Fed Minutes To Reveal The Sheer Chaos As Fed’s Entire Worldview Imploded

Starting a week of historic central bank interventions, at the 15th March weekend meeting, the Fed threw the proverbial kitchen sink at the market, taking aggressive measures (slashing rates by 100bps to 0.25%; committed to at least USD 700bln of QE; eased regulatory pressure on banks to free up capital, and announced dollar swap lines with other central banks), reaching decisions that may shape the global economy for decades to come in the space of a few frantic weeks. This was followed with a barrage of other measures which included the boosting of QE and MBS purchases on Mar 23, expanded repo for foreign central banks on Mar 31, and also announced six further facilities, including the commercial paper facility, de facto backstopping the entire market except equities and junk bonds.

The timing of the Fed’s announcement and the scope of the measures was a surprise: as NewsSquawk writes, it was the Fed’s “whatever it takes” commitment to ensure the smooth functioning of markets amid the virus fallout. Since then, it has flooded the market with liquidity, resulting in the premium for dollars easing.

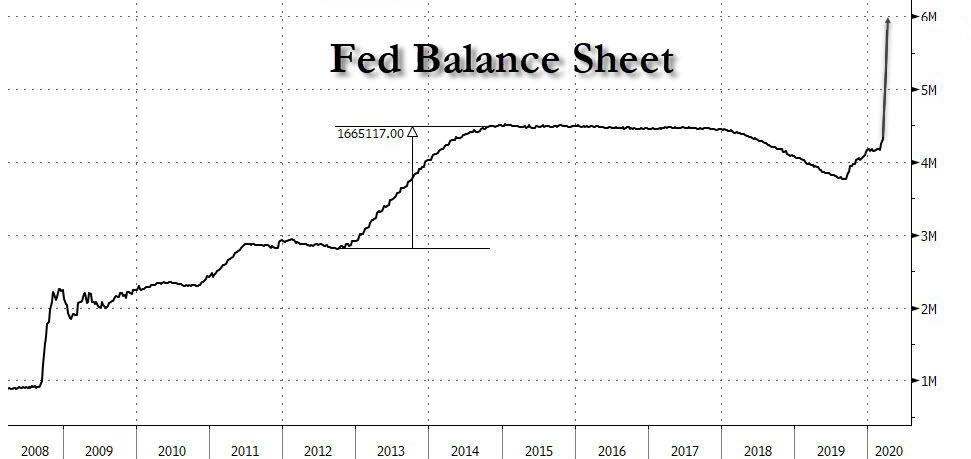

Since then, its balance sheet has ballooned to by USD 1.5trln to a new record high USD 5.86trln, and it has seen wide take-up of its liquidity facilities from banks and other central banks.

Fast forward to today, when at 2pm the first detailed accounts of that debate will be released when the central bank publishes minutes of the meetings.

The minutes will provide detail on the Fed decisions announced on March 3 and March 15 after Fed Chair Jerome Powell convened emergency meetings as the scale of the pandemic and its risk to the U.S. economy became clear. The readout may also include their discussions of a slate of related actions that flowed from those two meetings.

Amusingly, just five weeks before the surprise rate cut on March 3, Powell and his colleagues had wrapped up their first meeting of the year on Jan. 29 with an air of cautious optimism, and it even looked like 2020 could be a year of steady growth and continued strength in the job market, a fresh updraft after a rocky 2019 in which the Fed cut rates three times to blunt the effects of the Trump administration’s trade war with China.

Fast forward to today, when most Fed officials now agree the U.S. economy is in a recession that may cut U.S. output by double digits in the second quarter and throw 20 million people or more out of work, at least temporarily, due to measures taken to contain the spread of COVID-19, the illness caused by the coronavirus.

Wednesday’s minutes may show just how dire a threat officials saw in those earliest moments and what spurred them to action. The first move came on Feb. 28.

With the S&P 500 Index tumbling 15% from its record high in just seven sessions and corporate credit spreads widening fast, Powell released an unscheduled statement at 2:30 p.m. pledging that Fed officials would “use our tools and act as appropriate to support the economy.”

The following Tuesday – March 3 – the Fed cut its benchmark lending rate by half a percentage point to a range of 1.00% to 1.25%.

“The fundamentals of the U.S. economy remain strong,” the U.S. central bank said. “However, the coronavirus poses evolving risks to economic activity.”

One month later, the US economy was in a recession, or perhaps a depresion.

That said, today’s minutes are unlikely to contain anything to spook markets, given that it has rolled-out measures to assuage market concerns, and will likely reiterate its pledge to support the financial system. Of most interest will be whether there was any discussion in the minutes of if, when and under what, the Fed would start buying stocks.

Tyler Durden

Wed, 04/08/2020 – 12:25