Whitney Tilson Congratulates Himself For Calling The Market Bottom

Whitney Tilson wants you to know that he called the stock market bottom. Or the coronavirus top. Either way, Tilson swears he was right about something and he needs you to know it.

Tilson, famous for blowing up two hedge funds before becoming a newsletter writer, wrote exactly that to his mailing list on April 13, referring to comments he had made in weeks prior.

“I nailed the timing of the top,” Tilson boasted in the subject line of an April 13 e-mail. His e-mail continued:

From its intraday low on Monday, March 23 of 2,191.86 – the very hour that Enrique and I were recording our coronavirus webinar (which aired the next evening), in which we pounded the table and said this was the best buying opportunity we’d seen since the global financial crisis – the S&P 500 has soared 27.3% (as of Friday’s close). It’s been one of the fastest, biggest rallies in history.

In fact, last week and three weeks ago were two of the top 10 weeks for the Dow Jones Industrial Average in its entire 135-year history!

And the stock market has reacted exactly as I expected it would.

Tilson then answered a question that nobody asked of him, offering up his prediction on the market going forward and rounding it all out by joining every other useless bull on Wall Street with an S&P target of “just over 3,000”.

“My best guess – and it’s only an educated guess – is that the market trades in a 10% to 15% range for a few months, as investors wait to gauge the impact of the coronavirus crisis. Then, as clarity emerges and we start to recover, the market moves materially higher and closes the year roughly 10% higher than today (which would be just over 3,000 for the S&P 500),” Tilson said.

