By Daisy Luther

By Daisy Luther

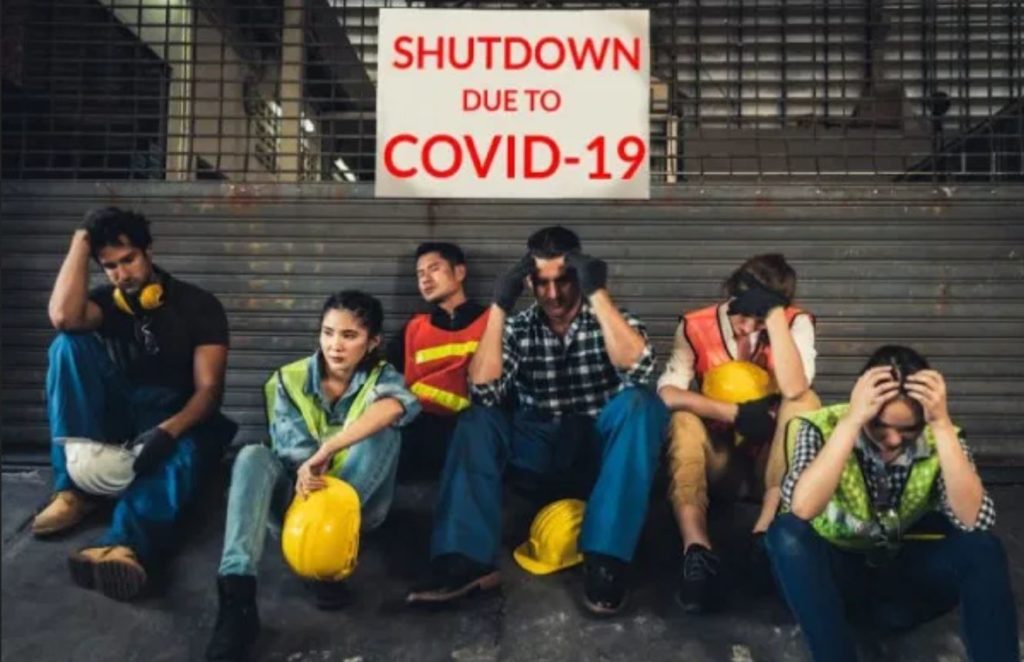

Unless you live in a neighborhood of rainbows and unicorns, it’s a good bet that either your family or someone you know has lost their job due to COVID-19. Over the past three weeks, more than 16 million people have filed for unemployment as their workplaces shut down or decreased the number of employees.

While this happened through no fault of your own, playing the victim and feeling sorry for yourself won’t help your family. You need to take action to keep your head above water financially.

This article is not about how to prep for a personal financial collapse. Hopefully, you’ve already begun creating a food stockpile, socking away an emergency fund

, and working towards self-reliance

. This is about the steps you should take if you’ve lost your job due to COVID-19.

Here are the steps you should take to minimize the damage to your personal finances if you have lost your job due to the COVID-19 shutdowns.

1) Begin a total spending freeze for a couple of days.

The first thing you need to do is put that debit card back in your wallet and stop spending money.

One of the biggest mistakes people make when faced with a shocking job loss is to go on spending as though they still have an income. Perhaps they go and buy something to try and make themselves feel better. Maybe they just continue spending like they always did (in a coronavirus-modified way), with hundreds of dollars going out for cable television and online shopping sprees.

Just stop.

You need a few days to re-assess your budget and see where you’re at. You don’t want to regret the expenditures you make right after a job loss. Put yourself on a complete spending freeze for the next few days while you assess the change in your financial situation.

2) Apply for unemployment benefits.

Unemployment is not welfare. It is something that you have been paying into the entire time you were employed. Please don’t feel guilty about taking the money that is rightfully yours.

Keep in mind that it can take up to two months for your benefits to start, and that money from your severance package can delay the onset of benefits. Unemployment is only a portion of what you made when you were employed, so a revamp of the budget is a must.

Make your application immediately so that you know where you stand and when you can expect the money to start coming in. Getting online to apply may be tricky since there are millions of people in the same shoes.

You may be turned down initially by your state’s unemployment office. This doesn’t mean you won’t be able to apply again when the CARES Act finally gets it together. The requirements to qualify for CARES Act unemployment benefits are different, so don’t despair if your first application is denied. The best place to get reliable information about this is from this Facebook group and this website.

As always, never pin all your hopes on the government bailing you out. There are always loopholes when something is offered, so don’t let unemployment be your only plan for surviving financially.

3) Create a budget for necessities.

It’s absolutely vital that you drop your expenditures to the bare minimum until you are able to get another stream of income. You need to take a look at where your money goes and base your new budget on the necessities. Although having a vehicle in each stall of the garage and an iPhone in the hand of every family member may be nice, these are not necessary to sustaining life.

- Water

- Food (and the ability to cook it)

- Medicine and medical supplies

- Basic hygiene supplies

- Shelter (including sanitation, lights, heat)

- Simple tools

- Self-reliance tools and supplies like seeds, gardening tools, livestock, sewing supplies, and building supplies

- Defense items

Absolutely everything above those basic necessities is a luxury.

So, by this definition, what luxuries do you have?

