Here Is The “Secret Weapon” That Allowed Tiny Oil Producer Mexico To Defy Giant Saudi Arabia

It wasn’t meant to be like this.

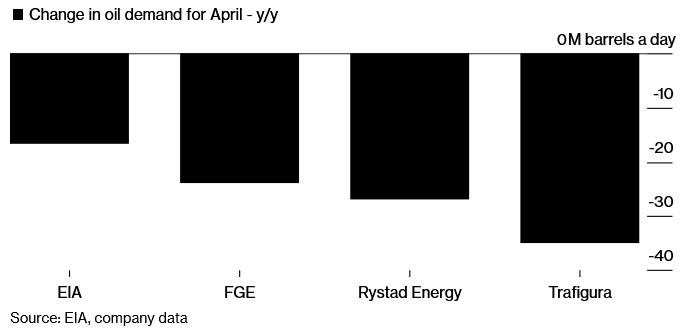

After the Saudis and Russia cobbled a historic OPEC+ oil production cut which at 10 million b/d was the biggest ever, and one which received the blessing – if not the participation – of Donald Trump, the rest of OPEC+ was supposed to applaud the two oil exporting giants who agreed to cut 23% of their, and everyone else’s output, and fall in line agreeing to the terms that were imposed upon them in hopes of sending the price of oil slightly higher, because as a reminder even the agreed upon 10 million cut would do nothing to balance an oil market crushed by what Trafigura calculates was a record 36 million b/d drop in oil demand.

However, that did not happen because one country dared to stand up to not just Saudi Arabia, but also Russia and the rest of the OPEC cartel, and even forced Trump to bend to its will with the US president – desperate to get the price of WTI higher in hopes of avoiding mass defaults for the US shale industry – saying he would be responsible for Mexico’s production cut balance.

That country is the southern US neighbor, Mexico, which pumps a relatively tiny 1.5 million b/d and which would have been forced to cap its output some 400,000 barrels lower to comply with the deal, however the most Mexico would agree to was a a minuscule 100kb/d cut – a number that is completely meaningless in the grand scheme of the oil market – yet one which openly defies Saudi Arabia which staked its reputation as OPEC’s most powerful nation by guaranteeing that every OPEC member would agree to the 23% production cut.

What followed has been the most surreal “Mexican standoff”, one which started during the OPEC teleconference on Thursday, continued on Friday when the G-20 was supposed to also join the production cut yet failed to do so over the confusion over Mexico’s ongoing intransigence, and has not yet been resolved as of late on Saturday, with Mexico’s Energy Minister Rocio Nahle refusing to budge from her insistence that the country could only cut output by 100,000 barrels a day, 300,000 less than its fair share of 23% reductions by everyone in the OPEC+ group. On Friday morning, Mexican President Andres Manuel Lopez Obrador said he had resolved the matter in a phone call with Trump. The U.S. would make an additional 250,000 barrels a day of cuts on Mexico’s behalf. But such a theatrical sleight of hand was not enough for the Saudis who would appear weak, and unable to reign in the cartel’s members, would risk cheating and excess production by virtually every smaller OPEC member who would feel, rightfully so, that it is unfair for Mexico to get preferential treatment.

As a result, two days after oil surged on hopes of (at least) a 10mmb/d cut, the deal that was supposedly finalized on Thursday has yet to emerge, with the that come Sunday evening when trading reopens, Brent could plunge as the production cut ends in disarray.

But why is Mexico risking the collapse of OPEC, and another sharp plunge in oil prices, by refusing to comply with the deal – after all if Mexico cuts just another 250K barrels in output from its adjusted total it will unlock if not higher prices, then at least avoid an even sharper plunge in the price of oil. Sure, it may not balance the market, and $50 Brent won’t come back for a long time, but avoiding another dramatic plunge in oil would be worth the cut, right?

Well, no because while that would be the reasonable economic equation for all other OPEC members, Mexico has always had what Bloomberg dubbed a “sector weapon” up its sleeve, one which incentivizes Mexico’s president to either get his way, or watch as oil craters… and get paid billions.

We are talking of course about Mexico’s famous annual oil hedge, which in recent years has manifested itself mostly in the form of billions of dollars spent on oil puts, which we profiled extensively back in 2016 and 2017.

As Bloomberg’s Javier Blas, who has closely followed Mexico’s oil hedgers in the recent past writes, for the last two decades, Mexico has bought “Asian” style put options from some of the most prominent US investment banks and oil companies, in what’s considered Wall Street’s largest – and most closely guarded – annual oil deal. The options give Mexico the right to sell its oil at a predetermined price. They are the equivalent of an insurance policy: the country banks all gains from higher prices but enjoys the security of a minimum floor. So – unlike all of its OPEC peers – if oil prices remain weak or plunge even further, Mexico will still book higher prices.

