“Fade The Rip”: BofA Warns “Bear Market Far From Over Unless We Escape A Recession”

“Have we hit the bottom?”

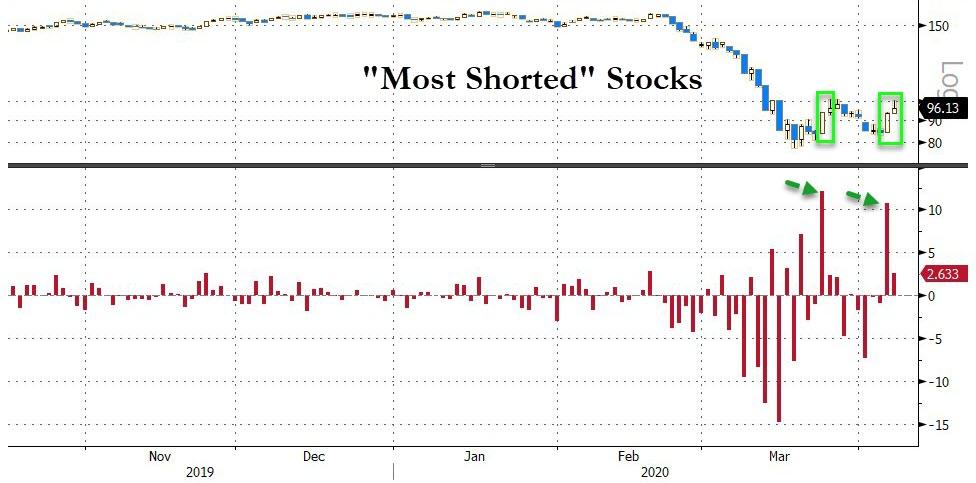

Ask 100 traders what their biggest concern about the market is right now, and that will be the answer roughly 100 times. And while the frazzled bulls will be quick to point to the recent massive surge as proof positive the lows have been hit, those with actual market experience such as Nomura will tell you that what we have seen in recent weeks is nothing but a massive short squeeze.

Yet while that may explain the market moves in the recent past what about the future: after all what traders want to know is where stocks go from here, not how we got here.

To answer that question we go to the derivatives team at Bank of America, according to who this – and by “this” we mean the reaction to the unprecedented stimulus unleashed by the Fed on March 23, when Powell unveiled unlimited QE, purchases of corporate bonds, and a slew of other measures, which also marked the lows so far this crisis – may be as good as it gets, because as BofA’s Benjamin Bowel writes overnight, “history shows markets still need to generate significantly more “total volatility” before the bear market ends” which prompts him to recommend to “Fade the rip.“

Here’s how the derivatives strategist deliver his bad news to the bulls expecting nothing but smooth sailing from now on: “bear market rallies are common and historical analogs suggest the S&P could rally to near 3000, but still roll-over and touch new lows before staging a full-fledged recovery.”

Picking up on what Morgan Stanley said yesterday, BofA writes that looking at markets since 1929, it would be unprecedented if the S&P failed to re-test or even fall below its Mar 23rd low, given the size of the recent drawdown (-34%) and assuming a recession ensues.

