Oil Stored At Sea Hits A Record 160 Million Barrels, Doubling In Two Weeks

The historic OPEC+ “Mexican Standoff” production cut came and went, and after a very short kneejerk spike higher oil has continued to plunge to historic lows for the two reasons we laid out previously: i) the production cut was not nearly enough to offset the demand collapse of as much as 36 million barrels, and ii) every day that tens of millions of excess barrels are produced brings us one day closer to that catastrophic D-day when oil storage runs out.

Of course, just like not all oil producers are equal – recall Goldman recently predicted that landlocked producers may see oil prices slide negative while tanker access to most Brent exporters means that the price of Brent will not drop materially below $20 – not all storage is equal, and while Cushing and ARA commercial storage is expected to hit full in just a few months, many producers are using water storage as a flexible alternative.

As a result, traders are now storing an estimated record 160 million barrels of oil on ships – double the level from two weeks ago as they seek to tackle a glut of stocks, Reuters reportsas traders have rushed to find storage on land and at sea in what is believed to be the biggest oil glut in history.

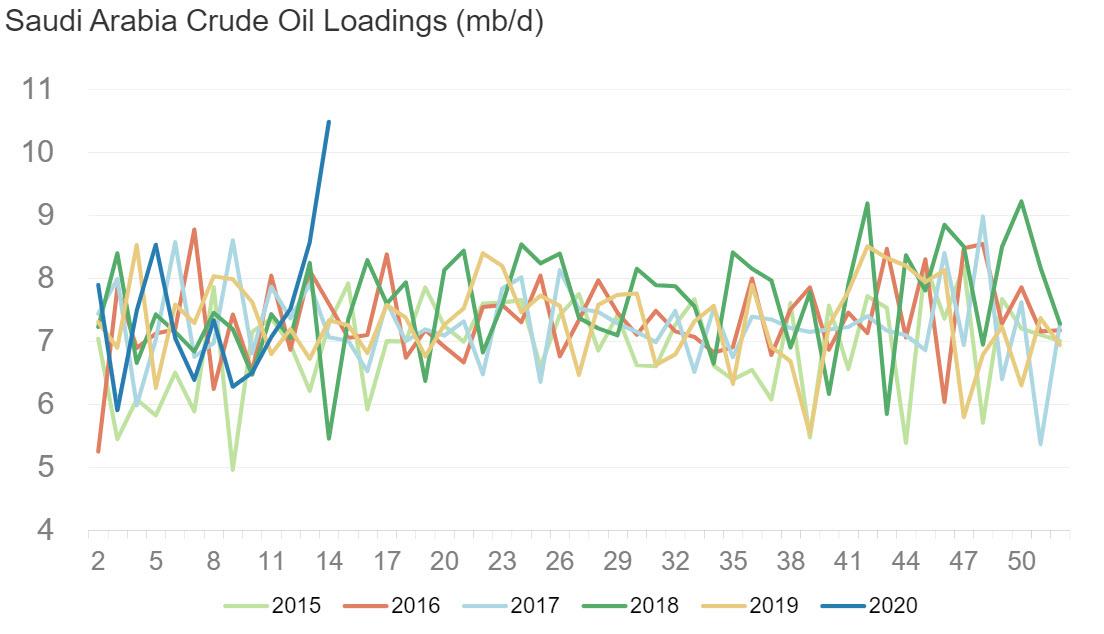

The surge in water storage, which started with Saudi Arabia unleashing an armada of tankers last month to flood the world with cheap oil…

… has swept the globe and shipping sources say oil held in floating storage on tankers had reached at least 160 million barrels including 60 supertankers, aka very large crude carriers (VLCCs), which can each hold 2 million barrels. This compared with just 25 to 40 VLCCs already chartered with storage options at the start of April and fewer than 10 VLCCs in February, the sources said adding that smaller tankers were also being used, which was also boosting volumes being held at anchor.

The last time floating storage reached levels close to this was in 2009, when traders stored over 100 million barrels at sea before offloading stocks; the plunge in oil prices then prompted one of our very first posts in January 2009 “Risk-Free Profit Idea of the Day” in which we explained how to benefit from $25 contango.

