Cryptos Are Getting Clubbed But ‘Whale’ Numbers Soar Mirroring 2016 ‘Halving’

Amid some positive headlines from New York on the virus, and the potential for a deal between the G-20 and OPEC, it appears the risk-off sentiment of a long weekend is being taken out on cryptos for now (as almost the only asset trading in the world currently).

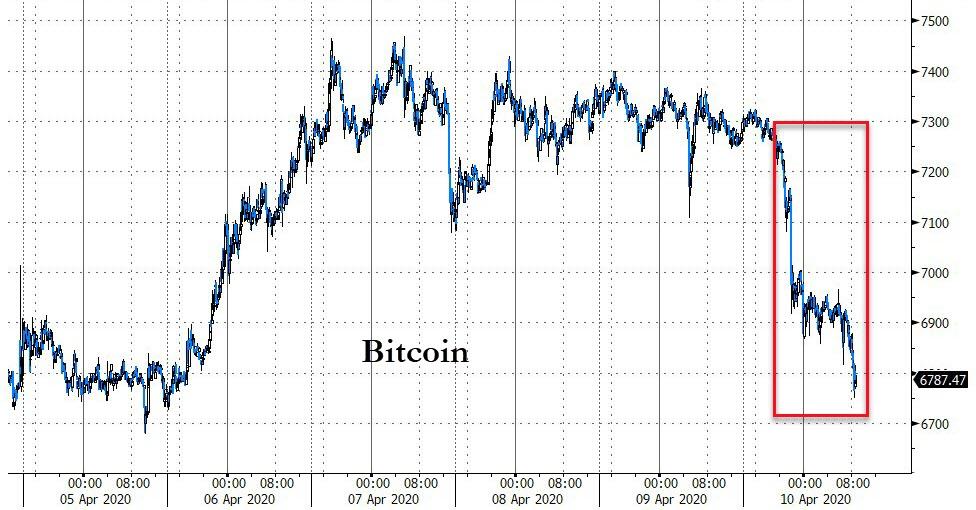

Bitcoin has been clubbed back below $7,000…

Source: Bloomberg

And the rest of the major altcoins have given up most of the week’s gains (Ethereum is still up around 10% on the week)…

Source: Bloomberg

But despite this puke, CoinTelegraph.com’s William Suberg reports that

There are more Bitcoin whales now than at any point in the past two years — and that mimics a trend from its 2016 halving, data shows.

In its latest Week On-Chain report on April 9, monitoring resource Glassnode revealed that current numbers of major Bitcoin investors are extremely similar to early 2016.

image courtesy of CoinTelegraph

Glassnode: whales see “room for growth”

Specifically, 30 days before Bitcoin’s 2020 halving, the number of entities holding at least 1,000 BTC ($6.92 million) is now just under 1,850. At the start of Q2 2016, several months before the previous halving, the number of such entities was almost exactly the same.

The almost uncanny resemblance between these two identical points in two Bitcoin halving cycles suggests that whales know the market well.

Glassnode summarized:

“This trend implies that despite an uncertain market environment, whales remain confident that now is a good time to be accumulating BTC, suggesting that they believe there is further room for growth.”

