either case.

More importantly, let the gamblers and so-called investors who piled into these stocks get their just deserts. That is, a 100% loss on their gambling stakes because that’s all it ever was when the Big Four’s combined market cap hit $130 billion compared to just $43 billion now.

Even more importantly, let these bankrupt shareholders file class action suits against the idiots and clowns in the C-suites and on the boards of directors who made such foolish decisions in the first place. Hopefully, these cats would be legally stalked and harassed to the ends of the earth as an object lesson in the personal cost of imperiling corporate balance sheets to feather their own stock options nest.

Of course, the airlines are only the poster boy for this long overdue moment of truth. The problem is universal because today’s rotten regime of Keynesian central banking has caused the entire financial system and main street economy to become riddled with rank speculation and reckless disregard for financial discipline and prudence.

And the crime starts right in the Eccles Building where over the last several decades an inbred posse of PhDs and Washington apparatchiks have taken it upon themselves to destroy honest price discovery in the money and capital markets in the name of levitating financial asset prices and thereby fostering more growth, jobs, incomes and spending than the main street economy would allegedly produce on its own.

Self-evidently, main street didn’t need no stinkin’ help from a wanna be 12-member monetary politburo. They have created serial bubbles that have gotten more inflated with each cycle, leaving the main street economy exposed to increasingly brutal episodes of correction when the proverbial Black Swan, or Black Bat, as the case may be, makes its grim appearance.

Still, the very idea that agents of the state could have enough information and wisdom to best the work of millions of traders, investors, speculators and dealers was ridiculous from the start; and the further idea that financial assets prices falsified by the FOMC to the second decimal point could cause main street to produce more output, jobs, efficiency and real living standard gains than would be the case under market determined financial asset prices was even more ludicrous.

Self-evidently, the only thing Keynesian central bankers have accomplished has been to fuel egregious speculations in the canyons of Wall Street; drain main street businesses of real productive investment; and leave businesses and households living hand-to-mouth and therefore vulnerable to even short-run interruptions of cash flow.

So we will say it again: Hand-to-mouth economics is not the natural modality on the free market; it is a malignant product of bad money and the debt-fueled speculative manias that are the consequence of Keynesian central banking.

Left to their own devices on the free market, households save and provide for rainy days, regardless of income level or social status.

Likewise, in a world not poisoned by cheap debt and falsified costs of capital, businesses nurture their balance sheets and provide for cash flow interruptions either by buying insurance or setting aside liquid reserves and equity capital based shock absorbers.

That’s the real message of this – the second great financial heart attack of the last decade. But rather than allowing the rot to be purged, the central bankers are now out pouring kerosene on the fires.

That is, insisting upon even greater central bank intrusion in the financial markets and even more egregious falsification of the prices of money, debt and every manner of risk assets. In effect, they are advocating the complete euthanasia of market prices in the financial system in favor of their own administered price folly.

At some point the very chutzpah of it gets downright maddening. We are referring to this morning’s missive in the FT from the Boobsie Twins, Ben Bernanke, and Janet Yellen, who were major architects of the disaster now underway.

Yet they now want the Fed to have expanded powers to buy corporate debt and who knows what else:

The Fed could ask Congress for the authority to buy limited amounts of investment-grade corporate debt. Most central banks already have this power, and the European Central Bank and the Bank of England regularly use it. The Fed’s intervention could help restart that part of the corporate debt market, which is under significant stress. Such a programme would have to be carefully calibrated to minimise the credit risk taken by the Fed while still providing needed liquidity to an essential market.

The bolded part is a risible lie. There is absolutely nothing wrong with the corporate debt market that even a modicum of honest interest rates could not handle.

That’s evident from the price chart of the largest corporate bond ETF shown below. It is trading no lower than in previous risk-off periods including November-December 2018, January 2016, late 2013 and during the US debt ceiling crisis of August 2011.

Yes, it has plunged from the absurd levels reached during the stock markets blow-off top a few weeks ago.

But so what? At the February extreme, the implied yield on corporate debt was hardly 2.6%, and even after the price plunge of recent days the implied yield is just 3.7%.

So what in the world are the Boobsie Twins talking about? Do they really think we are stupid enough to believe that a 3.7% investment grade yield is an end of the world crisis that requires the Fed to put its Big Fat Thumb on this sector of the rates market, too, after it has already reduced sovereign debt to yield-free status?

Indeed, when you look at the real corporate debt yield after inflation it is downright minuscule at 1.35%. So these Keynesian morons want the Fed to buy massive amounts of investment grade corporate debt with fiat credits snatched from thin air because they think, apparently, that the US economy will collapse at a real yield to just 1.35% after the current running level of inflation.

So what we have here is a far more insidious reality. Namely, the reaction function of Keynesian central bankers past and present has degenerated into an Atlas Syndrome.

