“That’s A Huge Warning For What Lies Ahead”: Futures Tumble After Senate Passes Massive Bailout Bill

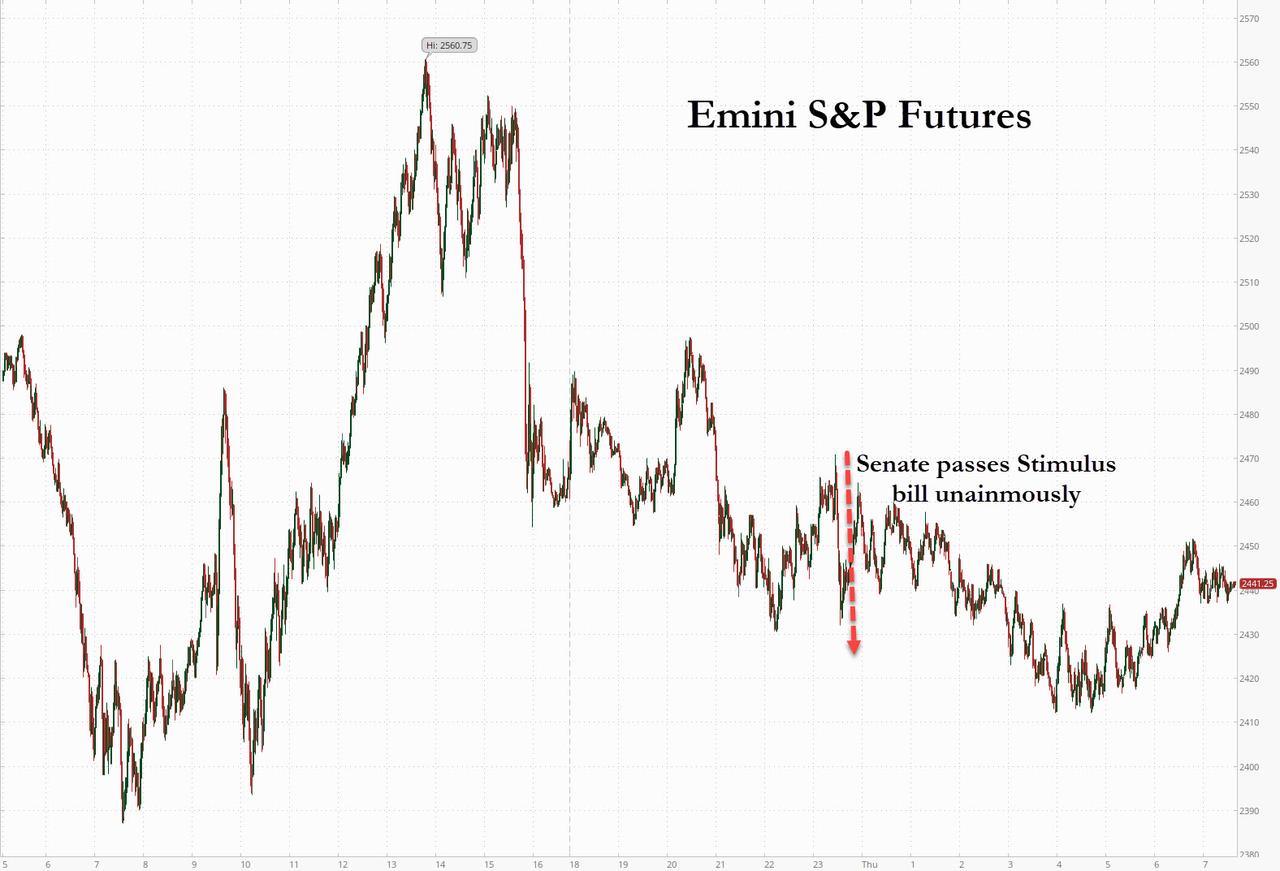

Buy the rumor of the “Largest Rescue Package in American History”, one which will explode both the US deficit and US debt and unleash helicopter money by the Fed… and sell the news.