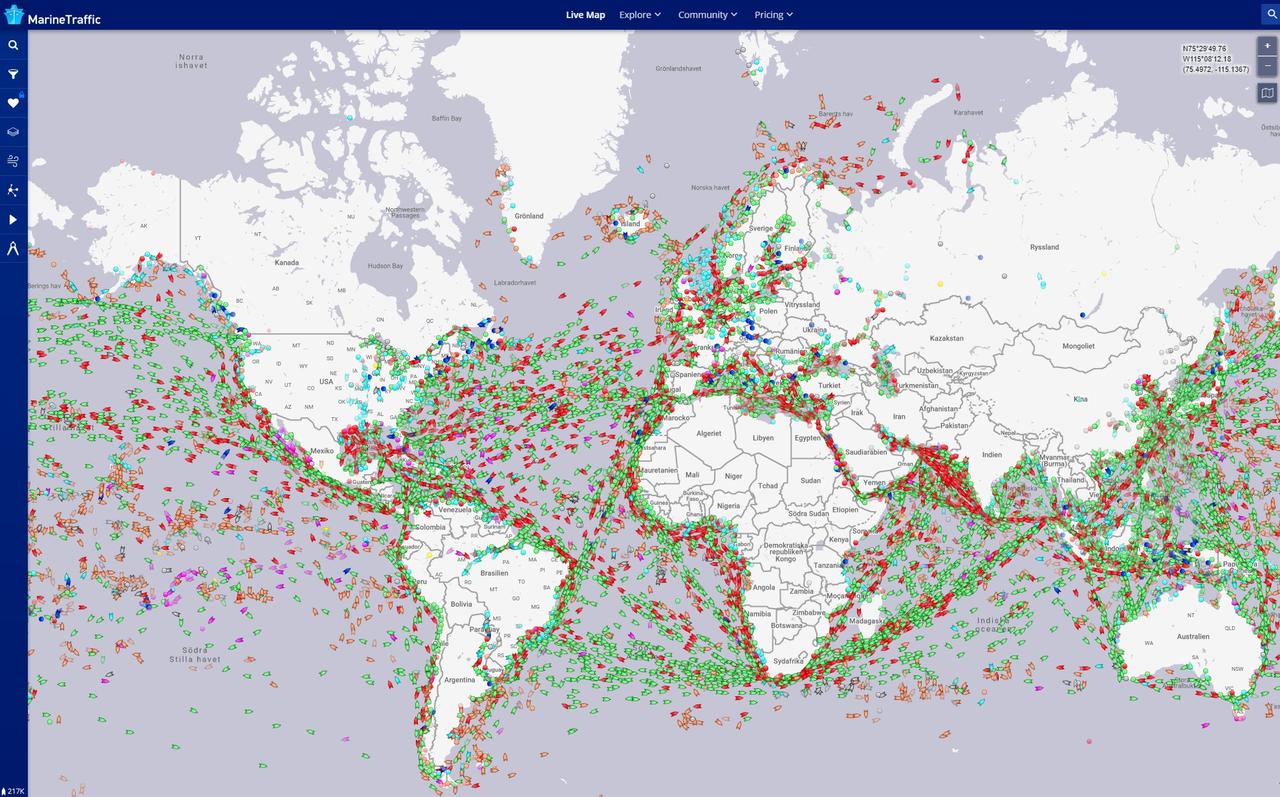

Putting naval oil infrastructure in context, the red dots show oil-tankers transporting over 100 million barrels each day. Now add another 60 million barrels to begin..

“This is an unprecedented time in the history of tankers and while VLCC tanker storage is garnering the headlines, smaller crude and product tankers are also being used for storage,” said BTIG shipping analyst Gregory Lewis.

