Steve Cohen Doubts This Is The Bottom: “Markets Don’t Come Back In A Straight Line”

Over the weekend, we reported that the only question Goldman’s client are asking is “are we past the bottom” and “has a new bull markets started.” Not surprisingly, today we also learned from Michael Wilson that the main question Morgan Stanley clients were asking was almost identical: “will US equity markets make fresh lows in this bear market.”

And while Wilson’s answer was yes, a far more iconic investor – and one whose massively levered hedge fund that has substantial exposure to the blown up Treasury cash/swap basis trade was recently bailed out by the Fed’s mega repos – had a different take.

In an internal memo sent out on Friday and seen by Reuters, billionaire trader Steven A. Cohen cautioned his traders at Point72 Asset Management, to remain cautious as “markets don’t come back in a straight line; after an earthquake there are tremors.”

“We need to continue to be disciplined. We are seeing plenty of opportunities to generate returns, but I don’t want us taking undue risks” he added.

Cohen also wrote that his $16 billion firm’s returns are “essentially flat for the year,” a result that “speaks to how well our investment professionals have managed risk in such a challenging environment.”

Cohen’s opinion is so sought out he was among the hedge fund managers that spoke directly to the president last week as we previously reported, when he participated in a conference call with President Trump and Vice President Mike Pence. Others on the call included Dan Loeb of Third Point LLC, Stephen Schwarzman of Blackstone Group, Robert Smith of Vista Equity Partners, Paul Tudor Jones of Tudor Investment Corp and Ken Griffin of Citadel.

What specifically the Republican donor told Trump and Pence was unclear. Reuters previously reported that the call was to discuss the U.S. economy, the Federal Reserve and other issues, according a Reuters source, although something tells us that letting true price discovery return without constant Fed manipulation and intervention, was very low on the list of priorities.

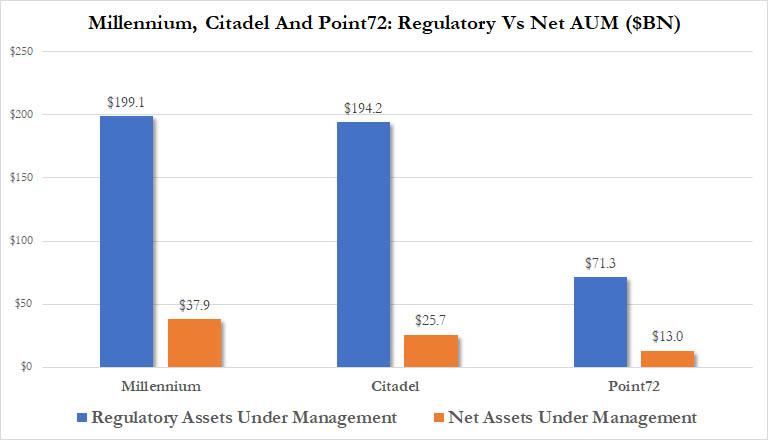

As we also reported previously, other massively levered multi-strategy macro hedge funds posted strong performance in the second half of March after getting crushed early in the month on the basis trade. They include the Millennium fund, which is up 0.17% for the year through Friday, and Citadel’s Wellington fund, which is also slightly positive for the year.

As a reminder, the trio of funds was the same as those we said last December were effectively rescued by the Fed’s restart of repo ops in September….

… which however turned out insufficient after this month’s turmoil, and they were forced to unwind failing bases trades, explaining why the Fed had to expand its repo to $1 trillion per day.

Tyler Durden

Tue, 03/31/2020 – 16:45