That’s what happened overnight, when after Senate passed the biggest 2-day rally since the Great Depression (the middle of the Great Depression, not the end of it mind you) just before midnight, U.S. equity futures slumped with European stocks and most Asian shares on Thursday as investors started to look past stimulus packages to the mounting human impact of the coronavirus outbreak. At the same time, the dollar slumped, government bonds and the yen advanced.

On Wednesday, the S&P 500 logged its first back-to-back gains since Feb. 12 as the mood was lifted by a $2 trillion economic rescue package, which was passed by the U.S. Senate and sent to the House of Representatives for a vote on Friday, as President Trump had urged Congress to act “without delay” and said he would sign it immediately.

However, the benchmark index is still off by about $8 trillion from its mid-February record high as fears of a global recession and corporate defaults continue to rage amid a breakdown in business activity.

And now that the stimulus bill is done, it’s time to face reality again, and so US equity futures dropped across the board as the US death toll from the pandemic topped 1,000, while Europe’s Stoxx 600 Index dropped led by real estate and energy companies.

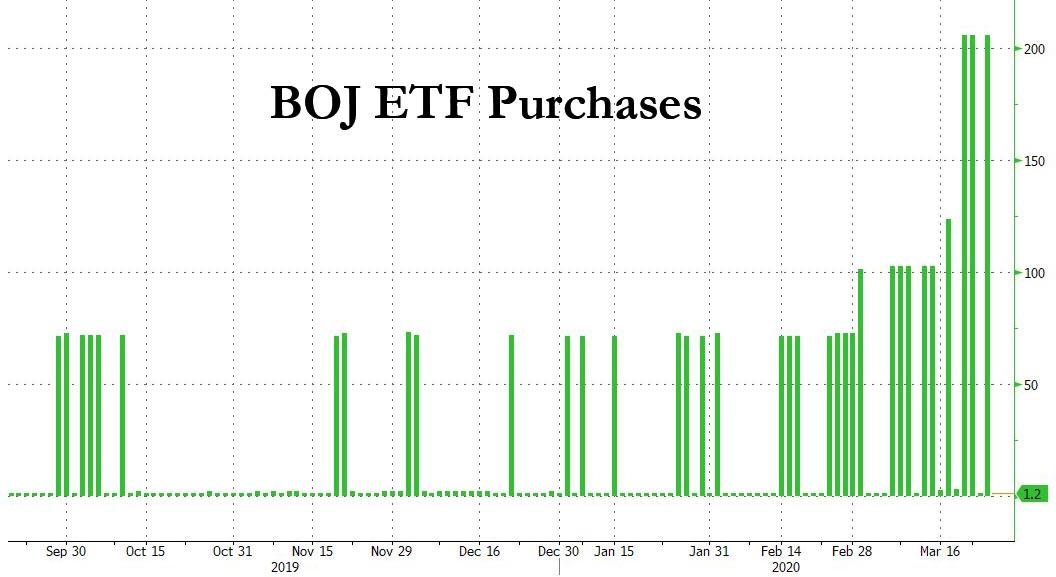

Earlier in the session, Asian stocks faded the recent euphoria, with Japanese shares closing almost 2% lower amid further efforts to contain the movement of people, despite the BOJ monetizing a record 206BN in ETFs for the 3rd time.

Equities in Australia and India rallied, bucking the trend and lifting the broader Asian gauge.

Looking ahead, Traders expect wild swings in the market to continue until there is evidence of a peaking in new coronavirus cases.

“If $2 trillion in fiscal stimulus was only enough to keep markets afloat for a couple of days, that’s a huge warning sign for what lies ahead,” said Marios Hadjikyriacos, a Cyprus-based investment analyst at broker XM.

