Bond Market Tears In Two: Distressed Debt Is Cratering, As Fed Buying Of Investment Grade Sends LQD NAV Soaring

Just last Friday we reported that the number of distressed debt in the US – roughly defined as bonds with a spread of over 10% – had soared, doubling in just two weeks to a remarkable $500 billion. Well, double it again.

According to Bloomberg’s James Crombie, there is now about $1 trillion of debt trading at distressed levels after this month’s credit rout, “and it’s rising fast” because as the impact of a severe economic slump, which as noted earlier includes nearly 50,000 shuttered retail locations, and surging funding becomes clear, “credit spreads are set to spiral higher.”

Specifically, the number of distressed bonds neared 1,900 this week, just shy of the record 2000 hit during the financial crisis, Bloomberg data shows.

Putting this surge in context, just three weeks ago, at the start of March there were less than 300 distressed issues. The rout is to be expected as the spread on the entire junk bond index flipped above 1,000 bps on Friday, and strategists from JPM and other banks expect it to surpass 1,200 bps soon, leading to a surge in defaults.

In a report published last Friday by Bank of America, its credit analyst Oleg Melentyev said “we think this credit cycle has turned and expecting default rates to rise meaningfully in coming months.”

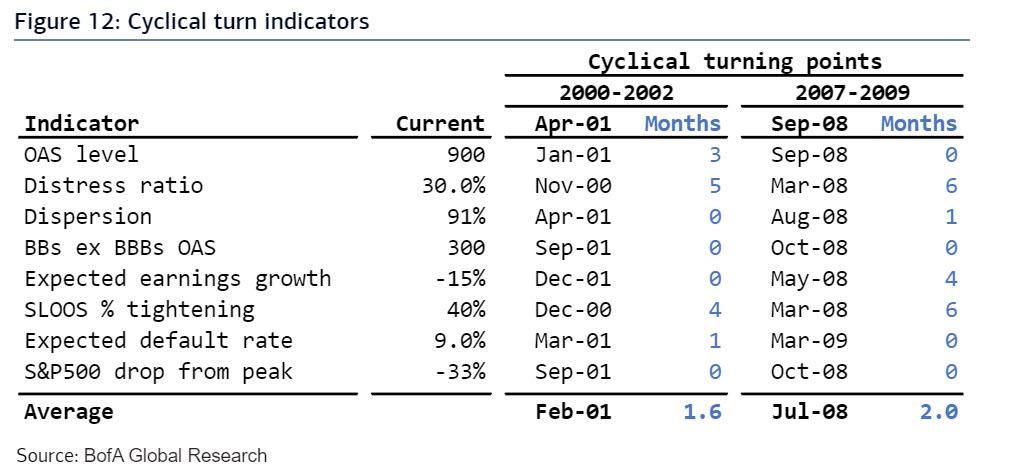

Only a week ago, we summarized all key leading indicators of credit stress in a table below, where we compared the current level on each one of them, to the point in time closest to it going into the two previous credit cycles. Marking Apr 2001 and Sept 2008 as the points of no return corresponding to 1,000bps levels on the HY index, we argued that the whole collection of indicators was about 3-4 months away from such threshold, where a turn in the credit cycle becomes inevitable and irreversible.

BofA’s conclusion: “As things continued to move at lightning speed over the past several days, those same indicators are now averaging only 1.5-2 months of cushion before they reach such a point. Based on those timelines, today’s market environment is equivalent to Feb 2001 and Jul 2008.“

But wait, it gets worse. As Bloomberg also notes, “there’s a whole world of grief in the $1 trillion leveraged-loan market, which is trading on average below 80 cents on the dollar, a level typically associated with distress.” Indicatively, while far worse than the loan selloffs in late 2015 and the Q4 2018 mini bear market, leveraged loans have another 15 points to drop before they catch down to financial crisis levels.

Naturally, most of the pain’s been in energy, which is at a 2,217 bps spread amid fears the plunge in oil prices will lead to a collapse in cash flow and rising insolvencies, but the non-energy part of junk is already at 948 bps – boosted by travel, leisure and retail names – “and no corner of high yield is immune.”

As Bloomberg concludes, there’s more trouble ahead “as the smaller and more levered junk issuers throw in the towel amid extended economic misery. As the U.S. high-yield default rate leaps above 10% this year, from 3% last month, expect the distressed universe to expand accordingly.”

Yet as the distressed bond market continues its relentless selloff, a different picture has emerged in the investment grade market, where as we pointed out yesterday, the discount on the IG ETF, the LQD, has now flipped and reversed from a 5% discount observed last week to a record premium of 3%.

The reason: with the Fed – via Blackstone – now buying the LQD ETF as part of its corporate debt bazooka, but not buying the single-name securities that comprise the ETF, investors are frontrunning the Fed’s purchases to the point where the ETF no longer reflects the fundamental values of its constituent bonds, but instead merely reflect the fact that everyone expects the Fed to buy the ETF any time there is a market event. As a result, expect this premium to be a permanent fixture of the ETF as it is pulled into two directions – on one hand lower to reflect the fundamental value of its bonds, and on the other hand higher to reflect the Fed’s infinite liquidity which can and will be used to backstop the IG bond market no questions asked.

Tyler Durden

Wed, 03/25/2020 – 15:05