In Late Thriller, OPEC Production Cut Deal Collapses After Mexico Gives Crown Prince The Finger

Earlier today we reported that following a dramatic objection to the OPEC+ production cut which was agreed upon by Russia and Saudi Arabia (but few other OPEC members), Mexico had initially threatened to quit OPEC as it refused to comply with the imposed 23% cut forced on all members, but less than an hour later the southern US neighbor reportedly had changed its mind as Reuters reported that Mexico had in fact agreed to the OPEC+ production cut deal after all.

Well, scratch all that because it appears the Reuters “news” was fake, sourced from some conflicted Saudi minister who wanted to put Mexico in a position where it had no choice but to accept the reality that had been imposed upon it. Unfortunately for the Saudis, this “plan” was laughable and late on Thursday, Mexico logged off the OPEC+ alliance’s videoconference emergency meeting after nine hours of talks Thursday, without agreeing to the landmark 10 million b/d production cut accord that members were hoping could stem a bruising rout in oil prices caused by the coronavirus pandemic and send the price of oil surging, S&P Global Platts reported, whose sources we can now confirm are far more credible than those of Reuters.

The rest of the coalition, led by Saudi Arabia and Russia, were in discussions over how to proceed, with many ministers angry over the potential blow-up of the deal. The coalition will likely try to convince Mexico again Friday at a G20 energy ministerial that was originally scheduled to seek the participation of the US, Canada, Brazil and other key producers outside of OPEC+ to join its efforts.

But while the participation of G-20 non-OPEC members in the production cut deal is optional, Mexico’s isn’t and in fact has veto power, with Bloomberg reporting that unless Mexico agrees to be bound by the deal (something about a cartel and what not), the rest of OPEC+ wont’ cut oil production, threatening to send the price of oil crashing on Friday if oil exporters fail to agree on removing 10MM b/d from the market, an outcome that would result in storage spaces running out as soon as May and sending landlocked oil prices negative.

So what does Mexico want?

Well, it wants to have its cake, and eat almost all of it too: Mexico proposed an oil production cut of just 100k b/d over the next 2 months to help stabilize oil prices, Energy Secretary Rocio Nahle Garcia said in a statement on Twitter.

México en el consenso para estabilizar el precio del petróleo en la reunión de la @OPECSecretariat ha propuesto una reducción de 100 mil barriles por día en los próximos 2 meses. De 1.781 mbd de producción que reportamos en marzo del 2020 disminuiremos a 1.681 mbd. @GobiernoMX

— Rocío Nahle (@rocionahle) April 10, 2020

This is a problem because it means that while all OPEC+ members are equal – all those who are cutting production by roughly 23% – some are more equal than others, namely Mexico, whose production would have dropped to 1.681m b/d from 1.781m b/d in March, while under the OPEC plan, Mexico was required to cut production by 400,000 barrels a day, from a starting point of 1,753 million barrels a day to 1,353m barrels a day.

And if Mexico is granted a loophole, then all other OPEC members – at least the non-Saudi ones – would demand similar treatment, forcing Saudi Arabia to should all of the production cuts, which would then nearly double from 4MMb/d to 8MMb/d. Needless to say that is a nonstarter, and explains why OPEC was quick to balk and warn that unless Mexico also agrees to cut by 23%, then the entire deal is off, and Brent, which was last trading at $32 would plunge 30%, maybe 40% overnight as the massive oversupply into a world which has 35MMb/d less oil demand, would continue indefinitely.

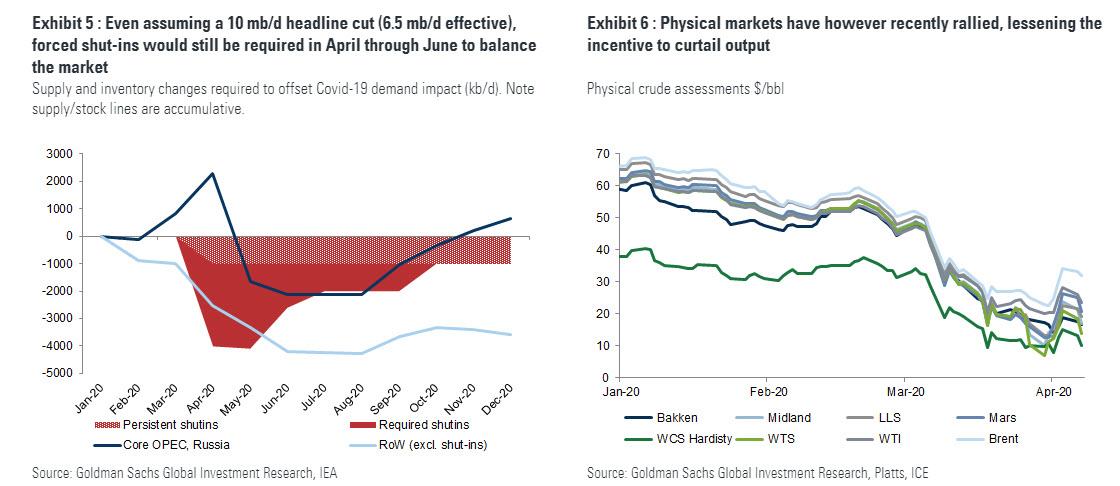

As we reported earlier, under the proposed deal, the 10 million b/d OPEC+ cuts would cover the months of May and June, and then be rolled back to 8 million b/d for the rest of 2020, and then down to 6 million b/d for all of 2021 through April 22.