These cats think they have the entire $85 trillion world economy on their shoulders and that any time there is an abrupt re-pricing of the hideous financial bubbles they have inflated, they propose to throw financial sanity to the winds lest the whole financial system and economy splatter against the wall.

It won’t, of course, because re-pricing of financial assets back to quasi-sane levels is actually what is desperately needed to stop the violent boom and bust cycles that have been gaining momentum under their tutelage for three decades now.

Stated differently, if Keynesian central banks fear a 3.7% investment grade bond yield, what they actually fear is the price mechanism itself.

That’s the heart of the matter: All of the emergency facilities and new legislative authority proposals emanating from the central bankers and their Wall Street acolytes and shills are designed to eviscerate and override the price mechanism in the financial markets.

The very absurdity and danger of that idea, however, is dramatized in spades by the juxtaposition of what happened yesterday. Presumably, the Boobsie Twins were emailing their draft FT op ed back and forth during market daylight hours.

Alas, the corporate bond market was so badly “broken” as they penned up their SOS proposal that, well, the largest amount of corporate debt deals of the year was brought to market!

That’s right. About $28 billion of new deals were priced yesterday, of which $10 billion were was 20+ years.

Duh. If that’s “broken”, we truly do not understand what financial planet these Keynesian central bankers actually inhabit.

On the other hand, we know full well where drastic and sustained repression of bond yields have already led.

To wit, to a massive scramble for yield among money managers, which in turn has fueled the outbreak of epic-scale financial engineering in the C-suites. That’s because they could sell ultra-cheap debt for any cockamamie purpose that pleased Wall Street, including idiotic empire-building through M&A and the depletion of corporate cash reserves and debt capacity in order to fund massive stock buybacks and other balance sheet impairments.

Indeed, from the point of view of the central banker Atlas Syndrome, financial price repression is the gift that keeps on giving. Having dissipated their balance sheet liquidity on financial engineering, corporations now allegedly are facing a liquidity squeeze owing to the COVID-19 supply-side shocks.

So without missing a beat, the Fed was out with a resurrection of the emergency commercial paper funding facility that was used during the 2008 crisis to rescue con men like General Electric’s Jeff Immelt, who had loaded his $600 billion balance sheet with upwards of $200 million of cheap commercial paper.

As explained below, that particular facility ended up so malodorous even in the eyes of the fools who populate Capitol Hill that they forbade the Fed from using it in the future without the permission of the Secretary of the Treasury.

Little did they anticipate, of course, that during the next financial meltdown the office would be occupied by the greatest flunky to ever hold the post, and that his real job as the Donald’s campaign finance chairman would be to tap the public till for whatever it would take to insure his re-election.

So now that Secy Mnuchin has green-flagged this abomination, just recall briefly what happened last time around.

Back then the alleged titan of corporate America didn’t cotton to the idea of paying 5% or 7% or even 10% to rollover his short-term funding, least the hit to earnings would have monkey-hammered his 2008 bonus and the value of his massive stock options.

So Immelt went running to his Goldman Sachs benefactor, Hank Paulson, who soon persuaded Bernanke to open up a window at the Fed under its emergency section 13-3 authority.

That action guaranteed virtually unlimited commercial paper funding at the Fed window’s ultra-cheap rates so as not to disturb the year end bonuses of Immelt or hundreds of other CEOs who had put their companies in harm’s way be over-reliance on cheap short-term funding.

As it happened, the commercial paper bailout didn’t help GE anyway, as perhaps indicated by the shrinkage of its market cap from $500 billion at the peak to $55 billion a present.

But more importantly, there was absolutely no shortage of cash available to GE when Immelt pulled his crony capitalist raid 12 years ago. What it needed to do was fill the approximate $30 billion hole in its balance sheet by raising long-term debt, preferred stock or even common stock.

Yet, the mere statement of the obvious underscores the entire scam behind the Fed’s intrusions into the money and capital markets with these so-called emergency facilities. To wit, they have nothing to do with insuring the companies have the cash to meet their payrolls or pay other bills as is so mendaciously claimed by Wall Street and the Eccles Building.

No, it’s about keeping the cost of capital ultra low and minimizing the hit to earnings that might result from tapping higher cost capital markets, which are still wide-open at a higher yield per yesterday’s massive pricing of new corporate debt issues.

In more unvarnished terms, the only real function of this massive new commercial paper facility, which the Fed has stood up practically overnight, is protection of corporate earnings, CEO bonuses and stock options and the remaining winnings of Wall Street gamblers.