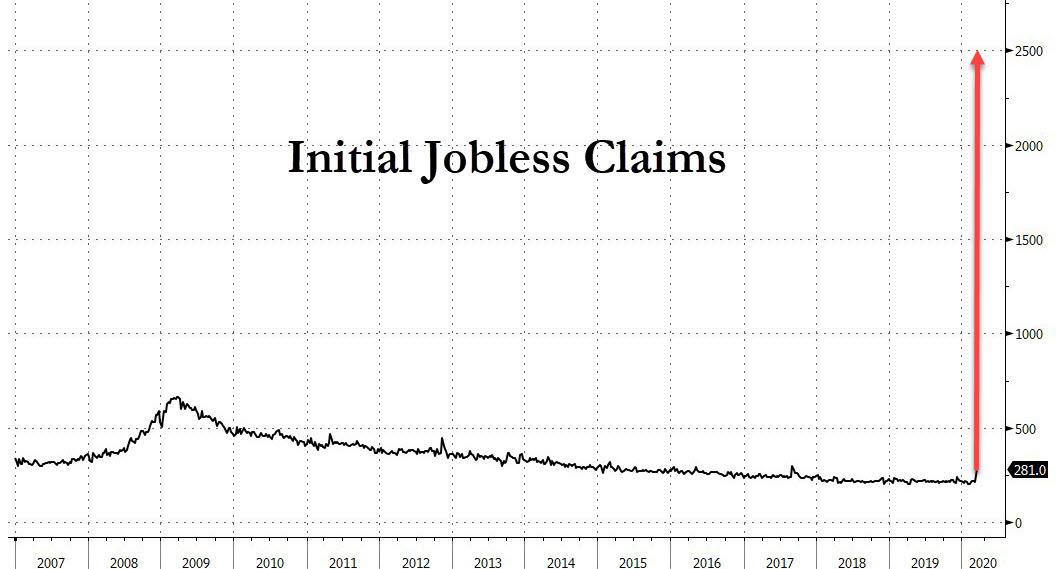

An early look of the scale of economic damage wrought by the outbreak will come when the U.S. Labor Department releases initial jobless claims data at 8:30 a.m. ET. A Reuters poll predicts weekly jobless claims ranging from a minimum of 250,000 initial claims to up to 4 million. The poll shows a median forecast of 1 million claims, which would top highs logged during recessions in 1982 and 2009. According to Southbay, one of the most accurate predictors of macro data, the number will be 2.5 million. This chart put it in its grotesque perspective.

“This print could make or break the latest recovery in stocks,” Hadjikyriacos said.

In FX, the dollar drop accelerated for a third consecutive session even as the FRA/OIS moved higher again. Commodity currencies bounced back from losses after the U.S. Senate approved a $2 trillion stimulus package while the rising death toll from the coronavirus kept risk sentiment in check. The Aussie dollar traded little changed around 6.30 a.m. New York, recovering from a drop of as much as 1.5% earlier.

In commodities, WTI and Brent front-month futures continue to bleed as sentiment ticks back into broad risk aversion and with underlying fundamentals still bearish for both the demand and supply side of the equation. WTI futures lurk under USD 24/bbl while its Brent counterpart eyes 26.50/bbl to the downside, with both benchmarks around session lows at the time of writing. Participants will be closely watching today’s G20 call; sources expect the oil market to be discussed, at least as part of the wider economy, although an outright oil market discussion was rebuffed by Russia’s Kremlin. CME raised COMEX 5000 silver futures maintenance margins by 12.5% to USD 9000/contract and raised palladium futures NYMEX margins by 13.2% to USD 43000/contract from USD 38000/contract.

