“Don’t Fight The Fed”: Wall Street’s Former Biggest Bear Goes All In, Raises S&P Price Target To 3,000

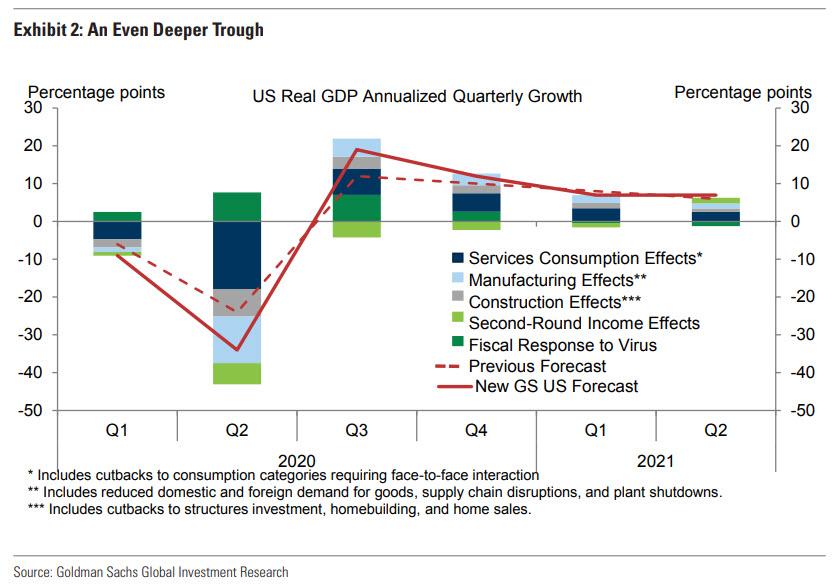

For much of 2019, Morgan Stanley’s chief equity strategist Michael Wilson issued a weekly sermon of fire and brimstone in his Monday Morning market takes, which contrasted with the euphoric pronouncements by his peers at other banks – most notably Goldman, which in December hilarious declared that the US economy is “structurally less recession-prone today” (which also meant especially depression-prone), which probably explains why three months later the same bank cut its Q2 GDP estimate to -34%…

… earning him the moniker of Wall Street’s biggest bear (a few permabearish exceptions such as Albert Edwards were excluded from the tally), not to mention quite a few angry clients.

Then, in November, just as the melt up phase of the post “Not QE” market was kicking in sending stocks to all time highs every single day, Wilson got the proverbial tap on the shoulder, and threw in the towel raising his S&P “bull case” price target to 3,250, however not without a slew of warnings that the most likely outcome was another retest in stocks lower.

In retrospect, Wilson should have held fast to his bearish conviction as the unprecedented March market crisis confirmed he was spot on (even if for different reasons).

And yet, demonstrating just how fickle Wall Street fates can be, just as Goldman turned beyond bearish (before again flipping today and chasing the market, now expecting a rebound in stocks removing its downside case of S&P 2,000 and expecting the index to rise to 3,000 by year end) Wall Street’s “biggest bear”, Michael Wilson turned bullish when two weeks ago when, paraphrasing Michael Hartnett who famously says that “markets stop to panic when officials start to panic”, he said that “crises lead to bailouts and this time it’s extreme given health angle. As a result, the inevitable credit crunch could be truncated this time, leaving us buyers of dips.”

Given that most stocks have been in a bear market for two years or longer, we recommend investors start buying stocks now because we cannot be sure if the next pull back will lead to lowers lows or not given we already experienced forced liquidation. Bottom line, we believe 2400-2600 on the S&P 500 will prove to be very good entry points for those with a time horizon of 6-12 months. – Michael Wilson, March 30

Fast forward to today when, as noted earlier Goldman also capitulated on its brief infatuation with bearishness and turned bullish expecting the S&P to ramp right back to 3,000, Wilson doubled down and urging his clients “not to fight the Fed” on Monday morning raised his S&P500 base case to 3,000 from 2.750, to wit:

Don’t Fight the Fed. The Fed surprised again last week, this time offering up to $2.3T in loan support while moving further down the quality curve with their secondary market purchases pushing into high yield. This move is in-line with our prior view that investors should have no doubt about the Fed’s resolve to do whatever it takes to make sure this recession does not turn into a depression.

