Another Busted M&A Arb As Xerox Abandons Hostile Bid For HP, Blames Virus

So it appears David will not be slaying Goliath this time (in what is likely to come as no surprise to anyone who has actually been paying attention).

Having started this debacle on Nov 5th 2019, Xerox has decided to end its hostile takeover bid for HP Inc. because of uncertainty stemming from the COVID-19 pandemic, a person familiar with the matter said, marking a blow to the photocopier company’s efforts to stimulate future growth.

In a press release, Xerox reported:

The current global health crisis and resulting macroeconomic and market turmoil caused by COVID-19 have created an environment that is not conducive to Xerox continuing to pursue an acquisition of HP Inc. (NYSE: HPQ) (“HP”). Accordingly, we are withdrawing our tender offer to acquire HP and will no longer seek to nominate our slate of highly qualified candidates to HP’s Board of Directors.

While it is disappointing to take this step, we are prioritizing the health, safety and well-being of our employees, customers, partners and other stakeholders, and our broader response to the pandemic, over and above all other considerations.

There remain compelling long-term financial and strategic benefits from combining Xerox and HP. The refusal of HP’s Board to meaningfully engage over many months and its continued delay tactics have proven to be a great disservice to HP stockholders, who have shown tremendous support for the transaction.

Xerox’s Board of Directors and management team are grateful for the significant backing we received from both Xerox and HP stockholders throughout this process. We thank the talented individuals who agreed to stand for election to the HP Board, making time in their busy schedules to take on this responsibility when HP’s existing Board did not. And finally, we thank the banks who agreed to finance this acquisition, who never wavered in their commitments, even during the market turmoil caused by COVID-19.

It’s been an ugly ride since Xerox announced, with it stock down 48% (and HPQ’s stock down just 5%)…

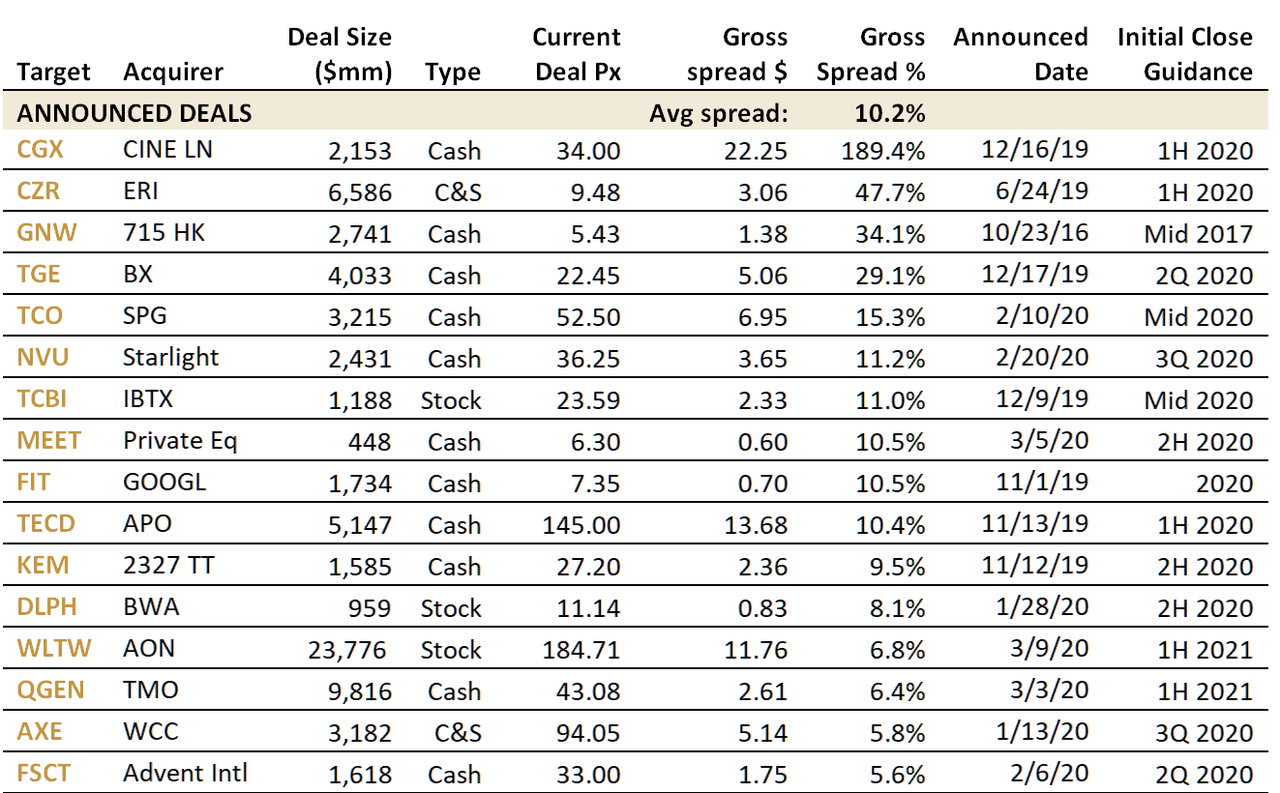

Just add it to the list of busted M&R arb deals…

Oddly, often times, when markets see volatility and prices move sharply lower, dealmaking can be a tailwind. Interested buyers with cash on the sidelines scoop up assets on the cheap and companies in financial distress start to look for synergies and ways to survive the current downturn.