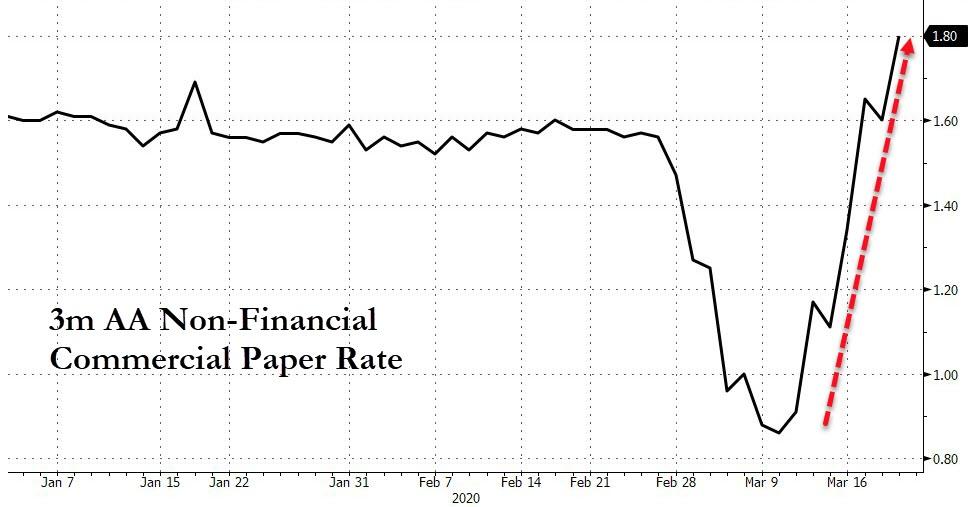

The chart below highlights the massive lie behind this new facility. The ostensible reason was that commercial paper yields spiked in the last few days from practically nothing to hardly much more.

In the case of AA rated three-month nonfinancial commercial paper, the yield rose from 0.86% on March 10 to 1.80% Friday afternoon.

But so f*cking what!

Back on February 27 when the stock market was just off its all-time highs, and when Powell was claiming the US economy was in a “good place “and the Donald was ballyhooing the Greatest Economy Ever the yield on this prime 90 day paper was actually higher at 1.56%!

Think about that one. In less than three weeks the Fed has panicked into resurrecting the Jeff Immelt Memorial Scam with commercial paper rates so low as to make a mockery of the notion of a shock or a malfunction in the plumbing.

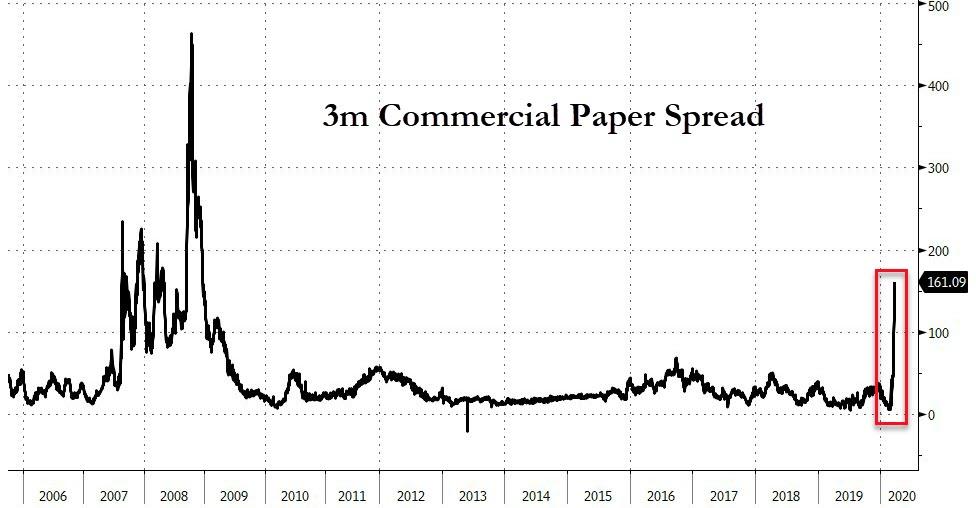

[ZH: But it’s the spread that counts.]

Still, the dutiful shills of the Wall Street Journal cut and pasted the Fed’s press release to this effect:

To ease escalating strains in credit markets. Turmoil escalated in commercial paper in recent days, sending the cost of borrowing for companies sharply higher, in some cases above the cost of selling 30-year bonds. Investors including money-market funds have sold commercial paper, saddling dealers such as JPMorgan Chase & Co. and Goldman Sachs Group Inc. with more inventory at a time when they could least accommodate it….

Oh, pulease!

Here is the 20 year history of the AA rated three month nonfinancial commercial paper yield. Self-evidently, a 1.34% interest rate is not going to break the American economy, nor would 2.00% or 4.00% or even 6.00%.

Indeed, if the market were allowed to clear at those levels the only “shock” which would trouble Wall Street would be the plunging stock prices which might result from companies having to pay a market rate of interest or issue dilutive amounts of common stock or long-term debt.

As we said, SO WHAT!

Tyler Durden

Sun, 03/22/2020 – 14:02