The Unthinkable Is Happening: Oil Storage Space Is About To Run Out

In the past three weeks, oil plunged and has continued to plunge even more in the aftermath of the oil price war declared between Saudi Arabia and Russia, and where US shale (and its junk bonds) has been caught in the crossfire. However, as we reported last week, we may get to the absurd point when the price of a barrel of oil not only hits $0 but goes negative.

The reason: according to Mizuho’s Paul Sankey, at a whopping 15MM b/d in oversupply, crude prices could go negative as Saudi and Russian barrels enter the market. According to Sankey, much of the US 4MM bpd in crude exports will be curtailed as prices fall and tanker rates soar. And with US storage roughly 50% full, and able to take another 135MM bbl more, assuming a build rate of 2MM b/d, the US can add 14MM bbl/week for 10 weeks until full.

As a result, there is a now race between filling storage and negative pricing “unless U.S. decline rates can outpace inventory builds, which we very much doubt.” Said otherwise, absent dramatic changes, in roughly 3 months, energy merchants will be paying you if you generously take a couple million barrels of crude off their hands.

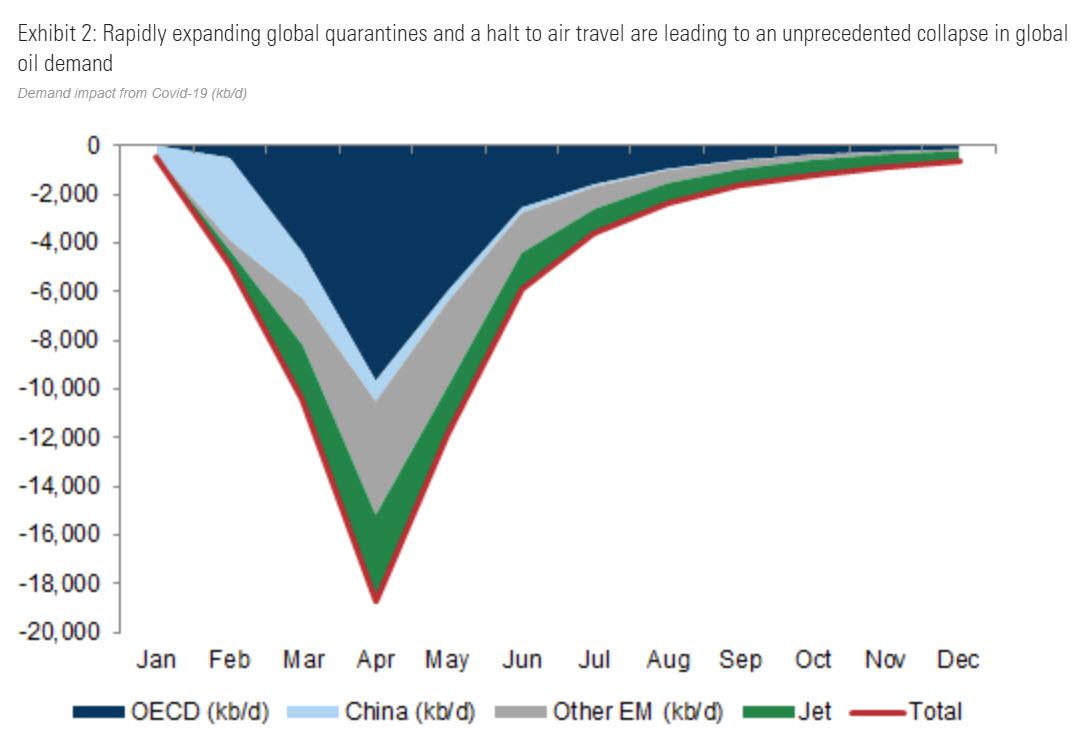

It went from bad to an outright disaster earlier this week when Goldman, Vitol, and the IEA all raised their estimate for daily oil oversupply to an unthinkable 20 million barrels per day, as a result of the collapse in oil demand as the global economy grinds to a halt coupled with Saudi Arabia’s determination to put all of its higher-cost OPEC peers out of business.

This means that for the oil market to rebalance, both Saudi Arabia and Russia would have to halt all output. Needless to say that is not happening, in fact Saudi Arabia is now pumping between 2 and 3 million barrels more than it did last month, which is why the negative oil price scenario envisioned by Sankey is looking more real by the day.

So real, in fact, that the US energy industry is starting to contemplate the all too real possibility of running out of storage and as Bloomberg reports American pipeline operators have begun asking oil producers to voluntarily ratchet back their output in the clearest sign yet that a growing glut of crude is overwhelming storage capacity.