Wilson then notes that while “most investors have been expecting more out of the Fed, based on our conversations with many clients on Thursday and over the long weekend, this salvo from the Fed far surpassed expectations in terms of size and scope.”

Amusingly, Wilson almost goes so far as to agree with Deutsche Bank that free markets no longer exist when he notes that “in fact, [the Fed] now appears to be trying to limit the healthy damage we typically get from a garden variety recession. As noted in our prior research, we think the nature of this recession–the unprecedented suddenness and trajectory of the contraction centered on a health crisis–has provided absolute cover for policy makers to go well beyond traditional support.”

As a result, Wilson – agreeing with Goldman and virtually everyone else that the Fed will not allow another drop in stocks – is raising his year-end S&P Bear/Base/Bull Targets to 2500/3000/3250:

Our target increases are purely a reflection of higher multiples resulting from a faster and fuller normalization of the equity risk premium. If there is one lesson we have learned during the financial repression era it’s that when risk premium appears, you better take it before it quickly disappears.

Ironically even as he hikes his S&P price targets, Wilson lowers his 2020 EPS forecasts while our 2021 forecasts, and concludes that while a “pullback is likely after last week’s run but we think it will be shallower (i.e. 2550- 2650) than the consensus.” Finally, echoing what he said on March 31, the MS strategist repeats that “pullbacks should be bought (aka “Buy the Dips”).” Some more details:

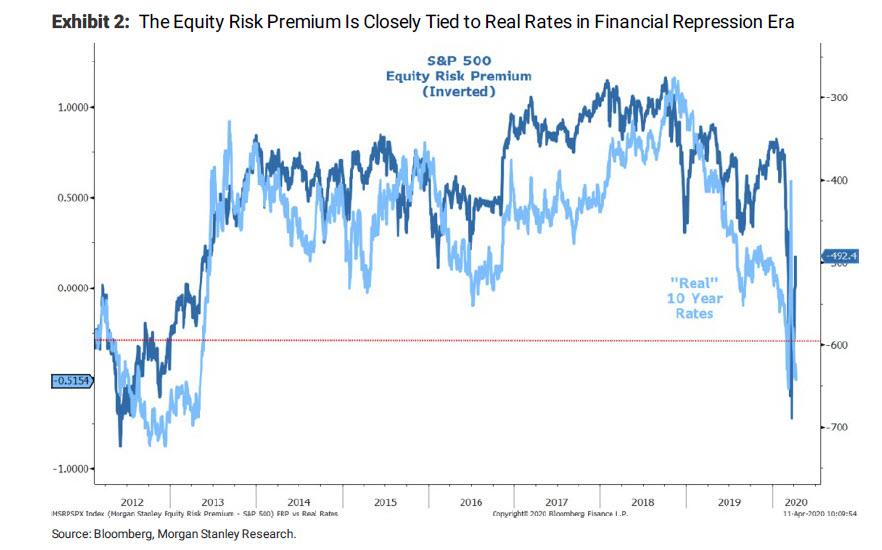

The price target increases are purely a reflection of higher multiples that result from a faster normalization of the equity risk premium (ERP) much like we are seeing with credit spreads [ZH: where the Fed is now active in the market by openly purchasing bonds]. We see no reason investors won’t begin to discount the Fed’s direct intervention into equity markets if necessary, which by definition reduces the tail risk and therefore the risk premium. At Friday’s closing price of 2790, the S&P 500 is now sporting an ERP of just 492bps which is well below the peak of 700bps at the March lows. However, bear in mind that the average ERP is closer to 350bps in the post GFC, financial repression era–an era we are clearly still in. Some may argue it’s too early to see a compression of the ERP back to normal while we are still in this crisis, and we would agree. However, by year end that will not be the case and that is what our price targets reflect…year end, not today.”

