NYC Apartment Leases Plunge As Real Estate Industry Paralyzed

New York City apartment leases plunged last month as stay-at-home government-enforced public health orders paralyzed the real-estate industry, reported Bloomberg, citing appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate.

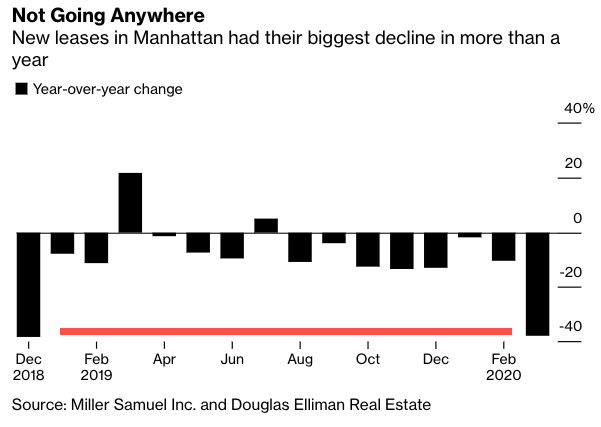

New lease agreements plunged 38% in March over the prior year, the second-biggest drop in 11 years. Similar numbers were seen in Brooklyn and Queens, down 46% and 34%, respectively.

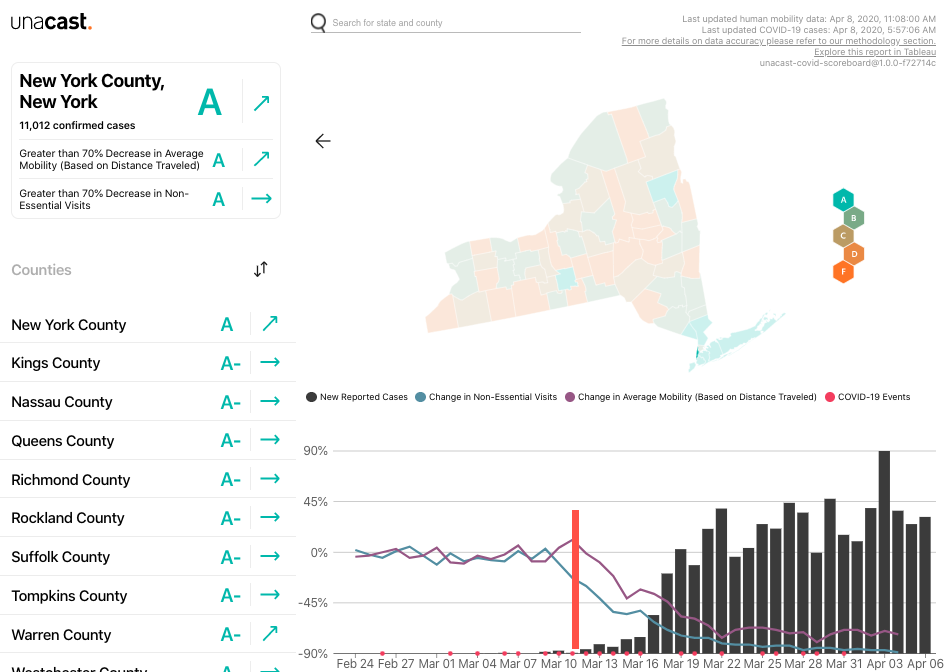

New York state and New York City governments issued strict stay-at-home public health orders in early March. The Social Distancing Scoreboard app shows average travel in New York County, New York, started to decline around March 10 and has been downward sloping since COVID-19 cases and deaths surged. Suggesting people in Manhattan are staying put.

Jonathan Miller, president of Miller Samuel, said, “Tenants can’t really look at new apartments other than virtually. And then they’d have to move, and moving has become one of the biggest problems because many buildings are restricting or prohibiting moving trucks.”

It was only until April 2 that New York state reclassified the real-estate industry as an essential business. However, there is a caveat, apartment showings can resume, but they must be virtual.

“Brokers can only transact business in their offices or show properties virtually, and anything else is off-limits,” said a spokesman with Empire State Development, the state’s economic development arm.

Rents for small to medium-sized apartments in Manhattan and Brooklyn were still at record highs during the month. The monthly median rent for a studio in Manhattan soared 9.3% to $2,843, while one-bedrooms rose 4.4% to $3,650.

And with jobless rates in the city could approach historic highs as tens of thousands have been laid off in the last three weeks – downward pressure on rents could be ahead. The city’s real estate industry has likely topped, now the next phase could be down:

“Originally, economists were talking about a ‘v-shaped’ recovery, fast down fast up,” said Greg David, a reporter for real estate magazine Crain’s New York Business. “But more and more of them are talking about a ‘L-shaped’ recovery, which would be like the Great Recession. Down, and then a very slow climb up.”

Tyler Durden

Thu, 04/09/2020 – 12:35