As Bloomberg details, Plains All American Pipeline, one of the biggest shippers of crude in the U.S., sent a letter this week asking its suppliers to scale back production. The notice came from the company’s marketing unit that buys and sells oil to customers. At the same time, a Texas oil regulator said Saturday that drillers were getting similar notices from pipeline operators.

“We are sending this proactive request to our suppliers to ask that you take steps to reduce oil production in response to the pandemic,” Plains said in the letter obtained by Bloomberg. Good luck with that: in an industry geared to always producing, that’s similar to asking the Nile to reverse course.

The company sent a separate letter requiring customers to prove they have a buyer or place to offload the crude they’re shipping, according to people familiar with the matter. Enterprise Products Partners LP put out a similar call, one person said. The firm didn’t immediately have comment. The idea is to prevent anyone from parking oil in pipelines, an unprecedented step which suggests pipeline are now convinced US commercial storage will soon be full, at which point oil producers will have no choice but to pay customers to take the oil or wreck unprecedented havoc on the US oil infrastructure.

If there is any confusion, Bloomberg explains the situation succinctly: “the messages signal the oil market is fast approaching the moment traders have been warning about – when crude supplies overflow storage tanks and pipelines as the coronavirus pandemic drags down oil demand by the most in history.“

* * *

Also on Saturday, Ryan Sitton, a member of the Texas Railroad Commission that regulates the state’s oil industry, said he’d heard that “some Texas producers are starting to get letters from shippers (pipelines) asking for oil production cuts because they are out of storage.”

There were already signs that North America’s storage system was nearing its limit. On Friday, prices for physical delivery of several key crude grades in North America plunged to the lowest levels in decades. West Texas Intermediate crude in the heart of the Permian shale region plunged to $13.01 a barrel, the lowest since 1999. Meanwhile, West Canada oil is just $5 away from turning negative.

It gets crazier: trading giant Mercuria Energy Group bid just 95 cents for Wyoming Asphalt Sour, a dense oil used mostly to produce paving bitumen, and said the same barrel was bid at below zero earlier this month.

Surprisingly this plunge in oil prices has yet to really hit the gas pump, perhaps because US oil refiners have been steadily cutting back on the amount of crude they buy and process as lockdowns across the nation keep cars off the road, sending gasoline demand plummeting.

Meanwhile, a new wave of defaults is coming as US shale producers have begun to anticipate the day their product will be rejected by intermediaries, and are throttling back drilling even if it means they are staring a bond default squarely in the face. That said, it could take weeks if not months before that translates into a meaningful decline in oil production. Meanwhile, America’s largest oil-storage hub at Cushing, Oklahoma is already more than half full, and filling up at a furious pace.

Sitton has been pushing a plan that would have Texas imposing limits on its crude production as part of a deal with the Organization of Petroleum Exporting Countries. “We need to get in front of this,” he said on Twitter Saturday.

Ok, so ground storage is almost full but what about filling up all those tankers that are floating around aimlessly now that global demand has collapsed? After all it wouldn’t be the first time the US commercial storage was nearly exhausted forcing tankers to be deployed as temporary warehouses of physical product?

Well, that’s precisely what is going on. With the oil market falling into a so-called super contango, which means it is now profitable for traders to buy oil today, store it, and reap the profits by selling it at a higher price months or even years down the line, traders are scrambling to dump oil in portable storage. Firms including Vitol Group and Gunvor Group, two of the world’s largest oil traders, say there’s intense demand to keep barrels at sea.

Traders typically look to use the largest ships for oil storage as they are the most cost-effective. In recent days though, shipowners have also been receiving inquiries about smaller vessels that can hold a million barrels or fewer and for periods of time longer than 12 months, said International Seaways Chief Executive Officer Lois Zabrocky.

“This is a once-in-a-generation type of event,” she said Thursday, quoted by OilandGas360.

As Bloomberg reported separately, citing Robert Hvide Macleod, CEO of tanker owner Frontline Management, “oil is going on ships at a speed never seen before,” as a result of the market’s glut; he added that vessels are being filled at five times the pace of 2015, when oil market was last heavily oversupplied. International Seaways, another owner, said on Thursday that the total volume of oil in floating storage may top 100 million barrels during this glut.

Why? Because the bottom line bears repeating: “The world is producing 20 million barrels of oil too much every day”, or said otherwise there is no demand for roughly 20% of global output every single day. At this rate, how long before all the storage in Cushing, ARA and China is overflowing and every single tanker in the world is full?

And what happens to the oil price then? One thing is certain – there will be blood.

Tyler Durden

Sun, 03/29/2020 – 11:05