Expected data include jobless claims and the third print of fourth-quarter GDP. KB Home and Lululemon are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 1.7% to 2,425.25

- STOXX Europe 600 down 1.5% to 308.78

- MXAP down 0.04% to 134.43

- MXAPJ up 0.7% to 430.21

- Nikkei down 4.5% to 18,664.60

- Topix down 1.8% to 1,399.32

- Hang Seng Index down 0.7% to 23,352.34

- Shanghai Composite down 0.6% to 2,764.91

- Sensex up 2.2% to 29,176.19

- Australia S&P/ASX 200 up 2.3% to 5,113.29

- Kospi down 1.1% to 1,686.24

- German 10Y yield fell 5.1 bps to -0.313%

- Euro up 0.5% to $1.0938

- Italian 10Y yield fell 2.2 bps to 1.372%

- Spanish 10Y yield fell 9.2 bps to 0.781%

- Brent futures down 2% to $26.85/bbl

- Gold spot down 0.7% to $1,605.22

- U.S. Dollar Index down 0.6% to 100.49

Top Overnight News from Bloomberg

- The Federal Reserve could now have as much as $4.5 trillion to keep credit flowing and make direct loans to U.S. businesses through the massive coronavirus stimulus bill being considered by U.S. lawmakers.

- Ray Dalio is turning to history in an attempt to make sense of what he says is a changing world order fueled by the confluence of high levels of indebtedness coupled with low to negative interest rates as well as yawning wealth gaps and China’s rise

- Singapore delivered a second stimulus package of S$48 billion ($33 billion) to fight the coronavirus outbreak, drawing on national reserves for the first time since the global financial crisis to support an economy heading for recession.

- The U.S. Senate approved a historic $2 trillion rescue plan to respond to the economic and health crisis caused by the coronavirus pandemic, putting pressure on the Democratic-led House to pass the bill quickly and send it to President Donald Trump for his signature

- The U.S. death toll from the coronavirus topped 1,000, according to a Johns Hopkins tally. Singapore estimated that its economy contracted the most in a decade, an early sign of what’s in store for many

- The International Monetary Fund will provide $50 billion in emergency facilities to low- income and emerging-market countries to mitigate the economic shocks of the coronavirus, including $10 billion in concessional loans.

- Italian Prime Minister Giuseppe Conte said he plans new stimulus measures for the country’s economy worth at least as much as the 25 billion-euro ($27 billion) package now being discussed in parliament

- Boris Johnson’s top medical adviser said the U.K. must learn from other countries’ experience of coronavirus testing as he warned the National Health Service may be overwhelmed by the pandemic

- Federal Reserve Chairman Jerome Powell will make a rare televised interview appearance in a Thursday broadcast, as the U.S. central bank deploys an unprecedented array of tools to prevent the health crisis from becoming a financial one

- Oil’s recovery rally faltered as political haggling over a U.S. rescue package threatened to delay its passage, while more evidence of the demand devastation being wrought by the coronavirus piled up

Asian equity markets traded cautiously amid headwinds from the US where most major indices finished in the green although pulled back heading into the Wall St. close after the USD 2tln coronavirus relief bill hit a snag at the Senate. This follows reports GOP Senators Graham, Sasse and Scott noted they won’t speed up the bill until a drafting error in the stimulus bill is addressed which otherwise could provide an incentive for employees to be laid off, while Democrat Senator Sanders threatened he will demand restrictions on USD 500bln fund for corporates if the 3 Republican Senators do not drop their objections to unemployment insurance expansions. Nonetheless, the bill was eventually passed via unanimous vote which gets sent to the House for a vote on Friday. ASX 200 (+2.3%) gained as the RBA remained active in its QE efforts and with notable outperformance in tech and defensive sectors such as healthcare and utilities. Nikkei 225 (-4.5%) was heavily pressured as exporters including index heavyweight Fast Retailing staggered on the detrimental currency flows and with SoftBank also among the worst hit after its credit rating was downgraded 2 notches and deeper into junk status by Moody’s, while participants were also ruffled by the Tokyo Governor’s requests for residents to stay at home during the weekend to curb the spread of COVID-19. Hang Seng (-0.7%) and Shanghai Comp. (-0.6%) were indecisive as focus also shifted to earnings including the upcoming releases by the Big 4 banks which are set to begin announcing their results from today. Finally, 10yr JGBs were higher due to the underperformance of risk sentiment in Japan and following similar rebound in T-notes, with weaker results at the latest 40yr JGB auction doing little to stall the overnight bond rally.

