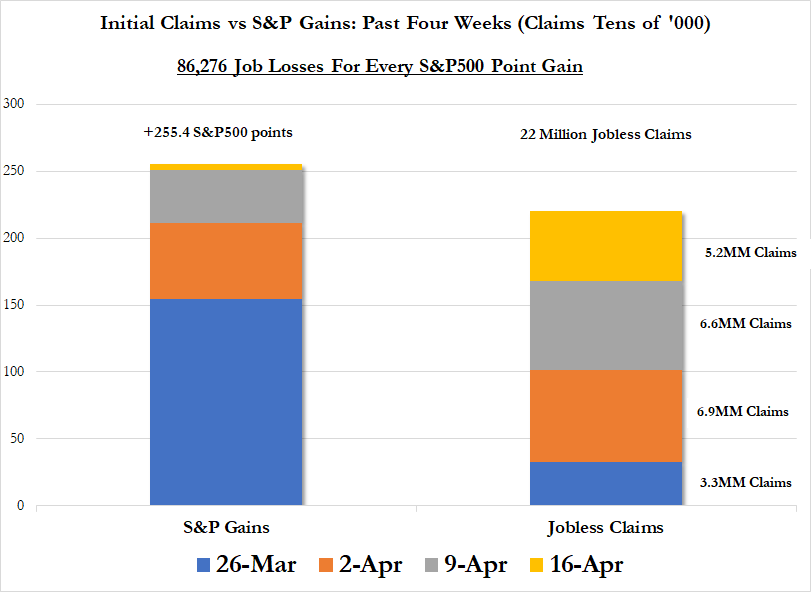

Stocks Surge On Soaring Unemployment For 4th Week In A Row

S&P is up 255.4 point cumulatively each Thursday in the past 4 weeks; over the same period we have lost 22.03 million jobs.

Consumer Comfort has collapsed back below when Trump was elected

Source: Bloomberg

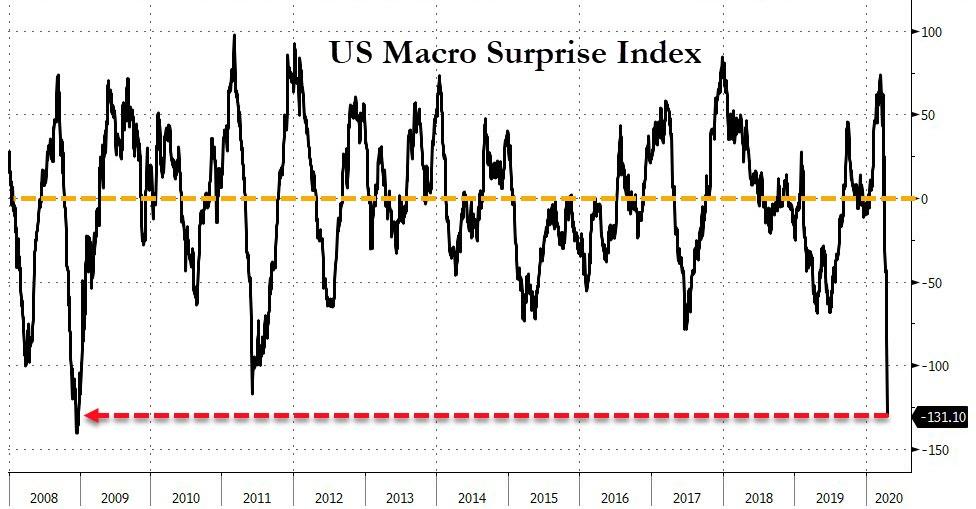

Overall macro-economic data has never disappointed and fallen this fast…

Source: Bloomberg

Earnings expectations are collapsing…

Source: Bloomberg

All of which explains why Nasdaq 100 just went green year-to-date… (spot the odd one out)…

Source: Bloomberg

On the week, Nasdaq is up over 4%, Small Caps are down almost 7%…

Which leaves the Nasdaq 100 just shy of its richest relative to small caps ever…

Source: Bloomberg

Bloomberg’s Cameron Crise also noted that the pace of NDX outperformance over the last three months has “dotcom bubble” written all over it. Maybe it can continue indefinitely and your favorite friendly tech behemoth can keep rallying, making money and avoiding scrutiny over antitrust issues or aggressive tax avoidance. But the only thing more certain than the difficulty of timing the end of parabolic price action is that the end is coming — sooner or later.

