US Treasury Cash Balance Hits Record $750 Billion After Historic Flood Of Bill Issuance

It may not quite be last week’s $563 billion T-bill deluge, but it will do.

After a tsunami of new T-Bill and Cash Management Bill issuance last week, which saw no less than $85 billion in new short-term debt issued every every day except Friday, sending the Treasury’s cash balance soaring to new all time highs, in the first three days of the current week the Treasury has been just as busy and has continued to flood the market with new short-term debt, in a dramatic reversal of the T-Bill shortage we reported two weeks ago.

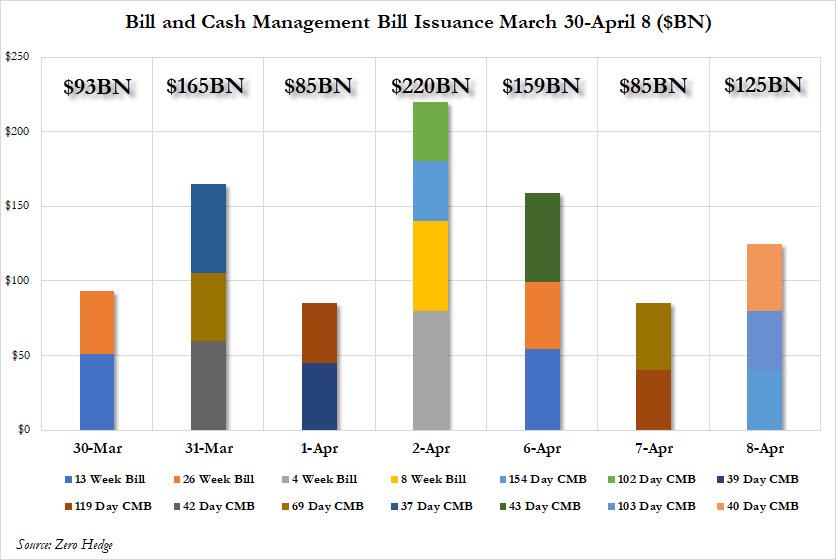

As shown in the chart below, after the $563BN in Bills and CMBs issued last week, this week the Treasury has continued its T-bill firehose and in just the past 3 days has issued, in addition to the regularly scheduled 3-Month and 6-Month Bills, also 154 Day, 119 Day, 69 Day, 43 Day, 103 Day and 40 Days Cash Management Bills, for a total of $369BN in just the first three days of the week as shown in the chart below:

And while a portion of this $369BN gross issuance went to offset current maturities, the net effect was massive nonetheless, and nowhere more so than the Treasury’s cash balance (i.e. the Federal Reserve Account).

As shown in the next chart, the result of the Bill issuance flood from the last two weeks is that the cash balance of the Treasury (i.e. the US government) just hit a record $750 billion, up $235 billion from last week, and the highest on record.

Why this flood of new issuance?

Because we are now three days since the crisis response officially began as hundreds of billions in small, medium and very large business bailout demands will soon hit the Treasury as up to $2 trillion in funds are handed out across the economy over the coming weeks.

As such, the three quarters of a trillion dollars held electronically at the US Treasury is just the beginning.

And here a quick aside: consider the path the money is taking before ending up in Joe Sixpack’s pocket: a desk worker at the Treasury punches a few buttons and sells electronic certificates which mature in a few weeks and are backstopped by the US government and which in turn fund the Treasury’s account with electronic dollars which were paid by some investor who similarly punched a few buttons on his computer and in hopes of parking his cash somewhere safe, handed over his electronic money to the Treasury desk worker. As a result of this transaction, hundreds of millions will receive a small amount of electronic ones and zeros in the next few days, which for countless people will mean the difference between disaster and survival.

Tyler Durden

Wed, 04/08/2020 – 21:40