Each member would lower its output 23% from its October 2018 levels, except for Saudi Arabia and Russia, who would make their cuts from a baseline of 11 million b/d. That means both countries would limit their production to 8.5 million b/d for the initial two months of the deal.

Saudi Arabia, the world’s largest crude exporter, said it had ramped up its crude output to a record 12 million b/d this month. Russia, meanwhile, pumped 10.5 million b/d of crude in March, according to S&P Global Platts Analytics.

But Mexico balked at its new quota of 1.353 million b/d, as the country plans to unveil a $13.5 billion energy investment package to help state oil company Pemex raise its production to 2 million b/d by the end of the year, according to Platts. In other words, the country’s entire budget depends on pumping as much oil as possible. Furthermore, with Mexico’s industrial production now imploding even as domestic coronavirus cases rise exponentially, the last thing AMLO will do is accept a world in which the country’s much needed dollar-denominated revenues are cut by almost a quarter.

In the end it was AMLO who killed the deal: Mexico initially agreed to the cut and the coalition was on the verge of finalizing the deal, before its delegation asked for time to consult with President Andres Manuel Lopez Obrador, sources said. Those consultations and continued haggling over its cut went on for almost four hours, but Mexico stayed firm.

As the impasse lingered, US President Donald Trump, who had convinced Saudi Arabia and Russia to set aside their oil price war and come to the negotiating table, made a phone call with Saudi King Salman and Russian President Vladimir Putin, according to Dan Scavino Jr., a White House aide.

After speaking with the leaders for 90 minutes, he told reporters that he believed the OPEC+ coalition was close to a deal but did not reveal any details.

“We had a really good talk, but we’ll see what happens,” Trump said. “As you know, OPEC met today and I would say they are getting close to a deal and we will soon find out.”

Little did he know that his southern neighbor president had different plans, and now the entire deal is on the verge of collapse.

Today’s OPEC webcast came after a week of furious petrodiplomacy and back channel pressure by Trump for a deal that could rescue ailing US shale producers, even as Trump is reluctant to commit US companies to participating in any OPEC+ pact, despite urging by Saudi Arabia and Russia, and antitrust laws make any collective action legally impossible.

Instead, US Energy Secretary Dan Brouillette is expected to tell the G20 ministerial meeting Friday that some 2 million b/d of US production is forecast to be shut in over the next year, according to a person briefed on his plans; this was a non-starter for Russia and the Saudis until yesterday, but then the two nations quietly conceded to the US position.

And then, Mexico’s unexpected objection could make it all moot.

