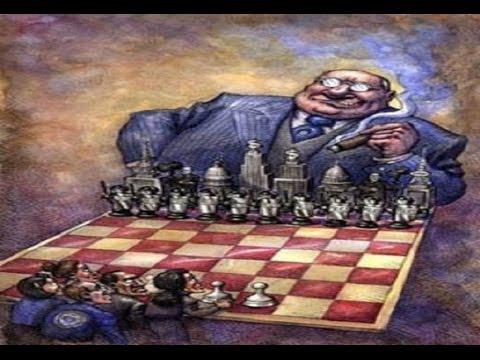

The “Iron Law” Of Oligarchy – Always Pick The Policy-Makers

“The iron law of oligarchy” is a political theory, first developed by the German sociologist Robert Michels in his 1911 book, Political Parties.

It asserts that rule by an elite, or oligarchy, is inevitable as an “iron law” within any democratic organization as part of the “tactical and technical necessities” of an organization.

Michels’ theory states that all complex organizations, regardless of how democratic they are when started, eventually develop into oligarchies. Michels observed that since no sufficiently large and complex organization can function purely as a direct democracy, power within an organization will always get delegated to individuals within that group, elected or otherwise.

Michels argues that democratic attempts to hold leadership positions accountable are prone to fail, since with power comes the ability to reward loyalty, the ability to control information about the organization, and the ability to control what procedures the organization follows when making decisions.

All of these mechanisms can be used to strongly influence the outcome of any decisions made ‘democratically’ by members.

Michels stated that the official goal of representative democracy of eliminating elite rule was impossible, that representative democracy is a façade legitimizing the rule of a particular elite, and that elite rule, which he refers to as oligarchy, is inevitable.” (sourced from Wikipedia)

Stiegler refines the Iron Law of Oligarchy, in his Theory of Economic Regulation, also suggesting that the big guys will always win and the little guys will always lose. He bases this conclusion on the following premises:

-

The fundamental asset controlled by the state is the power to coerce. Any group that can control how this power is used can profit.

-

Since we are self-interested actors, we will seek to get the state’s coercive power to support our interests. Efforts to do so, however, are costly.

Large firms win because:

-

Large firms have high benefits from mobilizing (the stakes our high). Since they are a small group, and since they are fairly homogeneous, they have no difficulty with collective action problems (they can lobby efficiently).

-

Small firms don’t organize for political reasons because of collective action problems (very high coordination costs).

-

Consumers don’t organize because the costs of doing so are high compared to the benefits (very high coordination costs).

This is made crystal clear in the financial crisis of 2008 and the current economic collapse. In 2008 the perpetrators of the reckoning were provided with cheap loans that negated free market forces while rewarding excessive risk taking. This free flow of cheap money continued for the next decade. Financial markets as an efficient pricing mechanism of the productive allocation of finite resources died in 2008. What we were left with was a clear display of The Iron Law of Oligarchy.

Millions of young Americans were inundated with loans that could not be absolved even through bankruptcy. While they took these loans of their own free will, they were entering adult life during the greatest economic failure of all time and so most were left with very few viable alternatives. The $1.8 trillion in student loans provided a huge boost to corporate earnings as about only half of borrowing goes to tuition. So about $900 billion was spent at Walmart, Target, etc., and lots of consumer goods were consumed. That consumption transferred cash to the top line of S&P 500 income statements. And while the cash from the loan was transferred to corporations, the obligation remained with America’s youth.

In today’s crisis we see that financial markets received enough support to prop market capital within short reach of all time highs despite the economy seeing 22 million working Americans filing for unemployment. Policy makers first response to the crisis was to quickly allocate $5 trillion to a relatively few financial firms in order to prevent them from having to take losses on their speculative trades. These firms used the cash to re-inflate market prices, which created profits, from which they paid back the loan via the repo market.

On the other hand, it took several weeks for policy makers to allocate only $350 billion to support the government forced closure of around 20 million small businesses. This relatively small funding allocation ran out after 1.5 million small businesses received assistance.

Policy makers are yet to agree on a second bill to increase funding while many small business owners are left with $0 in the bank to feed their kids, pay their bills and wonder how they are going to recover. Imagine the stress. No seriously, pause and imagine the soul crushing stress they are living with every minute of every day. Yet policy makers are choosing to remain on break until early May. You can be certain if the banks or hedge funds were in trouble a bill would be passed immediately.

Stiegler argues:

“the first purpose of empirical studies of regulatory policy is to identify the purpose of the legislation! The announced goals of a policy are often unrelated or perversely related to its actual effects and the truly intended effects should be deduced from the actual effects [over time].”

That is, don’t listen to the stated objectives of policy makers but study the actual results of their policies over time; the results over time are the intended effects. If we look at the actual effects of economic policies over the past 30 years it should provide us a strong indication of the intended effects.

Market capital driven wealth of the S&P 500 has increased by 1500% since 1988 while median weekly incomes have increased by 113%. For some perspective, rents of primary residence for Americans has increased 269.7% over that same time period.

It doesn’t matter to me what profession you chose or how proficient you are in finance, the notion that the system is designed to enrich a few and enslave many has never been more clear. You may be one of those still receiving an income but at some point you will be on the other side. That is guaranteed. Because the Oligarchs don’t want to be wealthy they want to have all the wealth. That is the way our system works. Slowly, over time, policies will allocate all wealth to those that can coerce the policies.

Jeff Bezos’s wealth has increased by $24 Billion since the crisis began. That is due to market share capture from millions of small businesses. Policy makers pick winners and losers. Oligarchs pick policy makers.

Tyler Durden

Fri, 04/17/2020 – 20:00