Top Asian News

- Singapore Air Considering Corporate Action Supported By Temasek

- AirAsia Is Said to Explore Options for Long-Haul Unit AirAsia X

European equity markets remain under-pressure (Euro Stoxx 50 -2.2%) and are on course to snap its two-day winning streak following a mostly downbeat APAC session. The positive sentiment faded following the anticipated passage of the US coronavirus bill through Senate, with eyes now on the House vote – with House Speaker Pelosi refusing to provide timings as the legislation needs to be closely examined. US equity futures also succumb to the broad stock sell-off as traders eye the key initial jobless claims data due at 1230GMT as an initial gauge of the COVID-19 impact on State-side jobs. In terms of Europe, cash and futures markets remain off lows with modest outperformance seen in Italy; FTSE MIB (-1.0%) – potentially on reports that the ECB will not apply issuer limits on its EUR 750bln QE bazooka, meaning that bond purchase cap at 33% of each country’s debt will not apply under the PEPP. Sectors all reside in negative territory with underperformance seen in Energy, whilst Industrials benefit from softer energy and base metal prices, broad-based losses are seen across the sector breakdown (ex-industrial goods and services). In terms of individual movers, Casino (-5.2%) sees downside post-earnings after suspending guidance. ABN AMRO (-3.9%) shares fell after announcing an incidental net loss of EUR 200mln which will be included in its Q1 20 results. Finally, Barclays (-2.2%) experiences headwinds from lower yields and mounting doubts regarding its promised GBP 1.03bln dividend pay-out next week.

Top European News

- ABN Amro Clearing Takes $250 Million Hit on Single U.S. Client

- Bosch Develops Fast Virus Tests to Shorten Wait for Answers

- European Stocks Retreat After Best Two-Day Rally Since 2008

- ECB Steps Up Virus Fight With Landmark Move on Bond-Buying Limit

In FX, a marked change of fortunes amidst yet another twist in the risk roller-coaster has propelled the Yen back to the top of the major ranks and dragged Usd/Jpy down from 111.50+ peaks through 111.00 on the way towards 109.80, with Yen crosses also retreating even though other G10 currencies are benefiting from a more pronounced pull-back in the Greenback and DXY in return (index now hovering near the base of a new, lower 101.020-100.330 range).

- EUR/CHF – The single currency continues to track broader Buck and overall sentiment movements rather than COVID-19 Eurozone economic contagion evident most recently in a much more pronounced deterioration in Gfk German consumer confidence and the IW institute warning that GDP could contract by 10% at worst. However, Eur/Usd has now breached resistance ahead of 1.0900 to test 1.0950 before the next set of upside chart levels at 1.0964 and 1.0981 that are protecting 1.1000 where 1 bn option expiries roll off. Similarly, the Franc is eyeing higher ground vs the Dollar at 0.9700, while keeping pace with the Euro as the cross meanders between 1.0653-20.

- NZD/CAD/AUD/GBP – All firmer against the Usd, albeit less so and more wary about renewed risk aversion, with the Kiwi cresting 0.5850, Loonie testing 1.4150 and Aussie capped into 0.6000. Elsewhere, the Pound has been choppy again as Cable settles down around the 1.1900 handle having been up to circa 1.1960 from sub-1.1800 lows at one stage and now waiting for the BoE after largely shrugging off UK retail sales given that the reported figures pre-dated nCoV. Note, our full preview of the March MPC policy meeting is available via the Research Suite.

- SCANDI/EM – Some loss of bullish momentum due to further erosion of risk appetite and a downturn in crude alongside other commodities, but the Swedish Krona has also had to contend with worrying declines in industrial and consumer morale, while the Czech Koruna is conscious that the CNB is widely tipped to lower rates by another 50 bp on top of the emergency ease of the same magnitude, and may even signal QE.

