WeWork Sues SoftBank For Pulling $3 Billion Payoff To Neumann & Other Insiders

As WeWork founder Adam Neumann tries to save his billionaire status, and several other shareholders, including Benchmark Capital, a PE firm that retains several seats on WeWork’s board, fight to avoid being stuck with worthless WeWork shares at the top of what’s looking to be a brutal recession – one which WeWork almost certainly won’t survive – WeWork is suing SoftBank, its biggest VC backer, for reneging on a $3 billion tender offer of WeWork shares.

The purchase was part of a deal that infused WeWork with billions of dollars in emergency capital to keep the lights on after the company’s IPO collapsed. It also resulted in Neumann walking away from the company with a $1 billion-plus payout. None of the money that SoftBank is seeking to pull would have been spent on running WeWork, anyway, CNBC said.

SoftBank’s decision, which we chronicled last week, was undertaken as Masayoshi Son struggles to appease activist investor Paul Singer’s Elliott Management. Elliott, which announced its position in SoftBank a few months back, is calling on the Japanese conglomerate to ramp up corporate buybacks to save its share price. Masa Son also clearly has something to prove, since he pledged even more of his personal wealth to the company’s lenders while bashing Moody’s for cutting the company deep into ‘junk’ territory.

In a statement, the WeWork board’s special committee called SoftBank’s decision to reneg on the money “wrongful” and alleged that SoftBank had breached its obligations under the master transaction agreement signed at the time the deal was struck.

The lawsuit is seeking a judge to either compel SoftBank to hand over the money, or at least pay a punitive breakup fee.

“SoftBank’s failure to consummate the tender offer is a clear breach of its contractual obligations under the MTA as well as a breach of SoftBank’s fiduciary obligations to WeWork’s minority stockholders, including hundreds of current and former employees,” the special committee said in the statement.

“The Special Committee is seeking specific performance requiring SoftBank to complete the tender offer or, in the alternative, compensatory damages for SoftBank’s breaches of contract and fiduciary duty.”

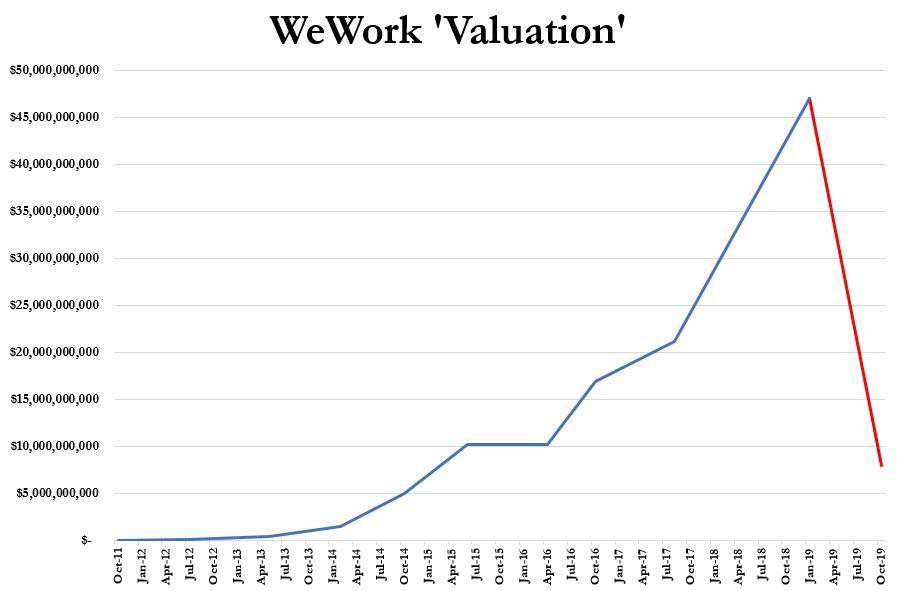

Casual observers could be forgiven for feeling like the lawsuit is a little ungrateful: After all, SoftBank did pump money into WeWork at a peak valuation of nearly $50 billion, a staggering number for a company that burned $900 million over the 9 months before releasing its IPO prospectus last year.

Of course, that valuation number plunged to a low of around $10 billion, according to media reports, as the company and its bankers tried to curry interest from wary investors.

As Reuters reported, the SoftBank money would mostly have benefited a small group of insiders, including Neumann.

SoftBank cited federal investigations currently ongoing into WeWork from the SEC and other agencies. According to the terms of the agreement, SoftBank has the right to pull the money if WeWork has unresolved legal issues.

Tyler Durden

Tue, 04/07/2020 – 12:50