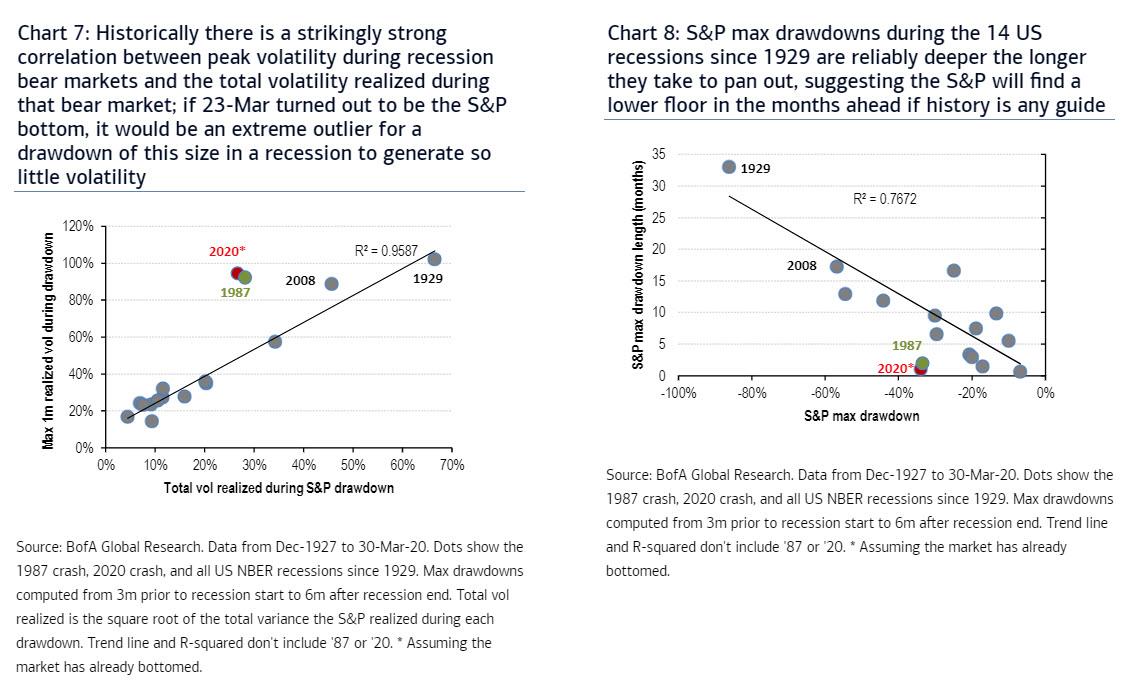

Furthermore, unlike a technical shock such as the ’87 crash which did not result in a recession, bear markets that coincide with recessions have very strong relationships between their depth and length, in part as economies carry significant momentum. Among the strongest relationships is between peak volatility and the total volatility generated during the bear market, as volatility decays at a very consistent rate during recessions.

As such, and given 1-month S&P vol recently peaked at 95%, implies we are only about 50% of the way through this bear market (in vol terms). Additionally, BofA’s finding that a recession bear-market of this size on average has lasted about 11 months strengthens the argument that we will likely retest the lows.

There is just one possible wait out: “Only if we were to escape recession (which no one expects) would the Mar-23 low be consistent with history.”

Alas, with GDP set to plunge as much as 50% in Q2 according to Evercore ISI’s Ed Hyman…

… and barely rebound in subsequent quarters (as a reminder a 50% drop has to be followed by a 100% surge to get back to even), the recession – if not depression – will be with us for a long time.

* * *

Below we excerpt the key section from BofA’s latest note, explaining why “this market is still not trading like a recession bear market”

Looking last week at S&P drawdowns during recessions, we concluded that the S&P will find a lower floor in the months ahead (i.e. it is highly unlikely 23-Mar was the low), if history is any guide. We reiterate here that the length and size of the max S&P drawdowns in the 14 US recessions since 1929 are highly correlated; i.e. during recessions specifically there is a strong positive relationship between the length of bear markets and the size of the drawdown. This is not necessarily the case in bear markets outside of recessions, which can be more technical.

The S&P has so far dropped -34% peak to trough this year in around one month, a sharp selloff more similar to the technical, non-recessionary ’87 crash than to a bear market coinciding with a recession. Hence, assuming a recession firmly built into consensus, this year’s drawdown would be an extreme outlier if the S&P ends up not falling to new lows (Chart 8).

An even stronger historical relationship uncovered by BofA is that between peak volatility (max 1m realized vol) and the total vol generated by recession bear markets, as shown in Chart 7. As shown in Chart 8, the current drawdown has so far been more similar to the 1987 crash, and it would be an extreme outlier for a drawdown of this size in a recession (particularly one as deep as it is forecasted to be) to generate so little volatility.

BofA’s conclusion, again, “we think it’s instead more likely that we haven’t seen the bottom in equities yet.”

Tyler Durden

Tue, 04/07/2020 – 14:20