In commodities, WTI and Brent front-month futures continue to bleed as sentiment ticks back into broad risk aversion and with underlying fundamentals still bearish for both the demand and supply side of the equation. WTI futures lurk under USD 24/bbl while its Brent counterpart eyes 26.50/bbl to the downside, with both benchmarks around session lows at the time of writing. Participants will be closely watching today’s G20 call; sources expect the oil market to be discussed, at least as part of the wider economy, although an outright oil market discussion was rebuffed by Russia’s Kremlin. The Trump Administration also reportedly asked Saudi Arabia to hold off on plans to ramp up production to 12.3mln BPD in April (vs. 9.7mln BPD in March), whilst also asking the Kingdom to bring oil prices back to levels before the crude crash – a sign that US suppliers cannot tolerate prolonged periods of sub-30/bbl prices. The sources added that Saudi has no intention of changing course at the moment as it attempts to force Russia’s hand into production curtailments. Interestingly, in 1986 the US attempted to convince Saudi to abandon the price war at the time, an attempt that proved to be futile and the price war continued for another six months. Elsewhere, spot gold remains subdued and meanders around the USD 1600/oz – with investors favouring govt debt and haven FX in flights to safety given the yellow metal’s recent liquidity-induced selloff. Copper prices move in tandem with the risk aversion and almost reversed yesterday’s gains, albeit the red metal keeps its head above 2/lb. CME raised COMEX 5000 silver futures maintenance margins by 12.5% to USD 9000/contract and raised palladium futures NYMEX margins by 13.2% to USD 43000/contract from USD 38000/contract. Goldman Sachs forecasts oil demand to fall by 10.5mln bpd in March and 18.7mln bpd in April, while it suggested that a demand shock of this magnitude will overwhelm any supply response including core-OPEC freeze or cut. However, Goldman Sachs also noted it is seeing increasingly risks of a price rebound to be sharper than its base-case rally back to USD 40/bbl for Brent by Q4 2020.

US Event Calendar

- 8:30am: Advance Goods Trade Balance, est. $63.4b deficit, prior $65.5b deficit, revised $65.9b deficit

- 8:30am: Wholesale Inventories MoM, est. -0.2%, prior -0.4%; Retail Inventories MoM, est. -0.05%, prior 0.0%

- 8:30am: GDP Annualized QoQ, est. 2.1%, prior 2.1%;

- 8:30am: Personal Consumption, est. 1.7%, prior 1.7%

- 8:30am: GDP Price Index, est. 1.3%, prior 1.3%

- 8:30am: Core PCE QoQ, est. 1.2%, prior 1.2%

- 8:30am: Initial Jobless Claims, est. 1.64m, prior 281,000; Continuing Claims, est. 1.79m, prior 1.7m

- 11am: Kansas City Fed Manf. Activity, est. -10, prior 5

DB’s Jim Reid concludes the overnight wrap

You realise how pampered our generation is when after a week of self-isolating, joy in abundance comes in finally finding an online grocery delivery slot at 8am this Saturday. I was on a very important conference call yesterday and an email came through to me saying a small number of slots had become available to annual pass holders. Even though I was going through the very intricate new Fed corporate bond purchase plans at the time, as I spoke I scrambled to put a minimum order through online. I wonder if anyone has ever talked about the Fed while buying courgettes before. Multi-tasking at its finest and food for my wife, kids and dogs for the weekend.

All in all none of us can get away from the fallout from the virus. However, even though the percentage increase in new case numbers continue to rise at a high rate in many Western countries, there has definitely been more talk this week of how you get countries back to work with Mr. Trump leading the charge on this – at least in terms of rhetoric. In terms of science, last week we discussed how the UK government suggested they were in the process of buying a large number of antibody tests that may be able to tell you if you have had covid-19 or are immune to it. Well yesterday they provided more details and said that the UK had bought 3.5 million tests. Public Health England (PHE) suggested they could be on sale within days from the likes of Amazon or chemists. The scientific experts stressed at the daily Government press conference that they still had to be tested this week but confirmed they could be slowly rolled out if effective although next week looks optimistic. There are many unanswered logistical questions to this but it does provide some hope that there is an exit strategy for countries even before all the cases have been eradicated and shutdowns ended. Watch this space.