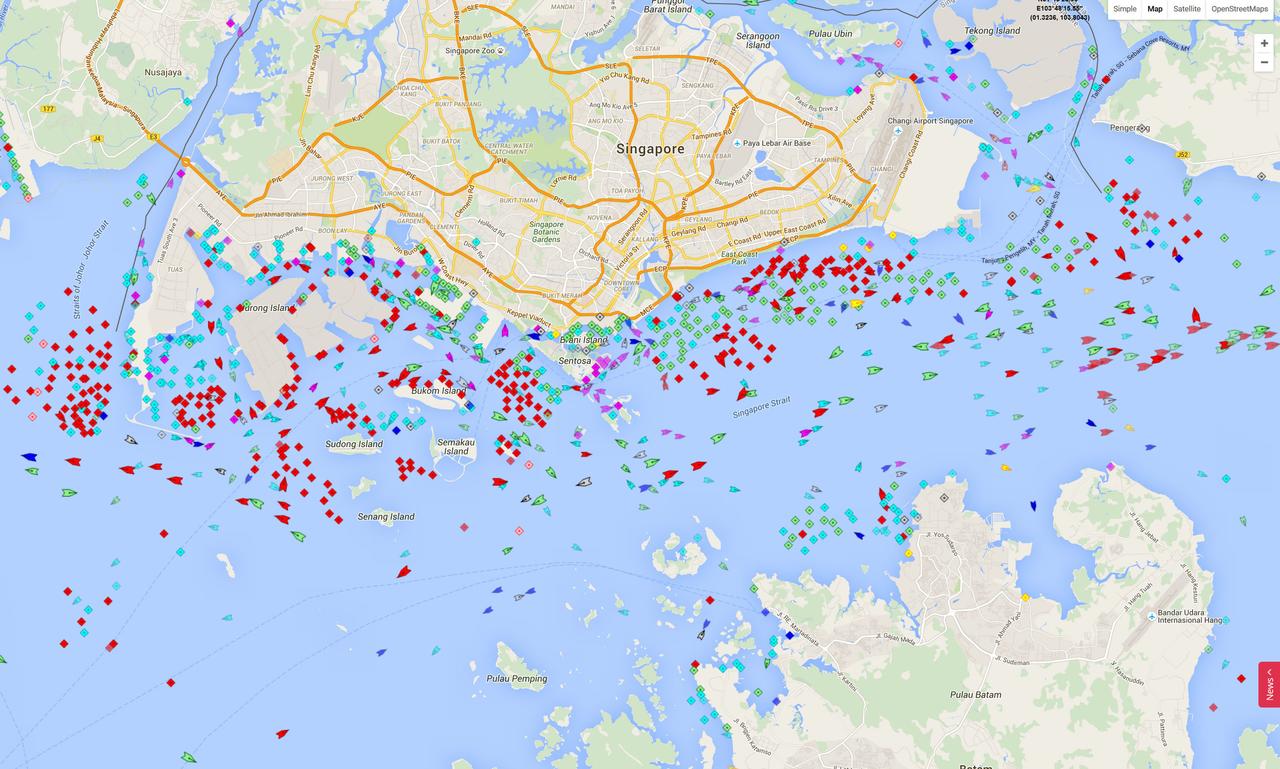

Locations typically include the U.S. Gulf and Singapore, where major oil hubs are situated. A supercontango that briefly emerged in 2016 when oil prices also crashed for a period of time, resulted in the following stunning navel map of tankers parked off Singapore.

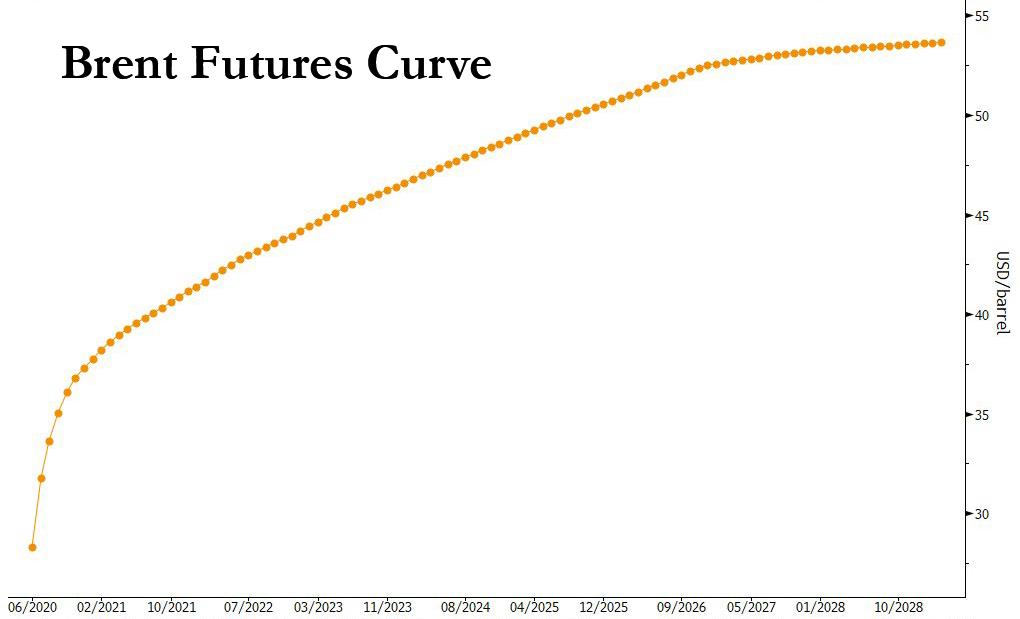

As mentioned above, the crude market is currently trading in deep contango, where forward prices are higher (in some cases much higher)than immediate prices.

The ability to buy a barrel of oil cheap today and lock in a profit by selling it in the future, encourages traders to park barrels in storage in the hopes of selling them for a profit later.

And with the contango barely budging, analysts – who notes that there are over 770 VLCCs in the world – estimate that as many as 100 to 200 supertankers could be deployed for floating storage in coming months.

“The eventual wind down of this inventory glut will be most painful to tanker demand, but in the meantime floating storage remains the only outlet for a mismatched production and consumption backdrop,” said Jonathan Chappell with investment banking advisory Evercore ISI

Tyler Durden

Fri, 04/17/2020 – 20:36