Finally, Wilson thinks it’s “instructive” to look at the GFC as a equally uncertain time for financial markets and highlights that following the ERP of 700bps at the March 2009 market lows, “it only took 3 months for it to fall back into a range of 300-400bps in which it remained for the next year. If there is one lesson we have learned during the financial repression era it’s that when risk premium appears, you better take it before it quickly evaporates. We don’t see why this time it’s any different given policy makers have once again illustrated what they are capable of doing.”

There is another reason why Wilson is doubling down on bullish: the coming runaway inflation, as he first hinted two weeks ago:

Another counter argument to this view is one we were making before the market dropped so sharply–that the ERP should be higher when real 10-year yields are in negative territory, like today. As discussed last week, we believe inflationary pressures may be building more than appreciated given the massive targeted fiscal stimulus, in conjunction with other ongoing trends in populism, nationalism, de-globalization and a worldwide pushback to the US dollar as the only reserve currency. As these inflationary pressures become more apparent, we suspect nominal and real interest rates can rise more than the consensus believes as market participants begin to demand a greater term premium. A materially weaker US dollar would accentuate such a new trend. As is usual with new trends that go against the consensus, they tend to be slow at first and then accelerate quickly, which is why it’s imperative to be thinking about them before they happen.

The bottom line, Wilson writes “is that stocks are beneficiaries of rising inflation. The recent rise in breakevens has been much greater than the recent rise in nominal yields, leaving real rates in negative territory. The rapid fall in ERPs over the past few weeks suggests the equity market may be moving ahead of the rates market in anticipation of the changing regime described above. If the Fed wants higher equity prices as a means of loosening financial conditions, we believe it could stop buying long dated Treasuries and let the back end move up with breakevens until real rates move into positive territory. 50-75bps real 10 year rates seems to be the sweet spot for equity valuations.”

Based on all of the above, the Morgan Stanley strategist is raising his base and bull price targets for the S&P 500 by 250 points to 3000, and 3250, respectively. His bear case rises by only 100 points to 2500 given the severity of the negative tail outcome. With respect to his earnings forecast, the 2020 bull and base case revert to our prior base and bear cases while our bear case moves to the GFC outcome we analyzed in our last 2 weekly warm-ups.

In short, Morgan Stanley is raising its price targets even as it is lowering its EPS forecasts today for 2020 to reflect a worse near term outlook. But ignore those, Wilson says, and just focus on next year (why? Because magical rebound).

For 2021, the snap back is related to the severity of the decline in the 2020–the worse the decline the bigger the bounce: The net effect of this is that our EPS forecasts don’t change much for 2021 which is the year that really matters for stocks. As we have said many times, the market now views 2020 as a write off and is trying to figure out the path of earnings in 2021.

And just in case it was not clear that Wilson is seriously doubling down on bullish, he concludes that given his more positive predisposition, “we are leaning toward our base/bull cases for the most likely outcome this year. Therefore, any pullbacks should be bought at this point.“