Interestingly as you’ll see from our new Corona Crisis Daily, the U.K. actually saw new case and mortality rate growth slow yesterday although day to day numbers are always going to be volatile. It will encourage a little hope that the U.K. is not going to exactly mirror Italy on the epi curve. Also on the optimistic side Italy saw its third single digit % case growth day in a row (rather than double digit before) and Italy’s very hard hit Lombardy region saw the new case growth rate fall more sharply. Spain continues to be hard hit but even here the number of new cases is slowing down in percentage terms. US new case growth dipped a little but it’s still on course to overtake China at some point before the start of next week with regards to total cases. See the new daily for more on this.

In terms of markets, this week has seen a little less pessimism on the duration of lockdowns and the firming up of various stimulus packages. This continued to support global equity markets yesterday, with the S&P 500 up over 3% mid-session until Congress’s continual vote delay helped pare these gains. However the index finished the day +1.15% higher, the first time in over a month that the index has risen twice in a row, and bringing its gains since the closing low on Monday to +10.64%. The Dow Jones outperformed other US indices to close up +2.39%, which came thanks to Boeing’s astonishing +23.13% surge, following the company’s +20.82% rally day before yesterday. The outsized moves came as the US stimulus package that both parties seem to have nominally agreed to contain a $17bn provision for businesses that are important for national security, something that could benefit the company. Furthermore, Reuters reported yesterday that the company planned to restart production of the 737 MAX by May. Earlier European equities advanced into the close, with the STOXX 600 up +3.09%, and the DAX recovering from earlier losses to close up +1.79%.

On the US fiscal package, the US Senate vote got delayed due to disagreements on unemployment benefits however it did finally pass a short time ago. The bill now moves to the House before being tabled in the White House for President Donald Trump to sign. The House is scheduled to vote on the legislation on Friday but President Trump has urged Congress to act “without delay” and added that he would sign the legislation immediately. However, one potential thorn in the passage of the legislature could be any House member asking for a recorded, roll-call vote instead of a voice vote, which has potential to drag out the process further.

In terms of markets, futures on the S&P 500 are down -0.78% as we type. There’s a lack of direction in Asia with the Nikkei (-3.16%), Hang Seng (-0.56%) and Shanghai Comp (-0.18%) down while the Kospi (+0.88%) and Autralia’s ASX (+1.98%) are up. In FX, the US dollar index is down for a fourth consecutive session (-0.27%) this morning after yesterday’s -0.97% decline. Yields on 10y USTs are down -7.9bps to 0.791% and in commodities Brent crude oil prices are down -0.66%.

Worth also flagging overnight is news that Fed Chair Powell will speak in a rare televised interview today at 7:05 am EST on the NBC Today show. So one to watch. Meanwhile, we’ve had the world’s first 1Q 2020 GDP print from Singapore overnight with reading falling to a worse than expected annualized -10.6% qoq (vs. -8.2% qoq expected). Our economists believe that the print could get revised down further in the final reading as the preliminary estimate mainly relies on Jan-Feb data. The GDP print from Singapore further highlighted that manufacturing (+4.2% qoq saar vs. -5.9% in the previous quarter) is proving to be more resilient to the virus impact viz-a-viz services (-1.9% qoq saar vs. +2.2% in last quarter) .A message we also got from flash PMIs earlier in the week. The government is now expecting a sharp full-year contraction in the economy of -1% to -4%.

Back to the stimulus bill where some of the highlights include direct payments of $1,200 for adults who earn an adjusted gross income of less than $75,000, with the payments tapering off above that income level. There’s also an increase in unemployment insurance, as well as expanded eligibility. Around $500bn in loans and assistance will be put aside for large companies and a separate pot of $350bn for small companies. To put some perspective on the size of this package, the Obama stimulus passed just after his administration came to office in 2009 was around $800bn.