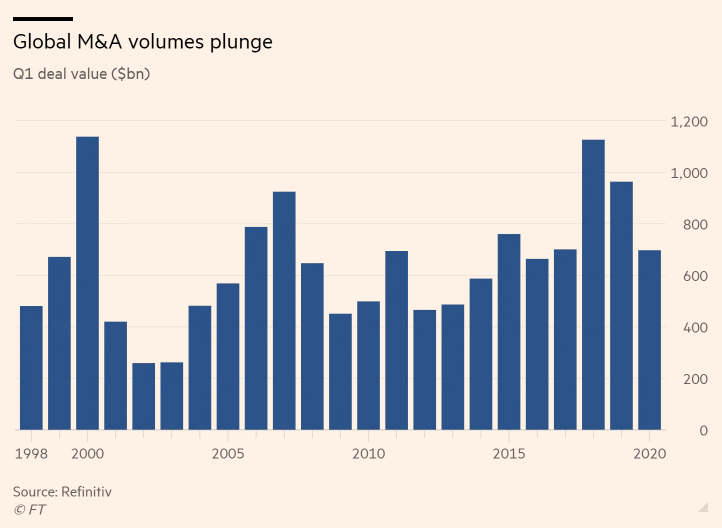

But in the case of the coronavirus pandemic that has shut down most of the world, dealmaking has simply ground to a halt.

Deal activity last week was down to just $12.5 billion, the lowest weekly total since April 2009, and the overall value of deals in Q1 fell 28% from a year ago to $698 billion. It’s the weakest year opening period since 2016, according to the Financial Times.

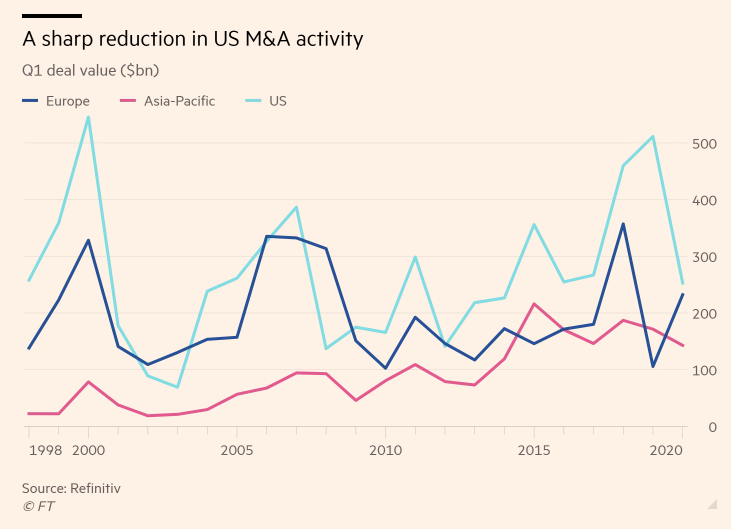

There was a “sudden reduction” in U.S. activity and the number of transactions greater than $10 billion also dropped sharply around the globe.

Leon Kalvaria, chairman of the institutional clients group at Citigroup, was not optimistic for the near term. He told FT: “Everyone is thinking about their employees and customers first. Few companies will be doing cash deals in this environment and private equity players will focus more on managing their portfolio companies before starting to do deals.”

U.S. dealmaking plunged 51% to $253 billion in the first quarter, even inclusive of Morgan Stanley’s takeover of E-Trade and Thermo Fisher’s takeover of Qiagen.

European volumes for the quarter were up due to a pick-up in private equity acquisitions and the takeover of Willis Towers Watson by Aon. European volumes rose 51% to $232 billion in the period.

Dietrich Becker, Perella Weinberg Partners’ head of European advisory, said:

“In the first week of a crisis, everyone looks at their balance sheet and says everything looks OK. And then as time goes on, they look at the cash burn rate amid declining revenue and become focused on their liquidity, credit profile and ratings.”

He continued:

“Activist defence and general corporate defence remain a theme that our clients are focused on given the sharp share price falls. I suspect there will be some good, old-fashioned defensive mergers as companies will need to accelerate consolidation.”

Cross-border transactions also plunged, down 17% from a year ago to $204 billion. As individual counties batten down their respective hatches, cross-border dealmaking will likely continue to suffer into the back end of 2020.

Ros L’Esperance, global co-head of banking at UBS, concluded:

“M&A activity has slowed down as clients are trying to assess where the market is moving, the impact on individual sectors and businesses, and are waiting for valuations to stabilise, but dialogues remain robust.”

Likely high off a hit of fresh Central Bank cash, L’Esperance continued: “Certainly there will be a delay in activity but once things reset they will probably bounce back and accelerate much faster than it did after the financial crisis in certain sectors.”

Keep thinking that, Ros.

Tyler Durden

Tue, 03/31/2020 – 17:05