4) Slash luxury spending.

Reduce your monthly payments by cutting frivolous expenses. Look at every single monthly payment that comes out of your bank account and slash relentlessly. Consider cutting the following:

- Cable

- Cell phones

- Home phones

- Gym memberships

- Restaurant meals

- Unnecessary driving

A lot of companies right now have relaxed their cancellation requirements, so you may be able to get out of contracts if you use the magic word “coronavirus” in your conversation with them about why you can no longer afford their services. As well, many businesses are shut down by the order of your state governments. Make sure you aren’t being charged for gym memberships you’re unable to use, for example.

See: 177 Different Ways to Generate Extra Income

Also, when your stimulus check arrives, don’t go spending it on luxury items or “treats” to make yourself feel better. You’re likely to need every dime of that for survival. Either save it, use it for an essential expense like housing or utilities, invest it in self-reliance projects like a garden, or stock up on food.

5.) Start looking for new streams of income.

Finding a new job right now may not be easy. If you have a family member with a compromised immune system it may be downright dangerous to take a job in which you mingle with customers. The jobs available are mostly in essential retail.

You may need to look at creating your own streams of income, like:

- Create an online business

(Free at the time this article was published)

- Using your expertise from your former job to work as a consultant

- Doing various small jobs

- Use creative skills to make things to sell

- Provide a service

. Maybe you can cook, sew, repair things, or build things. Lots of people can’t and will be willing to pay someone who can

If you do decide to start a business, now is not the time for a huge outlay of money. Consider a business that doesn’t require a lot of inventory to get things started. During the 2008 crash, I was laid off from my job for 3 months. I did home daycare during that time and it kept us afloat. Essential workers are struggling to find childcare right now, so this could be another option for you.

When I coach people who want to start a blog, the first thing we talk about when it gets to monetization is that you must have multiple streams of income. Really, it is the same for everyone. If you lose one stream of income, it’s best to have other streams to fall back on. This holds true in every business. Diversifying your income is one of the best financial preps you can make.

Related: If You Don’t Have a Job, Make One Up

6) Sell stuff.

All that stuff you’ve been meaning to go through in the basement just might be the key to keeping a roof over your head. It’s time to start an eBay account or list things on sites like Craigslist

or your local Facebook Marketplace. Any of these are options to start selling things that have just been sitting there for a while.

Your trash might be another person’s treasure. Instead of regifting those things in your attic, sell them so they can become someone else’s clutter. You’d be surprised how much money you can make while decluttering your home.

7) Work on becoming more self-reliant.

Some real talk here, and it isn’t pleasant. Things are never going to be the same as they were before this all began. Hopefully, your job is one that will be there waiting for you when the country re-opens. But many businesses are truly struggling to keep their workplaces alive.

Some jobs may no longer exist when workplaces open again. Yours could be one of them. It could be difficult to find work in the future when all the people who lost their jobs due to COVID-19 are also out there looking for a new place of employment.

So, work on becoming more self-reliant by practicing skills like gardening, repairing things, building things, food preservation, raising livestock (rabbits and chickens can be grown in many cities across the US), and cooking from scratch. Paying for the convenience of having somebody else do these things for you is unlikely to be an option.

8) Look for the silver lining.

Although job loss can be terrifying, it can also be the start of something wonderful.

When I lost my job in the automotive industry, I was devastated. As a single mom, how was I going to continue taking care of my two girls with no income? Instead of being a bad thing, it turned out to be the best thing that ever happened to me and many other people say the same thing.

I was able to take the writing I’d been dabbling in for years from a hobby to a full-time job. I made a conscious decision NOT to search for another job, but to follow my dream of being a writer and editor. Maybe I succeeded because it was do-or-die time. There was no option but to make it work. I began writing for other websites, started my own site, and began outlining books.

As it turned out, that shocking, unceremonious discussion in the manager’s office was the moment my life changed for the better. I’ve read many success stories that began the same way. If you can adjust your budget and use the time you have while collecting unemployment during the lockdown, you may be able to find a way to become self-employed. Think about what the future holds – we’re looking at economic devastation that could last for a very long time. What necessary and essential service or product can you provide?

Sometimes what seems like an ending can actually be a new beginning.

Related: How to Survive When You Can’t Pay Your Bills

What has been your experience?

You are not alone in all this. So many people are going through the same thing right now. Sixteen million of them and counting. I know it’s devastating and frightening to worry you may not be able to care for your family. But hang in there and follow the advice of people who have been there.

Have you ever lost your job? How long did it take to find a new one? Did it turn out to be a positive thing, or did it cause financial problems from which you could not easily recover?

Share your experiences and advice in the comments below.

Source: The Organic Prepper

Daisy Luther writes about current events, preparedness, frugality, voluntaryism, and the pursuit of liberty on her website, The Organic Prepper. She is widely republished across alternative media and she curates all the most important news links on her aggregate site, PreppersDailyNews.com. Daisy is the best-selling author of 4 books and runs a small digital publishing company. You can find her on Facebook, Pinterest, and Twitter.

Subscribe to Activist Post for truth, peace, and freedom news. Become an Activist Post Patron for as little as $1 per month at Patreon. Follow us on SoMee, Flote, Minds, Twitter, and Steemit.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.