While the stimulus package is clearly good news, there’s already been a substantial amount of damage to the US economy, something we’ll be able to take a more real time look at today when we get the release of the country’s weekly initial jobless claims. Our US economists are forecasting an unprecedented surge in claims, up to 1.7m, having been 281k the previous week and 211k the week before that. When I saw their forecast I had to make sure it wasn’t a typo. It’s worth bearing in mind that the peak week during the financial crisis in March 2009 saw “only” 665k claims and the highest in 53 years of data was the 695k in 1982.

It wasn’t just in the US that stimulus packages were being passed, with German lawmakers in the Bundestag voting in favour of the €750bn package and to suspend the country’s constitutional debt brake. The measures includes €156bn of new borrowing, or around 4.5% of GDP, and comes against the backdrop of a notable deterioration in the country’s economy. We saw this yesterday with the release of the Ifo’s final business climate reading which came in at 86.1, worse than the preliminary 87.7 reading, and making it the lowest number since July 2009. There wasn’t a great deal of hope for the future either, with the final expectations reading now at 79.7 (vs. preliminary 82.0), the lowest since December 2008 at the height of the financial crisis.

Over in sovereign debt markets, there was a notable narrowing of European spreads, with the Italian 10yr spread over bunds falling for a second day, down by -8.3bps to its lowest level in nearly 3 weeks. Other nations in the European periphery saw similar moves, with spreads for Spain (-6.9bps), Portugal (-7.9bps) and Greece (-16.6bps) all tightening. However, core countries’ debt lost ground yesterday, with 10yr yields on German (+6.0bps), Dutch (+7.0bps) and Swiss (+6.4bps) bonds all rising which is good news overall. In spite of being an era-defining crisis it is a major feature that 10yr bund yields are within 10bps of 10-month highs. Credit sentiment continued to improve. US CDX IG and HY were -5bps and -60bps tighter and the European equivalents were -9bps and -64bps tighter. In cash markets, US IG spreads were 28bps tighter as the Fed’s buying plan has started to bear fruit. However after the bell, Ford Motor Co. saw a downgrade by S&P following an earlier one from Moody’s which leaves it with an average BB+ rating and now makes it the second biggest fallen angel in history behind GM and the second time the company has made this journey after the big problems of 2005. As many of the index providers have suspended rebalancing for this month end, it will have a bit longer until it officially migrated which may help some holders. Ford’s shares fell as much as -7% after hours, before stabilising at -2%.

Before the day ahead we’ll briefly return to Europe. Bloomberg reported yesterday that the ECB were open to launching their Outright Monetary Transactions program if needed, and that there would be “broad support” according to the article. The program was launched all the way back in 2012, following former ECB President Draghi’s promise to do “whatever it takes”. However it has never been used, and requires governments to secure help from the European Stability Mechanism in order for them to do so. In turn, a credit line from the ESM usually comes with some form of conditionality (assuming this is not waived given the nature of the crisis), so there are certainly questions as to how keen governments would be on taking up assistance.

To the day ahead now, and there are a number of data highlights to look out for, with the initial weekly jobless claims a particularly important one to watch in the US. From the US we’ll also get the third reading of Q4’s GDP, personal consumption and core PCE, along with the preliminary February reading of wholesale inventories and the March reading of the Kansas City Fed’s manufacturing activity. Meanwhile in Europe, we’ll get UK retail sales for February, France’s business confidence for March, the Euro Area’s M3 money supply for February, and Germany’s GfK consumer confidence for April. Finally from central banks, the main highlights will be the Bank of England’s rate meeting, while the ECB will be publishing their Economic Bulletin today as well. Finally, EU leaders will be holding a European Council this afternoon via video conference, where they’ll be discussing their response to the coronavirus outbreak.

Tyler Durden

Thu, 03/26/2020 – 08:08