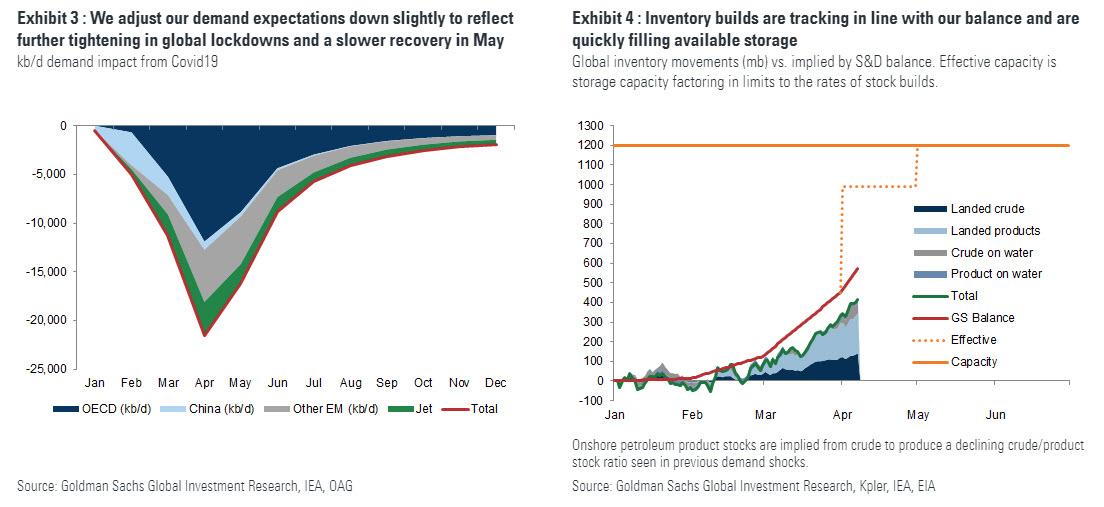

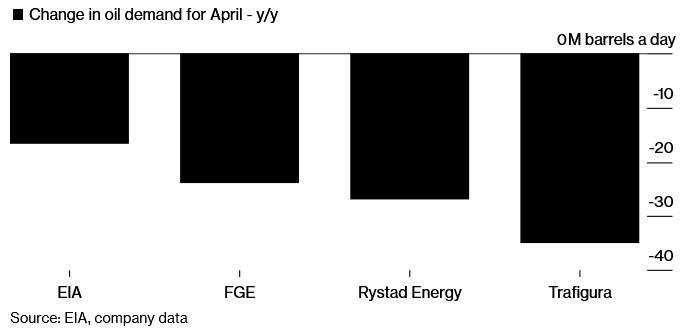

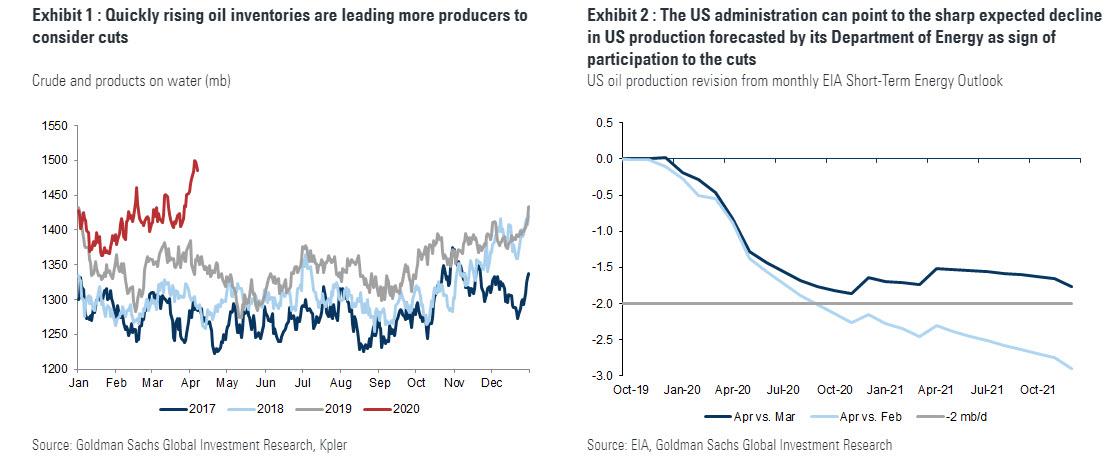

Meanwhile, the price of oil is one flashing red headline from cratering. The OPEC secretariat has forecast a 6.8 million b/d contraction in global oil demand for the whole of 2020, including close to 12 million b/d “and expanding” for the second quarter, Barkindo told the ministers who earlier toldthe group that the market outlook was “horrifying” and explained that at current rates of supply and demand, global crude oil storage capacity will fill up in the month of May, he said.

“These are staggering numbers,” he said, adding that the coronavirus outbreak had “upended market supply and demand fundamentals.”

Sources said Saudi Arabia had sought an even bigger OPEC+ cut of 15 million b/d but could not get Russia to agree. The two countries had feuded at the last OPEC+ meeting on March 6, when the impact of the coronavirus was already forcing analysts to downgrade their demand forecasts, with Russia balking at a Saudi-led proposal for cuts totaling 3.2 million b/d.

Back at the table again this time, they first agreed a deal between themselves, then spent most of Thursday’s meeting trying to convince smaller producers and tweaking the numbers.

Mexico was the last holdout, and with the deal requiring unanimous agreement, the relatively small oil producer suddenly had infinite leverage to demand its own deal. The problem is that unless AMLO concedes to the terms of the deal, it is about to get exponentially worse for Mexico and the rest of the cartel.

One last point: even a 10mmb/d production cut – the best the world can expect at this point – is nothing considering the 35mmb/d plunge in oil demand. According to Goldman, even with a 10mmb/d cut – the biggest in history – shut ins will still be required until June to balance the market. We doubt anyone will volunteer…

Which means it all depends on tomorrow’s Friday’s G20 meeting which will be chaired by Saudi energy minister Prince Abdulaziz bin Salman and is scheduled to begin at 1400 GMT: either Mexico agrees to the cut, or oil is about to crater (even more), while the Mexican peso will plunge to new all time lows. Finally, as Platts reports, with Mexico not the only country needing convincing, the G20 summit promises to be another test of geopolitical wills.

Tyler Durden

Thu, 04/09/2020 – 22:55