Bitcoin entities with 1,000 BTC or more. Source: Glassnode

Spotlight on accumulation, large and small

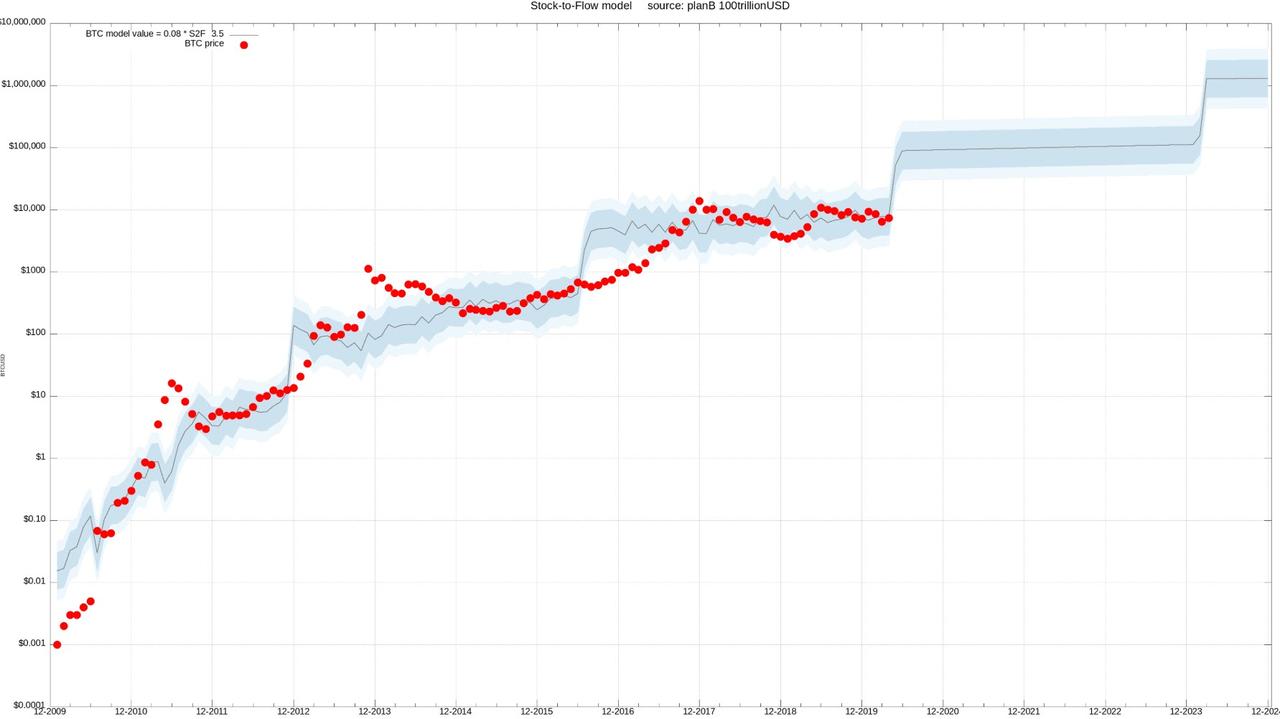

Comments from known whales appear to confirm the belief in future upside. Earlier this week, Bitfinex-based J0e007 delivered criticism of one Bitcoin price model which, he argued, was too optimistic about the speed at which the cryptocurrency would hit $100,000 or more.

At press time, BTC traded at around $6,900 – $300 lower year to date, having failed to hold support closer to $7,500 in line with expectations.

Meanwhile, it is not just whales who are accumulating. Last month, Glassnode noted that wallets containing a balance of at least 1 BTC were seeing new highs.

At the time, Cointelegraph cited in-house analyst Keith Wareing, who further believes that major miners will use lower prices to consolidate their positions and accumulate more BTC prior to the halving, scheduled for mid-May.

Additionally, Suberg reports that PlanB, the pseudonymous analyst behind the infamous stock-to-flow model, sees “nothing unusual” in the recent trading patterns:

“CME launched BTC futures Dec 2017. Many point to Dec 2017 ATH as proof futures have suppressed prices. But BTC prices stayed perfectly within S2F bands. I would have expected this to happen with or without futures. Nothing unusual.”

And adds that the current price mirrors the pre-$20K highs.

Stock-to-flow charts Bitcoin’s past and future price based on the interaction between “new” Bitcoins released to miners and the existing Bitcoins in circulation. The model has proven to be extremely efficient, despite facing continued criticism from industry figures.

Bitcoin stock-to-flow price chart as of April 7. Source: PlanB/ Twitter

Last week, the Twitter user known as J0e007, a large volume trader on exchange Bitfinex, described those who champion stock-to-flow as “thousands of muppets.”

Continuing, PlanB suggested that even Bitcoin’s run to current all-time highs of $20,000 and the subsequent bear market was not made worse by futures.

“Oct 2017 was at current $7k level. The introduction of futures sparked hope of massive institutional inflow (“the herd is coming”), and BTC jumped almost 3x to $20k in Dec 2017,” part of another post reads.

“The herd never came and prices bounced back to $7k and have been oscillating there 2.5 yrs.”

Tyler Durden

Fri, 04/10/2020 – 15:25