Oil Plunges After IEA Hints Russia, Saudis Would Need To Completely Halt Production To Balance The Market

With stocks soaring and even the VIX sliding today, there is one asset class that refuses to confirm the 3rd consecutive day of investor euphoria: no, not bonds which are being bought aggressively again (today’s 7Y auction was spectacular), although that is likely more a function of risky parity funds releveraging in a slightly more normal market where liquidity appears to be coming back. We are talking about oil, which is down nearly 4% on the day…

… and has failed to go anywhere in the past week as shown below.

One reason for oil’s dismal performance today is that as the head of the International Energy Agency repeated, “global oil demand is in freefall” because of the coronavirus pandemic, a situation that is exacerbated by the price war between Saudi Arabia and Russia.

Fatih Birol’s comments added to the dire outlook for the oil market with traders, banks and analysts forecasting a huge oversupply as governments shut their economies to combat the contagion. “The effects of the glut will be felt for years to come”, Birol said ominously.

Speaking at an even hosted by Atlantic Council on Thursday, Birol said that “today 3 billion people in the world are locked down. As a result of that, we may see demand fall by as much as 20 million barrels a day.”

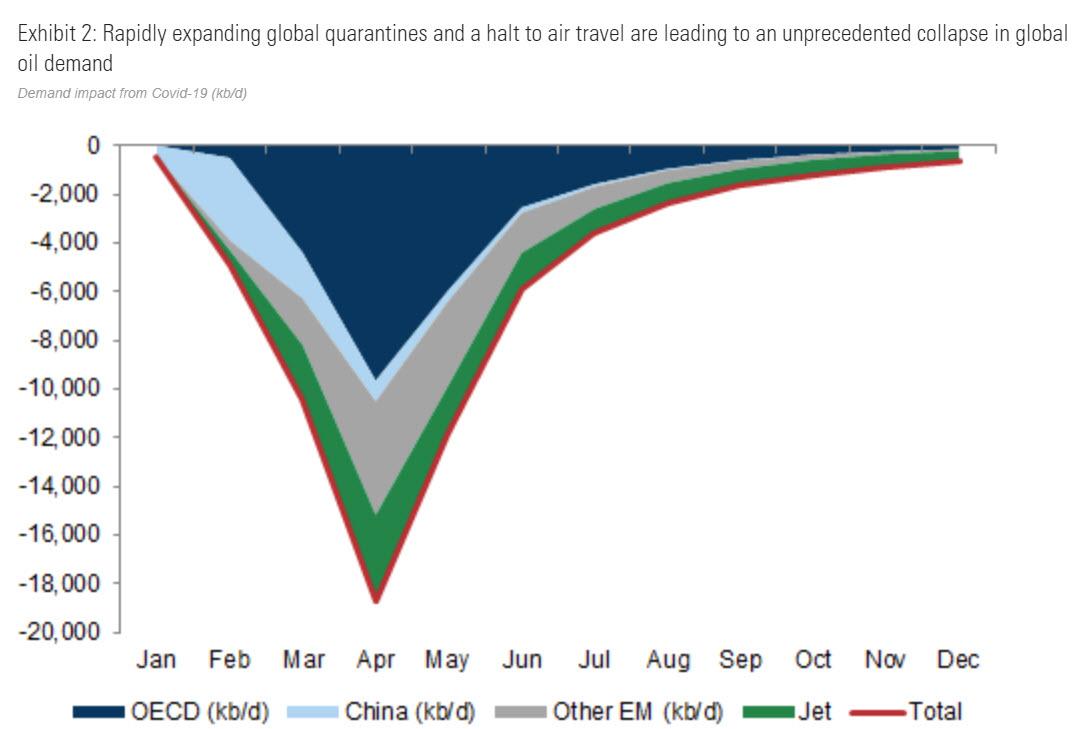

This echoes what Goldman’s commodity analysts wrote overnight, warning that “global isolation measures are leading to an unprecedented collapse in oil demand which we now forecast will fall by 10.5 mb/d in March and by 18.7 mb/d in April” or nearly the 20mb/d forecast by the IEA. As Goldman sumamrizes, “a demand shock of this magnitude will overwhelm any supply response including any potential core-OPEC output freeze or cut.“

Yesterday, top oil trading house Vitol Group also put the production glut at a record 20 million barrels a day, which as Bloomberg put it, means that “the magnitude of the oversupply is such that Russia and Saudi Arabia would need to completely stop all their output to balance the market.”

Going back to Birol, he forecast that demand is set to drop in the first quarter, and the decline will likely worsen in the next three months.

As most are aware by now, OPEC, or what’s left of it, is facing not a supply issue but a plunge in demand: as a result of the economic halt from the coronavirus pandemic, consumption of crude has dropped by between 15 million and 20 million barrels a day, and will be lower by at least 5 million a day this year, said Vitol’s head of trading Russell Hardy.

And with the market crushed by an unprecedented combination of demand destruction and a supply surge following the breakdown of Saudi Arabia and Russia’s partnership, Birol urged major producers to be more responsible.

The collapse in prices is likely to result in a major decline in U.S. shale output from the next quarter, according to Birol.

“With these prices, we will see a major decline in shale production in the United States, no question about that,” Birol said. There will be “huge suffering” in American oil industry, he said.

The danger to US shale output, and the millions of related jobs, is also why yesterday Mike Pompeo called up Saudi Crown Prince MBS in which he urged the de facto OPEC head to “rise to the occasion” and help lift the price of oil. The Saudi response? Well… just look at what the price of oil is doing today.

Tyler Durden

Thu, 03/26/2020 – 13:52