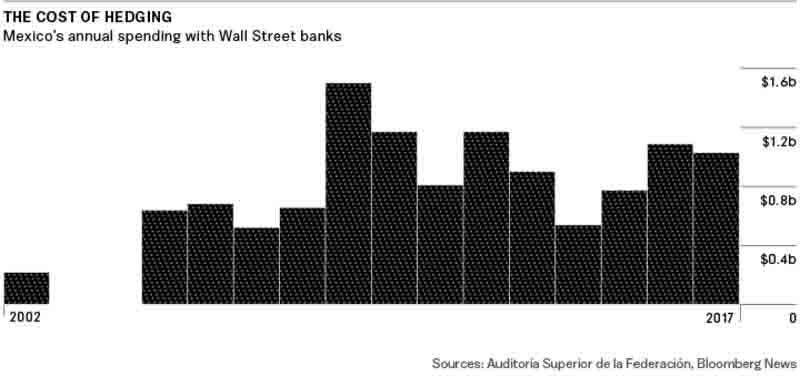

In 2016, Mexico spent $1.03 billion to protect itself from a downturn in prices, according to data released in the quarterly budget balance. In recent years, Mexico has spent an average $1 billion buying the hedges. The hedge first appeared in 2001, when Mexico made a tentative showing, spending just $217.3 million on put options, a fraction of the approximately $1 billion a year it would spend later. In 2003 and 2004, with oil prices rising, the country opted not to hedge at all. The strategy came into its own in 2005: Mexico has hedged every year since without interruption, giving it a unique peace of mind that should a worst case scenario happen, it would be able to sleep soundly a t night. Agustín Carstens, who later became head of the central bank, was finance minister when a massive $5.1 billion payout came in 2009; some government officials also refer to the annual oil bet as “the Agustínian hedge”; then in 2015, after the OPEC Thanksgiving massacre of 2015, the hedge made $6.4 billion and another $2.7 billion in 2016 after Saudi Arabia waged another failed price war aimed to crushing US shale producers.

Mexico’s annual spending on its hedge with Wall Street banks is shown in the chart below.

Unfortunately for the rest of the world’s oil producers, only Mexico had the foresight to hedge an outcome such as the one we are seeing now, and that is giving Mexico unprecedented leverage to demand… pretty much anything, even preferential treatment from its OPEC peers.

To be sure, the hedge isn’t the only reason Mexico is holding out, but it strengthens the country’s hand and makes it less desperate for a deal than countries whose budgets have been ravaged by the collapse in oil prices since the start of the year. As we reported on Thursday, the biggest reason driving leftwing populist President Andres Manuel Lopez Obrador to resist the deal, was his pledge to revive oil production via state-owned Pemex. Slashing 400,000 barrels a day to comply with the OPEC+ deal, rather than the 100,000 barrels a day that Mexico has counter-offered to Saudi Arabia, would put on hold his ambitious plan to return Pemex to its former glory.

But a token 100,000 cut – one which flaunts the Saudi demands for equal sacrifice by all the cartel members – is unacceptable to Crown Price MbS, hence the Mexican standoff continues.

“The insurance policy isn’t cheap,” Mexican Finance Minister Arturo Herrera told broadcaster Televisa on March 10. “But it’s insurance for times like now. Our fiscal budget isn’t going to be hit.” Pemex, the state-owned company, has its own separate, smaller oil hedge.

As Bloomberg reports, Mexico has disclosed very few details about its insurance for 2020 after it declared the sovereign hedge a state secret. However, based on limited public information, alongside historical data about previous years, it’s possible to make a rough estimate of the potential payout if prices remain low. The government told lawmakers it has guaranteed revenues to support the assumptions for oil prices made in the country’s budget – of $49 a barrel for the Mexican oil export basket, equivalent to about $60-$65 a barrel for Brent crude.

Mexico locks in that revenue via two elements: the hedge, and the country’s oil stabilization fund. The fund historically has only provided $2-$5 a barrel, so one can assume that Mexico hedged at $45 a barrel at least for its crude. In the past, Mexico has hedged around 250 million barrels, equal to nearly all its net oil exports in an operation that runs from Dec. 1 to Nov. 30.

Putting these calculations together suggests that if the Mexican oil export basket were to remain at current levels, the country would receive a multi-billion dollar payout. Since December, the Mexican oil basket has averaged $42 a barrel.

In other words, if current low prices for Mexican oil continue until the end of November, the average would drop to just above $20 a barrel, and the hedge would pay out close to $6 billion, according to Bloomberg News calculations.

In short, Mexico may be far more incentivized to see oil prices stay low, or drop lower, than rebound modestly while also losing out on an additional 250kb/d in potential output.

It is this math that is threatening to collapse not only the production cut deal, but OPEC itself because if the Saudis are seen as too weak to get even tiny oil exporters Mexico to heel – and absent MbS paying AMLO billions they won’t be able to – then all bets are off as Riyadh loses what little respect it had before the deal. and the “cartel” becomes an every oil producer for himself free for all.

Tyler Durden

Sat, 04/11/2020 – 22:03