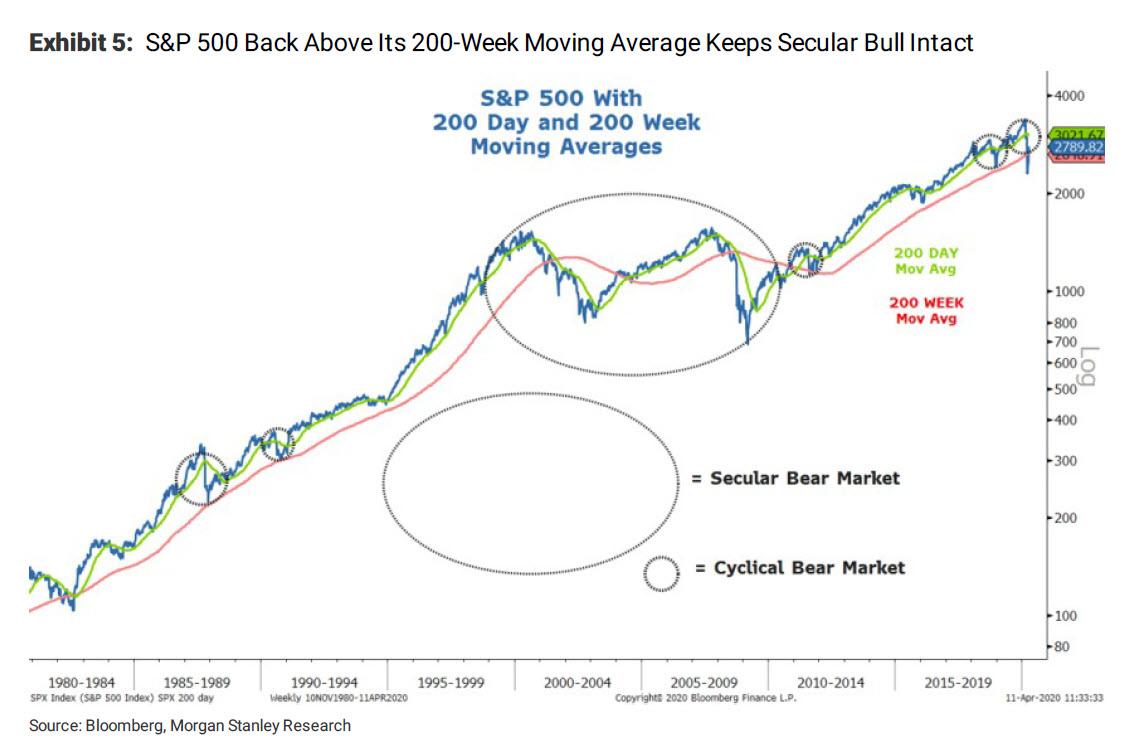

After the massive run in stocks we just experienced, a pull back seems quite likely as we enter what is likely bound to be grim earnings season with relatively bleak or uncertain outlooks, However, we also think investors should not get overly complacent and expect the market to hand us another great buying opportunity on a silver platter that is more comfortable to buy than the last one. That’s generally not how it works. Our base case view is that the market already had its successful re-test the week of March 30, meaning that week’s lows of 2450 should not be challenged again, especially with the extraordinary action by the Fed since then and flattening of the curve on COVID-19. Finally, the 200-week moving average is at 2650 as of Friday’s close (Exhibit 5). That is a very strong support level now with the market having quickly recaptured it last week, keeping our secular bull market view intact as discussed last week.

What does this mean when stripped of all the jargon? It means that to get to a 3,000 price target in the S&P and applying the “base case” EPS of 130, Wilson is using a 23x forward P/E multiple to get there, the highest PE multiple in this cycle! Is that high? Why yes, it is, but ignore 2020 earnings, Wilson says, because he is confident that he will be correct about his 2021 earnings forecast of 156… which is a far more “reasonable” 19.1x PE.

This, ladies and gents, is called goalseeking to reach a specific target, one which confirms that the present market and the underlying fundamentals are not only completely disconnected, but also which takes a priced to perfection forecast of the future which as every strategist admits is unpredictable due to the unprecedented nature of the current economic depression, yet which everyone is absolutely certain will have a happy ending. Why? Because of the Fed, the same Fed which has been forced to nationalize capital markets to avoid an up to 80% drop in stock prices.

Oh, and the reason why markets are now down sharply on the day after the two most important investment banks both turned uber bullish, is that with everyone now expecting the current bear market rally – which is precisely what this move is – the opposite will happen, just as Jeff Gundlach warned last week.

“A successful near-term retest of the March lows” was such a consensus opinion no wonder we got a big, rapid rally instead. The new narrative: “thanks to the Fed there will be no retest” will likely not come to pass either, leaving “a takeout of the March lows” as the base case.

— Jeffrey Gundlach (@TruthGundlach) April 9, 2020

Tyler Durden

Mon, 04/13/2020 – 13:04