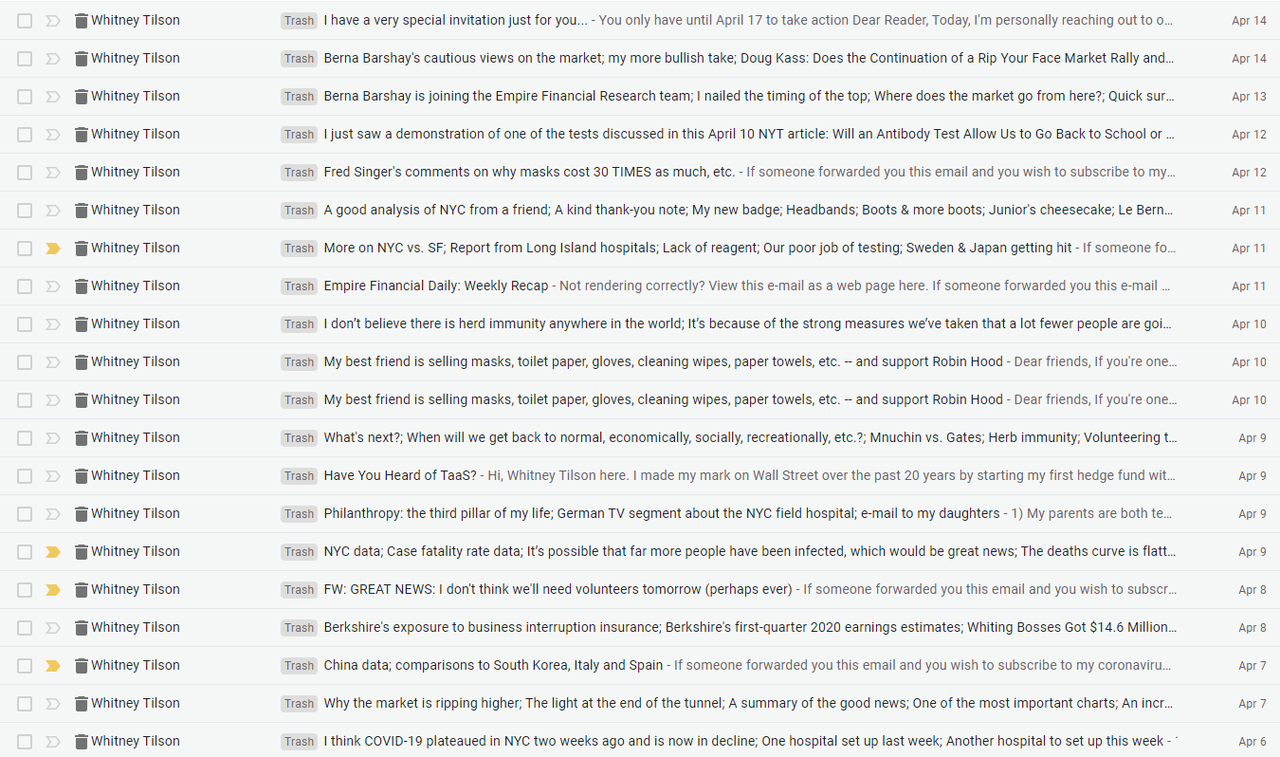

Tilson’s “Empire Financial Research”, which has actually garnered quite a following according to our sources, now spams inboxes relentlessly – sometimes two, three or even four times daily – with whatever pompous diatribes the former hedgie comes up with while on his latest skiing trip.

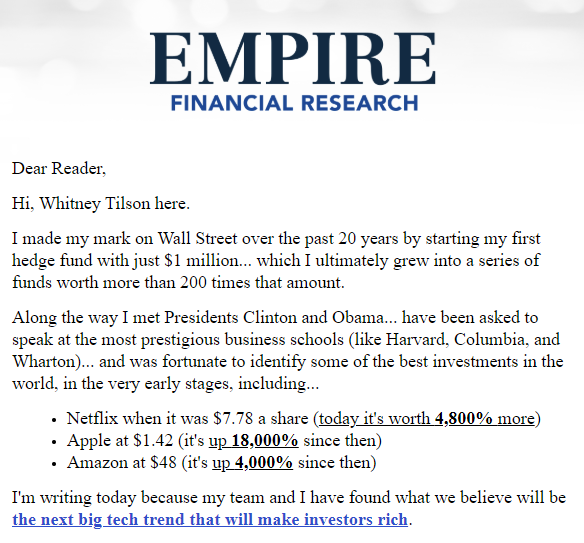

In addition to boasting about his unaudited “track record”, Tilson also recently sent out an e-mail to clients/prospective clients, letting them know that he started with just $1 million and turned it into “a series of funds worth more than 200 times that amount”.

As a reminder, Tilson famously blew up closed Kase Capital Management in 2017 (5 years after shuttering its predecessor T2) after getting his ass handed to him by the market “sustained underperformance”.

“Reporting sustained underperformance to you was making me miserable,” Tilson wrote to his investors in 2017.

He continued: “I couldn’t in good conscience continue to manage your money unless I had a high degree of confidence that I could turn things around within a reasonable time frame.” And with that, he wasn’t managing money anymore.

Recall, Tilson had relaunched his first fund, T2 Partners, as Kase Capital in 2012 after losing 24.9% in 2011.

It’s too bad (and dare we say a bit curious) that Tilson couldn’t get the market to react “exactly as he expected it would” when his results were being audited and he was a professional money manager. But now, in the unaudited realm of being a financial publisher/analyst, we are predicting many more grand slams to make appearances on Tilson’s track record.

In the same promotional e-mail, Tilson also boasts about hypothetical, unaudited peak-to-trough gains in names like Netflix, Amazon and Apple and meeting President Obama.

Regardless, stock talk could be a continued welcome change for Tilson’s former e-mail subscribers, who over the years have been treated to e-mails about a vast array of non-finance related topics, like Tilson’s time at Navy SEAL bootcamp with Bill Ackman and his most recent colonoscopy.

“I had a colonoscopy last week and, while the prep wasn’t so fun, overall it was a perfectly tolerable experience and I’m glad I did it,” Tilson said in a 2017 e-mail he fired out to his mailing list.

If you’re looking for a couple additional laughs, we stumbled upon this Tilson promotional video a couple of days ago, which labels him as “one of America’s most famous investors”.

Tyler Durden

Wed, 04/15/2020 – 14:50