The Dow was once again unable to hold above its 50% retracement…

As FANG stocks hit a new record high…

Source: Bloomberg

Put another way…

Over the last four weeks, on days the initial jobless claims data has been released and Americans have lost over 22 million jobs, the S&P 500 has actually rallied (+6.2%, +2.3%, +1.4%, and +0.6%), and Nasdaq 100 (+5.72%, +1.99%, +0.11%, and +2.0%).

Once again…

As stocks live on free Fed money as Americans die…

Source: Bloomberg

And The Virus Fear trade refuses to ease up…

Source: Bloomberg

HY and IG bond prices continue to drop lower, despite The Fed’s support…

Source: Bloomberg

Treasury yields were mixed on the day with the short-end flat but longer-end yields tumbled once again…

Source: Bloomberg

With 10Y back below 60bps intraday…

Source: Bloomberg

The yield curve has flattened dramatically…

Source: Bloomberg

And as yields tumbled and flattened, so did bank stocks…

Source: Bloomberg

The Dollar extended yesterday’s big gains back to one week highs…

Source: Bloomberg

Crytpos were also bid today led by Ethereum…

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

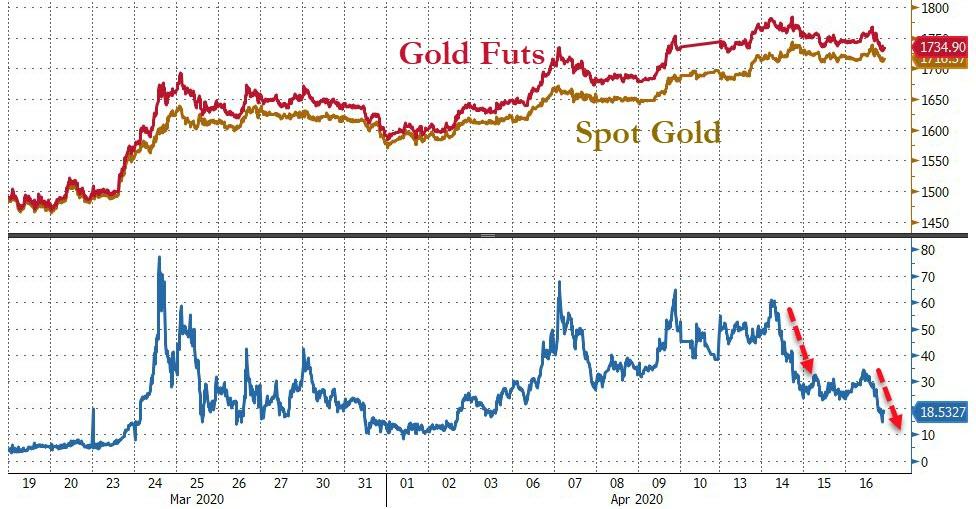

The premium between spot and futures gold prices compressed today…

Source: Bloomberg

Oil prices drifted lower once again with WTI back below $20…

Finally, we note that the prospect of the steepest global recession in almost a century and a massive currency-debasing debt buildup are driving investors into gold exchange-traded funds in startling numbers. The total stash of SPDR Gold Trust Holdings, the world’s largest bullion-backed fund, expanded for a 10th straight session on Tuesday, tying the record streak set in June 2016. All told, global holdings of gold-backed ETFs expanded for a 17th session (out of 18) to a fresh all-time high.

Source: Bloomberg

And the US Mint just closed due to COVID fears as gold coin demand nears a record high…

Source: Bloomberg

And then there’s this – as Bloomberg notes, U.S. stocks are out of step with one of most-watched segments of the yield curve by the most in 14 years.

Source: Bloomberg

The rebound in the S&P 500 over the past month has pushed the correlation with the 3m10y curve to the most negative since 2006. That suggests shares are ignoring signals about the economy, implying further upside may be capped.

Tyler Durden

Thu, 04/16/2020 – 16:01